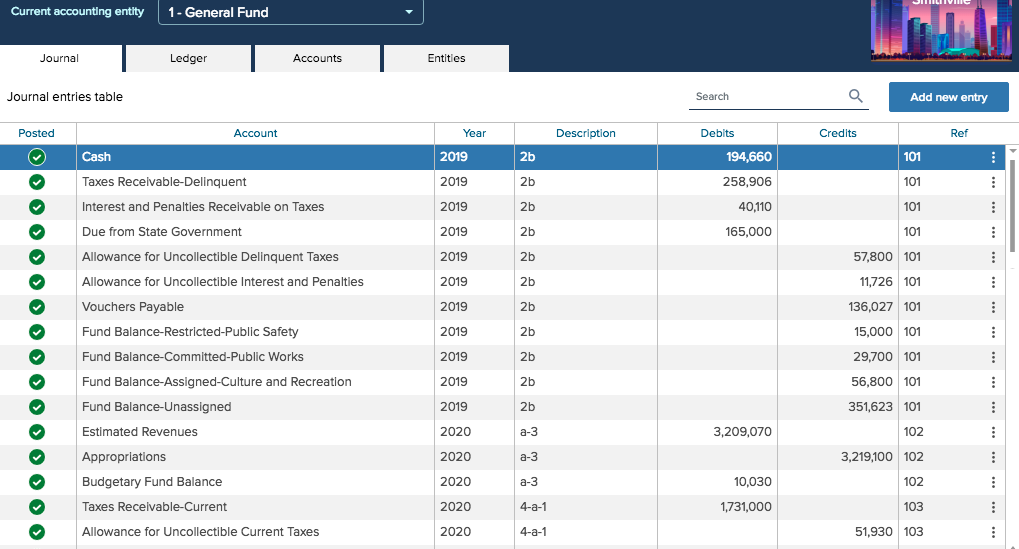

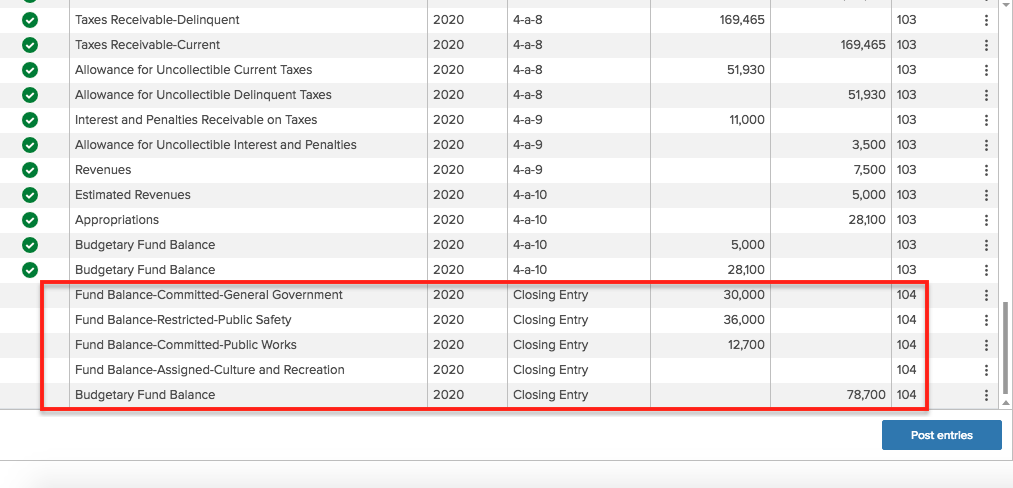

Can you have a look at the CLOSING ENTRIES at the end, where i put a red rectangle? and tell me if I answered correctly to the question? if not please provide me with the correct closing entries. ASAP, i have limited time to post this homework. Thanks

At year-end, an analysis by the citys finance department determined the following constraints on fund balances in the General Fund. Prepare the appropriate closing/reclassification journal entry in the General Fund to reclassify amounts between Fund BalanceUnassigned and the fund balance accounts corresponding to the constraints shown below. (Note: You should consider the beginning of year balances in fund balance accounts in calculating the amounts to be reclassified. Be sure the check mark in the box for [Closing Entry] is showing before closing each individual account.)

Account Ending Balance

Fund BalanceCommittedGeneral Government $30,000

Fund BalanceRestrictedPublic Safety 36,000

Fund BalanceCommittedPublic Works 12,700

Fund BalanceAssignedCulture and Recreation 0

JULIIVINE Current accounting entity 1-General Fund Journal Ledger Accounts Entities Journal entries table Search a Add new entry Posted Account Description Credits Ref Cash 101 Taxes Receivable-Delinquent Year 2019 2019 2019 2019 2019 Debits 194,660 258,906 40,110 165,000 Interest and Penalties Receivable on Taxes OOOOO 2019 Due from State Government Allowance for Uncollectible Delinquent Taxes Allowance for Uncollectible Interest and Penalties Vouchers Payable Fund Balance-Restricted-Public Safety Fund Balance-Committed-Public Works Fund Balance-Assigned-Culture and Recreation Fund Balance-Unassigned Estimated Revenues Appropriations Budgetary Fund Balance Taxes Receivable-Current Allowance for Uncollectible Current Taxes 2019 2019 2019 2019 2019 2020 57,800 11,726 136,027 101 15,000 101 29,700 56,800 101 351,623 3,209,070 2020 3,219,100 a-3 10,030 2020 2020 2020 4-a-1 1,731,000 4-a-1 51,930 Revenues 2020 4-a-1 1,679,070 103 Encumbrances 2020 4-a-2 608,314 103 Encumbrances Outstanding 608,314 103 Cash 3,399,599 103 Taxes Receivable-Current 4-a-2 4-a-3 4-a-3 4-a-3 4-a-3 4-a-3 Taxes Receivable-Delinquent Interest and Penalties Receivable on Taxes 2020 2020 2020 2020 2020 2020 2020 2020 2020 2020 2020 Due from State Government 1,561,535 103 235,000 103 34,270 103 165,000 103 1,403,794 103 Revenues 4-a-3 4--4 2,638,220 Expenditures Due to Federal Government 4-a-4 Due to State Government 4-a-4 740,356 103 293,478 103 1,604,386 103 4-a-4 Cash Encumbrances Encumbrances Outstanding 2020 4-a-5 573,034 103 4--5 573,034 103 2020 2020 Expenditures 4-a-5 572,777 103 572,777 Vouchers Payable Due from State Government 4-a-5 4-a-6 4-a-6 115,000 Revenues 115,000 2020 2020 2020 2020 2020 2020 2020 4-a-7 Vouchers Payable Due to Federal Government Due to State Government Cash 4-a-7 700,000 731,506 290,065 4-a-7 4-a-7 1,721,571 103 .. 169,465 Taxes Receivable-Delinquent Taxes Receivable-Current Allowance for Uncollectible Current Taxes 4-a-8 4-a-8 4-a-8 .. 51,930 ... 2020 2020 2020 2020 2020 2020 Allowance for Uncollectible Delinquent Taxes 4-a-8 4-a-9 ...... 11,000 103 169,465 103 103 51,930 103 103 3,500 103 7,500 5,000 103 28,100 103 Interest and Penalties Receivable on Taxes Allowance for Uncollectible Interest and Penalties ... 4-a-9 4-a-9 Revenues 2020 4-a-10 Estimated Revenues Appropriations Budgetary Fund Balance 4-a-10 4-a-10 Budgetary Fund Balance 2020 2020 2020 2020 2020 2020 2020 2020 2020 5,000 28,100 30,000 36,000 Fund Balance-Committed-General Government Fund Balance-Restricted-Public Safety Fund Balance-Committed-Public Works Fund Balance-Assigned-Culture and Recreation 4-a-10 Closing Entry Closing Entry Closing Entry Closing Entry Closing Entry 12,700 Budgetary Fund Balance 78,700 104 Post entries