Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Can you help me answer question 5 please t. Using the data in Figures 1 and 2, compute the company's average collection period (ACP) in

Can you help me answer question 5 please

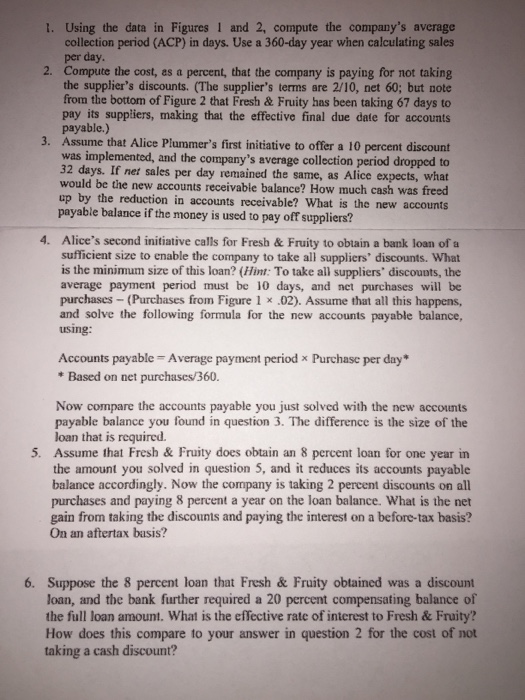

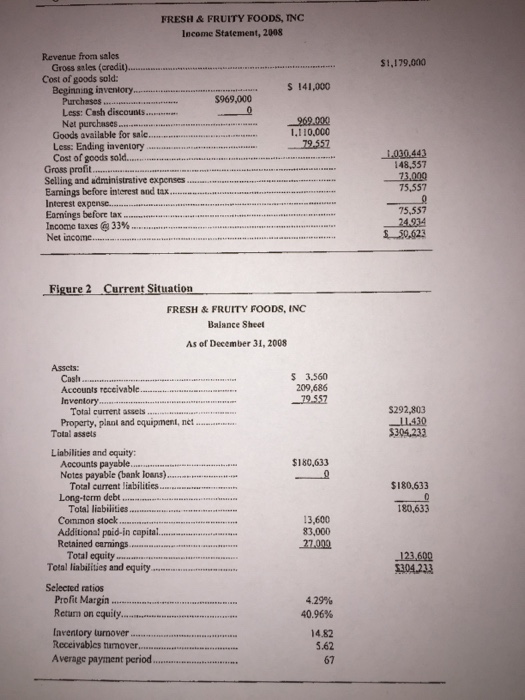

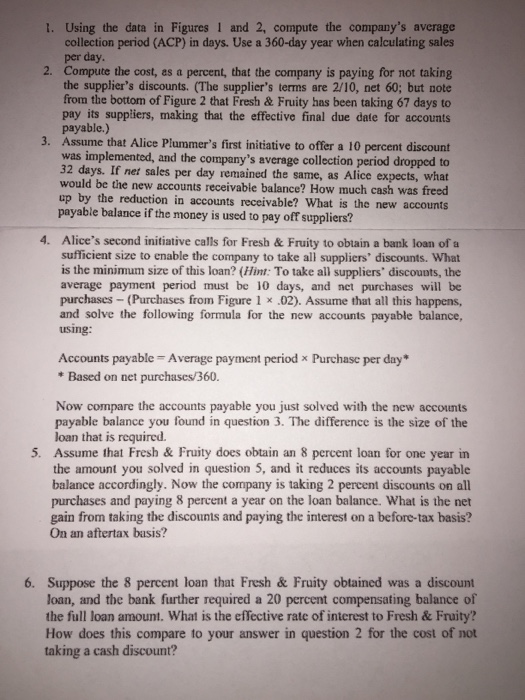

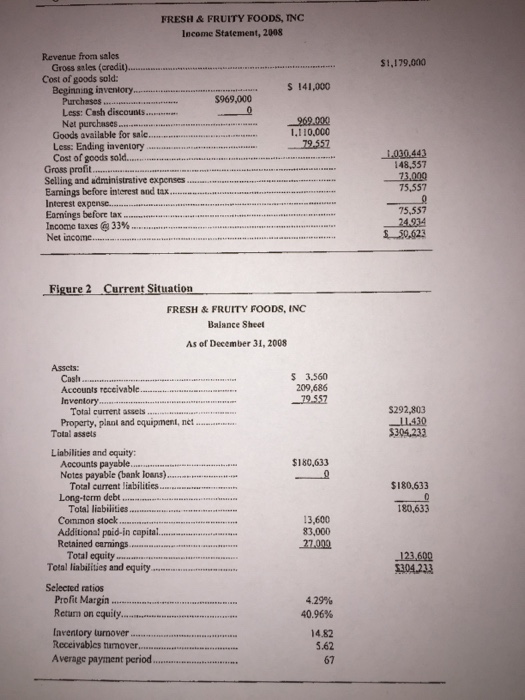

t. Using the data in Figures 1 and 2, compute the company's average collection period (ACP) in days. Use a 360-day year when calculating sales per day. 2. Compute the cost, as a percent, that the company is paying for not taking the supplier's discounts. (The supplier's terms are 2/10, net 60; but note from the bottom of Figure 2 that Fresh&Fruity has been taking 67 days to pay its suppliers, making that the effective final due date for accounts payable.) 3. Assume that Alice Plummer's first initiative to offer a 10 percent discount was implemented, and the company's average collection period dropped to 32 days. If net sales per day remained the same, as Alice expects, what would be the new accounts receivable balance? How much cash was up by the reduction in accounts receivable? What is the new acco payable balance if the money is used to pay off suppliers? freed unts Alice's second initiative calls for Fresh &Fruity to obtain a bank loan of a sufficient size to enable the company to take all suppliers' discounts. What is the minimum size of this loan? (Hint: To take all suppliers' discounts, the average payment period must be 10 days, and net purchases will be purchases (Purchases from Figure 1 x 02). Assume that all this happens, and solve the following formula for the new accounts payable balance, using: 4. Accounts payable Average payment period x Purchase per day Based on net purchases/360. Now compare the accounts payable you just solved with the new accounts payable balance you found in question 3The difference is the size of the loan that is required. Assume that Fresh &Fruity does obtain an 8 percent loan for one year in the amount you solved in question 5, and it reduces its accounts payable balance accordingly. Now the company is taking 2 percent discounts on all purchases and paying 8 percent a year on the loan balance. What is the net gain from taking the discounts and paying the interest on a before-tax basis? On an aftertax basis? 5. 6. Suppose the 8 percent loan that Fresh&Fruity obtained was a discount loan, and the bank further required a 20 percent compensating balance of the full loan amount. What is the effective rate of interest to Fresh & Fruity? How does this compare to your answer in question 2 for the cost of not taking a cash discount

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started