Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Can you help me answer this question please? It is from financial management course. It is written in two languages firstly Malaysian and then in

Can you help me answer this question please? It is from financial management course. It is written in two languages firstly Malaysian and then in English, just read it in English and answer it in English please ..

And please answer all parts of the question.

Thanks a lot in advance .

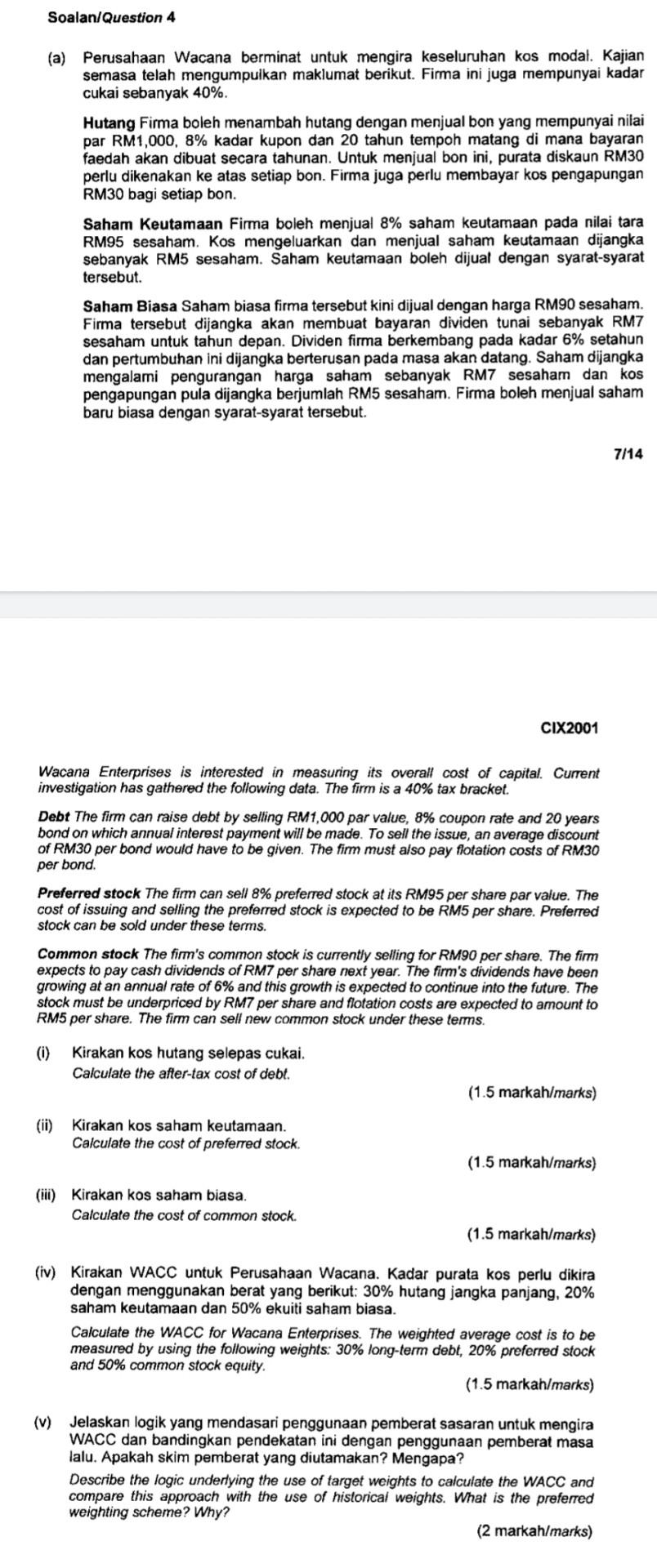

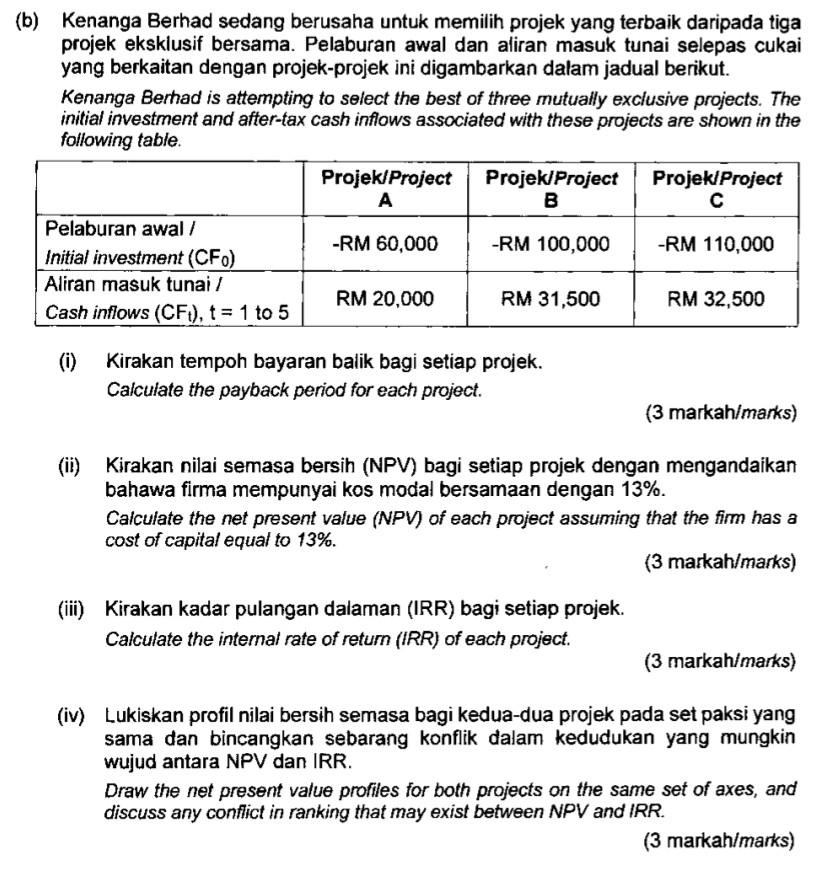

Soalan/Question 4 (a) Perusahaan Wacana berminat untuk mengira keseluruhan kos modal. Kajian semasa telah mengumpulkan maklumat berikut. Firma ini juga mempunyai kadar cukai sebanyak 40%. Hutang Firma boleh menambah hutang dengan menjual bon yang mempunyai nilai par RM1,000, 8% kadar kupon dan 20 tahun tempoh matang di mana bayaran faedah akan dibuat secara tahunan. Untuk menjual bon ini, purata diskaun RM30 perlu dikenakan ke atas setiap bon. Firma juga perlu membayar kos pengapungan RM30 bagi setiap bon. Saham Keutamaan Firma boleh menjual 8% saham keutamaan pada nilai tara RM95 sesaham. Kos mengeluarkan dan menjual saham keutamaan dijangka sebanyak RM5 sesaham. Saham keutamaan boleh dijual dengan syarat-syarat tersebut. Saham Biasa Saham biasa firma tersebut kini dijual dengan harga RM90 sesaham. Firma tersebut dijangka akan membuat bayaran dividen tunai sebanyak RM7 sesaham untuk tahun depan. Dividen firma berkembang pada kadar 6% setahun dan pertumbuhan ini dijangka berterusan pada masa akan datang. Saham dijangka mengal pengurangan har saham sebanyak RM7 sesaham dan kos pengapungan pula dijangka berjumlah RM5 sesaham. Firma boleh menjual saham baru biasa dengan syarat-syarat tersebut. 7/14 CIX2001 Wacana Enterprises is interested in measuring its overall cost of capital. Current investigation has gathered the following data. The firm is a 40% tax bracket. Debt The firm can raise debt by selling RM1,000 par value, 8% coupon rate and 20 years bond on which annual interest payment will be made. To sell the issue, an average discount of RM30 per bond would have to be given. The firm must also pay flotation costs of RM30 per bond Preferred stock The firm can sell 8% preferred stock at its RM95 per share par value. The cost of issuing and selling the preferred stock is expected to be RM5 per share. Preferred stock can be sold under these terms. Common stock The firm's common stock is currently selling for RM90 per share. The firm expects to pay cash dividends of RM7 per share next year. The firm's dividends have been growing at an annual rate of 6% and this growth is expected to continue into the future. The stock must be underpriced by RM7 per share and flotation costs are expected to amount to RM5 per share. The firm can sell new common stock under these terms. (0) Kirakan kos hutang selepas cukai. Calculate the after-tax cost of debt. (1.5 markah/marks) (ii) Kirakan kos saham keutamaan. Calculate the cost of preferred stock. (1.5 markah/marks) (iii) Kirakan kos saham biasa. Calculate the cost of common stock. (1.5 markah/marks) (iv) Kirakan WACC untuk Perusahaan Wacana. Kadar purata kos perlu dikira dengan menggunakan berat yang berikut: 30% hutang jangka panjang, 20% saham keutamaan dan 50% ekuiti saham biasa. Calculate the WACC for Wacana Enterprises. The weighted average cost is to be measured by using the following weights: 30% long-term debt, 20% preferred stock and 50% common stock equity. (1.5 markah/marks) (v) Jelaskan logik yang mendasari penggunaan pemberat sasaran untuk mengira WACC dan bandingkan pendekatan ini dengan penggunaan pemberat masa lalu. Apakah skim pemberat yang diutamakan? Mengapa? Describe the logic underlying the use of target weights to calculate the WACC and compare this approach with the use of historical weights. What is the preferred weighting scheme? Why? (2 markah/marks) (b) Kenanga Berhad sedang berusaha untuk memilih projek yang terbaik daripada tiga projek eksklusif bersama. Pelaburan awal dan aliran masuk tunai selepas cukai yang berkaitan dengan projek-projek ini digambarkan dalam jadual berikut. Kenanga Berhad is attempting to select the best of three mutually exclusive projects. The initial investment and after-tax cash inflows associated with these projects are shown in the following table. Projek/Project Projek Project Projek/Project A B Pelaburan awal / -RM 60,000 -RM 100,000 -RM 110,000 Initial investment (CF) Aliran masuk tunai / RM 20,000 RM 31,500 RM 32,500 Cash inflows (CFt), t = 1 to 5 (0) Kirakan tempoh bayaran balik bagi setiap projek. Calculate the payback period for each project. (3 markah/marks) (ii) Kirakan nilai semasa bersih (NPV) bagi setiap projek dengan mengandaikan bahawa firma mempunyai kos modal bersamaan dengan 13%. Calculate the net present value (NPV) of each project assuming that the firm has a cost of capital equal to 13%. (3 markah/marks) (iii) Kirakan kadar pulangan dalaman (IRR) bagi setiap projek. Calculate the internal rate of return (IRR) of each project. (3 markah/marks) (iv) Lukiskan profil nilai bersih semasa bagi kedua-dua projek pada set paksi yang sama dan bincangkan sebarang konflik dalam kedudukan yang mungkin wujud antara NPV dan IRR. Draw the net present value profiles for both projects on the same set of axes, and discuss any conflict in ranking that may exist between NPV and IRR. (3 markah/marks) Soalan/Question 4 (a) Perusahaan Wacana berminat untuk mengira keseluruhan kos modal. Kajian semasa telah mengumpulkan maklumat berikut. Firma ini juga mempunyai kadar cukai sebanyak 40%. Hutang Firma boleh menambah hutang dengan menjual bon yang mempunyai nilai par RM1,000, 8% kadar kupon dan 20 tahun tempoh matang di mana bayaran faedah akan dibuat secara tahunan. Untuk menjual bon ini, purata diskaun RM30 perlu dikenakan ke atas setiap bon. Firma juga perlu membayar kos pengapungan RM30 bagi setiap bon. Saham Keutamaan Firma boleh menjual 8% saham keutamaan pada nilai tara RM95 sesaham. Kos mengeluarkan dan menjual saham keutamaan dijangka sebanyak RM5 sesaham. Saham keutamaan boleh dijual dengan syarat-syarat tersebut. Saham Biasa Saham biasa firma tersebut kini dijual dengan harga RM90 sesaham. Firma tersebut dijangka akan membuat bayaran dividen tunai sebanyak RM7 sesaham untuk tahun depan. Dividen firma berkembang pada kadar 6% setahun dan pertumbuhan ini dijangka berterusan pada masa akan datang. Saham dijangka mengal pengurangan har saham sebanyak RM7 sesaham dan kos pengapungan pula dijangka berjumlah RM5 sesaham. Firma boleh menjual saham baru biasa dengan syarat-syarat tersebut. 7/14 CIX2001 Wacana Enterprises is interested in measuring its overall cost of capital. Current investigation has gathered the following data. The firm is a 40% tax bracket. Debt The firm can raise debt by selling RM1,000 par value, 8% coupon rate and 20 years bond on which annual interest payment will be made. To sell the issue, an average discount of RM30 per bond would have to be given. The firm must also pay flotation costs of RM30 per bond Preferred stock The firm can sell 8% preferred stock at its RM95 per share par value. The cost of issuing and selling the preferred stock is expected to be RM5 per share. Preferred stock can be sold under these terms. Common stock The firm's common stock is currently selling for RM90 per share. The firm expects to pay cash dividends of RM7 per share next year. The firm's dividends have been growing at an annual rate of 6% and this growth is expected to continue into the future. The stock must be underpriced by RM7 per share and flotation costs are expected to amount to RM5 per share. The firm can sell new common stock under these terms. (0) Kirakan kos hutang selepas cukai. Calculate the after-tax cost of debt. (1.5 markah/marks) (ii) Kirakan kos saham keutamaan. Calculate the cost of preferred stock. (1.5 markah/marks) (iii) Kirakan kos saham biasa. Calculate the cost of common stock. (1.5 markah/marks) (iv) Kirakan WACC untuk Perusahaan Wacana. Kadar purata kos perlu dikira dengan menggunakan berat yang berikut: 30% hutang jangka panjang, 20% saham keutamaan dan 50% ekuiti saham biasa. Calculate the WACC for Wacana Enterprises. The weighted average cost is to be measured by using the following weights: 30% long-term debt, 20% preferred stock and 50% common stock equity. (1.5 markah/marks) (v) Jelaskan logik yang mendasari penggunaan pemberat sasaran untuk mengira WACC dan bandingkan pendekatan ini dengan penggunaan pemberat masa lalu. Apakah skim pemberat yang diutamakan? Mengapa? Describe the logic underlying the use of target weights to calculate the WACC and compare this approach with the use of historical weights. What is the preferred weighting scheme? Why? (2 markah/marks) (b) Kenanga Berhad sedang berusaha untuk memilih projek yang terbaik daripada tiga projek eksklusif bersama. Pelaburan awal dan aliran masuk tunai selepas cukai yang berkaitan dengan projek-projek ini digambarkan dalam jadual berikut. Kenanga Berhad is attempting to select the best of three mutually exclusive projects. The initial investment and after-tax cash inflows associated with these projects are shown in the following table. Projek/Project Projek Project Projek/Project A B Pelaburan awal / -RM 60,000 -RM 100,000 -RM 110,000 Initial investment (CF) Aliran masuk tunai / RM 20,000 RM 31,500 RM 32,500 Cash inflows (CFt), t = 1 to 5 (0) Kirakan tempoh bayaran balik bagi setiap projek. Calculate the payback period for each project. (3 markah/marks) (ii) Kirakan nilai semasa bersih (NPV) bagi setiap projek dengan mengandaikan bahawa firma mempunyai kos modal bersamaan dengan 13%. Calculate the net present value (NPV) of each project assuming that the firm has a cost of capital equal to 13%. (3 markah/marks) (iii) Kirakan kadar pulangan dalaman (IRR) bagi setiap projek. Calculate the internal rate of return (IRR) of each project. (3 markah/marks) (iv) Lukiskan profil nilai bersih semasa bagi kedua-dua projek pada set paksi yang sama dan bincangkan sebarang konflik dalam kedudukan yang mungkin wujud antara NPV dan IRR. Draw the net present value profiles for both projects on the same set of axes, and discuss any conflict in ranking that may exist between NPV and IRR. (3 markah/marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started