Answered step by step

Verified Expert Solution

Question

1 Approved Answer

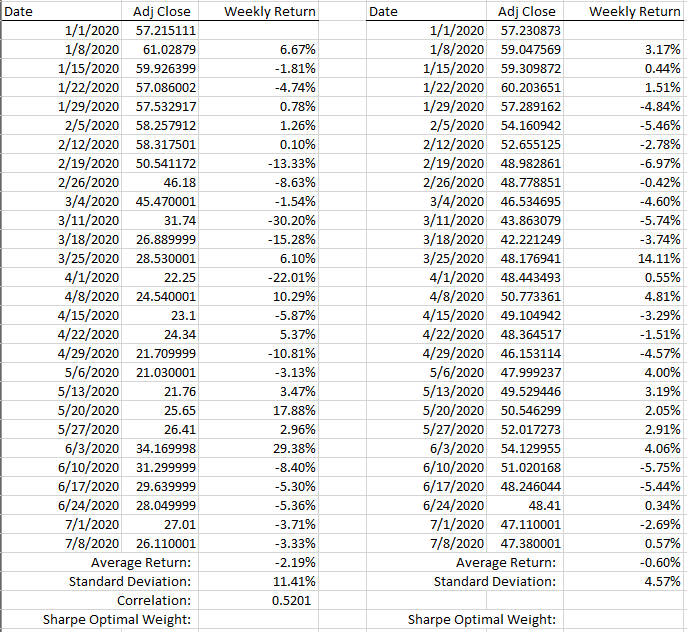

Can you help me calculate the Share Optimal Weight? Please show me the formula as well! Risk free Rate of return is 0.03% Thank you,

Can you help me calculate the Share Optimal Weight? Please show me the formula as well!

Risk free Rate of return is 0.03%

Thank you,

Date Weekly Return Date Weekly Return Adj Close 1/1/2020 57.215111 1/8/2020 61.02879 1/15/2020 59.926399 1/22/2020 57.086002 1/29/2020 57.532917 2/5/2020 58.257912 2/12/2020 58.317501 2/19/2020 50.541172 2/26/2020 46.18 3/4/2020 45.470001 3/11/2020 31.74 3/18/2020 26.889999 3/25/2020 28.530001 4/1/2020 22.25 4/8/2020 24.540001 4/15/2020 23.1 4/22/2020 24.34 4/29/2020 21.709999 5/6/2020 21.030001 5/13/2020 21.76 5/20/2020 25.65 5/27/2020 26.41 6/3/2020 34.169998 6/10/2020 31.299999 6/17/2020 29.639999 6/24/2020 28.049999 7/1/2020 27.01 7/8/2020 26.110001 Average Return: Standard Deviation: Correlation: Sharpe Optimal Weight: 6.67% -1.81% -4.74% 0.78% 1.26% 0.10% -13.33% -8.63% -1.54% -30.20% - 15.28% 6.10% -22.01% 10.29% -5.87% 5.37% - 10.81% -3.13% 3.47% 17.88% 2.96% 29.38% -8.40% -5.30% -5.36% -3.71% -3.33% -2.19% 11.41% 0.5201 Adj Close 1/1/2020 57.230873 1/8/2020 59.047569 1/15/2020 59.309872 1/22/2020 60.203651 1/29/2020 57.289162 2/5/2020 54.160942 2/12/2020 52.655125 2/19/2020 48.982861 2/26/2020 48.778851 3/4/2020 46.534695 3/11/2020 43.863079 3/18/2020 42.221249 3/25/2020 48.176941 4/1/2020 48.443493 4/8/2020 50.773361 4/15/2020 49.104942 4/22/2020 48.364517 4/29/2020 46.153114 5/6/2020 47.999237 5/13/2020 49.529446 5/20/2020 50.546299 5/27/2020 52.017273 6/3/2020 54.129955 6/10/2020 51.020168 6/17/2020 48.246044 6/24/2020 48.41 7/1/2020 47.110001 7/8/2020 47.380001 Average Return: Standard Deviation: 3.17% 0.44% 1.51% -4.84% -5.46% -2.78% -6.97% -0.42% -4.60% -5.74% -3.74% 14.11% 0.55% 4.81% -3.29% -1.51% -4.57% 4.00% 3.19% 2.05% 2.91% 4.06% -5.75% -5.44% 0.34% -2.69% 0.57% -0.60% 4.57% Sharpe Optimal WeightStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started