Answered step by step

Verified Expert Solution

Question

1 Approved Answer

can you help me find a finance expertQuestion 7 ( 7 marks ) Linear Interpolation Please use the Government of Canada bond data provided below.

can you help me find a finance expertQuestion marks Linear Interpolation

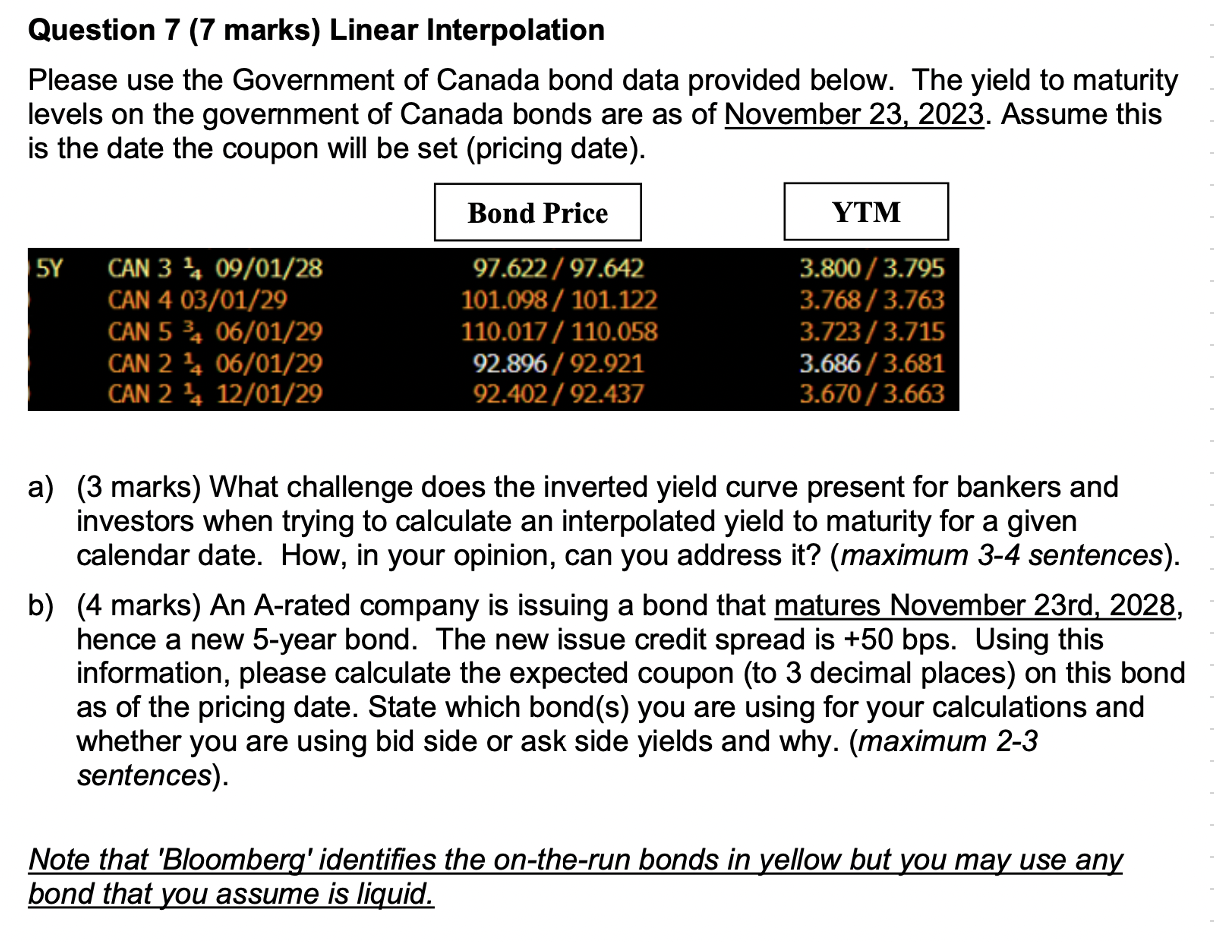

Please use the Government of Canada bond data provided below. The yield to maturity

levels on the government of Canada bonds are as of November Assume this

is the date the coupon will be set pricing date

a marks What challenge does the inverted yield curve present for bankers and

investors when trying to calculate an interpolated yield to maturity for a given

calendar date. How, in your opinion, can you address itmaximum sentences

b marks An Arated company is issuing a bond that matures November rd

hence a new year bond. The new issue credit spread is bps Using this

information, please calculate the expected coupon to decimal places on this bond

as of the pricing date. State which bonds you are using for your calculations and

whether you are using bid side or ask side yields and why. maximum

sentences

Note that 'Bloomberg' identifies the ontherun bonds in yellow but you may use any

bond that you assume is liquid.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started