Can you help me fix those, please? Thx!

Can you help me fix those, please? Thx!

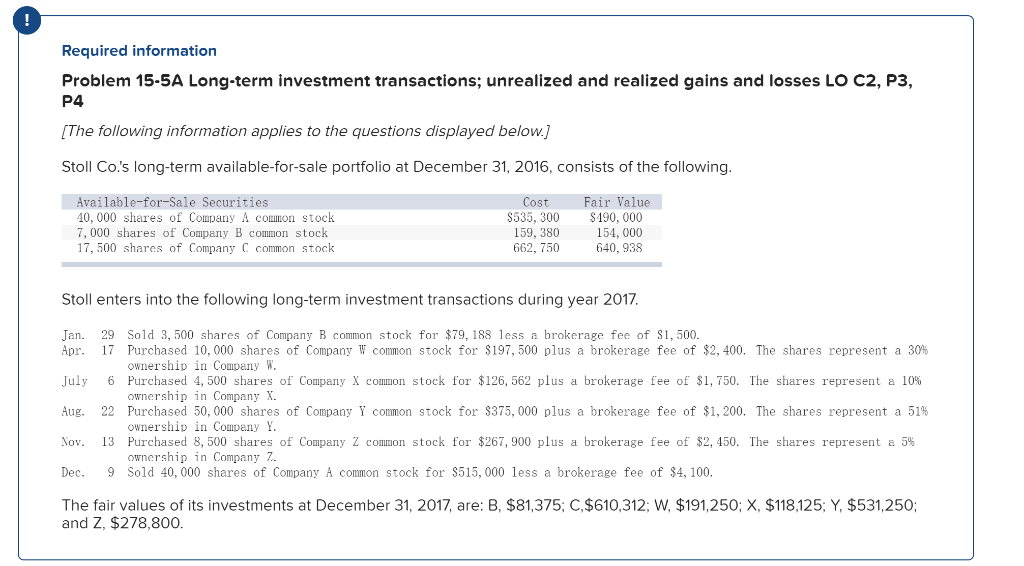

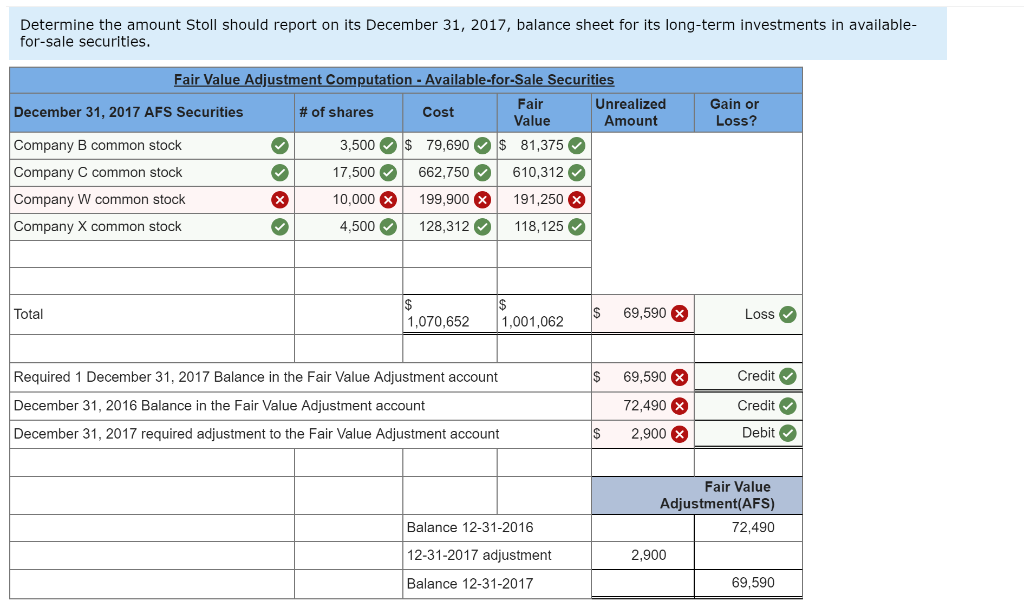

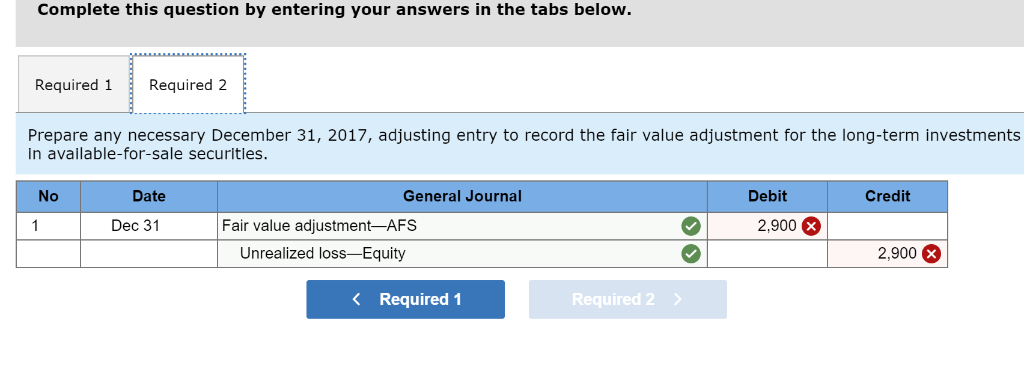

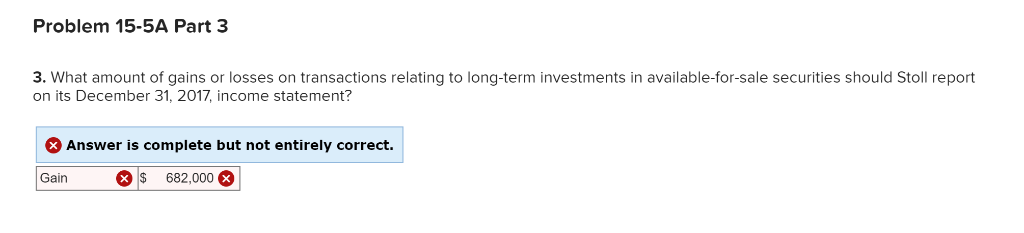

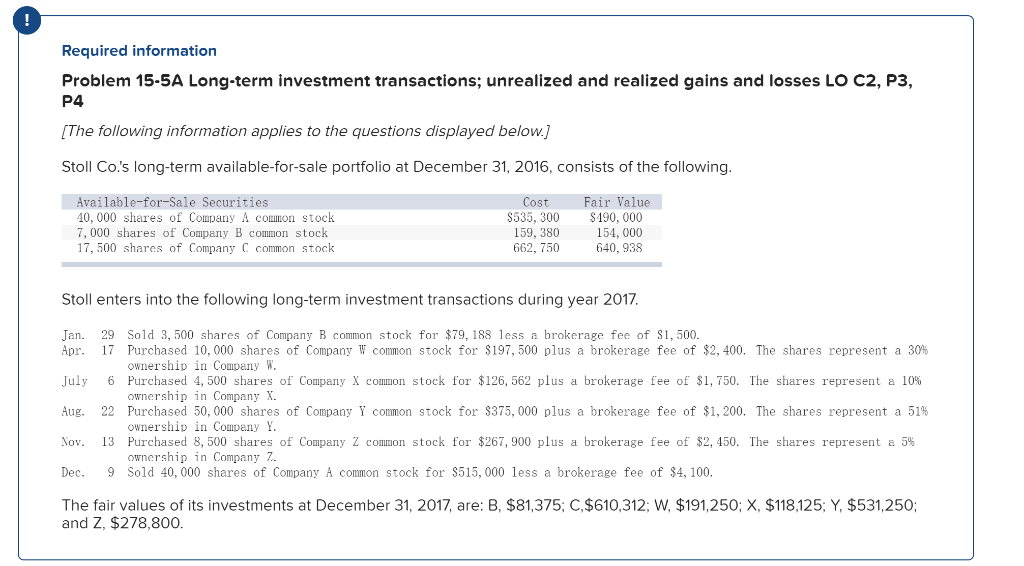

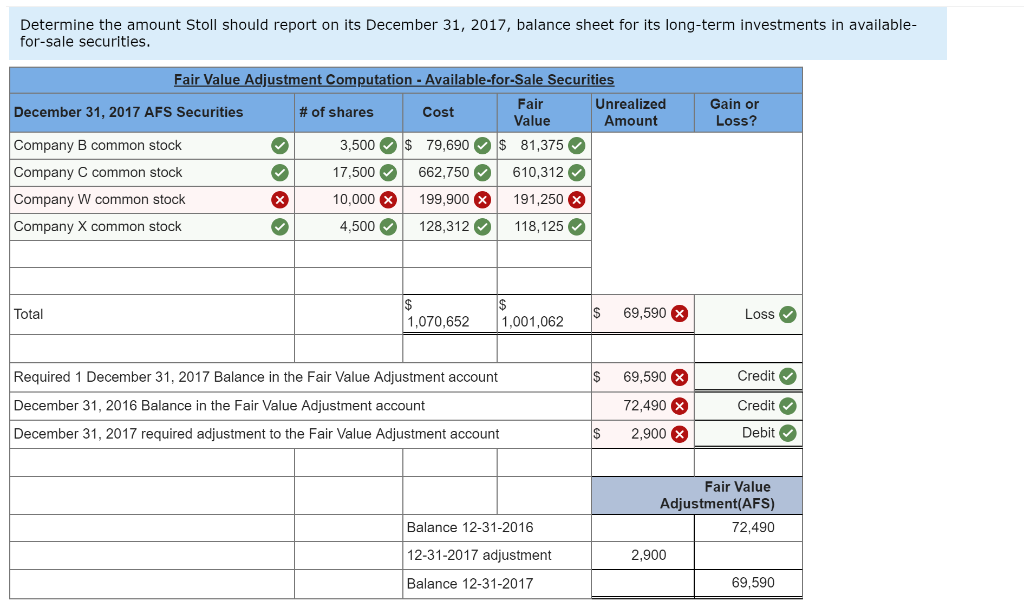

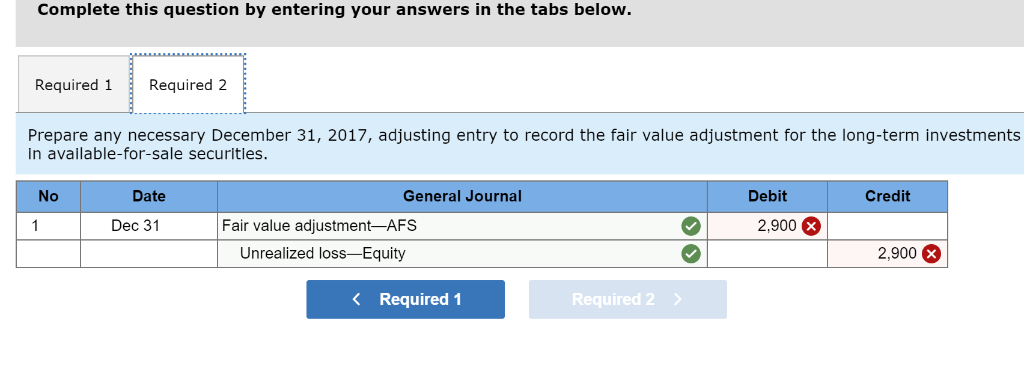

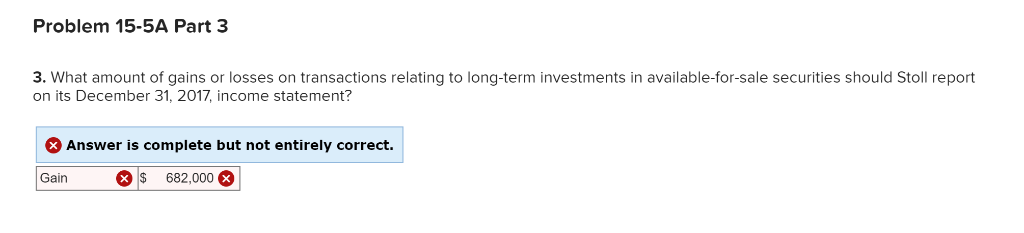

Required information Problem 15-5A Long-term investment transactions; unrealized and realized gains and losses LO C2, P3, P4 [The following information applies to the questions displayed below.] Stoll Co.'s long-term available-for-sale portfolio at December 31, 2016, consists of the following Available-for-Sale Securities 40, 000 shares of Company A comnon stoclk 7, 000 shares of Company B common stock 17, 500 shares of Company C common stock Cost Fair Value S535, 300 159, 380 662, 750 S190, 000 154, 000 640, 938 Stoll enters into the following long-term investment transactions during year 2017 Jan. 29 Sold 3, 500 shares of Company B common stock for $79, 188 less a brokerage fee of S1, 500 Apr. 17 Purchased 10,000 shares of Company W common stock for $197,500 plus a brokerage fee of $2,400. The shares represent a 30% July 6 Purchased 4,500 shares of Company X common stock for $126,562 plus a brokerage fee of $1,750. The shares represent a 10% Aug. 22 Purchased 50,000 shares of Company Y common stock for $375,000 plus a brokerage fee of $1,200. The shares represent a 51% Nov. 13 Purchased 8,500 shares of Company Z common stock for $267,900 plus a brokerage fee of $2,450. The shares represent a 5% Dec. 9 Sold 40, 000 shares of Company A common stock for 8515, 000 less a brokerage fee of $4, 100 The fair values of its investments at December 31, 2017, are: B, $81,375; C,$610,312: W, $191,250; X, $118,125; Y, $531,250 ownership in Company ownership in Company X. ownership in Company Y ownership in Company 7. and Z, $278,800 Determine the amount Stoll should report on its December 31, 2017, balance sheet for its long-term investments in available- for-sale securities Fair Value Unrealized Amount Gain or Loss? Cost December 31, 2017 AFS Securities Company B common stock Company C common stock Company W common stock Company X common stock # of shares ,500 s 79,690s 81,375 610,312 191,250 4,500 128,312118,125 662,750 6 199,900 17,500 10,000 Total $ 69,590 Loss 1,070,652 1,001,062 Required 1 December 31, 2017 Balance in the Fair Value Adjustment account December 31, 2016 Balance in the Fair Value Adjustment account December 31, 2017 required adjustment to the Fair Value Adjustment account $ 69,590 72,490 $ 2,900 Credit Credit Debit Fair Value Adjustment(AFS) 72,490 Balance 12-31-2016 12-31-2017 adjustment Balance 12-31-2017 2,900 69,590 Complete this question by entering your answers in the tabs below. Required 1Required 2 Prepare any necessary December 31, 2017, adjusting entry to record the fair value adjustment for the long-term investments n available-for-sale securitles. Debit Credit No Date General Journal 2,900 * Fair value adjustment-AFS Unrealized loss-Equity Dec 31 2,900 X Required 1 Required 2

Can you help me fix those, please? Thx!

Can you help me fix those, please? Thx!