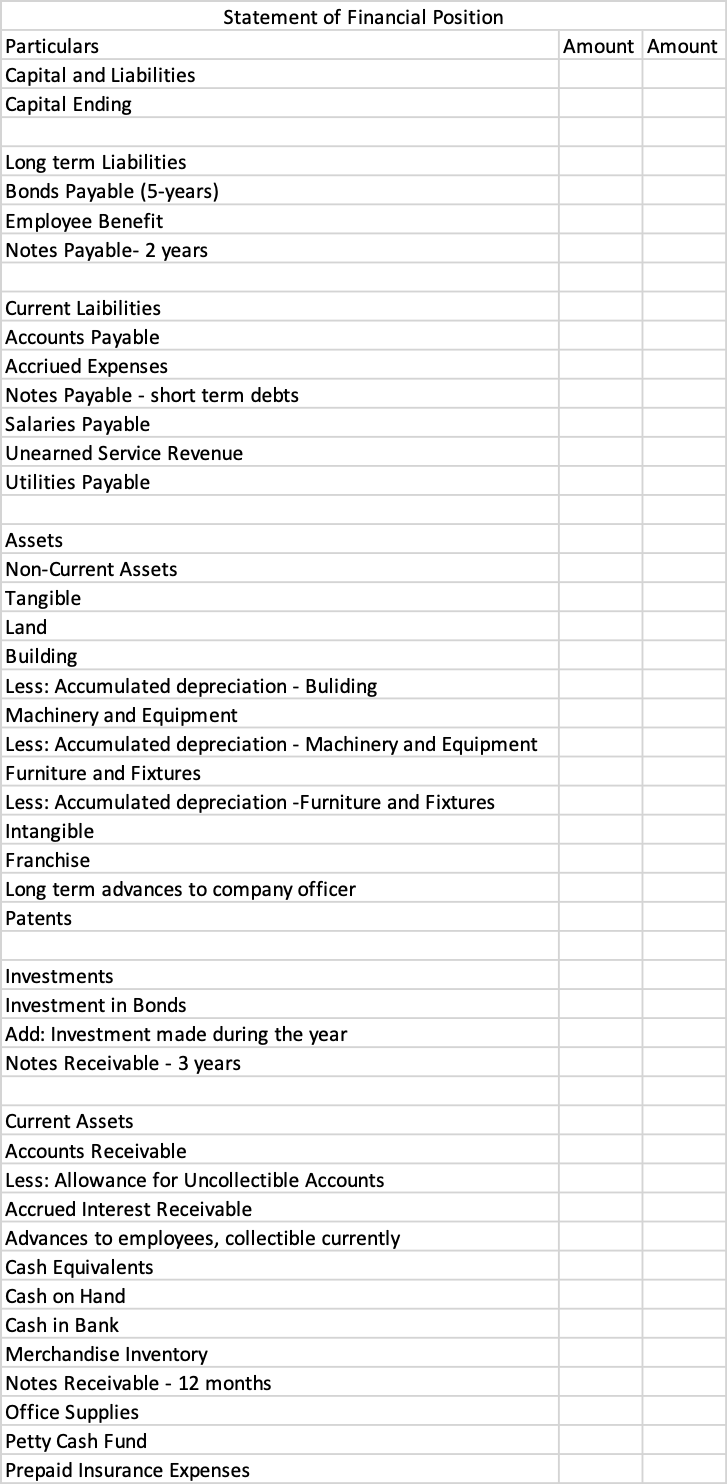

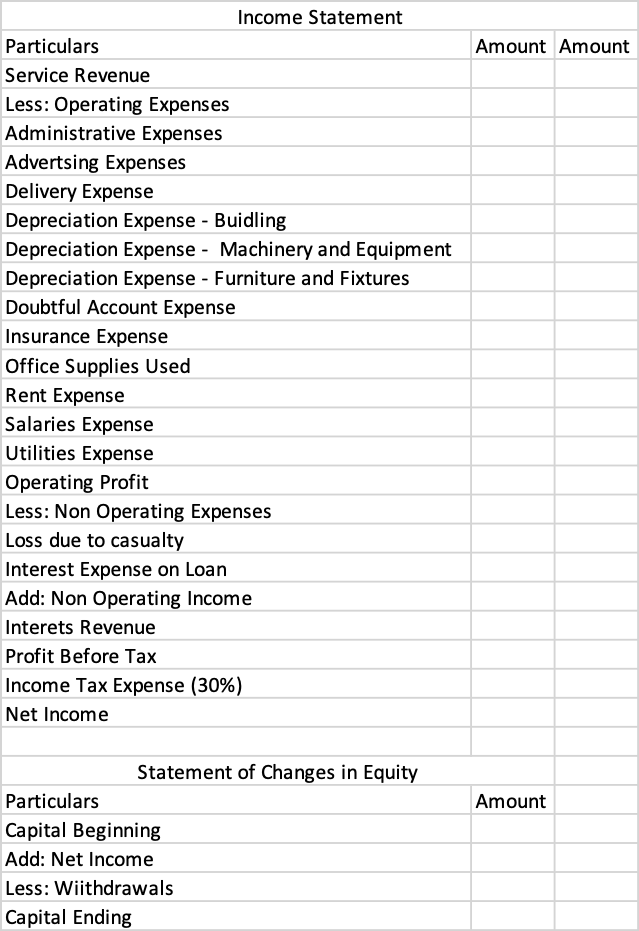

Can you help me put amounts to be assigned in each account title?

I already worked with the Statement of Financial Position, Income statement and Changes in equity but i am having a hard time to put some amounts. Can you help me?

(The assets must be equal with the total liabilities and equity.)

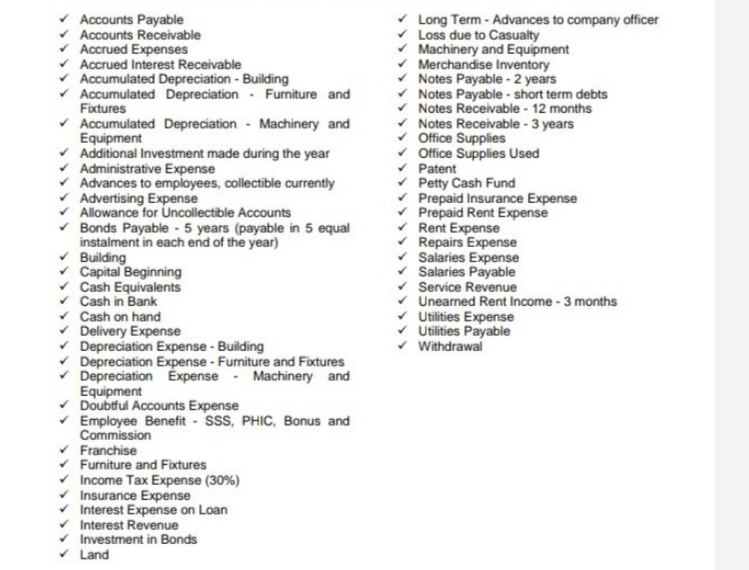

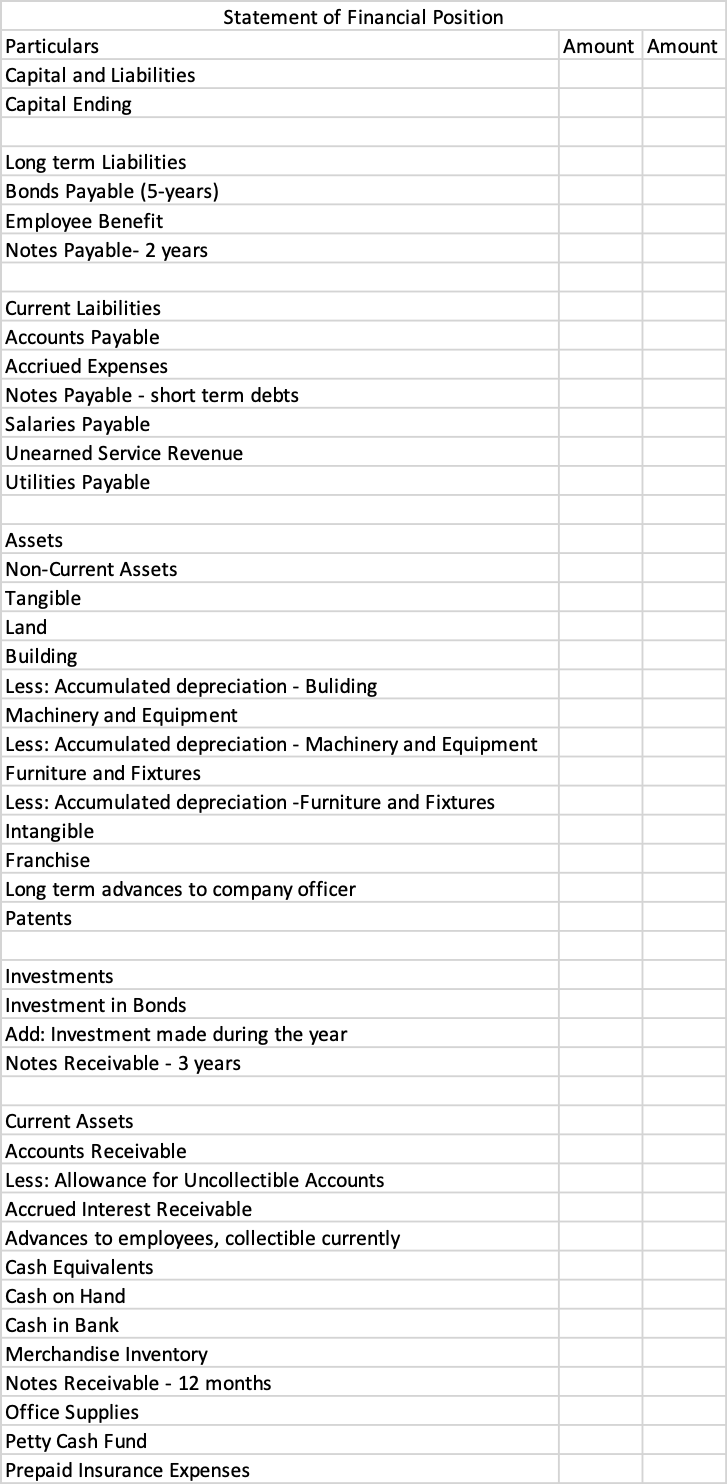

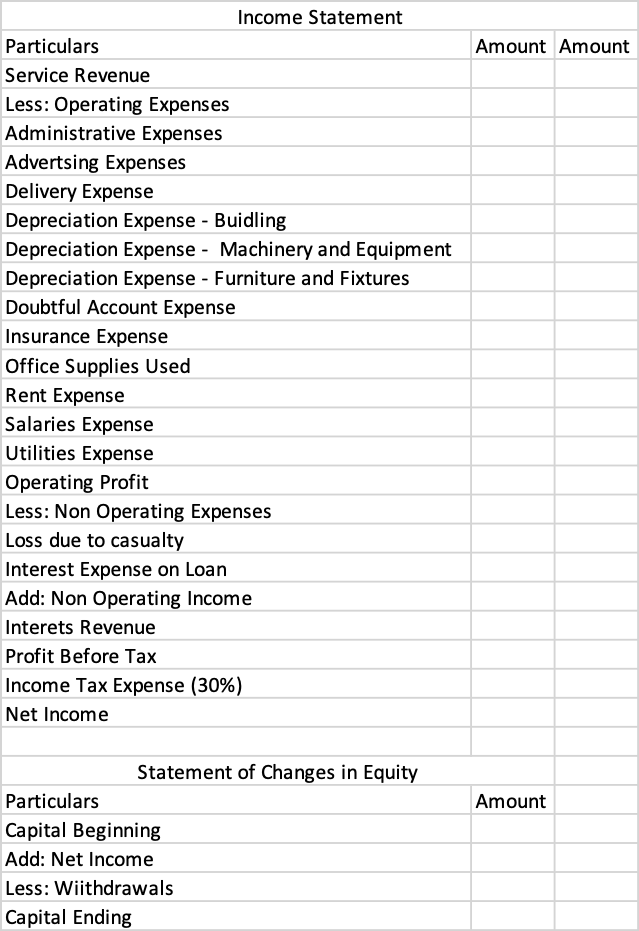

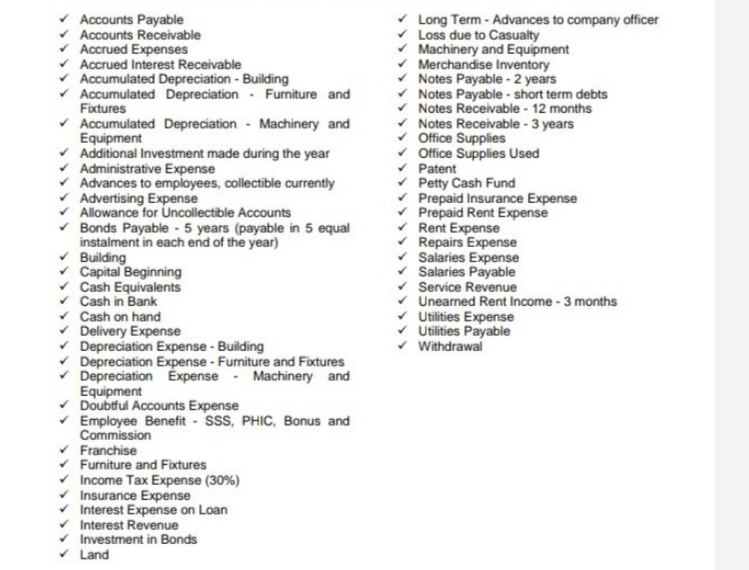

Accounts Payable Accounts Receivable Accrued Expenses Accrued Interest Receivable Accumulated Depreciation - Building Accumulated Depreciation - Furniture and Fixtures Accumulated Depreciation - Machinery and Equipment Additional Investment made during the year Administrative Expense Advances to employees, collectible currently Advertising Expense Allowance for Uncollectible Accounts Bonds Payable. 5 years (payable in 5 equal instalment in each end of the year) Building Capital Beginning Cash Equivalents Cash in Bank Cash on hand Delivery Expense Depreciation Expense - Building Depreciation Expense - Furniture and Fixtures Depreciation Expense . Machinery and Equipment Doubtful Accounts Expense Employee Benefit SSS, PHIC, Bonus and Commission Franchise Furniture and Fixtures Income Tax Expense (30%) Insurance Expense Interest Expense on Loan Interest Revenue Investment in Bonds Land Long Term - Advances to company officer Loss due to Casualty Machinery and Equipment Merchandise Inventory Notes Payable - 2 years Notes Payable - short term debts Notes Receivable - 12 months Notes Receivable - 3 years Office Supplies Office Supplies Used Patent Petty Cash Fund Prepaid Insurance Expense Prepaid Rent Expense Rent Expense Repairs Expense Salaries Expense Salaries Payable Service Revenue Unearned Rent Income - 3 months Utilities Expense Utilities Payable Withdrawal Statement of Financial Position Amount Amount Particulars Capital and Liabilities Capital Ending Long term Liabilities Bonds Payable (5-years) Employee Benefit Notes Payable- 2 years Current Laibilities Accounts Payable Accriued Expenses Notes Payable - short term debts Salaries Payable Unearned Service Revenue Utilities Payable Assets Non-Current Assets Tangible Land Building Less: Accumulated depreciation - Buliding Machinery and Equipment Less: Accumulated depreciation - Machinery and Equipment Furniture and Fixtures Less: Accumulated depreciation - Furniture and Fixtures Intangible Franchise Long term advances to company officer Patents Investments Investment in Bonds Add: Investment made during the year Notes Receivable - 3 years Current Assets Accounts Receivable Less: Allowance for Uncollectible Accounts Accrued Interest Receivable Advances to employees, collectible currently Cash Equivalents Cash on Hand Cash in Bank Merchandise Inventory Notes Receivable - 12 months Office Supplies Petty Cash Fund Prepaid Insurance Expenses Amount Amount Income Statement Particulars Service Revenue Less: Operating Expenses Administrative Expenses Advertsing Expenses Delivery Expense Depreciation Expense - Buidling Depreciation Expense - Machinery and Equipment Depreciation Expense - Furniture and Fixtures Doubtful Account Expense Insurance Expense Office Supplies Used Rent Expense Salaries Expense Utilities Expense Operating Profit Less: Non Operating Expenses Loss due to casualty Interest Expense on Loan Add: Non Operating Income Interets Revenue Profit Before Tax Income Tax Expense (30%) Net Income Amount Statement of Changes in Equity Particulars Capital Beginning Add: Net Income Less: Withdrawals Capital Ending Accounts Payable Accounts Receivable Accrued Expenses Accrued Interest Receivable Accumulated Depreciation - Building Accumulated Depreciation - Furniture and Fixtures Accumulated Depreciation - Machinery and Equipment Additional Investment made during the year Administrative Expense Advances to employees, collectible currently Advertising Expense Allowance for Uncollectible Accounts Bonds Payable. 5 years (payable in 5 equal instalment in each end of the year) Building Capital Beginning Cash Equivalents Cash in Bank Cash on hand Delivery Expense Depreciation Expense - Building Depreciation Expense - Furniture and Fixtures Depreciation Expense . Machinery and Equipment Doubtful Accounts Expense Employee Benefit SSS, PHIC, Bonus and Commission Franchise Furniture and Fixtures Income Tax Expense (30%) Insurance Expense Interest Expense on Loan Interest Revenue Investment in Bonds Land Long Term - Advances to company officer Loss due to Casualty Machinery and Equipment Merchandise Inventory Notes Payable - 2 years Notes Payable - short term debts Notes Receivable - 12 months Notes Receivable - 3 years Office Supplies Office Supplies Used Patent Petty Cash Fund Prepaid Insurance Expense Prepaid Rent Expense Rent Expense Repairs Expense Salaries Expense Salaries Payable Service Revenue Unearned Rent Income - 3 months Utilities Expense Utilities Payable Withdrawal Statement of Financial Position Amount Amount Particulars Capital and Liabilities Capital Ending Long term Liabilities Bonds Payable (5-years) Employee Benefit Notes Payable- 2 years Current Laibilities Accounts Payable Accriued Expenses Notes Payable - short term debts Salaries Payable Unearned Service Revenue Utilities Payable Assets Non-Current Assets Tangible Land Building Less: Accumulated depreciation - Buliding Machinery and Equipment Less: Accumulated depreciation - Machinery and Equipment Furniture and Fixtures Less: Accumulated depreciation - Furniture and Fixtures Intangible Franchise Long term advances to company officer Patents Investments Investment in Bonds Add: Investment made during the year Notes Receivable - 3 years Current Assets Accounts Receivable Less: Allowance for Uncollectible Accounts Accrued Interest Receivable Advances to employees, collectible currently Cash Equivalents Cash on Hand Cash in Bank Merchandise Inventory Notes Receivable - 12 months Office Supplies Petty Cash Fund Prepaid Insurance Expenses Amount Amount Income Statement Particulars Service Revenue Less: Operating Expenses Administrative Expenses Advertsing Expenses Delivery Expense Depreciation Expense - Buidling Depreciation Expense - Machinery and Equipment Depreciation Expense - Furniture and Fixtures Doubtful Account Expense Insurance Expense Office Supplies Used Rent Expense Salaries Expense Utilities Expense Operating Profit Less: Non Operating Expenses Loss due to casualty Interest Expense on Loan Add: Non Operating Income Interets Revenue Profit Before Tax Income Tax Expense (30%) Net Income Amount Statement of Changes in Equity Particulars Capital Beginning Add: Net Income Less: Withdrawals Capital Ending