Answered step by step

Verified Expert Solution

Question

1 Approved Answer

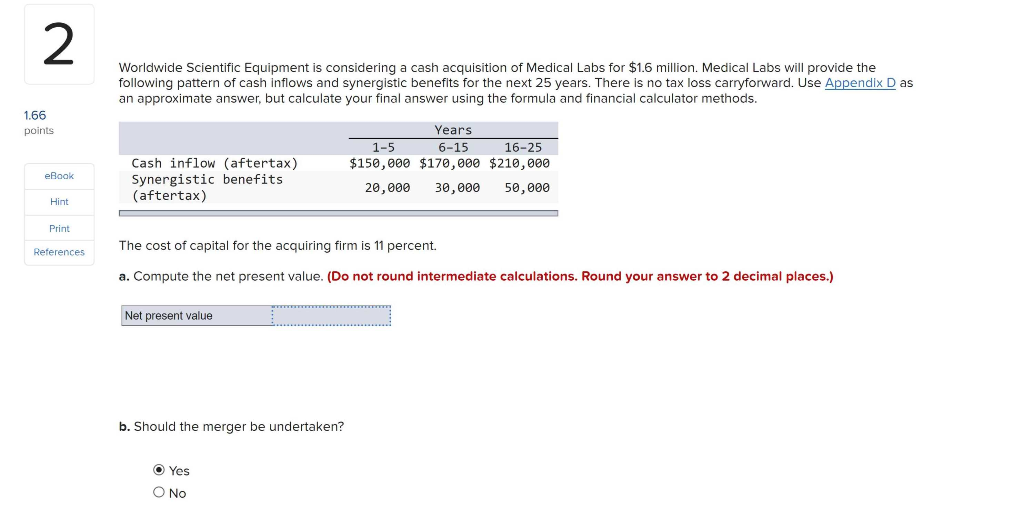

Can you help me solve question a), I know the answer for B is yes. The answer for a) is *not* $58,400 as found elsewhere

Can you help me solve question a), I know the answer for B is yes. The answer for a) is *not* $58,400 as found elsewhere on Chegg, this answer is incorrect. Thanks!

Worldwide Scientific Equipment is considering a cash acquisition of Medical Labs for $1.6 million. Medical Labs will provide the following pattern of cash inflows and synergistic benefits for the next 25 years. There is no tax loss carryforward. Use Appendix D as an approximate answer, but calculate your final answer using the formula and financial calculator methods. 1.66 points Years 1-5 6-15 16-25 $150,000 $170,000 $210,000 20,000 30,000 50,000 Cash inflow (aftertax) Synergistic benefits (aftertax) eBook Hint Print The cost of capital for the acquiring firm is 11 percent. References a. Compute the net present value. (Do not round intermediate calculations. Round your answer to 2 decimal places.) Net present value b. Should the merger be undertaken? Yes O NoStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started