Answered step by step

Verified Expert Solution

Question

1 Approved Answer

can you help me solve this problem? accounting 200 SA-11 accounts along with some ancillary information and ask the student to deduce what happened to

can you help me solve this problem? accounting 200

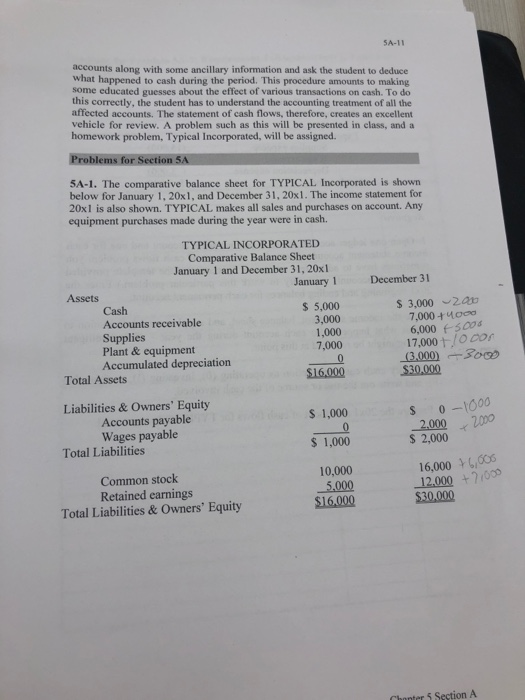

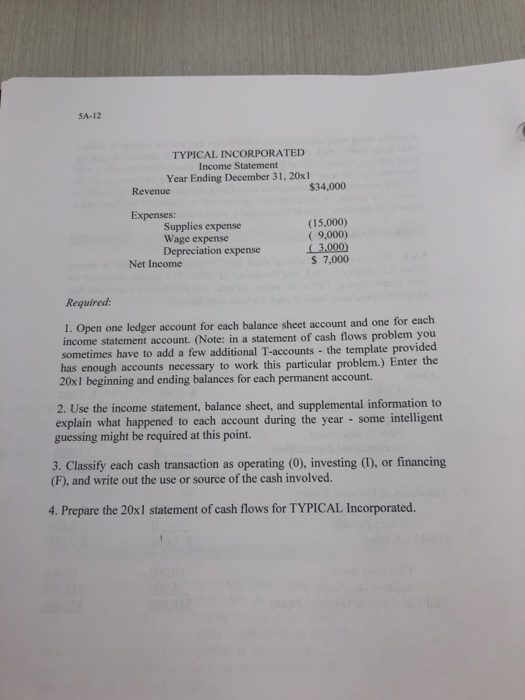

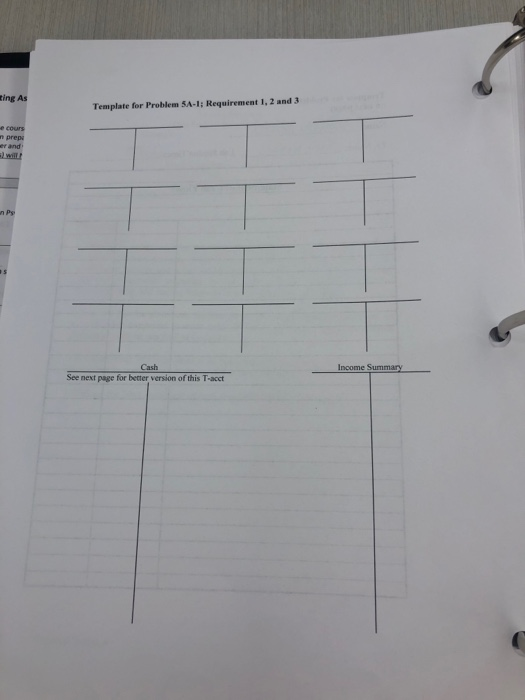

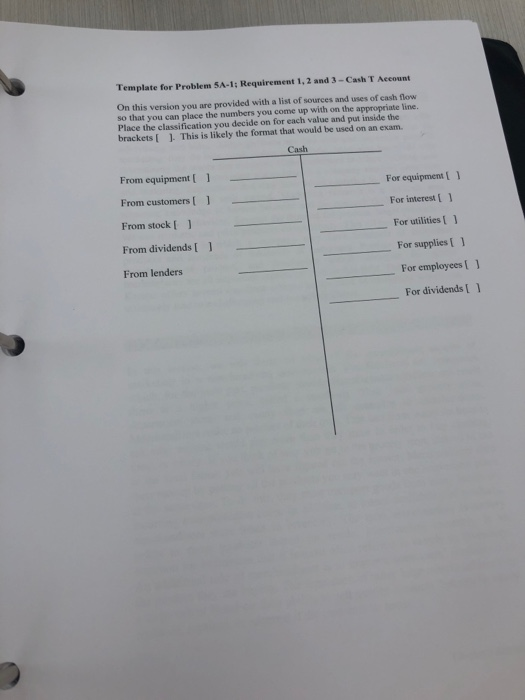

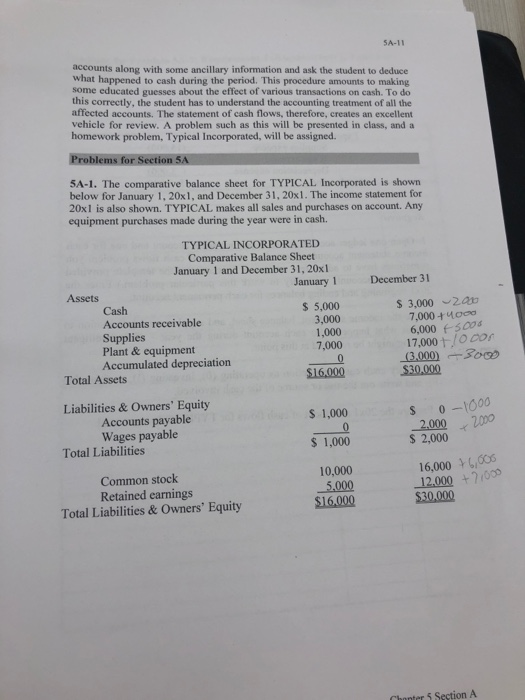

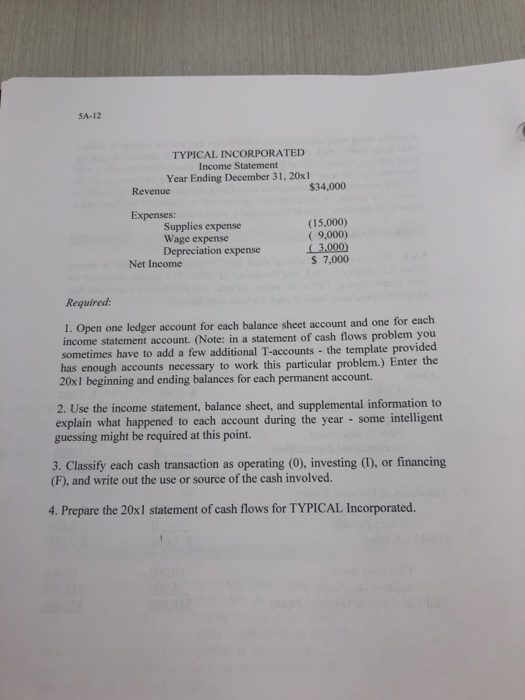

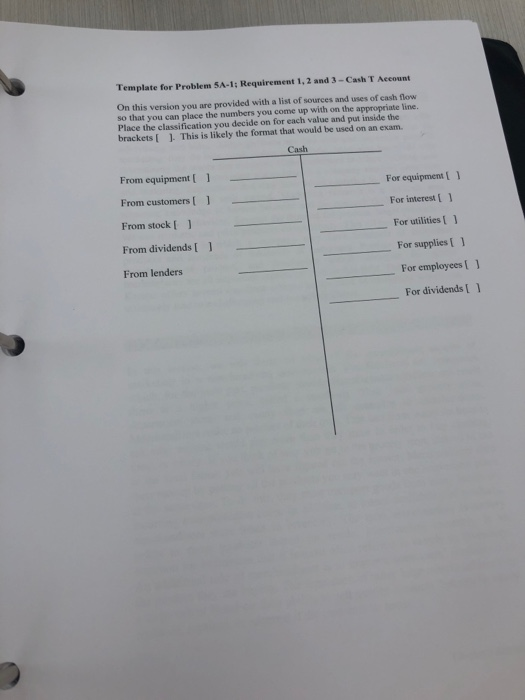

SA-11 accounts along with some ancillary information and ask the student to deduce what happened to cash during the period. This procedure amounts to making some educated guesses about the effect of various transactions on cash. To do this correctly, the student has to understand the accounting treatment of all the affected accounts. The statement of cash flows, therefore, creates an excellent vehicle for review. A problem such as this will be presented in class, and a homework problem. Typical Incorporated, will be assigned. Problems for Section 5A 5A-1. The comparative balance sheet for TYPICAL Incorporated is shown below for January 1, 20x1, and December 31, 20x1. The income statement for 20x1 is also shown. TYPICAL makes all sales and purchases on account. Any equipment purchases made during the year were in cash. December 31 TYPICAL INCORPORATED Comparative Balance Sheet January 1 and December 31, 20x1 January 1 Assets Cash $ 5,000 Accounts receivable 3,000 Supplies 1,000 Plant & equipment 7,000 Accumulated depreciation 0 Total Assets $16.000 $ 3,000 200 7,000+400 6,000 5006 17,000 /Ocon (3.000)-3000 $30,000 $ 1,000 $ 0 -1000 2000 Liabilities & Owners' Equity Accounts payable Wages payable Total Liabilities 2,000 $ 2,000 $ 1,000 ,000 16,000 10,000 5,000 $16.000 Common stock Retained earnings Total Liabilities & Owners' Equity 12,000 +7:00 $30.000 Chapter 5 Section A SA-12 TYPICAL INCORPORATED Income Statement Year Ending December 31, 20x1 Revenue S34.000 Expenses: Supplies expense Wage expense Depreciation expense Net Income (15,000) (9,000) 3,000 $ 7,000 Required: 1. Open one ledger account for each balance sheet account and one for each income statement account. (Note: in a statement of cash flows problem you sometimes have to add a few additional T-accounts - the template provided has enough accounts necessary to work this particular problem.) Enter the 20x1 beginning and ending balances for each permanent account. 2. Use the income statement, balance sheet, and supplemental information to explain what happened to each account during the year - some intelligent guessing might be required at this point. 3. Classify each cash transaction as operating (0), investing (1), or financing (F), and write out the use or source of the cash involved. 4. Prepare the 20x1 statement of cash flows for TYPICAL Incorporated. remont 4 ( R uirements 1.2 and a Templo on next Name: TA Name: Lab Section Time: 21.00 Statement of Cash Flows IR ting As Template for Problem SA-1: Requirement 1, 2 and 3 e cours npreps er and Income Summary Cash See next page for better version of this T-acct Template for Problem SA-1: Requirement 1, 2 and 3-Cash T Account On this version you are provided with a list of sources and uses of cash flow so that you can place the numbers you come up with on the appropriate line. Pince the classification you decide on for each value and put inside the brackets []. This is likely the format that would be used on an exam. Cash From equipment [ For equipment From customers [ 1 For interest From stock [ ] For utilities [ ] From dividends [ ] From lenders For supplies For employees For dividends

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started