Can you help me to answer this please I'm badly rey need help right now. Thank you

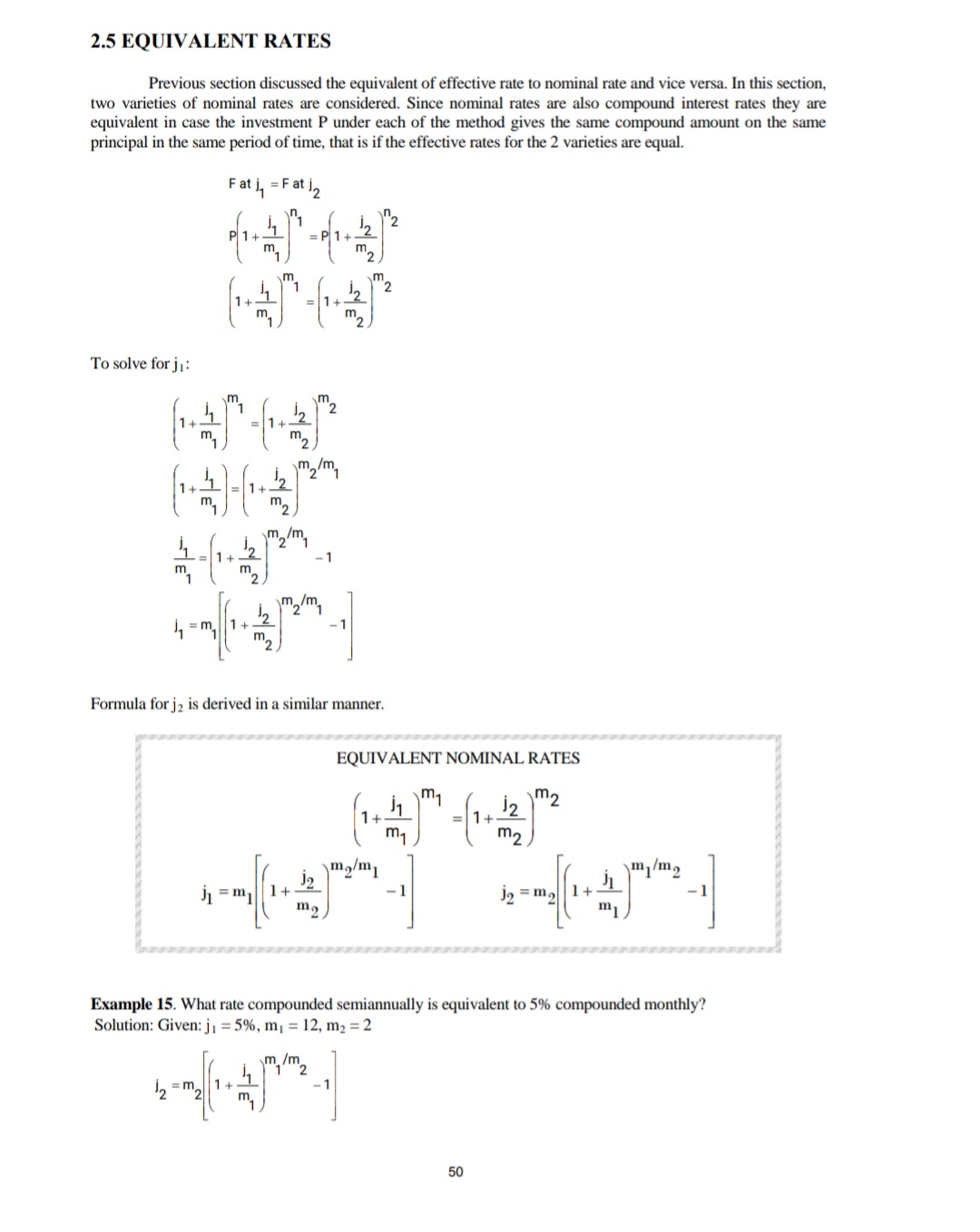

2.5 EQUIVALENT RATES Previous section discussed the equivalent of effective rate to nominal rate and vice versa. In this section, two varieties of nominal rates are considered. Since nominal rates are also compound interest rates they are equivalent in case the investment P under each of the method gives the same compound amount on the same principal in the same period of time, that is if the effective rates for the 2 varieties are equal. Fat j, = F at 12 P 1+ 1 1 To solve for ji: 1 + 2 = 1 + 12 ) 2 / my m 2 1 =1 + 2 2 m -1 Formula for j2 is derived in a similar manner. EQUIVALENT NOMINAL RATES 1 + 1 1 + 12 )m2 m2 h1 = m 1+ J2 \\m2/m1 m , 12 = m2 1+ -1 Example 15. What rate compounded semiannually is equivalent to 5% compounded monthly? Solution: Given: j1 = 5%, m, = 12, m2 = 2 12 = my 1 + 42 1/ 2 - 1 5012 = 2 (1.00416667)6 -1] j2 = 0.050524 x 100 j2 = 5.05% compounded monthly Example 16. What rate converted monthly is equivalent to 4-1/2 % converted quarterly? Solution: Given: j1 = 4.5%, m, =4, m2 = 12 12 = M2 1 + my 12 = 12 (14 0.045 3 12 = 12 (1.07125)3 -1 j2 = 0.044832x100 j2 = 4.48% compounded monthly Example 17. If Kay has 100,000 to invest, which of the two investments will she choose: Bond A at 10% compounded semiannually or Bond B at 9.5% compounded quarterly? Solution: Given: P100,000, j1 = 10%, m, = 2, J2 = 9.5%, m2 = 4 Since two nominal rates are given, they are not comparable unless they have the same conversion periods or they are expressed to effective rates. A. Second nominal rate is converted to a nominal rate with the same conversion period as the first. / m 1= m 1+ 2) -1 1 =2 1+ 0.095 4/2 4 1 =2 (1.02375)-1 j =9.61% compounded semiannually Since 9.5% compounded quarterly is equivalent to 9.61% compounded semiannually then Bond A is a better investment. That is, 10% compounded semiannually yields more interest than 9.61% compounded semiannually. B. The two nominal rates can also be compared by expressing both to effective rates. 511 = 1+47 1= 1 +-2 m2 1= 14 0.10 2 1= 1+ 0.095 4 2 i = (1.05)2 -1 i = (1.02375)4 -1 i = 10.25% i = 9.84% Again, 10.25% yields more interest than 9.84%. Example 18. What simple interest rate is equivalent to 6% compounded quarterly, if money is invested for 9 years and 9 months? Solution: Given: j = 6%, m = 4, t=9.75 years, n = 39 Since the unknown is the simple interest rate then F at simple interest i = F at j P (1 + it ) = P( 1 + 4)" (1 + it ) = (1 +4)" it = 1+4 -1 1+4 -1 Thus, 1+J -1 m 1 + 0.06 39 4 9.75 i (1.015 39 -1 9.75 i = 0.080740 x 100 i = 8.07% simple interest (1.015 4 39 - 1) +9.75 x 100 = 8.07 Example 19. What effective rate is equivalent to 15% simple interest for an amount invested for 12 years? Solution: Given: simple interest si = 15%, t = 12 years F at effective rate i = F at simple interest rate is P(1 +1) = P(1 + sit) 52(1 + 1) = (1 + ist) 1 +1 = V/1 + sit i = 1/1 + sit -1 1 = 121 + (0.15 12)-1 i = 8.96% (12 V( 1 +0.15 x 12) - 1) x 100 = or (( 1 +0.15 x 12 ) ^ ( 1/ 12) - 1) x 100 = 8.96 From the results of examples 18 and 19, the following formulas are derived. SIMPLE INTEREST RATE vs NOMINAL RATE 1+ 4 (1 + sit) = (1+j)" -1 si = m j = m W1 + sit -1 SIMPLE INTEREST RATE vs EFFECTIVE RATE i = V1 + sit -1 si = (1 +i)* -1 EXERCISES 2.5 01. Compare a nominal rate of 8% converted quarterly and a compound interest rate of 8% per quarter. 02. Compare a nominal rate of 8% compounded annually and 8% effective. 03. Which method is better, to invest at 5% compounded monthly or at 5.5% compounded semiannually? 04. Which investment is better, at 7% compounded semiannually or at 7.2% compounded quarterly? 05. What simple interest is equivalent to {7%, m = 12) if money is to be paid at the end of A) 3 years? B) 4 years? 06. What simple interest rate is equivalent to 7% compounded semiannually if money is invested for A) 3 years? B) 5 years? 07. What rate compounded semiannually is equivalent to {0.04, m = 4)? 08. What rate compounded quarterly is equivalent to {5.5%, m = 2)? 09. Mr. M invests 10,000 in a security. Will he invest the amount in a security with 6% compounded semiannually or in a security with 6% converted quarterly? 10. Ms. B has 8,000 to invest. Will she deposit the amount in the bank paying 6% compounded semiannually or invest the money in an investment house paying 6% converted quarterly? 53