can you help me to check and fill the blank, thank you

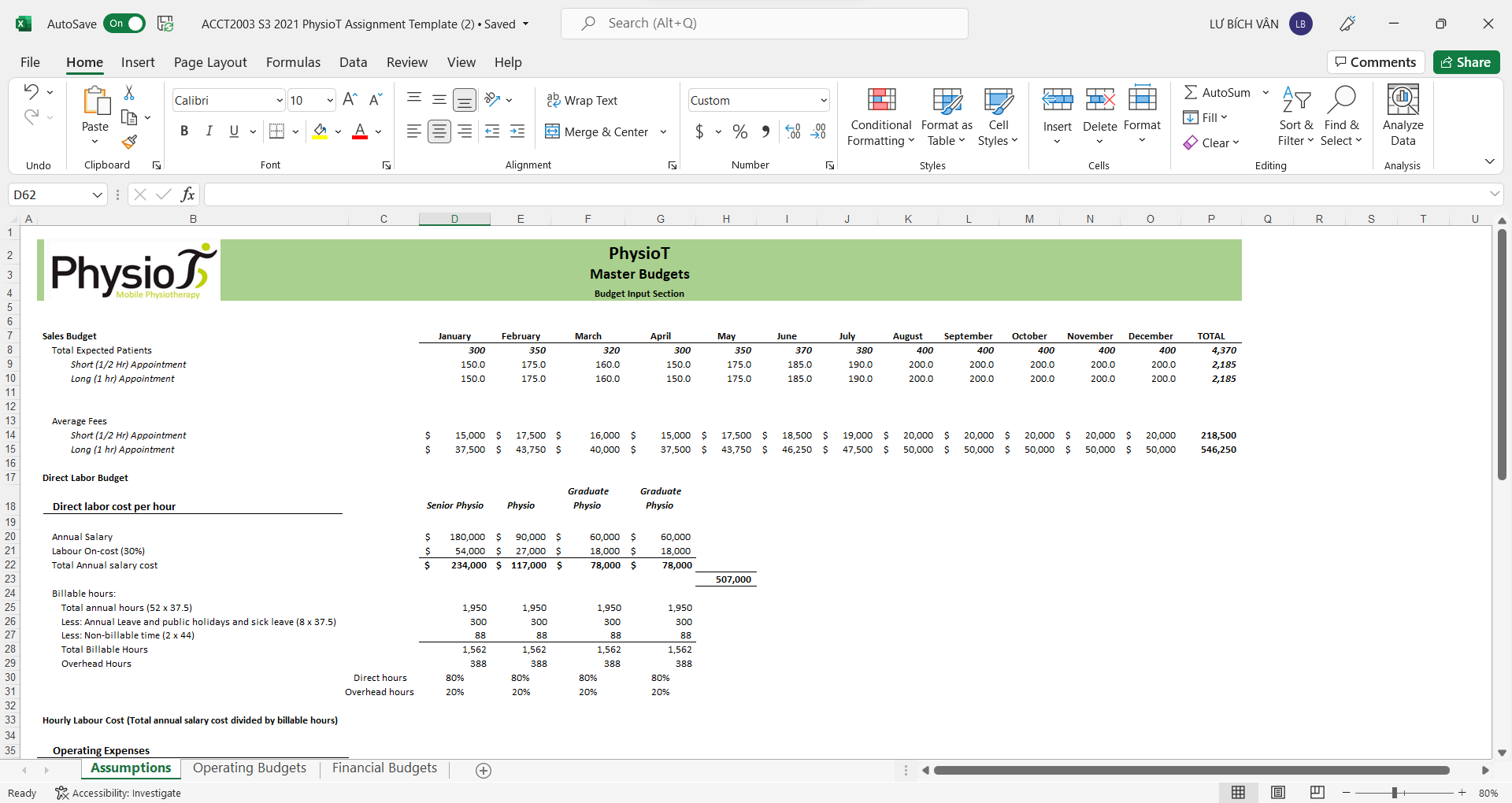

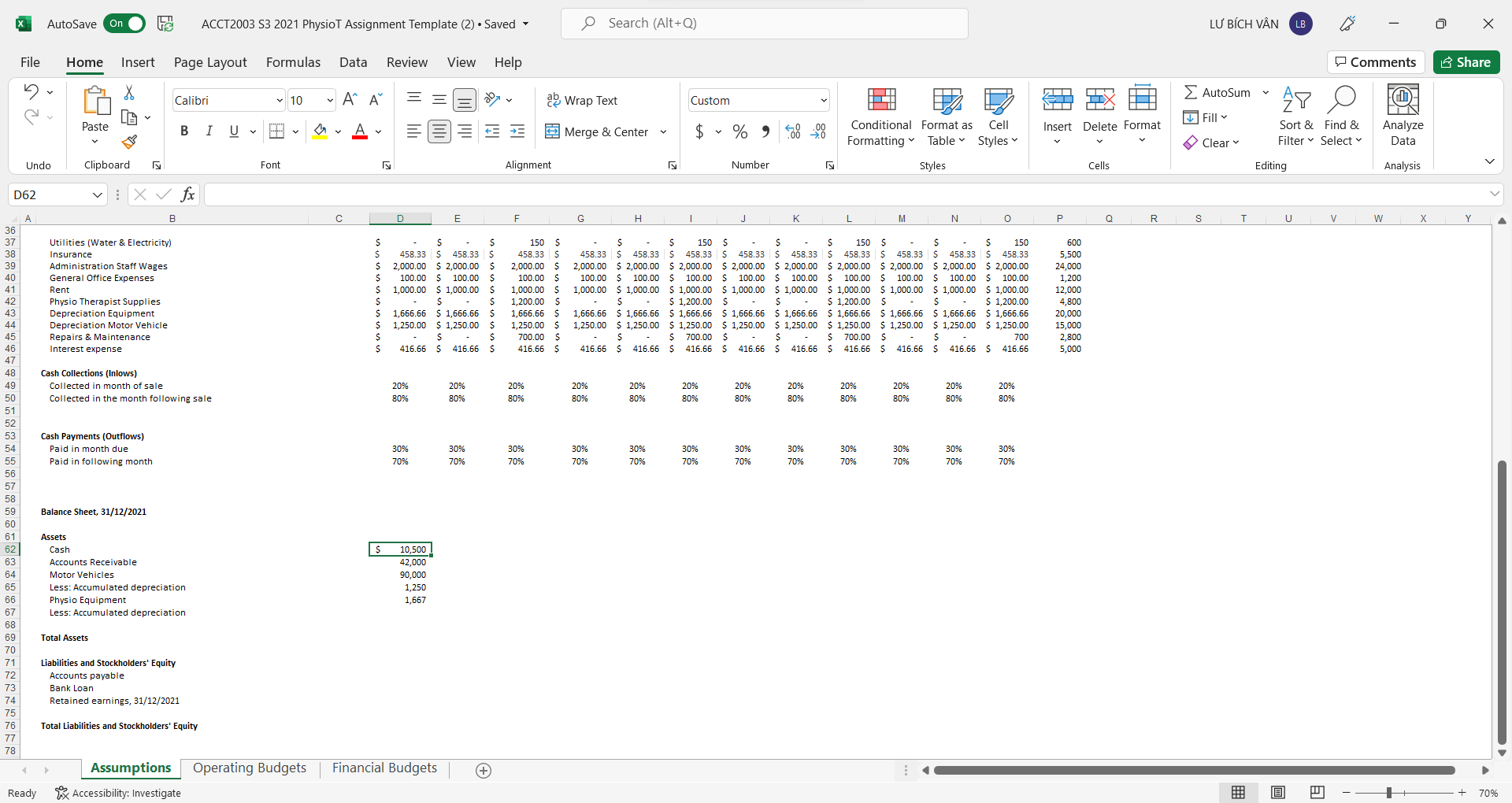

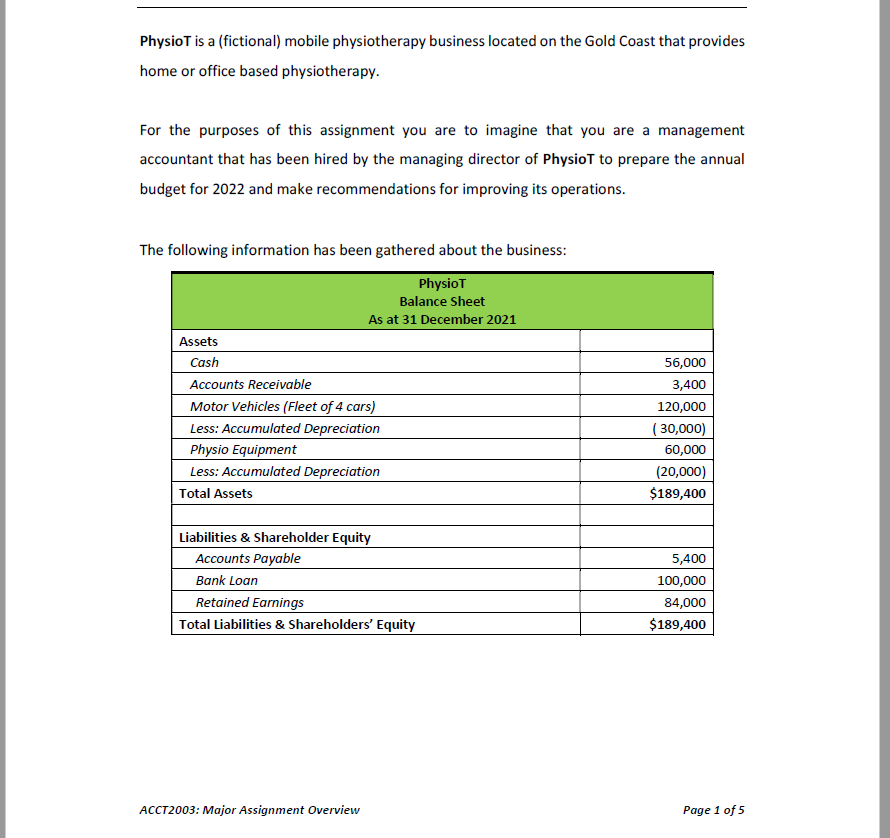

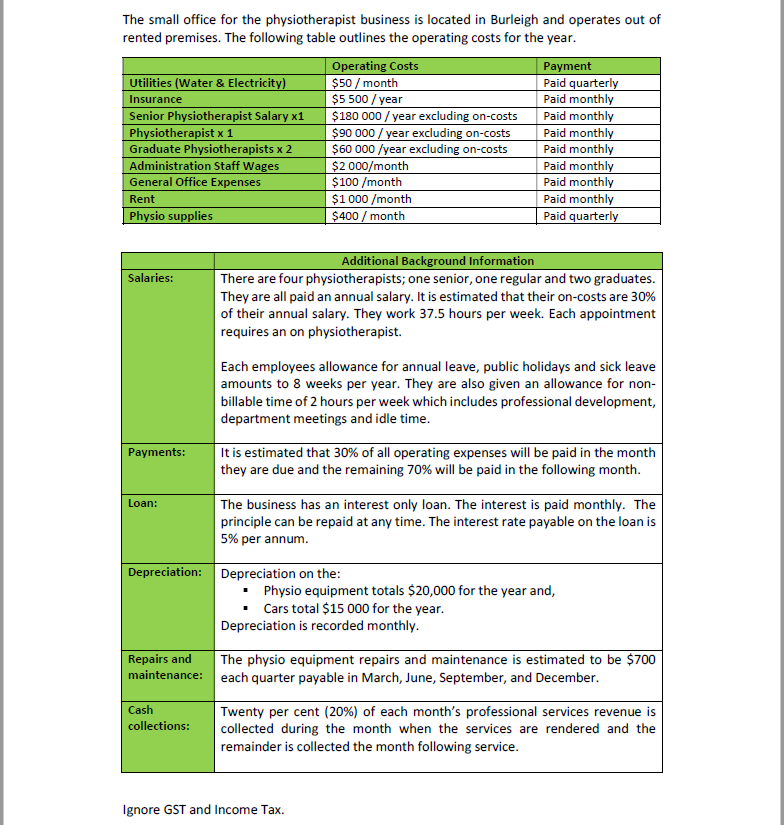

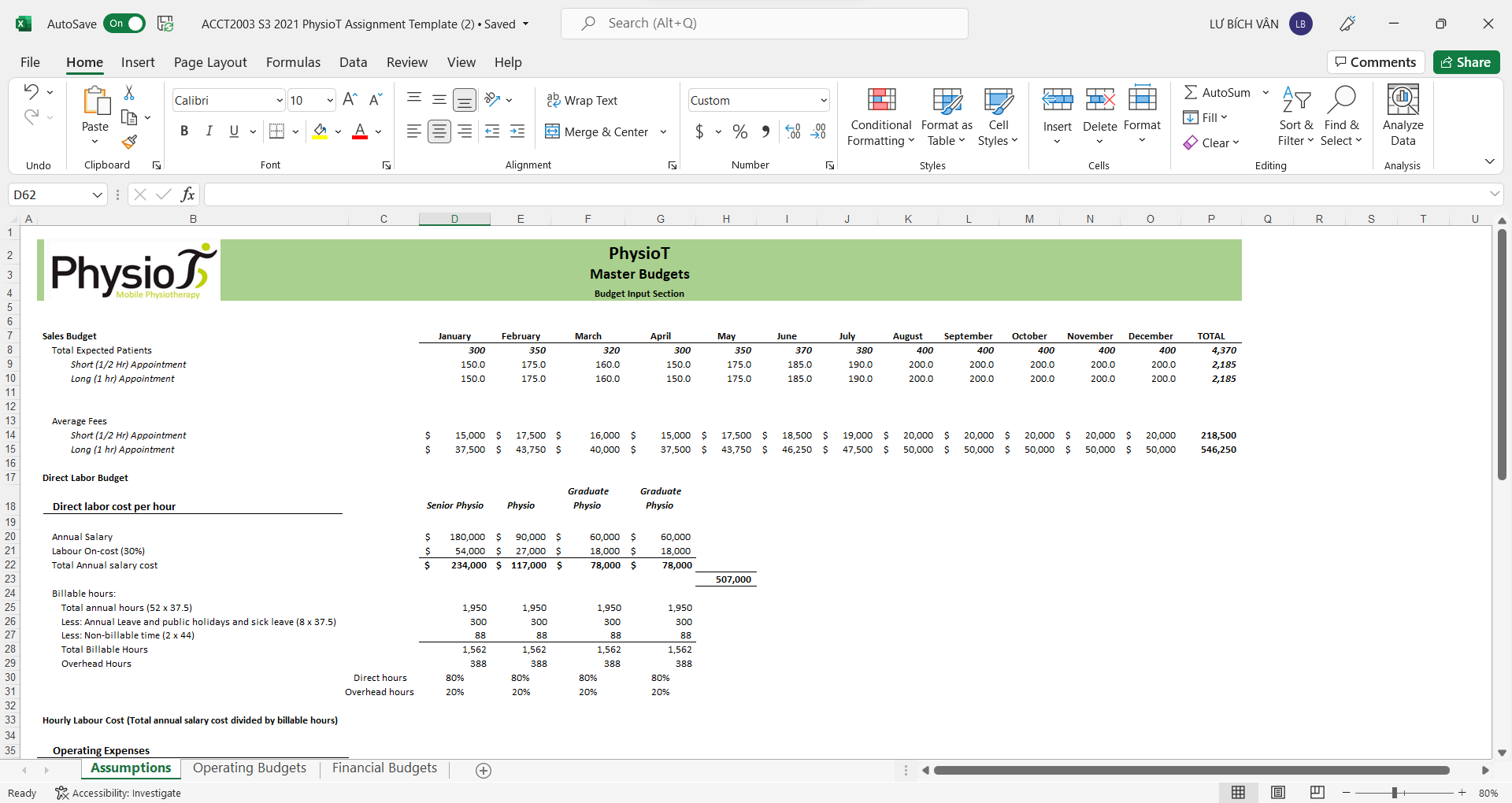

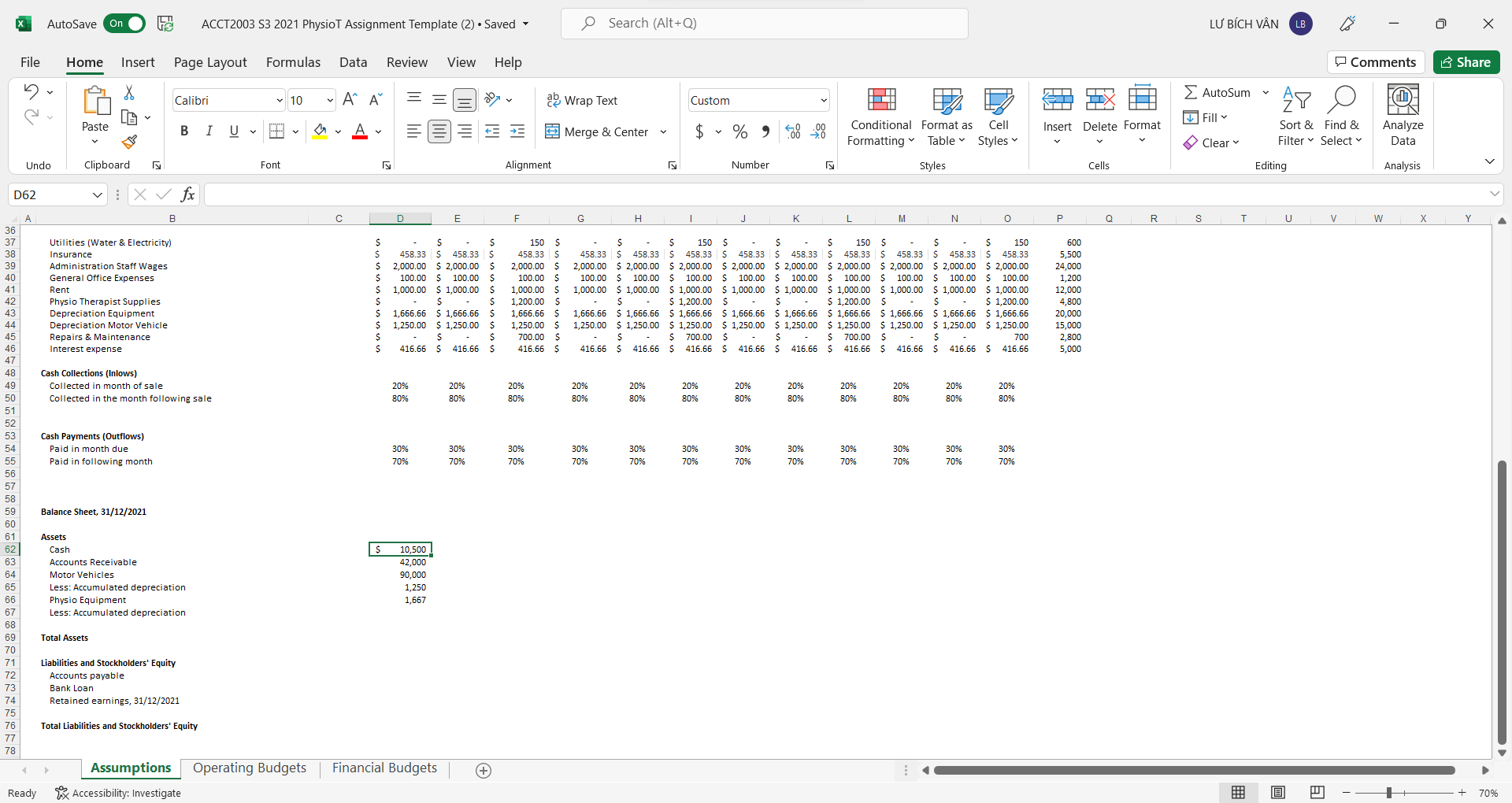

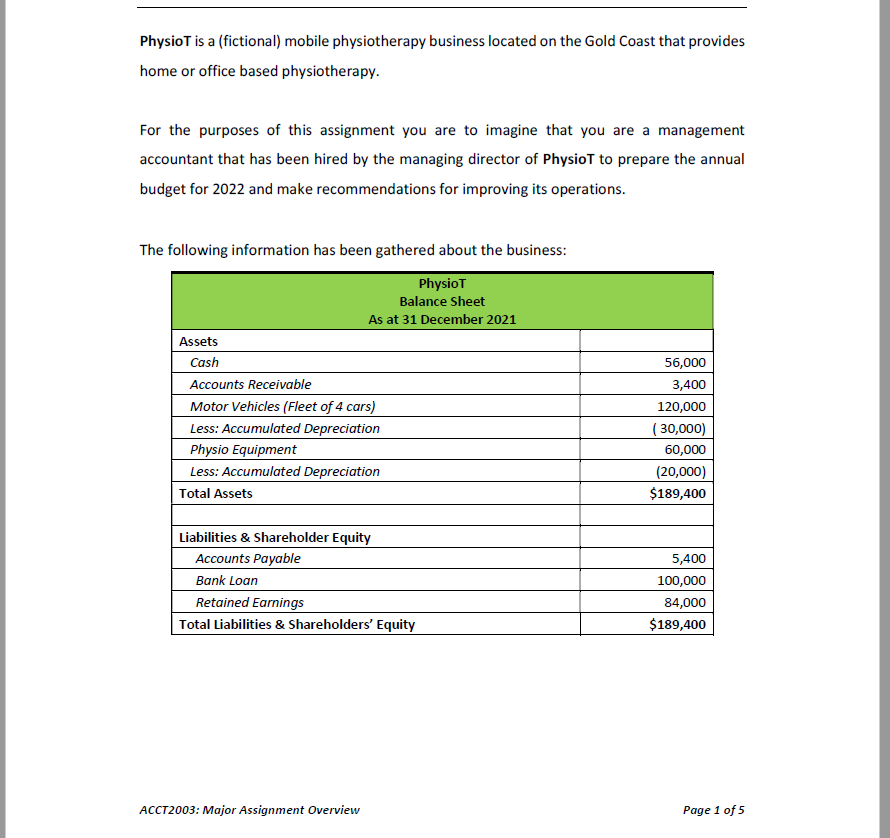

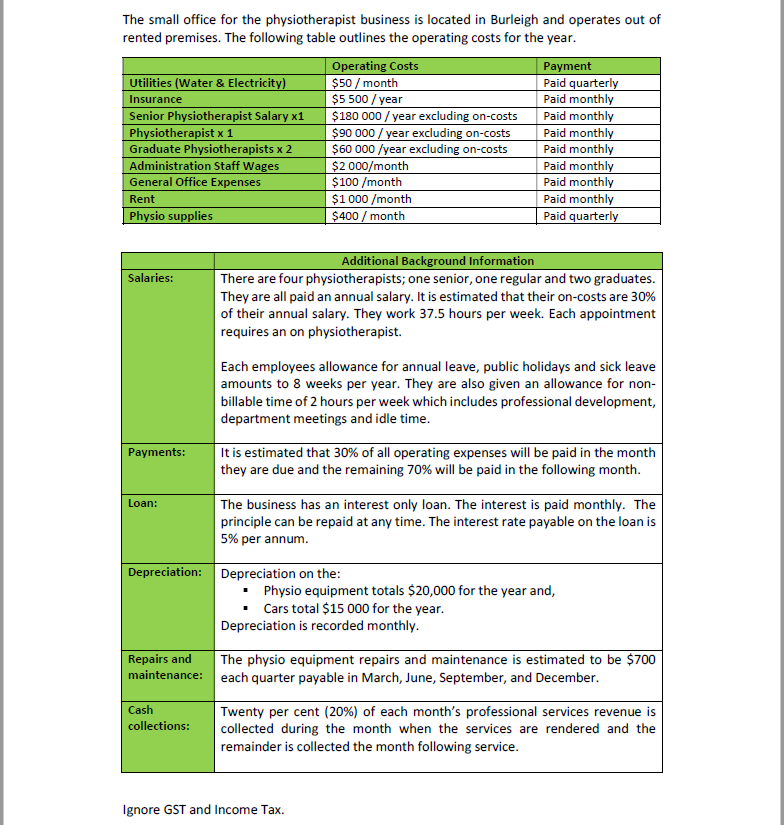

AutoSave On ACCT2003 S3 2021 Physiot Assignment Template (2) Saved Search (Alt+Q) L BCH VN LB - o File Home Insert Page Layout Formulas Data Review View Help Comments Share X DIT Calibri 10 ~ Ai X AutoSum = = a Wrap Text Custom IT AY LE Fill Paste B I U . = Merge & Center $ % , o . Insert Delete Format Conditional Format as Cell Formatting Table Styles Sort & Find & Filter Select Analyze Data Clear Undo Clipboard Font Alignment Number Styles Cells Editing Analysis D62 fx A B D E F G H 1 J K L M N O Q R S T U 1 2 3 Physios PhysioT Master Budgets Budget Input Section Mobile Physiotherapy Sales Budget Total Expected Patients Short (1/2 Hr) Appointment Long (1 hr) Appointment August 400 January 300 150.0 150.0 February 350 175.0 175.0 March 320 160.0 160.0 April 300 150.0 150.0 May 350 175.0 175.0 June 370 85.0 July 380 190.0 190.0 September 400 200.0 200.0 October 400 200.0 200.0 November 400 200.0 200.0 December 400 200.0 200.0 TOTAL 4,370 2,185 2,185 185.0 200.0 4 5 6 7 8 9 10 11 12 13 14 15 16 17 Average Fees Short (1/2 Hr) Appointment Long (1 hr) Appointment S $ $ 15,000 37,500 $ $ 17,500 $ 43,750 $ 16,000 $ 40,000 $ 15,000 $ 37,500 $ 17,500 $ 43,750 $ 18,500 $ 46,250 $ 19,000 47,500 $ $ 20,000 $ 50,000 $ 20,000 50,000 $ $ 20,000 $ 50,000 $ 20,000 50,000 20,000 50,000 218,500 546,250 $ Direct Labor Budget Graduate Physio Graduate Physio Direct labor cost per hour Senior Physio Physio Annual Salary Labour On-cost (30%) Total Annual salary cost $ S S 180,000 $ 90,000 $ 54,000 $ 27,000 $ 234,000 $ 117,000 $ 60,000 $ 18,000 78,000 $ 60,000 18,000 78,000 507,000 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 1,950 1,950 300 Billable hours: Total annual hours (52 x 37.5) Less: Annual Leave and public holidays and sick leave (8 x 37.5) Less: Non-billable time (2 x 44) Total Billable Hours Overhead Hours 1,950 300 88 1,562 388 80% 20% 300 88 1,562 388 80% 20% 88 1,562 388 80% 20% 1,950 300 88 1,562 388 80% 20% Direct hours Overhead hours Hourly Labour Cost (Total annual salary cost divided by billable hours) 34 35 Operating Expenses Assumptions Accessibility: Investigate Operating Budgets Financial Budgets # Ready 80% AutoSave On ACCT2003 S3 2021 Physiot Assignment Template (2) Saved Search (Alt+Q) L BCH VN LB - o File Home Insert Page Layout Formulas Data Review View Help Comments Share DIT Calibri 10 ~ Ai X AutoSum = = a Wrap Text Custom IT AY (d M x LE Fill Paste UV A fm = Merge & Center $ ~ % 9 - Insert Delete Format Conditional Format as Cell Formatting Table Styles Sort & Find & Filter Select Analyze Data Clear Undo Clipboard Font Alignment Number Styles Cells Editing Analysis D62 EX fx B D E F G . I M N O 0 R S T U V w Y $ 100.00 36 37 38 39 40 41 42 43 44 45 46 47 48 Utilities (Water & Electricity) Insurance Administration Staff Wages General Office Expenses Rent Physio Therapist Supplies Depreciation Equipment Depreciation Motor Vehicle Repairs & Maintenance Interest expense $ $ $ $ $ S $ $ $ 458,33 $ 458.33 2,000.00 $ 2,000.00 100.00 $ 1,000.00 $ 1,000.00 $ 1,666.66 $ 1,666.66 1,250.00 $ 1,250.00 $ 416.66 $ 416.66 $ $ $ $ $ S S $ 150 $ 458.33 $ 2,000.00 $ 100.00 $ 1,000.00 $ 1,200.00 $ 1,666.66 $ 1,250.00 $ 700.00 $ 416.66 $ $ $ 150 $ $ $ 150 $ 458.33 $ 458.33 $ 458.33 $ 458.33 $ 458.33 $ 458.33 $ 458.33 2,000.00 $ 2,000.00 $ 2,000.00 $ 2,000.00 $ 2,000.00 $ 2,000.00 $ 2,000.00 100.00 $ 100.00 $ 100.00 $ 100.00 $ 100.00 $ 100.00 $ 100.00 1,000.00 $ 1,000.00 $ 1,000.00 $ 1,000.00 $ 1,000.00 $ 1,000.00 $ 1,000.00 $ $ 1,200.00 $ $ 1,200.00 $ 1,666.66 $ 1,666.66 $ 1,666.66 $ 1,666.66 $ 1,666.66 $ 1,666.66 $ 1,666.66 1,250.00 $ 1,250.00 $ 1,250.00 $ 1,250.00 $ 1,250.00 $ 1,250.00 $ 1,250.00 $ $ 700.00 $ $ $ 700.00 $ 416.66 $ 416.66 $ 416.66 $ 416.66 $ 416.66 $ 416.66 $ 416.66 $ $ 150 $ 458,33 $ 458.33 $ 2,000.00 $ 2,000.00 $ 100.00 $ 100.00 $ 1,000.00 $ 1,000.00 $ $ 1,200.00 $ 1,666.66 $ 1,666.66 $ 1,250.00 $ 1,250.00 $ 700 $ 416.66 $ 416.66 600 5,500 24,000 1,200 12,000 4,800 20,000 15,000 2,800 5,000 $ Cash Collections (Inlows) Collected in month of sale Collected in the month following sale 20% 20% 80% 20% 80% 20% 80% 20% 80% 20% 80% 20% 80% 20% 80% 20% 80% 20% 80% 20% 80% 20% 80% 80% Cash Payments (Outflows) Paid in month due Paid in following month 30% 70% 30% 70% 30% 70% 30% 70% 30% 70% 30% 70% 30% 70% 30% 70% 30% 70% 30% 70% 30% 70% 30% 70% Balance Sheet, 31/12/2021 $ - Assets Cash Accounts Receivable Motor Vehicles Less: Accumulated depreciation Physio Equipment Less: Accumulated depreciation 10.500 42,000 90,000 1.250 1,667 Total Assets Liabilities and Stockholders' Equity Accounts payable Bank Retained earnings, 31/12/2021 74 75 76 77 78 Total Liabilities and Stockholders' Equity Operating Budgets Financial Budgets # Assumptions Accessibility: Investigate Ready + 70% PhysioT is a (fictional) mobile physiotherapy business located on the Gold Coast that provides home or office based physiotherapy. For the purposes of this assignment you are to imagine that you are a management accountant that has been hired by the managing director of PhysioT to prepare the annual budget for 2022 and make recommendations for improving its operations. The following information has been gathered about the business: PhysioT Balance Sheet As at 31 December 2021 Assets Cash Accounts Receivable Motor Vehicles (Fleet of 4 cars) Less: Accumulated Depreciation Physio Equipment Less: Accumulated Depreciation Total Assets 56,000 3,400 120,000 (30,000) 60,000 (20,000) $189,400 Liabilities & Shareholder Equity Accounts Payable Bank Loan Retained Earnings Total Liabilities & Shareholders' Equity 5,400 100,000 84,000 $189,400 ACCT2003: Major Assignment Overview Page 1 of 5 The small office for the physiotherapist business is located in Burleigh and operates out of rented premises. The following table outlines the operating costs for the year. Operating Costs Payment Utilities (Water & Electricity) $50 /month Paid quarterly Insurance $5 500/year Paid monthly Senior Physiotherapist Salary x1 $180 000 / year excluding on-costs Paid monthly Physiotherapist x 1 $90 000 / year excluding on-costs Paid monthly Graduate Physiotherapists x 2 $60 000/year excluding on-costs Paid monthly Administration Staff Wages $2 000/month Paid monthly General Office Expenses $100 /month Paid monthly Rent $1 000 /month Paid monthly Physio supplies $400 / month Paid quarterly Salaries: Additional Background Information There are four physiotherapists; one senior, one regular and two graduates. They are all paid an annual salary. It is estimated that their on-costs are 30% of their annual salary. They work 37.5 hours per week. Each appointment requires an on physiotherapist. Each employees allowance for annual leave, public holidays and sick leave amounts to 8 weeks per year. They are also given an allowance for non- billable time of 2 hours per week which includes professional development, department meetings and idle time. Payments: It is estimated that 30% of all operating expenses will be paid in the month they are due and the remaining 70% will be paid in the following month. Loan: The business has an interest only loan. The interest is paid monthly. The principle can be repaid at any time. The interest rate payable on the loan is 5% per annum. Depreciation: Depreciation on the: Physio equipment totals $20,000 for the year and, Cars total $15 000 for the year. Depreciation is recorded monthly. Repairs and The physio equipment repairs and maintenance is estimated to be $700 maintenance: each quarter payable in March, June, September, and December. Cash Twenty per cent (20%) of each month's professional services revenue is collections: collected during the month when the services are rendered and the remainder is collected the month following service. Ignore GST and Income Tax. AutoSave On ACCT2003 S3 2021 Physiot Assignment Template (2) Saved Search (Alt+Q) L BCH VN LB - o File Home Insert Page Layout Formulas Data Review View Help Comments Share X DIT Calibri 10 ~ Ai X AutoSum = = a Wrap Text Custom IT AY LE Fill Paste B I U . = Merge & Center $ % , o . Insert Delete Format Conditional Format as Cell Formatting Table Styles Sort & Find & Filter Select Analyze Data Clear Undo Clipboard Font Alignment Number Styles Cells Editing Analysis D62 fx A B D E F G H 1 J K L M N O Q R S T U 1 2 3 Physios PhysioT Master Budgets Budget Input Section Mobile Physiotherapy Sales Budget Total Expected Patients Short (1/2 Hr) Appointment Long (1 hr) Appointment August 400 January 300 150.0 150.0 February 350 175.0 175.0 March 320 160.0 160.0 April 300 150.0 150.0 May 350 175.0 175.0 June 370 85.0 July 380 190.0 190.0 September 400 200.0 200.0 October 400 200.0 200.0 November 400 200.0 200.0 December 400 200.0 200.0 TOTAL 4,370 2,185 2,185 185.0 200.0 4 5 6 7 8 9 10 11 12 13 14 15 16 17 Average Fees Short (1/2 Hr) Appointment Long (1 hr) Appointment S $ $ 15,000 37,500 $ $ 17,500 $ 43,750 $ 16,000 $ 40,000 $ 15,000 $ 37,500 $ 17,500 $ 43,750 $ 18,500 $ 46,250 $ 19,000 47,500 $ $ 20,000 $ 50,000 $ 20,000 50,000 $ $ 20,000 $ 50,000 $ 20,000 50,000 20,000 50,000 218,500 546,250 $ Direct Labor Budget Graduate Physio Graduate Physio Direct labor cost per hour Senior Physio Physio Annual Salary Labour On-cost (30%) Total Annual salary cost $ S S 180,000 $ 90,000 $ 54,000 $ 27,000 $ 234,000 $ 117,000 $ 60,000 $ 18,000 78,000 $ 60,000 18,000 78,000 507,000 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 1,950 1,950 300 Billable hours: Total annual hours (52 x 37.5) Less: Annual Leave and public holidays and sick leave (8 x 37.5) Less: Non-billable time (2 x 44) Total Billable Hours Overhead Hours 1,950 300 88 1,562 388 80% 20% 300 88 1,562 388 80% 20% 88 1,562 388 80% 20% 1,950 300 88 1,562 388 80% 20% Direct hours Overhead hours Hourly Labour Cost (Total annual salary cost divided by billable hours) 34 35 Operating Expenses Assumptions Accessibility: Investigate Operating Budgets Financial Budgets # Ready 80% AutoSave On ACCT2003 S3 2021 Physiot Assignment Template (2) Saved Search (Alt+Q) L BCH VN LB - o File Home Insert Page Layout Formulas Data Review View Help Comments Share DIT Calibri 10 ~ Ai X AutoSum = = a Wrap Text Custom IT AY (d M x LE Fill Paste UV A fm = Merge & Center $ ~ % 9 - Insert Delete Format Conditional Format as Cell Formatting Table Styles Sort & Find & Filter Select Analyze Data Clear Undo Clipboard Font Alignment Number Styles Cells Editing Analysis D62 EX fx B D E F G . I M N O 0 R S T U V w Y $ 100.00 36 37 38 39 40 41 42 43 44 45 46 47 48 Utilities (Water & Electricity) Insurance Administration Staff Wages General Office Expenses Rent Physio Therapist Supplies Depreciation Equipment Depreciation Motor Vehicle Repairs & Maintenance Interest expense $ $ $ $ $ S $ $ $ 458,33 $ 458.33 2,000.00 $ 2,000.00 100.00 $ 1,000.00 $ 1,000.00 $ 1,666.66 $ 1,666.66 1,250.00 $ 1,250.00 $ 416.66 $ 416.66 $ $ $ $ $ S S $ 150 $ 458.33 $ 2,000.00 $ 100.00 $ 1,000.00 $ 1,200.00 $ 1,666.66 $ 1,250.00 $ 700.00 $ 416.66 $ $ $ 150 $ $ $ 150 $ 458.33 $ 458.33 $ 458.33 $ 458.33 $ 458.33 $ 458.33 $ 458.33 2,000.00 $ 2,000.00 $ 2,000.00 $ 2,000.00 $ 2,000.00 $ 2,000.00 $ 2,000.00 100.00 $ 100.00 $ 100.00 $ 100.00 $ 100.00 $ 100.00 $ 100.00 1,000.00 $ 1,000.00 $ 1,000.00 $ 1,000.00 $ 1,000.00 $ 1,000.00 $ 1,000.00 $ $ 1,200.00 $ $ 1,200.00 $ 1,666.66 $ 1,666.66 $ 1,666.66 $ 1,666.66 $ 1,666.66 $ 1,666.66 $ 1,666.66 1,250.00 $ 1,250.00 $ 1,250.00 $ 1,250.00 $ 1,250.00 $ 1,250.00 $ 1,250.00 $ $ 700.00 $ $ $ 700.00 $ 416.66 $ 416.66 $ 416.66 $ 416.66 $ 416.66 $ 416.66 $ 416.66 $ $ 150 $ 458,33 $ 458.33 $ 2,000.00 $ 2,000.00 $ 100.00 $ 100.00 $ 1,000.00 $ 1,000.00 $ $ 1,200.00 $ 1,666.66 $ 1,666.66 $ 1,250.00 $ 1,250.00 $ 700 $ 416.66 $ 416.66 600 5,500 24,000 1,200 12,000 4,800 20,000 15,000 2,800 5,000 $ Cash Collections (Inlows) Collected in month of sale Collected in the month following sale 20% 20% 80% 20% 80% 20% 80% 20% 80% 20% 80% 20% 80% 20% 80% 20% 80% 20% 80% 20% 80% 20% 80% 80% Cash Payments (Outflows) Paid in month due Paid in following month 30% 70% 30% 70% 30% 70% 30% 70% 30% 70% 30% 70% 30% 70% 30% 70% 30% 70% 30% 70% 30% 70% 30% 70% Balance Sheet, 31/12/2021 $ - Assets Cash Accounts Receivable Motor Vehicles Less: Accumulated depreciation Physio Equipment Less: Accumulated depreciation 10.500 42,000 90,000 1.250 1,667 Total Assets Liabilities and Stockholders' Equity Accounts payable Bank Retained earnings, 31/12/2021 74 75 76 77 78 Total Liabilities and Stockholders' Equity Operating Budgets Financial Budgets # Assumptions Accessibility: Investigate Ready + 70% PhysioT is a (fictional) mobile physiotherapy business located on the Gold Coast that provides home or office based physiotherapy. For the purposes of this assignment you are to imagine that you are a management accountant that has been hired by the managing director of PhysioT to prepare the annual budget for 2022 and make recommendations for improving its operations. The following information has been gathered about the business: PhysioT Balance Sheet As at 31 December 2021 Assets Cash Accounts Receivable Motor Vehicles (Fleet of 4 cars) Less: Accumulated Depreciation Physio Equipment Less: Accumulated Depreciation Total Assets 56,000 3,400 120,000 (30,000) 60,000 (20,000) $189,400 Liabilities & Shareholder Equity Accounts Payable Bank Loan Retained Earnings Total Liabilities & Shareholders' Equity 5,400 100,000 84,000 $189,400 ACCT2003: Major Assignment Overview Page 1 of 5 The small office for the physiotherapist business is located in Burleigh and operates out of rented premises. The following table outlines the operating costs for the year. Operating Costs Payment Utilities (Water & Electricity) $50 /month Paid quarterly Insurance $5 500/year Paid monthly Senior Physiotherapist Salary x1 $180 000 / year excluding on-costs Paid monthly Physiotherapist x 1 $90 000 / year excluding on-costs Paid monthly Graduate Physiotherapists x 2 $60 000/year excluding on-costs Paid monthly Administration Staff Wages $2 000/month Paid monthly General Office Expenses $100 /month Paid monthly Rent $1 000 /month Paid monthly Physio supplies $400 / month Paid quarterly Salaries: Additional Background Information There are four physiotherapists; one senior, one regular and two graduates. They are all paid an annual salary. It is estimated that their on-costs are 30% of their annual salary. They work 37.5 hours per week. Each appointment requires an on physiotherapist. Each employees allowance for annual leave, public holidays and sick leave amounts to 8 weeks per year. They are also given an allowance for non- billable time of 2 hours per week which includes professional development, department meetings and idle time. Payments: It is estimated that 30% of all operating expenses will be paid in the month they are due and the remaining 70% will be paid in the following month. Loan: The business has an interest only loan. The interest is paid monthly. The principle can be repaid at any time. The interest rate payable on the loan is 5% per annum. Depreciation: Depreciation on the: Physio equipment totals $20,000 for the year and, Cars total $15 000 for the year. Depreciation is recorded monthly. Repairs and The physio equipment repairs and maintenance is estimated to be $700 maintenance: each quarter payable in March, June, September, and December. Cash Twenty per cent (20%) of each month's professional services revenue is collections: collected during the month when the services are rendered and the remainder is collected the month following service. Ignore GST and Income Tax