can you help me to check this one, please thank you

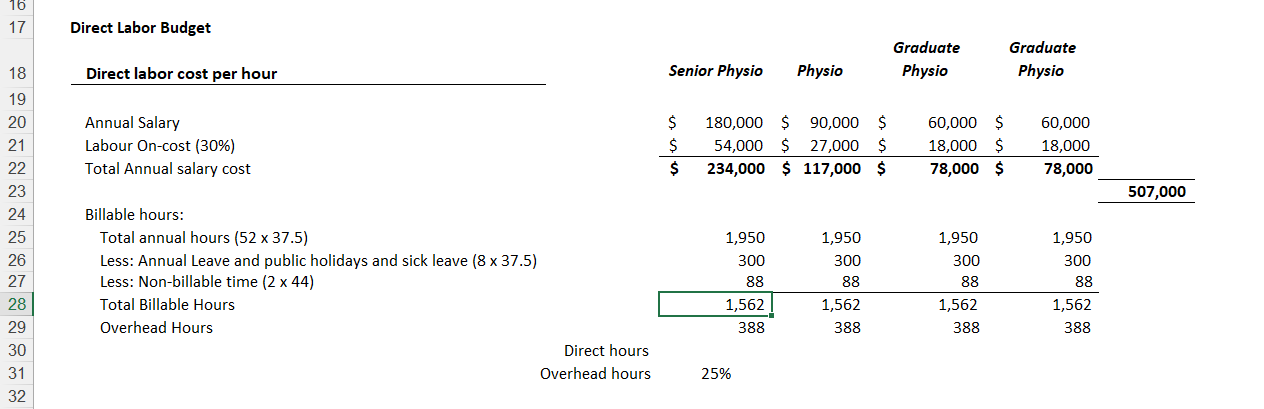

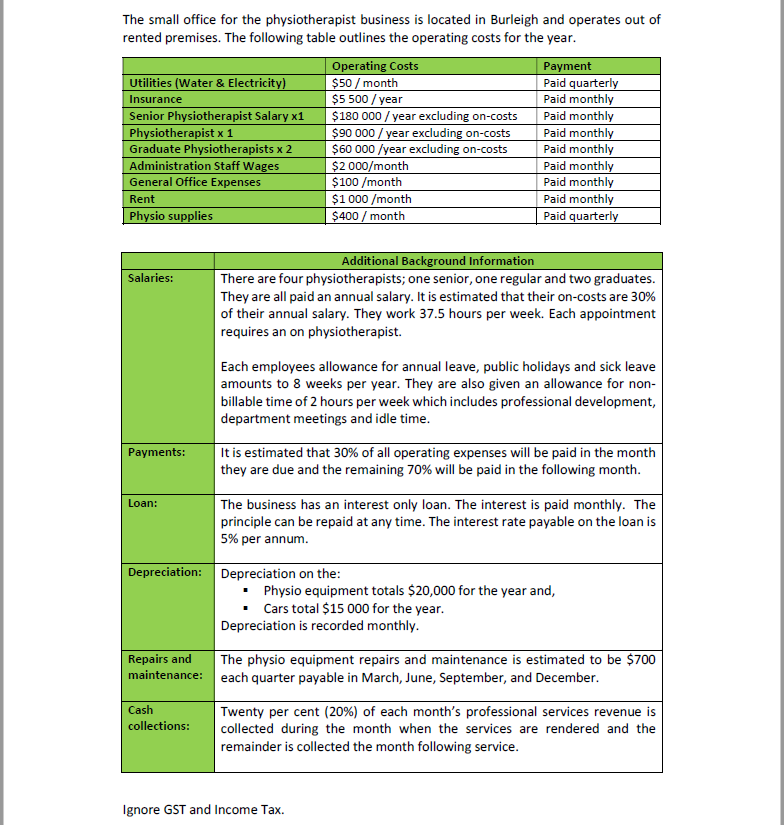

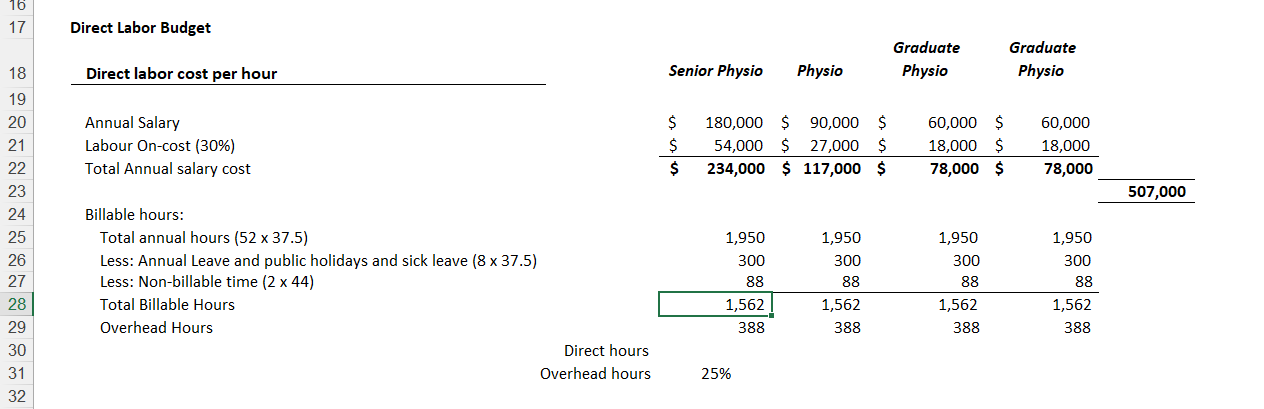

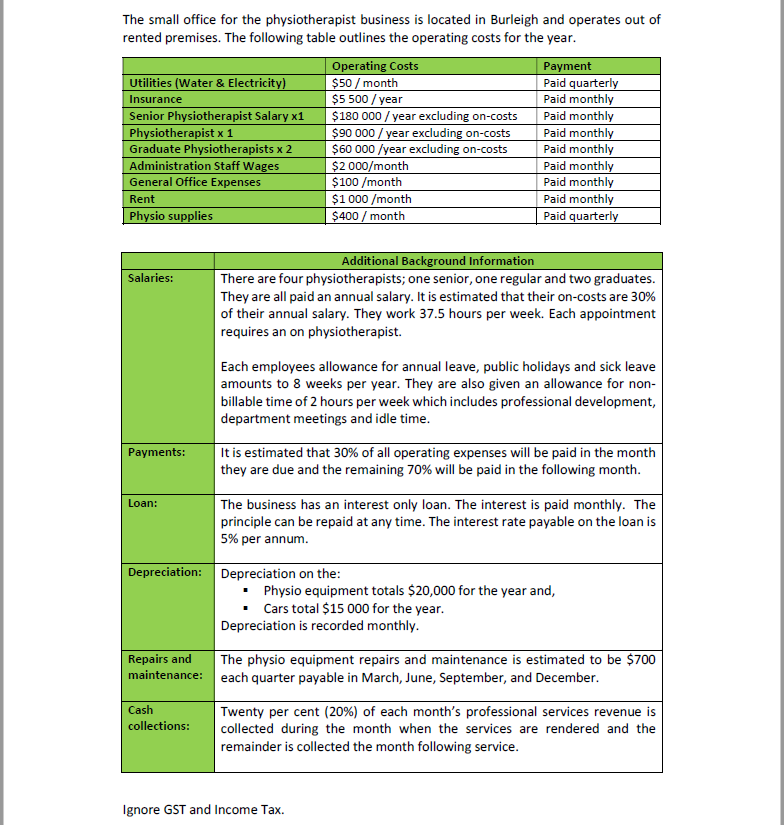

16 17 Direct Labor Budget Graduate Physio Graduate Physio Direct labor cost per hour Senior Physio Physio Annual Salary Labour On-cost (30%) Total Annual salary cost $ $ $ 180,000 $ 90,000 $ 54,000 $ 27,000 $ 234,000 $ 117,000 $ 60,000 $ 18,000 $ 78,000 $ 60,000 18,000 78,000 507,000 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 Billable hours: Total annual hours (52 x 37.5) Less: Annual Leave and public holidays and sick leave (8 x 37.5) Less: Non-billable time (2 x 44) Total Billable Hours Overhead Hours Direct hours Overhead hours 1,950 300 88 1,562 388 1,950 300 88 1,562 388 1,950 300 88 1,562 388 1,950 300 88 1,562 388 25% The small office for the physiotherapist business is located in Burleigh and operates out of rented premises. The following table outlines the operating costs for the year. Operating Costs Payment Utilities (Water & Electricity) $50 /month Paid quarterly Insurance $5 500/year Paid monthly Senior Physiotherapist Salary x1 $180 000 / year excluding on-costs Paid monthly Physiotherapist x 1 $90 000 / year excluding on-costs Paid monthly Graduate Physiotherapists x 2 $60 000/year excluding on-costs Paid monthly Administration Staff Wages $2 000/month Paid monthly General Office Expenses $100 /month Paid monthly Rent $1 000 /month Paid monthly Physio supplies $400 / month Paid quarterly Salaries: Additional Background Information There are four physiotherapists; one senior, one regular and two graduates. They are all paid an annual salary. It is estimated that their on-costs are 30% of their annual salary. They work 37.5 hours per week. Each appointment requires an on physiotherapist. Each employees allowance for annual leave, public holidays and sick leave amounts to 8 weeks per year. They are also given an allowance for non- billable time of 2 hours per week which includes professional development, department meetings and idle time. Payments: It is estimated that 30% of all operating expenses will be paid in the month they are due and the remaining 70% will be paid in the following month. Loan: The business has an interest only loan. The interest is paid monthly. The principle can be repaid at any time. The interest rate payable on the loan is 5% per annum. Depreciation: Depreciation on the: Physio equipment totals $20,000 for the year and, Cars total $15 000 for the year. Depreciation is recorded monthly. Repairs and The physio equipment repairs and maintenance is estimated to be $700 maintenance: each quarter payable in March, June, September, and December. Cash Twenty per cent (20%) of each month's professional services revenue is collections: collected during the month when the services are rendered and the remainder is collected the month following service. Ignore GST and Income Tax