Answered step by step

Verified Expert Solution

Question

1 Approved Answer

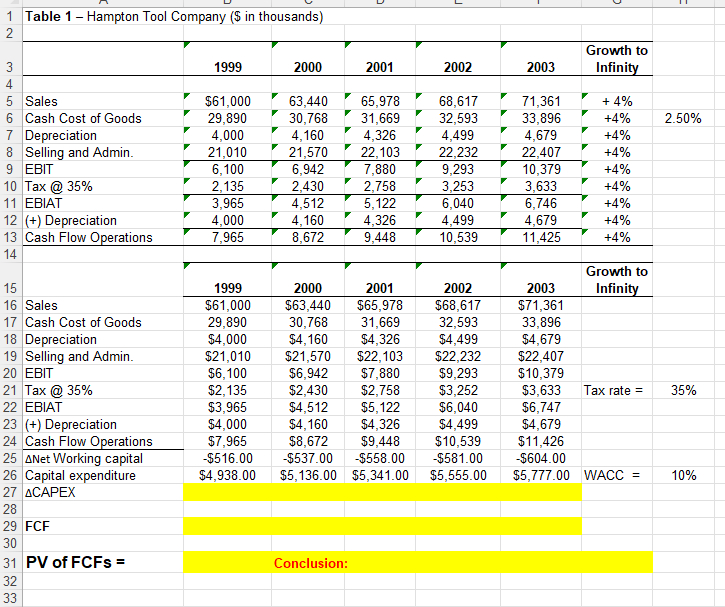

Can you help me to fill this Excel document, and please provide Excel formulas? 7. Lycos, Inc. was considering the acquisition of a smaller competitor

Can you help me to fill this Excel document, and please provide Excel formulas?

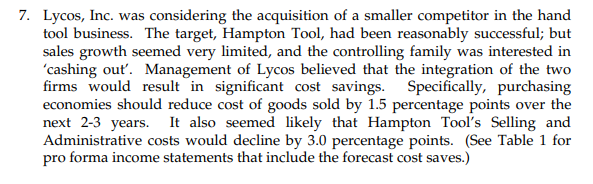

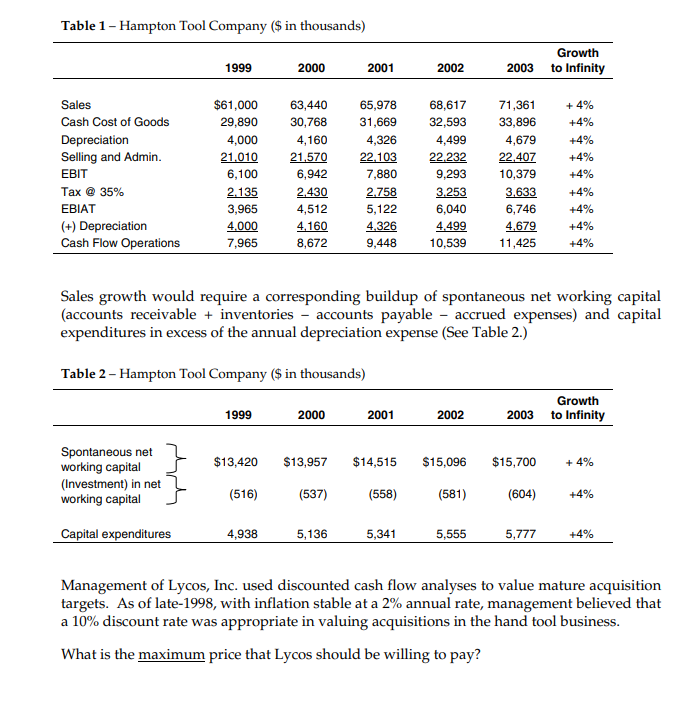

7. Lycos, Inc. was considering the acquisition of a smaller competitor in the hand tool business. The target, Hampton Tool, had been reasonably successful; but sales growth seemed very limited, and the controlling family was interested in 'cashing out'. Management of Lycos believed that the integration of the two firms would result in significant cost savings. Specifically, purchasing economies should reduce cost of goods sold by 1.5 percentage points over the next 2-3 years. It also seemed likely that Hampton Tool's Selling and Administrative costs would decline by 3.0 percentage points. (See Table 1 for pro forma income statements that include the forecast cost saves.) Table 1 - Hampton Tool Company (\$ in thousands) Sales growth would require a corresponding buildup of spontaneous net working capital (accounts receivable + inventories - accounts payable - accrued expenses) and capital expenditures in excess of the annual depreciation expense (See Table 2.) Table 2 - Hampton Tool Company (\$ in thousands) Management of Lycos, Inc. used discounted cash flow analyses to value mature acquisition targets. As of late-1998, with inflation stable at a 2% annual rate, management believed that a 10% discount rate was appropriate in valuing acquisitions in the hand tool business. What is the maximum price that Lycos should be willing to payStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started