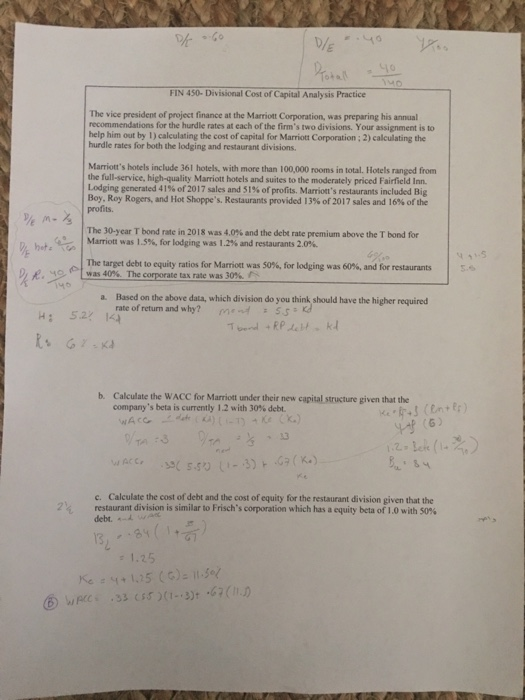

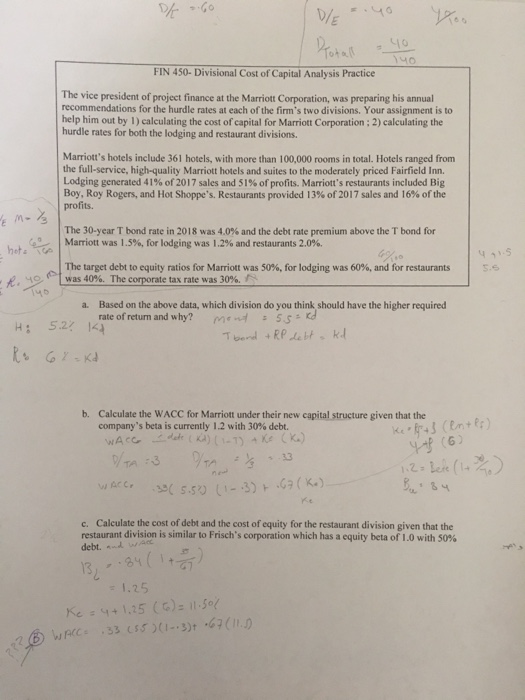

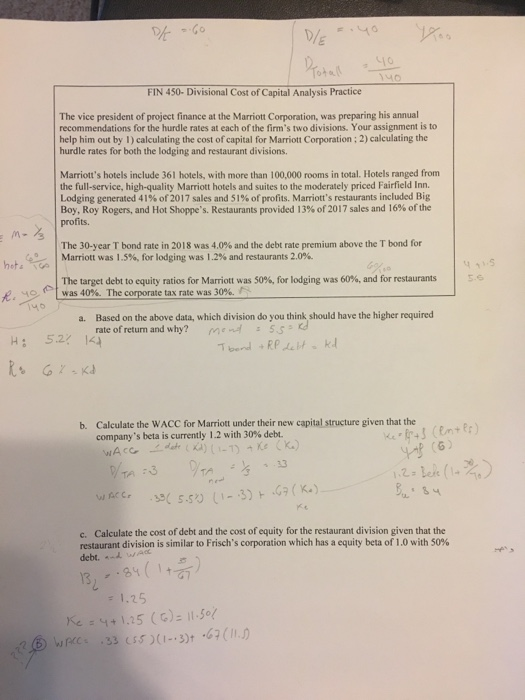

Can you help me to solve this problem Show as much as you can of your work A, b, and a Dk 60 Totally FIN 450. Divisional Cost of Capital Analysis Practice The vice president of project finance at the Marriott Corporation, was preparing his annual recommendations for the hurdle rates at each of the firm's two divisions. Your assignment is to help him out by I) calculating the cost of capital for Marriott Corporation : 2) calculating the hurdle rates for both the lodging and restaurant divisions Marriott's hotels include 361 hotels, with more than 100.000 rooms in total Hotels ranged from the full service, high-quality Marriott hotels and suites to the moderately priced Fairfield in Lodging generated 4156 of 2017 sales and 51% of profits. Marriot's restaurants included Big Boy, Roy Rogers, and Hot Shoppe's Restaurants provided 13% of 2017 sales and 16% of the profits. 3 /e mot The 30-year Tbond rate in 2018 was 4.0% and the debt rate premium above the Thond for Marriott was 1.5%, for lodging was 1.2% and restaurants 2.0% The target debt to equity ratios for Marriott was 50%, for lodging was 60%, and for restaurants was 409. The corporate tax rate was 30 Based on the above data, which division do you think should have the higher required rate of return and why? Men 555 H: 5.2/ 14 Tbond - RP delt, kd. Rs GroKo b. Calculate the WACC for Marriott under their new capital structure given that the company's beta is currently 1.2 with 30% debt. 6 12 Sete (10% WATC (5.50 -3) . 814 c. Calculate the cost of debt and the cost of equity for the restaurant division given that the restaurant division is similar to Frisch's corporation which has a equity beta of 1.0 with 50% debt 13 -84 - 1.25 Keay 15 (6) = 11.30% WPC5305) (-3) 67 (11) D/E - 40 FIN 450- Divisional Cost of Capital Analysis Practice The vice president of project finance at the Marriott Corporation, was preparing his annual recommendations for the hurdle rates at each of the firm's two divisions. Your assignment is to help him out by 1) calculating the cost of capital for Marriott Corporation : 2) calculating the hurdle rates for both the lodging and restaurant divisions. Marriott's hotels include 361 hotels, with more than 100.000 rooms in total. Hotels ranged from the full-service, high-quality Marriott hotels and suites to the moderately priced Fairfield Inn. Lodging generated 41% of 2017 sales and 51% of profits. Marriott's restaurants included Big Boy, Roy Rogers, and Hot Shoppe's, Restaurants provided 13% of 2017 sales and 16% of the profits. WE M-Z The 30-year T bond rate in 2018 was 4.0% and the debt rate premium above the T bond for Marriott was 1.5%, for lodging was 1.2% and restaurants 2.0%. 2.49 The target debt to equity ratios for Marriott was 50%, for lodging was 60%, and for restaurants was 40%. The corporate tax rate was 30%. a. Based on the above data, which division do you think should have the higher required rate of return and why? Mon 55 : Kd Hi 5.28 K Tbond + RP deft, kd. Ro 6l. Kd b. Calculate the WACC for Marriott under their new capital structure given that the company's beta is currently 1.2 with 30% debt. WACG dete (ka) (1T) + Ke (ka). TA :3 - 13 1,2= Bele (10 (5.50 (-03) + 6(ke). keots (enter) 44 (6 c. Calculate the cost of debt and the cost of equity for the restaurant division given that the restaurant division is similar to Frisch's corporation which has a equity beta of 1.0 with 50% debt. = 1.25 Kes 4+1,25 (6) = 11.50% 26 Wrec. 33 (85)(1-3)* 67(11.0. DE TOP FIN 450. Divisional Cost of Capital Analysis Practice The vice president of project finance at the Marriott Corporation, was preparing his annual recommendations for the hurdle rates at each of the firm's two divisions. Your assignment is to help him out by 1) calculating the cost of capital for Marriott Corporation : 2) calculating the hurdle rates for both the lodging and restaurant divisions. Marriott's hotels include 361 hotels, with more than 100.000 rooms in total. Hotels ranged from the full-service, high-quality Marriott hotels and suites to the moderately priced Fairfield Inn. Lodging generated 41% of 2017 sales and 51% of profits. Marriott's restaurants included Big Boy, Roy Rogers, and Hot Shoppe's. Restaurants provided 13% of 2017 sales and 16% of the profits The 30-year Tbond rate in 2018 was 4.0% and the debt rate premium above the T bond for Marriott was 1.5%, for lodging was 1.2% and restaurants 2.0% 40 The target debt to equity ratios for Marriott was 50%, for lodging was 60%, and for restaurants was 40%. The corporate tax rate was 30% a. Based on the above data, which division do you think should have the higher required rate of return and why? more 55 H: 5.21 Kd Tbond + RP Left kd. Ro Gyako b. Calculate the WACC for Marriott under their new capital structure given that the company's beta is currently 1.2 with 30% debt. WACG dete (Xd) (1T) + Ke (ko) G DTA :3 - ..13 1,20 bele (12 WACG (5.50 (123) +.67(ko)- ) c. Calculate the cost of debt and the cost of equity for the restaurant division given that the restaurant division is similar to Frisch's corporation which has a equity beta of 1.0 with 50% debt. We 13 .84 ((1+2 = 1.25 Kes 4+1.25 (6) = 11.301 20 Wpct33 055)(1--3)+ 567 (II