Can you help me to solve those question - that is my class exercise. My teacher went through them but some i do not understand!

Thanks!

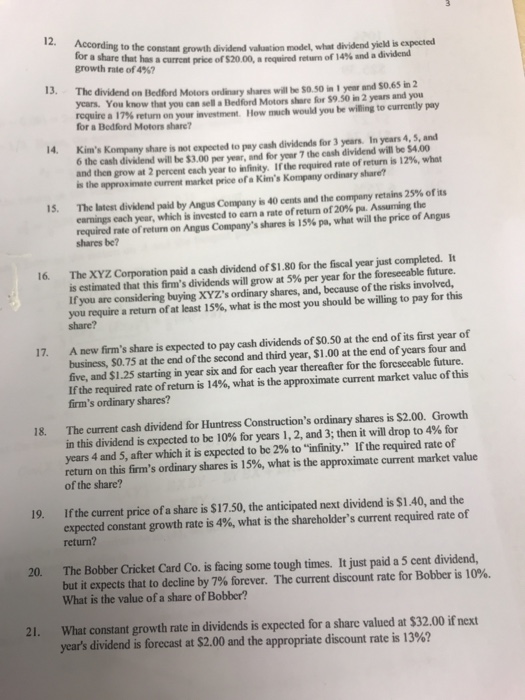

12. According to the constant growth dividend valuation model, what dividend yicld is expected dividend or a share that hasa current price ofS20 00, a req ined return of 14% and a di iden growth rate of 4%? 13. The dividend on Bedford Motors years. You know that require a17% return on your investment ordinary shares will be so.50 ilyear and $0.65 in 2 you can sell a Bedford Motors share for $9.50 in 2 years and you How mch would you be willing to currently pay for a Bedford Motors share? Kim's Kompany share is not expected to pay cash dividends for 3 years. 6 the cash diviklend will be $3.00 per year, and for year 7 the cash dividend will be $4.00 and then grow at 2 percent each year to infinity. If the required rate of return is 12%, what is the upproximate current market price of a Kim's Kompany ordinary share 14. In years 4, 5,and nd the company retains 25% of its The latest dividend paid by Angus Company is 40 cents earninggs each year, which is invested to earn a rate of return of 20% pa. Assuming the required rate of return on Angus Company's shares is 15% pa, what will the price of Angus shares be? 15. 16. The XYZ Corporation paid a cash dividend of $1.80 for the fiscal year just completed. It is estimated that this firm's dividends will grow at 5% per year for the foreseeable future. If you are considering buying XYZ's ordinary shares, and, because of the risks involved you require a return ofat least 15%, what is the most you should be willing to pay for this share? 17. A new firm's share is expected to pay cash dividends of S0.50 at the end of its first year of business, SO.75 at the end of the second and third year, $1.00 at the end of years four and five, and $1.25 starting in year six and for each year thereafter for the foresecable future. Ifthe required rate ofretum is 14%, what is the approximate current market value of this firm's ordinary shares? The current cash dividend for Huntress Construction's ordinary shares is $2.00. Growth In this dividend s expected to be 10% for years 1,2,and 3; then it will drop to 4% for years 4 and 5, after which it is expected to be 2% to "infinity" rthe required rate of return on this firm's ordinary shares is l 5%, what is the approximate current market value of the share? 18. If the current price ofa share is $17.50, the anticipated next dividend is $1.40, and the expected constant growth rate is 4%, what is the shareholder's current required rate of return? 19. The Bobber Cricket Card Co. is facing some tough times. but it expects that to decline by 7% forever. What is the value of a share of Bobber? 20. It just paid a 5 cent dividend, The current discount rate for Bobber is 10%. 21. What constant growth rate in dividends is expected for a share valued at $32.00 if next year's dividend is forecast at S2.00 and the appropriate discount rate is 13%