Answered step by step

Verified Expert Solution

Question

1 Approved Answer

can you help me to this question please.I need it immediately.Thank you Sofiza was employed by a Malaysian tax resident company EX Sdn Bhd (EXSB)

can you help me to this question please.I need it immediately.Thank you

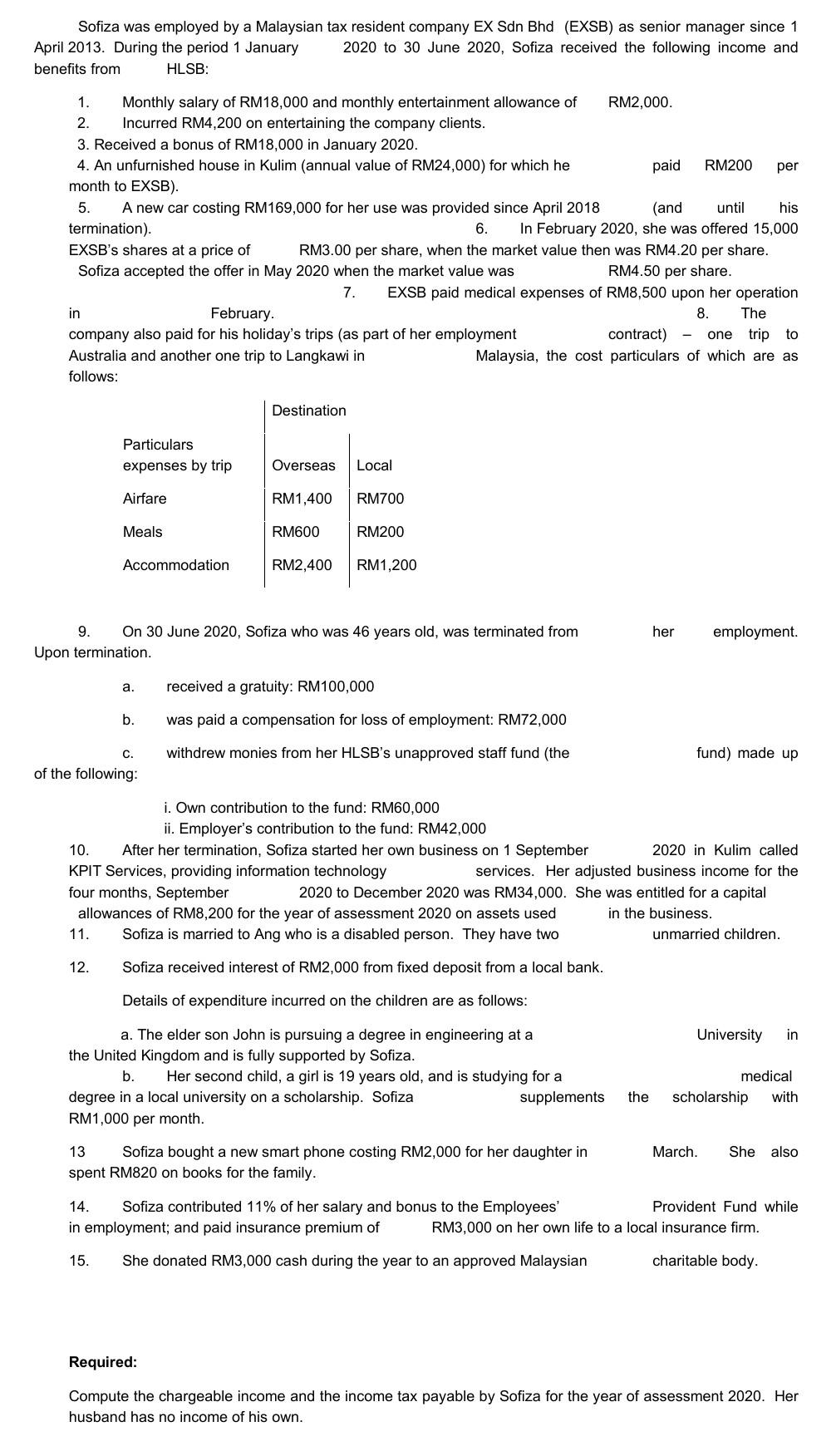

Sofiza was employed by a Malaysian tax resident company EX Sdn Bhd (EXSB) as senior manager since 1 April 2013. During the period 1 January 2020 to 30 June 2020 , Sofiza received the following income and benefits from HLSB: 1. Monthly salary of RM18,000 and monthly entertainment allowance of RM2,000. 2. Incurred RM4,200 on entertaining the company clients. 3. Received a bonus of RM18,000 in January 2020. 4. An unfurnished house in Kulim (annual value of RM24,000) for which he paid RM200 per month to EXSB). 5. A new car costing RM169,000 for her use was provided since April 2018 (and until his termination). 6 In February 2020, she was offered 15,000 EXSB's shares at a price of RM3.00 per share, when the market value then was RM4.20 per share. Sofiza accepted the offer in May 2020 when the market value was RM4.50 per share. 7. EXSB paid medical expenses of RM8,500 upon her operation in February. 8. The company also paid for his holiday's trips (as part of her employment contract) - one trip to Australia and another one trip to Langkawi in Malaysia, the cost particulars of which are as follows: 9. On 30 June 2020 , Sofiza who was 46 years old, was terminated from Upon termination. her employment. a. received a gratuity: RM100,000 b. was paid a compensation for loss of employment: RM72,000 c. withdrew monies from her HLSB's unapproved staff fund (the fund) made up of the following: i. Own contribution to the fund: RM60,000 ii. Employer's contribution to the fund: RM42,000 10. After her termination, Sofiza started her own business on 1 September 2020 in Kulim called KPIT Services, providing information technology services. Her adjusted business income for the four months, September 2020 to December 2020 was RM34,000. She was entitled for a capital allowances of RM8,200 for the year of assessment 2020 on assets used in the business. 11. Sofiza is married to Ang who is a disabled person. They have two unmarried children. 12. Sofiza received interest of RM2,000 from fixed deposit from a local bank. Details of expenditure incurred on the children are as follows: a. The elder son John is pursuing a degree in engineering at a University in the United Kingdom and is fully supported by Sofiza. b. Her second child, a girl is 19 years old, and is studying for a medical degree in a local university on a scholarship. Sofiza supplements the scholarship with RM1,000 per month. 13 Sofiza bought a new smart phone costing RM2,000 for her daughter in March. She also spent RM820 on books for the family. 14. Sofiza contributed 11% of her salary and bonus to the Employees' Provident Fund while in employment; and paid insurance premium of RM3,000 on her own life to a local insurance firm. 15. She donated RM3,000 cash during the year to an approved Malaysian charitable body. Required: Compute the chargeable income and the income tax payable by Sofiza for the year of assessment 2020. Her husband has no income of his ownStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started