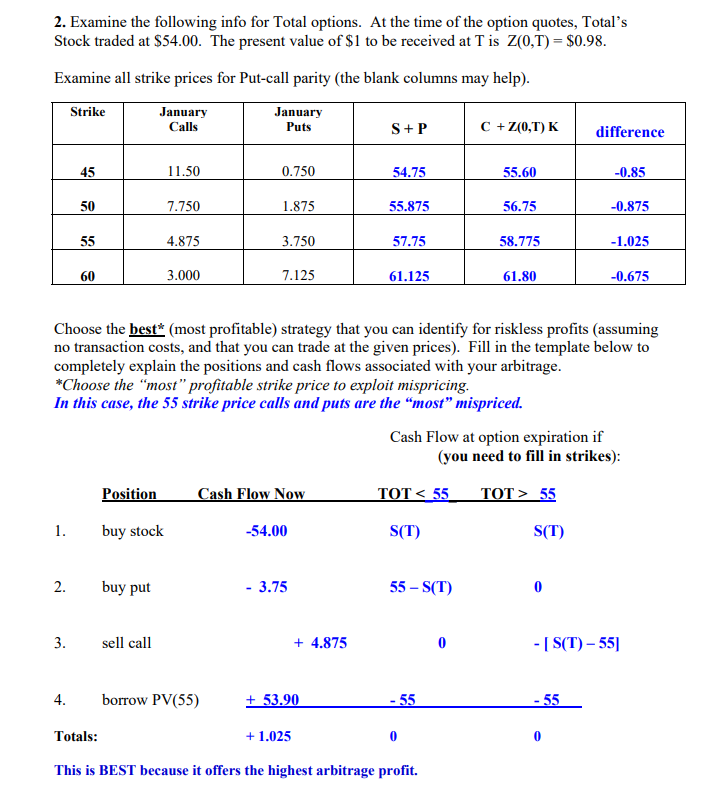

CAN YOU HELP ME UNDERSTAND THE CHART AND JUST THE BOTTOM CHART TOO PLEASE.

CAN YOU SHOW HOW THEY GOT C+Z(0,T)K THE COLUMN

CAN YOU EXPLAIN WHAT THE SYMBOLS/LETTERS MEAN.

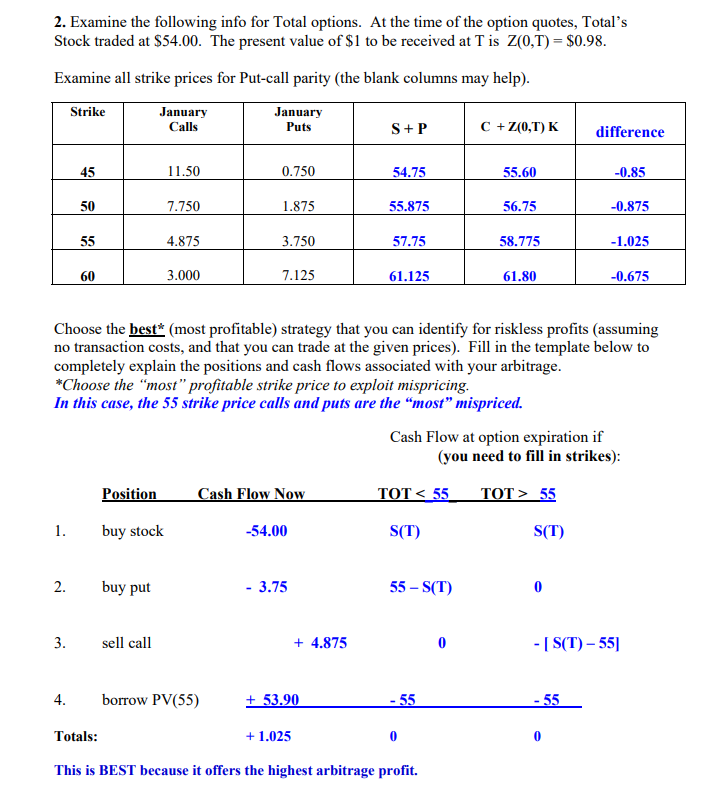

2. Examine the following info for Total options. At the time of the option quotes, Total's Stock traded at $54.00. The present value of $1 to be received at T is Z(0,T) = $0.98. Examine all strike prices for Put-call parity (the blank columns may help). Strike January Calls January Puts S+P C + Z(0,1) difference 11.50 0.750 54.75 55.60 -0.85 7.750 1.875 55.875 56.75 -0.875 4.875 3.750 57.75 58.775 -1.025 3.000 7.125 61.125 61.80 -0.675 Choose the best* (most profitable) strategy that you can identify for riskless profits (assuming no transaction costs, and that you can trade at the given prices). Fill in the template below to completely explain the positions and cash flows associated with your arbitrage. *Choose the "most" profitable strike price to exploit mispricing. In this case, the 55 strike price calls and puts are the "most" mispriced. Cash Flow at option expiration if (you need to fill in strikes): Position Cash Flow Now TOT 55 buy stock -54.00 S(T) S(T) 2. buy put - 3.75 55-S(T) 3. sell call + 4.875 - [S(T) - 55) 4. borrow PV(55) + 53.90 - 55 Totals: + 1.025 This is BEST because it offers the highest arbitrage profit. 2. Examine the following info for Total options. At the time of the option quotes, Total's Stock traded at $54.00. The present value of $1 to be received at T is Z(0,T) = $0.98. Examine all strike prices for Put-call parity (the blank columns may help). Strike January Calls January Puts S+P C + Z(0,1) difference 11.50 0.750 54.75 55.60 -0.85 7.750 1.875 55.875 56.75 -0.875 4.875 3.750 57.75 58.775 -1.025 3.000 7.125 61.125 61.80 -0.675 Choose the best* (most profitable) strategy that you can identify for riskless profits (assuming no transaction costs, and that you can trade at the given prices). Fill in the template below to completely explain the positions and cash flows associated with your arbitrage. *Choose the "most" profitable strike price to exploit mispricing. In this case, the 55 strike price calls and puts are the "most" mispriced. Cash Flow at option expiration if (you need to fill in strikes): Position Cash Flow Now TOT 55 buy stock -54.00 S(T) S(T) 2. buy put - 3.75 55-S(T) 3. sell call + 4.875 - [S(T) - 55) 4. borrow PV(55) + 53.90 - 55 Totals: + 1.025 This is BEST because it offers the highest arbitrage profit