Answered step by step

Verified Expert Solution

Question

1 Approved Answer

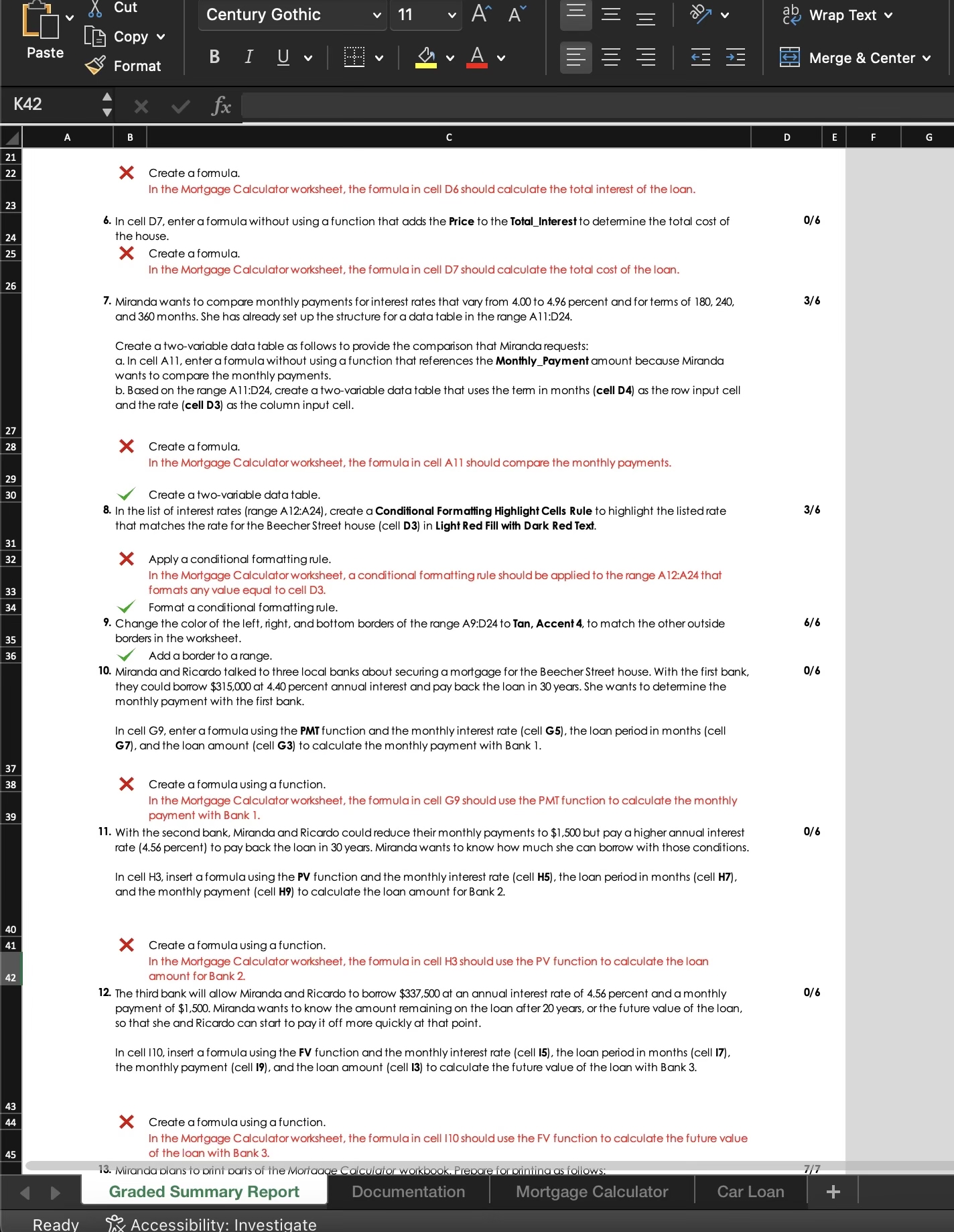

CAN YOU HELP ME WITH CORRECTING MY ANSWERS. I got the ones in red wrong and i have tried multiple ways. Could you please help

CAN YOU HELP ME WITH CORRECTING MY ANSWERS. I got the ones in red wrong and i have tried multiple ways. Could you please help me in how to do those, in a detailed but simple way. Please! I will like the answer.

K

A

B

C

D

E

F

G

Create a formula.

In the Mortgage Calculator worksheet, the formula in cell D should calculate the total interest of the loan.

In cell D enter a formula without using a function that adds the Price to the TotalInterest to determine the total cost of the house.

Create a formula.

In the Mortgage Calculator worksheet, the formula in cell D should calculate the total cost of the loan.

Miranda wants to compare monthly payments for interest rates that vary from to percent and for terms of

and months. She has already set up the structure for a data table in the range A:D

Create a twovariable data table as follows to provide the comparison that Miranda requests:

a In cell All, enter a formula without using a function that references the MonthlyPayment amount because Miranda wants to compare the monthly payments.

b Based on the range A:D create a twovariable data table that uses the term in months cell D as the row input cell and the rate cell D as the column input cell.

Create a formula.

In the Mortgage Calculator worksheet, the formula in cell Al should compare the monthly payments.

Create a twovariable data table.

In the list of interest rates range A:A create a Conditional Formatting Highlight Cells Rule to highlight the listed rate

that matches the rate for the Beecher Street house cell D in Light Red Fill with Dark Red Text.

X Apply a conditional formatting rule.

In the Mortgage Calculator worksheet, a conditional formatting rule should be applied to the range A:A that formats any value equal to cell D

Format a conditional formatting rule.

Change the color of the left, right, and bottom borders of the range A:D to Tan, Accent to match the other outside

borders in the worksheet.

Add a border to a range.

Miranda and Ricardo talked to three local banks about securing a mortgage for the Beecher Street house. With the first bank, they could borrow $ at percent annual interest and pay back the loan in years. She wants to determine the monthly payment with the first bank.

In cell G enter a formula using the PMT function and the monthly interest rate cell G the loan period in months cell G and the loan amount cell G to calculate the monthly payment with Bank

X Create a formula using a function.

In the Mortgage Calculator worksheet, the formula in cell G should use the PMT function to calculate the monthly payment with Bank

With the second bank, Miranda and Ricardo could reduce their monthly payments to $ but pay a higher annual interest

rate percent to pay back the loan in years. Miranda wants to know how much she can borrow with those conditions.

In cell insert a formula using the PV function and the monthly interest rate cell H the loan period in months cell H and the monthly payment cell H to calculate the loan amount for Bank

X Create a formula using a function.

In the Mortgage Calculator worksheet, the formula in cell H should use the PV function to calculate the loan amount for Bank

The third bank will allow Miranda and Ricardo to borrow $ at an annual interest rate of percent and a monthly

payment of $ Miranda wants to know the amount remaining on the loan after years, or the future value of the loan, so that she and Ricardo can start to pay it off more quickly at that point.

In cell I insert a formula using the FV function and the monthly interest rate cell I the loan period in months cell I the monthly payment cell I and the loan amount cell I to calculate the future value of the loan with Bank

Create a formula using a function.

In the Mortgage Calculator worksheet, the formula in cell I should use the FV function to calculate the future value

of the loan with Bank

Miranda plans to orint barts of the Mortaaqe Calculator workbook. Prepare for printing as follows:

Graded Summary Report

Documentation

Mortgage Calculator

Car Loan

Ready Accessibility: Investigate

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started