Answered step by step

Verified Expert Solution

Question

1 Approved Answer

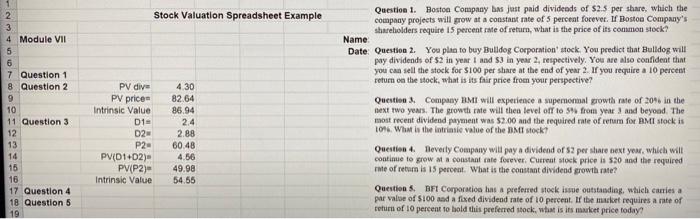

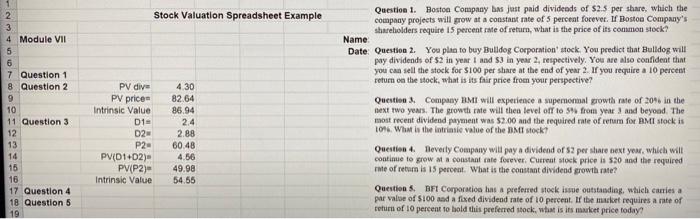

can you help me with question 5 Question 1. Bostoa Company bas jest paid divideods of 52.5 per share, which the company projects will grow

can you help me with question 5

Question 1. Bostoa Company bas jest paid divideods of 52.5 per share, which the company projects will grow at a constant rate of 5 perceat focevet. If Bostoe Company's shareholders require 15 percent rafe of refurn, what is the price of its common stock? Question 2. Yoa plaa to boy Brulldog Cocporation' stock. You predict that Bulldog will pay dividends of 52 in year 1 and 53 in year 2, reipectively. You are also coufident that you caa sell the stock for $100 per share at the end of year 2 . If you recquire a 10 percens retum oa the stock, what is its fair price from your perspective? Questise 3. Company HMI will experience a supernonmal growta rate of 20 b in the next two years. The growth rate will thea level off to 5% from yeat 3 and beyood. The most recent dividend payzent was 52.00 and the required rate of rerum for BMII stock is tots. What is the intriasis value of the Distl stockt Questien 4. Beverly Comapamy will pay a dividend of s2 per share next year, which wilt continue to srow at a ponstant rate focever. Cucreat stock price is 520 and the required rate of retarn is 15 percent. What is the conuant dividend erowth rate? Quention 5. BFI Comparatioo has a prefersed mock ispe outstasdiag. Whuch carries a par valse of $100 asd a fised dividend rate of 10 percent. If tbe makket requires a rate of roturu of 10 percent 10 hald this preferred ttock, whay is its maxket price today

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started