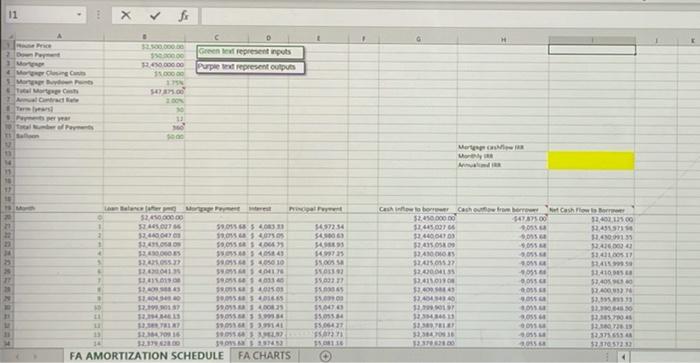

Can you help me with the IRR and the excel?

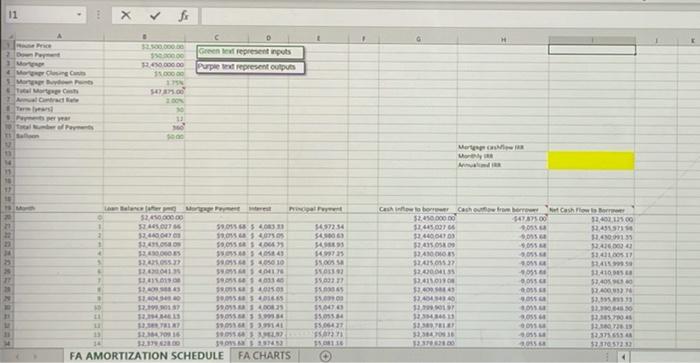

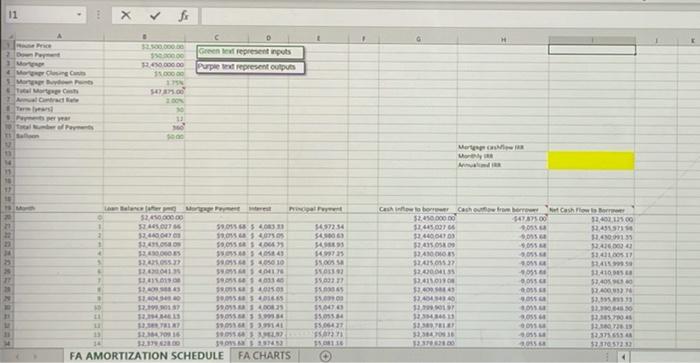

TI 2 200.000 59000 Peo.c00.00 11 000 Green represent inputs Purple represent outputs Marger MEE JOS al ser 11 547700 90 WS 5 + dan Balance Mermerest 32.450,000.00 1 SOUTH 59.0555 4033 14972.54 3 GAS 18.07.09 5450069 1 16 $9.01.2004 SEE 120.000.55 540541 14 15 3 HOSS 95405010 35.00 2013 39. 10 . 1916031 1 80 40 SA 153401 5. 12.10 5900082 10476 1214 103 104 15.05 LI 19.03.14 15.04 13 523470316 50.053 251453 FA AMORTIZATION SCHEDULE FA CHARTS 15 52.450.000 SCOT 34404705 AOS BADOS 2015 $2.60 04135 12111 17.40 13.4544360 12.01 32 33 533 TELE! 32 34 36 13700 12.00 2498571 H400013 1940 SIT 124155 14100 52.400 2003) $3.9.11 2004 3704 2013 23753 5210:52 005 SOS BOSS US BET PLEASE ENTER ANSWERS IN BLUE BOLD INK! Use the following information for all the questions. Ann would like to buy a house. It costs $2,500,000. Her down payment will be $50,000. She will take out a mortgage for the remainder. It will be a 30 year, fully amortizing, FRM, with constant monthly payments and monthly compounding. The annual interest rate is 2.00%. She will pay $5,000 in closing costs at origination. She will also pay 1.75% of the balance in buy-down points at origination. Note: the home is bought and the loan is taken in month O, the first payment is due in month 1. In the spreadsheet where it says "cash inflow", "outflow" and "net cash flow" you should only take into account cash flow related to the mortgage. 1. Fill in the spreadsheet (sheet "FA AMORTIZATION SCHEDULE") for Ann. (It is called an amortization schedule or amortization calendar.) 2. Compute Ann's annualized IRR for the mortgage in the spreadsheet. (Use the net cash flow.) What is the annualized IRR for the mortgage? 3. Plot Ann's mortgage balance in one graph. Copy & paste the graph here. TI 2 200.000 59000 Peo.c00.00 11 000 Green represent inputs Purple represent outputs Marger MEE JOS al ser 11 547700 90 WS 5 + dan Balance Mermerest 32.450,000.00 1 SOUTH 59.0555 4033 14972.54 3 GAS 18.07.09 5450069 1 16 $9.01.2004 SEE 120.000.55 540541 14 15 3 HOSS 95405010 35.00 2013 39. 10 . 1916031 1 80 40 SA 153401 5. 12.10 5900082 10476 1214 103 104 15.05 LI 19.03.14 15.04 13 523470316 50.053 251453 FA AMORTIZATION SCHEDULE FA CHARTS 15 52.450.000 SCOT 34404705 AOS BADOS 2015 $2.60 04135 12111 17.40 13.4544360 12.01 32 33 533 TELE! 32 34 36 13700 12.00 2498571 H400013 1940 SIT 124155 14100 52.400 2003) $3.9.11 2004 3704 2013 23753 5210:52 005 SOS BOSS US BET PLEASE ENTER ANSWERS IN BLUE BOLD INK! Use the following information for all the questions. Ann would like to buy a house. It costs $2,500,000. Her down payment will be $50,000. She will take out a mortgage for the remainder. It will be a 30 year, fully amortizing, FRM, with constant monthly payments and monthly compounding. The annual interest rate is 2.00%. She will pay $5,000 in closing costs at origination. She will also pay 1.75% of the balance in buy-down points at origination. Note: the home is bought and the loan is taken in month O, the first payment is due in month 1. In the spreadsheet where it says "cash inflow", "outflow" and "net cash flow" you should only take into account cash flow related to the mortgage. 1. Fill in the spreadsheet (sheet "FA AMORTIZATION SCHEDULE") for Ann. (It is called an amortization schedule or amortization calendar.) 2. Compute Ann's annualized IRR for the mortgage in the spreadsheet. (Use the net cash flow.) What is the annualized IRR for the mortgage? 3. Plot Ann's mortgage balance in one graph. Copy & paste the graph here