can you help me with these?

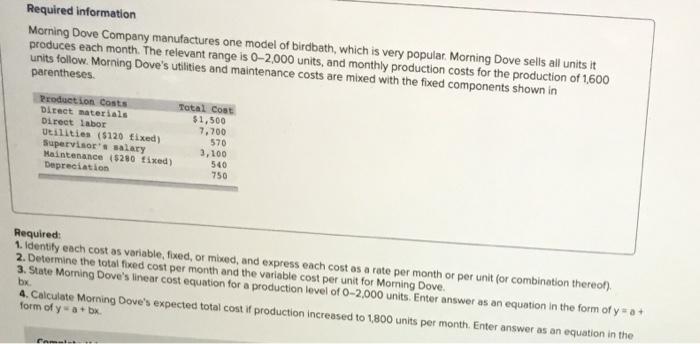

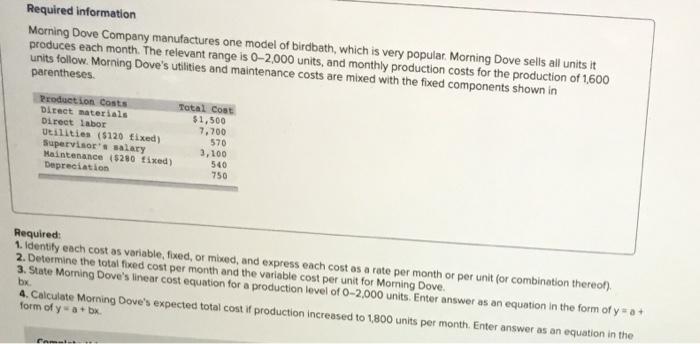

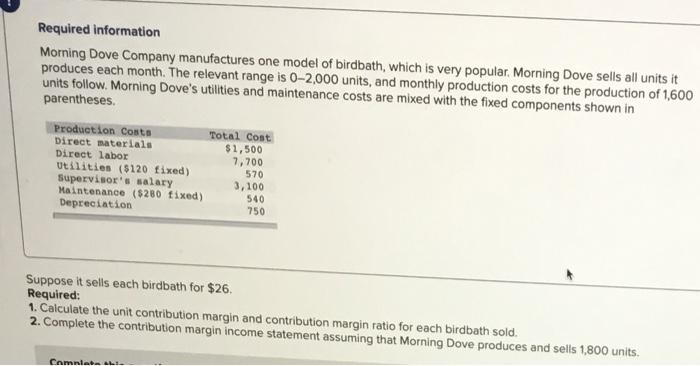

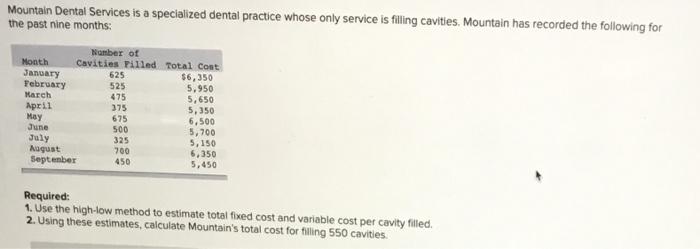

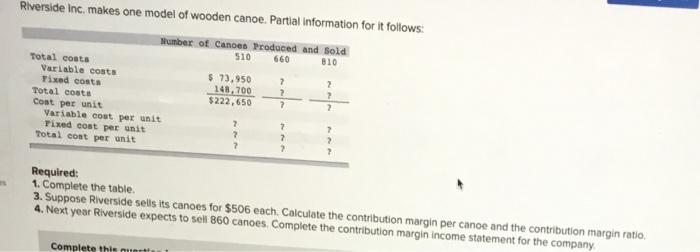

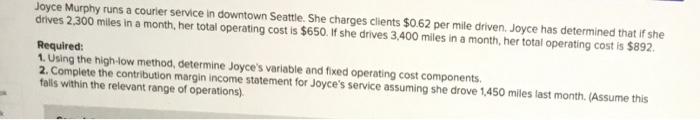

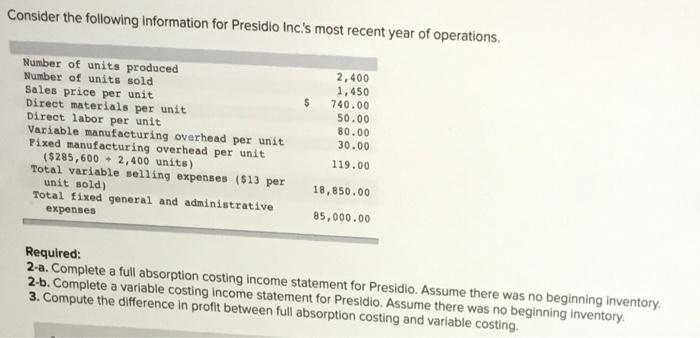

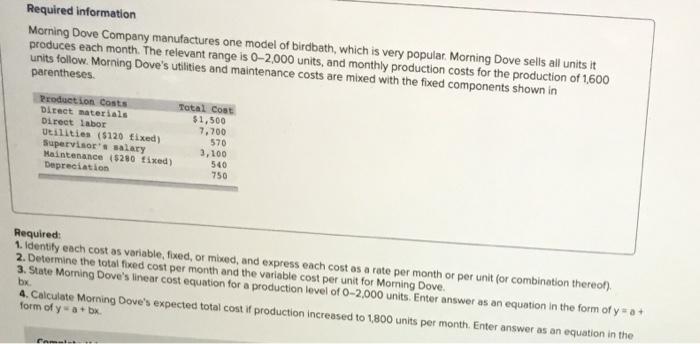

Required information Morning Dove Company manufactures one model of birdbath, which is very popular. Morning Dove sells all units it produces each month. The relevant range is 0-2,000 units, and monthly production costs for the production of 1,600 units follow. Morning Dove's utilities and maintenance costs are mixed with the fixed components shown in parentheses Production Costs Total Cost Direct materials $1,500 Direct labor 7.700 Utilities ($120 fixed) 570 Supervisor's salary 3,100 Maintenance ($280 Fixed) 540 Depreciation 750 Required: 1. Identity ench cost as variable, fixed, or mbed, and express each cost as a rate per month or per unit (or combination thereof). 2. Determine the total fixed cost per month and the variable cost per unit for Morning Dove. 3. State Morning Dove's linear cost equation for a production level of 0-2,000 units Enter answer as an equation in the form of y* 3+ 4. Calculate Morning Dove's expected total cost of production increased to 1,800 units per month. Enter answer as an equation in the form of ya. bx bx Required information Morning Dove Company manufactures one model of birdbath, which is very popular. Morning Dove sells all units it produces each month. The relevant range is 0-2,000 units, and monthly production costs for the production of 1,600 units follow. Morning Dove's utilities and maintenance costs are mixed with the fixed components shown in parentheses. Production Costa Total cost Direct materials $1,500 Direct labor 7,700 Utilities ($120 fixed) 570 Supervisor's salary 3,100 Maintenance ($280 fixed) 540 Depreciation 750 Suppose it sells each birdbath for $26. Required: 1. Calculate the unit contribution margin and contribution margin ratio for each birdbath sold. 2. Complete the contribution margin income statement assuming that Morning Dove produces and sells 1,800 units. Camna Mountain Dental Services is a specialized dental practice whose only service is filling cavities. Mountain has recorded the following for the past nine months Number of Month cavities Filled Total Cost January 625 $6,350 February 525 5.950 March 475 5,650 April 375 5,350 May 675 6.500 June 500 5,700 July 325 5,150 August 700 6,350 September 450 5,450 Required: 1. Use the high-low method to estimate total fixed cost and variable cost per cavity filled. 2. Using these estimates, calculate Mountain's total cost for filling 550 cavities Riverside Inc. makes one model of wooden canoe. Partial information for it follows: Number of Canoes Produced and sold 510 660 810 Total costs Variable costs $ 73,950 2 2 Fixed costs 148,700 2 2 Total costa $222,650 2 2 Cost per unit Variable cost per unit 2 2 7 Tixed cost per unit 2 2 Total cost per unit ? 2 2 Required: 1. Complete the table 3. Suppose Riverside sells its canoes for $506 each. Calculate the contribution margin per canoe and the contribution margin ratio, 4. Next year Riverside expects to sell 860 canoes. Complete the contribution margin income statement for the company Complete this Joyce Murphy runs a courier service in downtown Seattle. She charges clients $0.62 per mile driven. Joyce has determined that if she drives 2.300 miles in a month, her total operating cost is $650. she drives 3,400 miles in a month, her total operating cost is $892 Required: 1. Using the nigh-low method, determine Joyce's variable and fixed operating cost components. 2. Complete the contribution margin income statement for Joyce's service assuming she drove 1.450 miles last month. (Assume this talls within the relevant range of operations), Consider the following information for Presidio Inc.'s most recent year of operations, Number of units produced Number of units sold Sales price per unit Direct materials per unit Direct labor per unit Variable manufacturing overhead per unit Pixed manufacturing overhead per unit ($285,600 - 2,400 units) Total variable selling expenses ($13 per unit sold) Total fixed general and administrative expenses 2,400 1,450 740.00 50.00 80.00 30.00 119.00 18,850.00 85,000.00 Required: 2-a. Complete a full absorption costing income statement for Presidio. Assume there was no beginning inventory. 2-b. Complete a variable costing Income statement for Presidio. Assume there was no beginning inventory 3. Compute the difference in profit between full absorption costing and variable costing