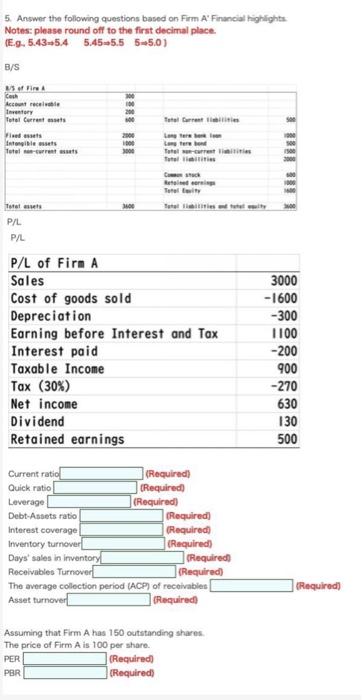

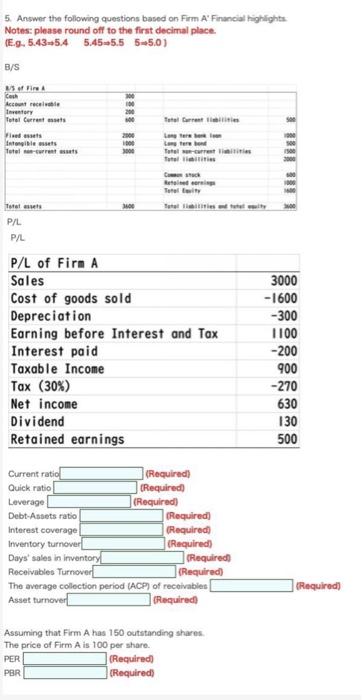

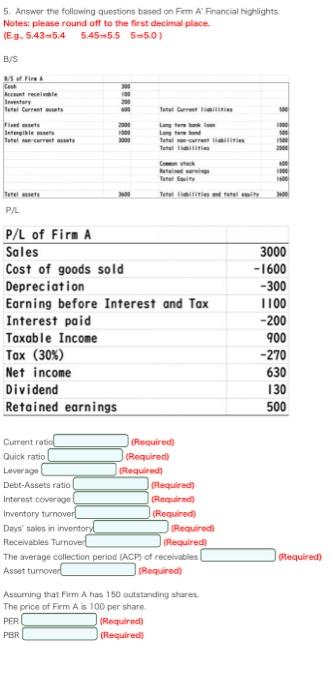

can you help solve this, thank you so much

5. Answer the following questions based on Firm A' Financial Highlights Notes: please round off to the first decimal place. 15.9.5.43-54 545-5.5 5-5,0) B/S of Fire controle Inventory Total Currentes Www Intangibles Tutal -rants 1000 300 Total Current Lanterne er Lameron Total time Tutelis Beta Tural vity Tort P/L P/L P/L of Firm A Sales Cost of goods sold Depreciation Earning before Interest and Tax Interest paid Taxable income Tax (30%) Net income Dividend Retained earnings 3000 -1600 -300 1100 -200 900 -270 630 130 500 Current ratio (Required) Quick ratio (Required Leverage (Required Debt-Assets ratio Required Interest coverage (Required Inventory turnover! Required) Days' sales in inventory (Required Receivables Turnover (Required The average collection period (ACP) of receivables Asset turnover (Required (Required) Assuming that Firm A has 150 outstanding shares The price of Firm Als 100 per share. PER (Required PBR (Required) 5. Answer the following questions based on Fem A' Francial highlights: Notesplease round off to the first decimal place. (Eg. 5.43-5.4 5.45-5.5 5-5.0) B/S as wir Cse Rent receive try ut Current Fusta Begile **** 11 Totale Telli Tali P/L P/L of Firm A Sales Cost of goods sold Depreciation Earning before Interest and Tax Interest paid Taxable Income Tax (30%) Net income Dividend Retained earnings 3000 -1600 -300 1100 -200 900 -270 630 130 500 Current ratio Required Quick ratio (Required Leverage Required Debt-Assets ratio Required) Interest coverage Required Inventory turnover (Required) Days' sales in inventory Required Receivables Turnover Required The average collection period (ACP) of receivables Asset turnover (Required) Required) Assuming that Firm A has 150 outstanding shares. The price of Firm As 100 per share (Required) PBR (Required) PER 5. Answer the following questions based on Firm A' Financial Highlights Notes: please round off to the first decimal place. 15.9.5.43-54 545-5.5 5-5,0) B/S of Fire controle Inventory Total Currentes Www Intangibles Tutal -rants 1000 300 Total Current Lanterne er Lameron Total time Tutelis Beta Tural vity Tort P/L P/L P/L of Firm A Sales Cost of goods sold Depreciation Earning before Interest and Tax Interest paid Taxable income Tax (30%) Net income Dividend Retained earnings 3000 -1600 -300 1100 -200 900 -270 630 130 500 Current ratio (Required) Quick ratio (Required Leverage (Required Debt-Assets ratio Required Interest coverage (Required Inventory turnover! Required) Days' sales in inventory (Required Receivables Turnover (Required The average collection period (ACP) of receivables Asset turnover (Required (Required) Assuming that Firm A has 150 outstanding shares The price of Firm Als 100 per share. PER (Required PBR (Required) 5. Answer the following questions based on Fem A' Francial highlights: Notesplease round off to the first decimal place. (Eg. 5.43-5.4 5.45-5.5 5-5.0) B/S as wir Cse Rent receive try ut Current Fusta Begile **** 11 Totale Telli Tali P/L P/L of Firm A Sales Cost of goods sold Depreciation Earning before Interest and Tax Interest paid Taxable Income Tax (30%) Net income Dividend Retained earnings 3000 -1600 -300 1100 -200 900 -270 630 130 500 Current ratio Required Quick ratio (Required Leverage Required Debt-Assets ratio Required) Interest coverage Required Inventory turnover (Required) Days' sales in inventory Required Receivables Turnover Required The average collection period (ACP) of receivables Asset turnover (Required) Required) Assuming that Firm A has 150 outstanding shares. The price of Firm As 100 per share (Required) PBR (Required) PER