Answered step by step

Verified Expert Solution

Question

1 Approved Answer

can you help with #10? LWU UI U PULO d) None of the above Janice Peterson Personal Data Client: Children: Janice's parents: Janice Peterson, age

can you help with #10?

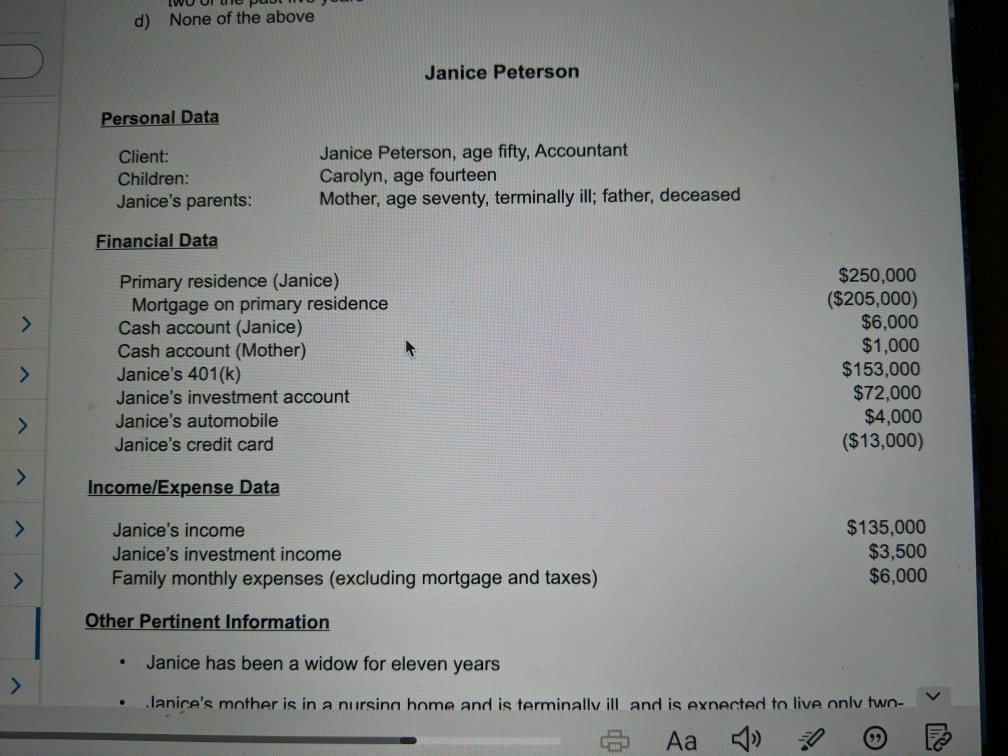

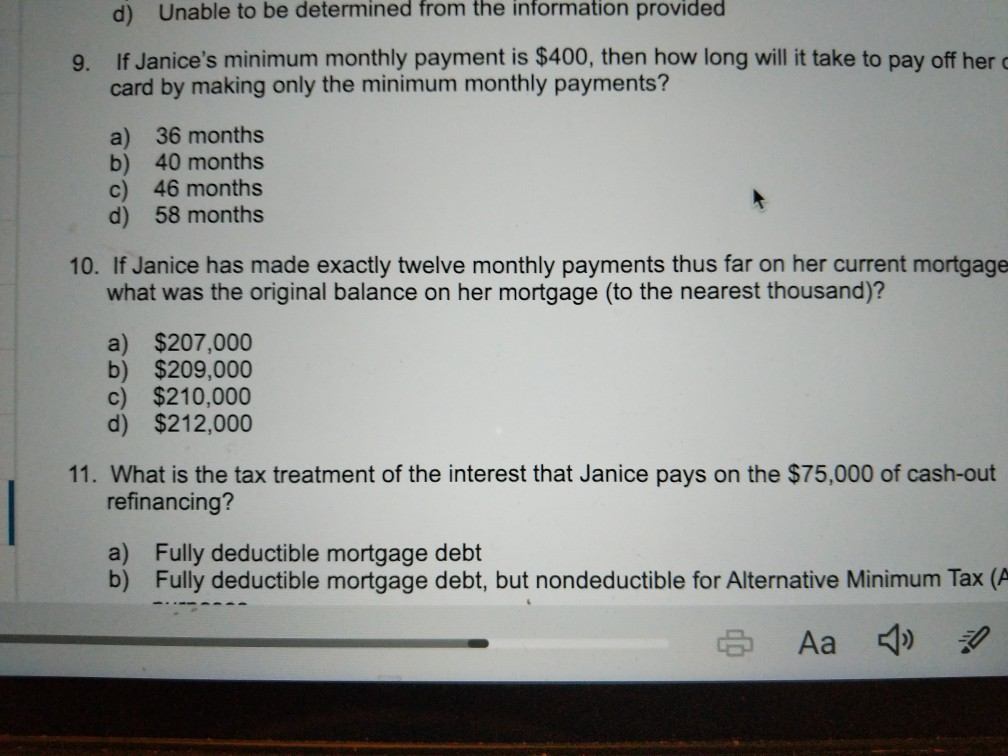

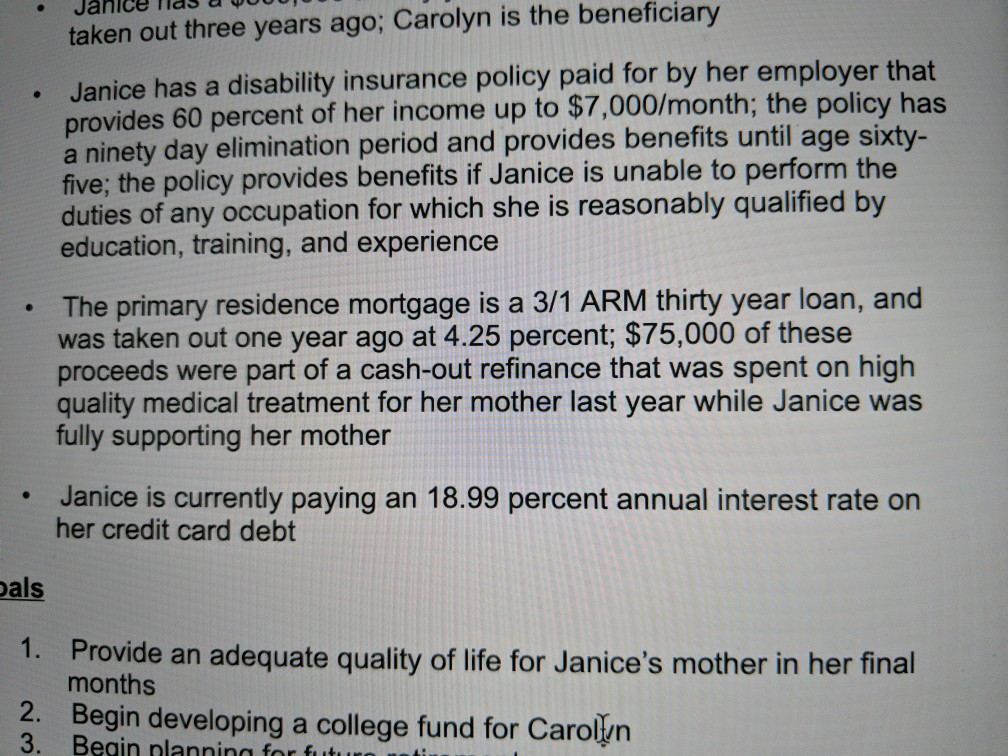

LWU UI U PULO d) None of the above Janice Peterson Personal Data Client: Children: Janice's parents: Janice Peterson, age fifty, Accountant Carolyn, age fourteen Mother, age seventy, terminally ill; father, deceased Financial Data Primary residence (Janice) Mortgage on primary residence Cash account (Janice) Cash account (Mother) Janice's 401(k) Janice's investment account Janice's automobile Janice's credit card $250,000 ($ 205,000) $6,000 $1,000 $153,000 $72,000 $4,000 ($13,000) Income/Expense Data Janice's income Janice's investment income Family monthly expenses (excluding mortgage and taxes) $135,000 $3,500 $6,000 Other Pertinent Information Janice has been a widow for eleven years Janice's mother is in a nursing home and is terminally ill and is expected to live only two- 6 Aa : d) Unable to be determined from the information provided 9. If Janice's minimum monthly payment is $400, then how long will it take to pay off her card by making only the minimum monthly payments? a) 36 months 40 months c) 46 months d) 58 months 10. If Janice has made exactly twelve monthly payments thus far on her current mortgage what was the original balance on her mortgage (to the nearest thousand)? a) $207,000 $209,000 c) $210,000 d) $212,000 11. What is the tax treatment of the interest that Janice pays on the $75,000 of cash-out refinancing? a) Fully deductible mortgage debt b) Fully deductible mortgage debt, but nondeductible for Alternative Minimum Tax (A & A & Janice lles a VUUU taken out three years ago; Carolyn is the beneficiary Janice has a disability insurance policy paid for by her employer that provides 60 percent of her income up to $7,000/month; the policy has a ninety day elimination period and provides benefits until age sixty- five; the policy provides benefits if Janice is unable to perform the duties of any occupation for which she is reasonably qualified by education, training, and experience The primary residence mortgage is a 3/1 ARM thirty year loan, and was taken out one year ago at 4.25 percent; $75,000 of these proceeds were part of a cash-out refinance that was spent on high quality medical treatment for her mother last year while Janice was fully supporting her mother Janice is currently paying an 18.99 percent annual interest rate on her credit card debt bals 1. Provide an adequate quality of life for Janice's mother in her final months 2. Begin developing a college fund for Carolyn 3. Begin nlanning for future

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started