Answered step by step

Verified Expert Solution

Question

1 Approved Answer

can you help with test corrections all questions please, I just want to check what i did wrong. so if you can solve all of

can you help with test corrections

all questions please, I just want to check what i did wrong. so if you can solve all of them i'll grealty appreciate it.

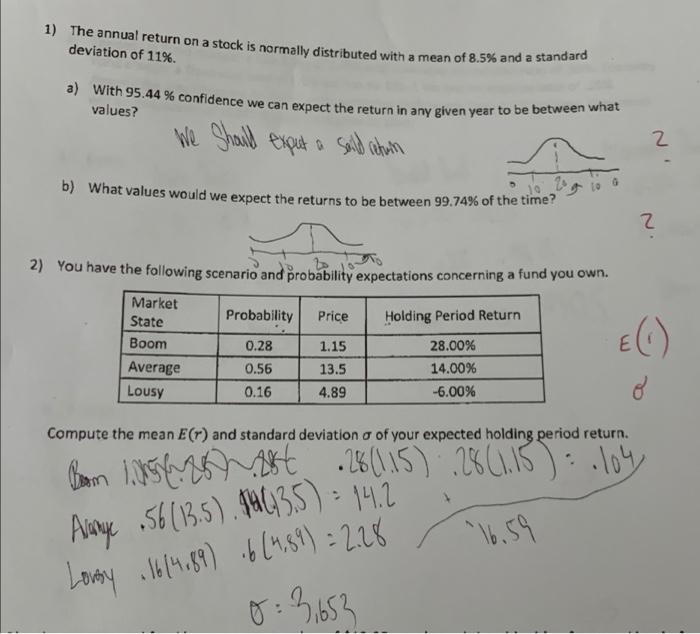

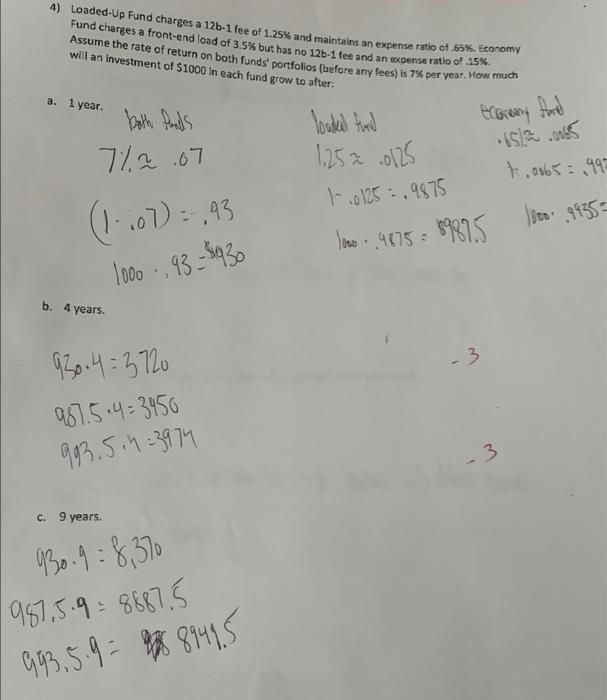

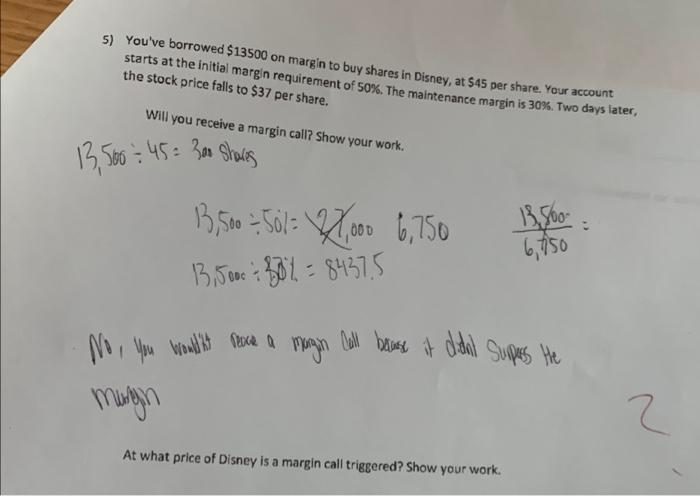

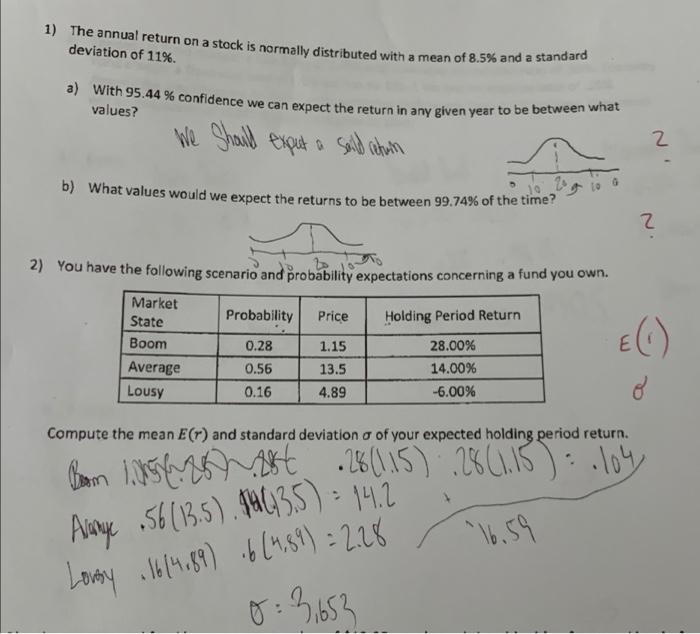

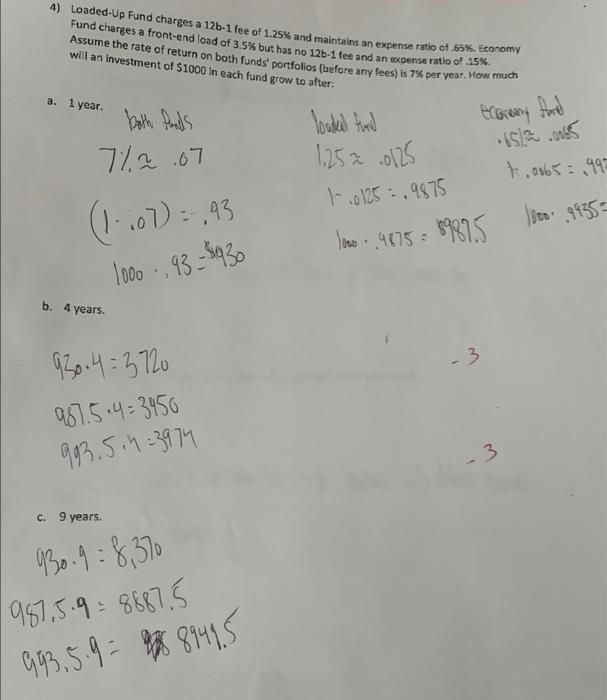

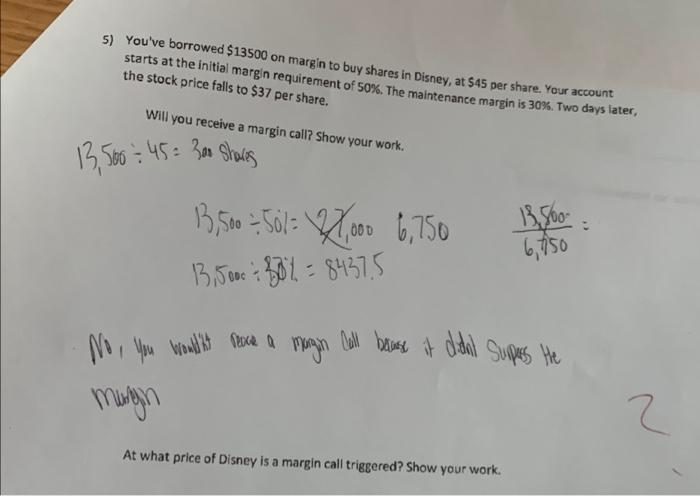

1) The annual return on a stack is normally distributed with a mean of 8.5% and a standard deviation of 11% 3) With 95.44 % confidence we can expect the return in any given year to be between what We Should expect a said return values? 2 b) What values would we expect the returns to be between 99.74% of the time? 2 ? 2) You have the following scenario and probability expectations concerning a fund you own. Probability Price Holding Period Return Market State Boom Average Lousy E 1.15 0.28 0.56 0.16 13.5 4.89 28.00% 14.00% -6.00% 8 Compute the mean E(r) and standard deviation o of your expected holding period return. Ben senest 28 (115) ::28 (1.15): 104 linhas . 16.59 Alarge 56(13,5). Ja23.5) - 14.2 Lousy .16 14.89) 6 (4,89) = 2.28 ) = 0:3,653 4) Loaded-Up Fund charges a 126-1 fee of 1.25% and maintains an expense ratio of 65%, Economy Fund charges a front-end load of 35% but has no 125-1 fee and an expense ratio of 15% Assume the rate of return on both funds portfolios (before any fees) is 7% per year. How much will an investment of $1000 in each fund grow to after: a. 1 year. Elorany Anal .652.0065 7% 2.67 1.25 = 10125 * 0865997 (1-7):43 1 .0125.9875 lowo 9875 = 89875 1000 9935= 1000 , 93 -9930 b. 4 years 930.4 = 3720 -3 987.5.4 = 3950 993.5.4 3974 3 C. 9 years. 930-9 = 8,370 1957,5.9 - 8887.5 99.5 9 945 5) You've borrowed $13500 on margin to buy shares in Disney, at $45 per share. Your account starts at the initial margin requirement of 50%. The maintenance margin is 30%. Two days later, the stock price falls to $37 per share. Will you receive a margin call? Show your work. 13,560 = 45= 300 Shares 3,500 = 501 = 8,000 6,750 18.500 6,750 13,500 282 = 84375 No You Would it nexe a margin Cell because it didn't surpers He mungon 2 At what price of Disney is a margin call triggered? Show your work. 1) The annual return on a stack is normally distributed with a mean of 8.5% and a standard deviation of 11% 3) With 95.44 % confidence we can expect the return in any given year to be between what We Should expect a said return values? 2 b) What values would we expect the returns to be between 99.74% of the time? 2 ? 2) You have the following scenario and probability expectations concerning a fund you own. Probability Price Holding Period Return Market State Boom Average Lousy E 1.15 0.28 0.56 0.16 13.5 4.89 28.00% 14.00% -6.00% 8 Compute the mean E(r) and standard deviation o of your expected holding period return. Ben senest 28 (115) ::28 (1.15): 104 linhas . 16.59 Alarge 56(13,5). Ja23.5) - 14.2 Lousy .16 14.89) 6 (4,89) = 2.28 ) = 0:3,653 4) Loaded-Up Fund charges a 126-1 fee of 1.25% and maintains an expense ratio of 65%, Economy Fund charges a front-end load of 35% but has no 125-1 fee and an expense ratio of 15% Assume the rate of return on both funds portfolios (before any fees) is 7% per year. How much will an investment of $1000 in each fund grow to after: a. 1 year. Elorany Anal .652.0065 7% 2.67 1.25 = 10125 * 0865997 (1-7):43 1 .0125.9875 lowo 9875 = 89875 1000 9935= 1000 , 93 -9930 b. 4 years 930.4 = 3720 -3 987.5.4 = 3950 993.5.4 3974 3 C. 9 years. 930-9 = 8,370 1957,5.9 - 8887.5 99.5 9 945 5) You've borrowed $13500 on margin to buy shares in Disney, at $45 per share. Your account starts at the initial margin requirement of 50%. The maintenance margin is 30%. Two days later, the stock price falls to $37 per share. Will you receive a margin call? Show your work. 13,560 = 45= 300 Shares 3,500 = 501 = 8,000 6,750 18.500 6,750 13,500 282 = 84375 No You Would it nexe a margin Cell because it didn't surpers He mungon 2 At what price of Disney is a margin call triggered? Show your work Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started