Answered step by step

Verified Expert Solution

Question

1 Approved Answer

can you help with these two questions 10. According to the static tradeoff theory, what's the optimal capital structure? A. A firm should borrow up

can you help with these two questions

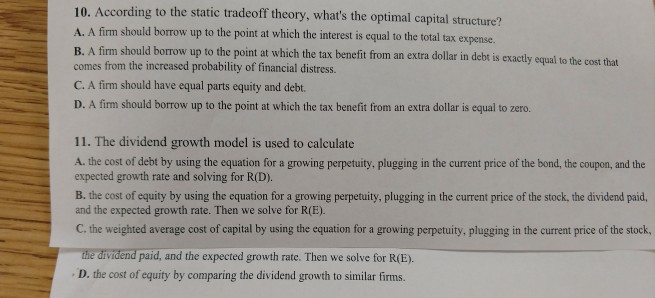

10. According to the static tradeoff theory, what's the optimal capital structure? A. A firm should borrow up to the point at which the interest is equal to the total tax expense. B. A firm should borrow up to the point at which the tax benefit from an extra dollar in debt is exactly comes from the increased probability of financial distress. C. A firm should have equal parts equity and debt. D. A firm should borrow up to the point at which the tax benefit from an extra dollar is equal to zero. 11. The dividend growth model is used to calculate A. the cost of debt by using the equation for a growing perpetuity, plugging in the current price of the bond, the coupon, and the expected growth rate and solving for R(D). B. the cost of equity by using the equation for a growing perpetuity, plugging in the current price of the stock, the dividend paid, and the expected growth rate. Then we solve for R(E). C. the weighted average cost of capital by using the equation for a growing perpetuity, plugging in the current price of the stock, vidend paid, and the expected growth rate. Then we solve for R(E). D. the cost of equity by comparing the dividend growth to similar firmsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started