Can you help with this assignment?

Can you help with this assignment?

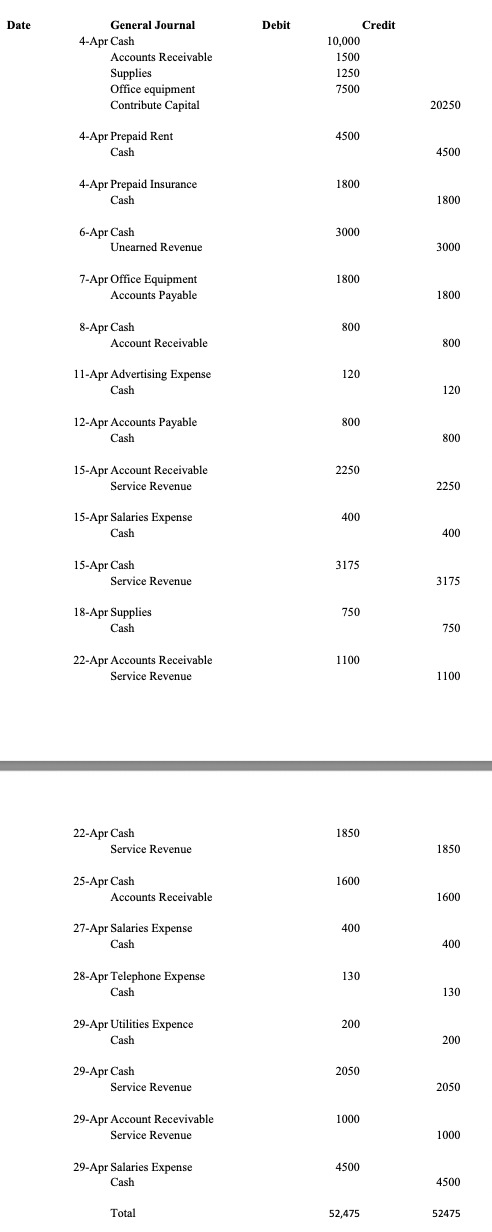

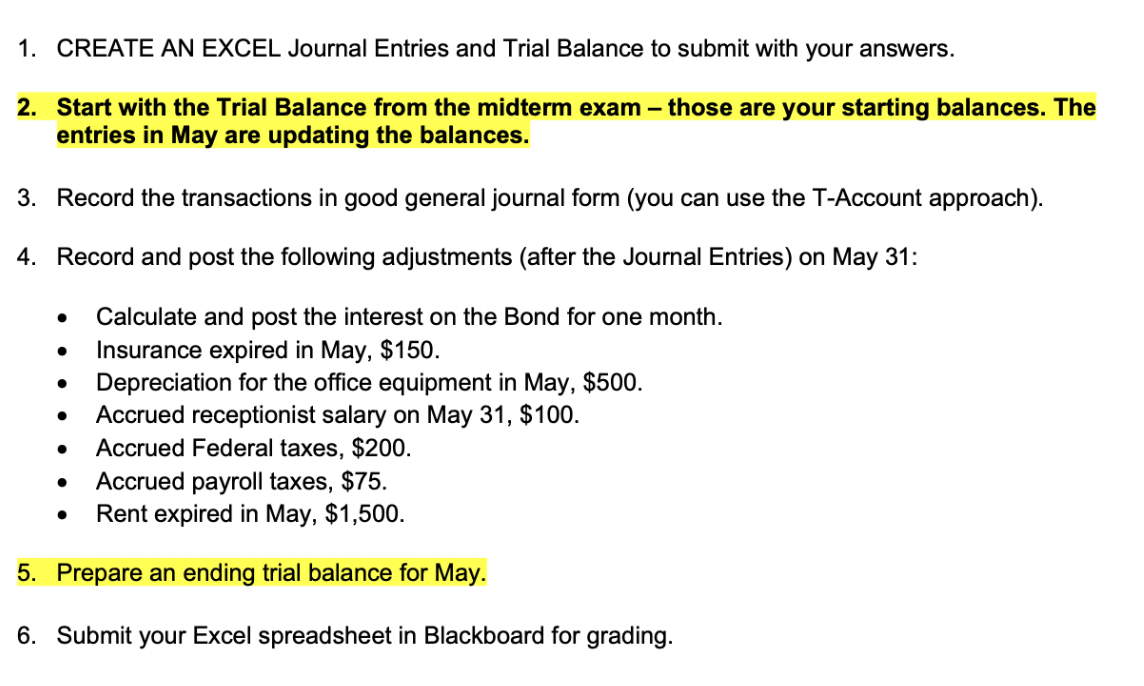

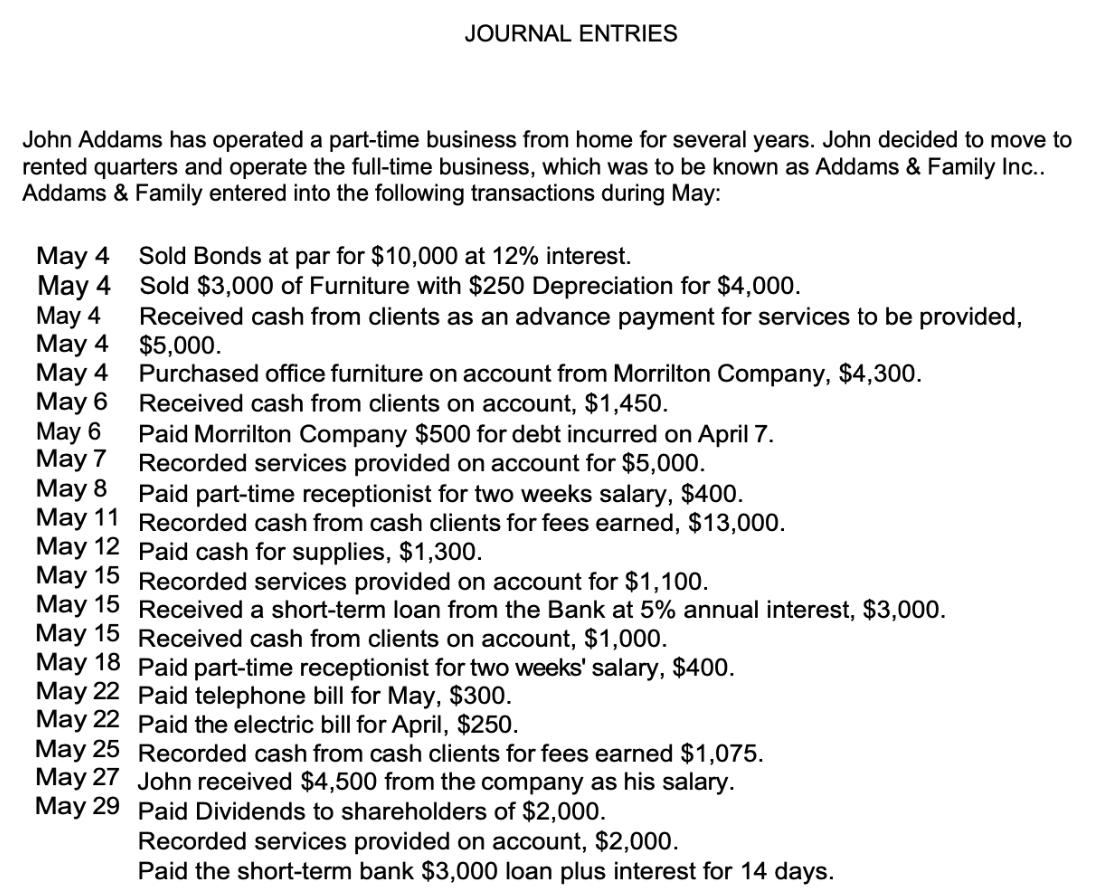

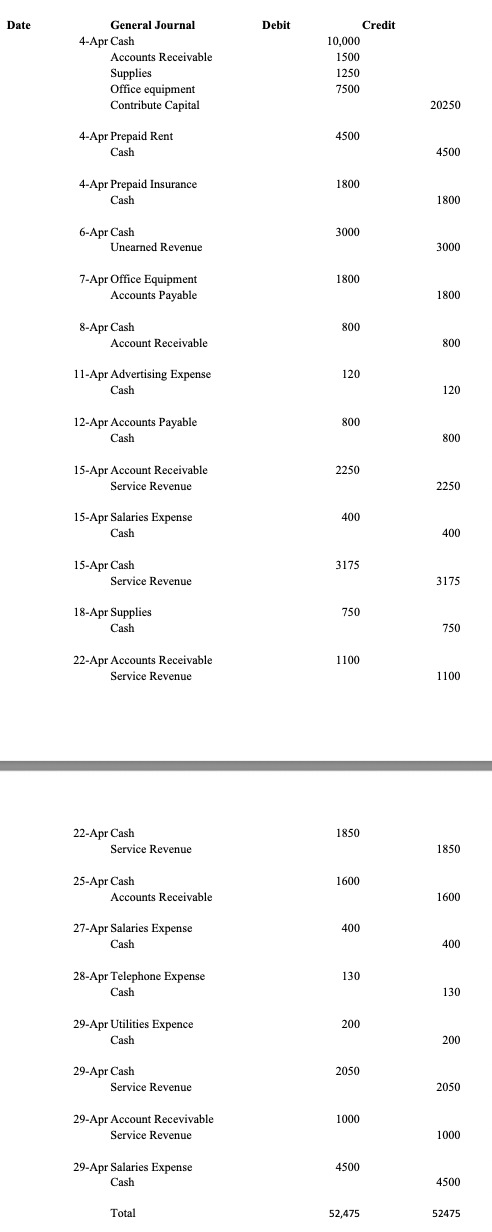

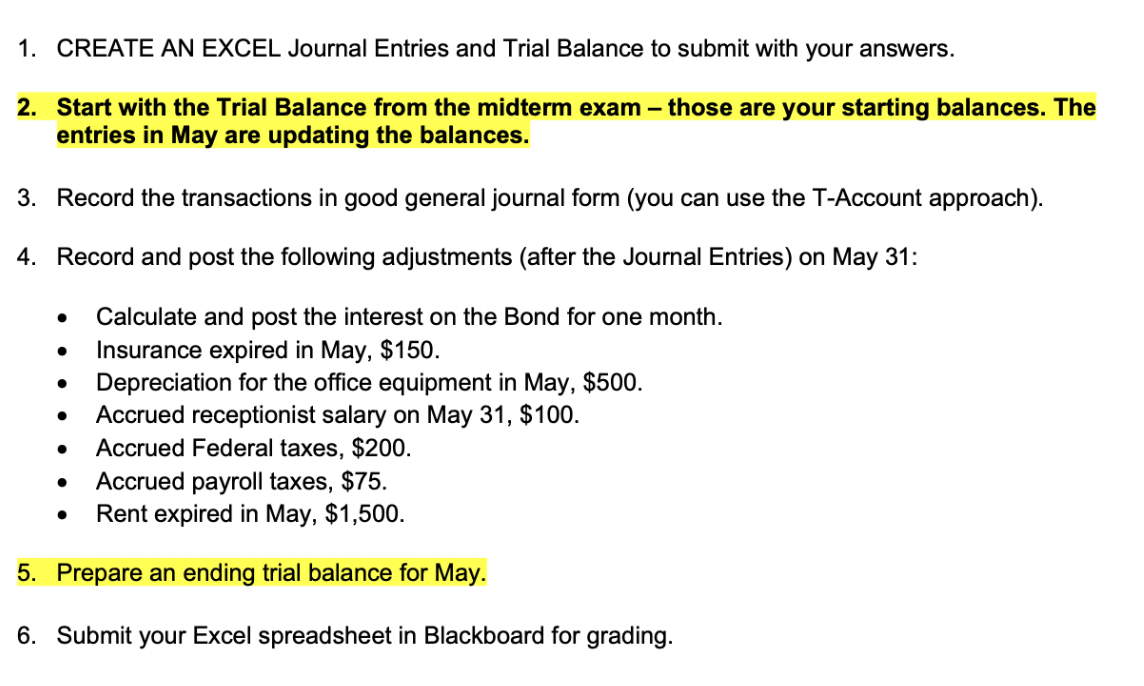

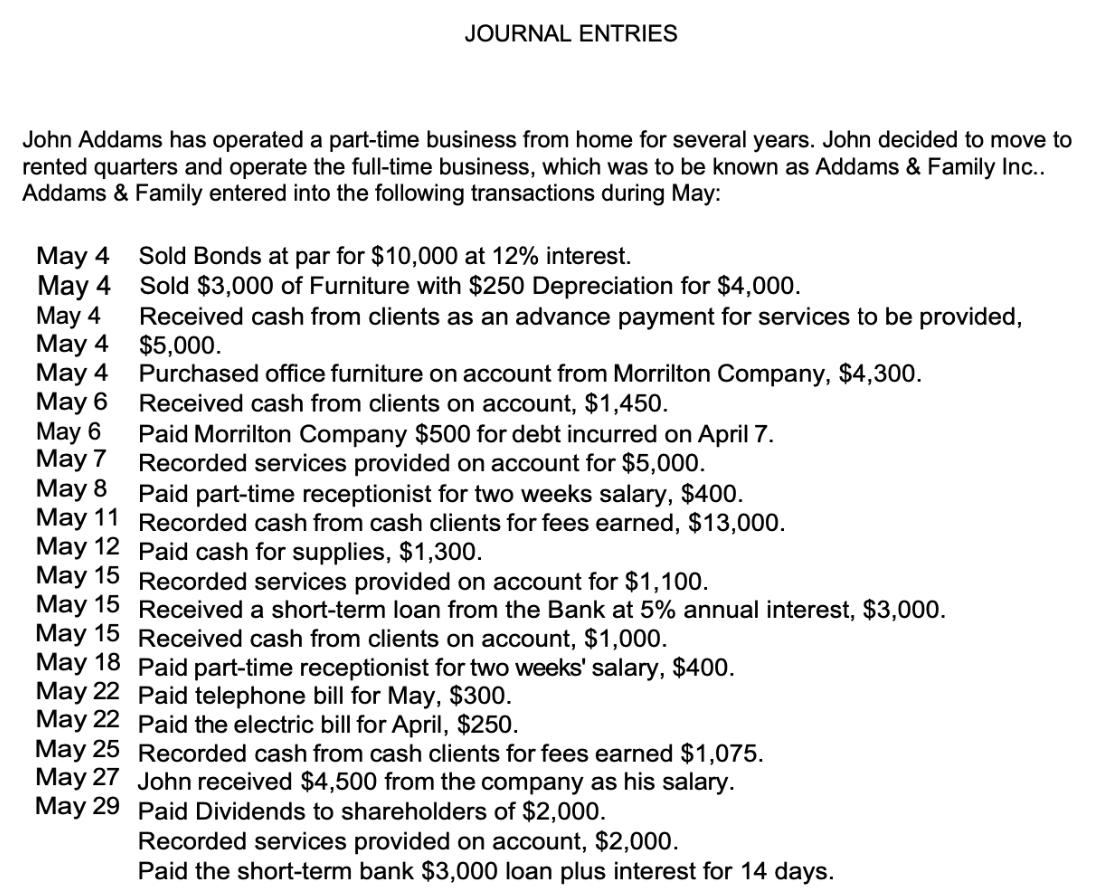

2. Start with the Trial Balance from the midterm exam - those are your starting balances. The entries in May are updating the balances. 3. Record the transactions in good general journal form (you can use the T-Account approach). 4. Record and post the following adjustments (after the Journal Entries) on May 31: - Calculate and post the interest on the Bond for one month. - Insurance expired in May, \$150. - Depreciation for the office equipment in May, $500. - Accrued receptionist salary on May 31,$100. - Accrued Federal taxes, $200. - Accrued payroll taxes, $75. - Rent expired in May, $1,500. 5. Prepare an ending trial balance for May. 6. Submit your Excel spreadsheet in Blackboard for grading. Date 22-Apr Cash Service Revenue 25-Apr Cash Accounts Receivable 27-Apr Salaries Expense Cash 28-Apr Telephone Expense Cash 29-Apr Utilities Expence Cash 29-Apr Cash Service Revenue 29-Apr Account Recevivable Service Revenue 29-Apr Salaries Expense Cash 1850 1600 400 130 200 2050 1000 4500 1850 1600 400 130 200 2050 2050 1000 4500 4500 52475 John Addams has operated a part-time business from home for several years. John decided to move to rented quarters and operate the full-time business, which was to be known as Addams \& Family Inc.. Addams \& Family entered into the following transactions during May: May 4 Sold Bonds at par for $10,000 at 12% interest. May 4 Sold $3,000 of Furniture with $250 Depreciation for $4,000. May 4 Received cash from clients as an advance payment for services to be provided, May 4$5,000. May 4 Purchased office furniture on account from Morrilton Company, $4,300. May 6 Received cash from clients on account, $1,450. May 6 Paid Morrilton Company $500 for debt incurred on April 7. May 7 Recorded services provided on account for $5,000. May 8 Paid part-time receptionist for two weeks salary, $400. May 11 Recorded cash from cash clients for fees earned, \$13,000. May 12 Paid cash for supplies, \$1,300. May 15 Recorded services provided on account for $1,100. May 15 Received a short-term loan from the Bank at 5% annual interest, $3,000. May 15 Received cash from clients on account, $1,000. May 18 Paid part-time receptionist for two weeks' salary, $400. May 22 Paid telephone bill for May, $300. May 22 Paid the electric bill for April, \$250. May 25 Recorded cash from cash clients for fees earned $1,075. May 27 John received $4,500 from the company as his salary. May 29 Paid Dividends to shareholders of $2,000. Recorded services provided on account, $2,000. Paid the short-term bank $3,000 loan plus interest for 14 days

Can you help with this assignment?

Can you help with this assignment?