Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Can you include calculations and formulas please! The initial proceeds per bond, the size of the issue, the initial maturity of the bond, and the

Can you include calculations and formulas please!

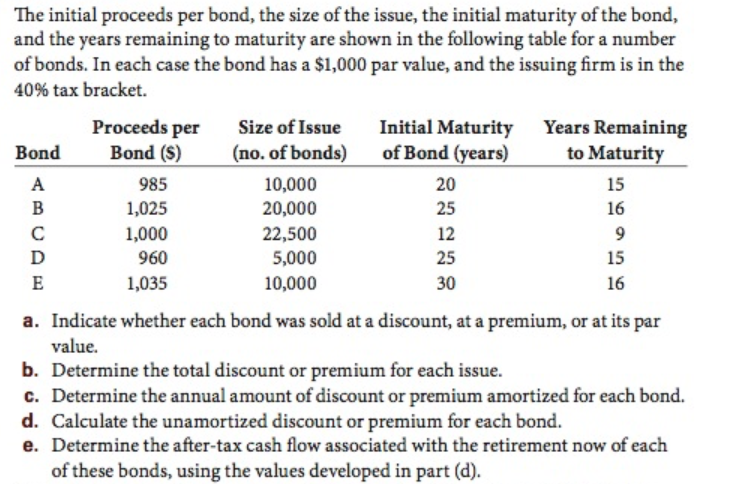

The initial proceeds per bond, the size of the issue, the initial maturity of the bond, and the years remaining to maturity are shown in the following table for a number of bonds. In each case the bond has a $1,000 par value, and the issuing firm is in the 40% tax bracket. Proceeds per Size of Issue (no. of bonds) 10,000 20,000 22,500 5,000 10,000 Initial Maturity of Bond (years) 20 25 12 25 30 Years Remaining to Maturit BondBond (S) 985 1,025 1,000 960 1,035 16 15 16 Indicate whether each bond was sold at a discount, at a premium, or at its par a. value. b. Determine the total discount or premium for each issue. c. Determine the annual amount of discount or premium amortized for each bond. d. Calculate the unamortized discount or premium for each bond. e. Determine the after-tax cash flow associated with the retirement now of each of these bonds, using the values developed in part (d)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started