Answered step by step

Verified Expert Solution

Question

1 Approved Answer

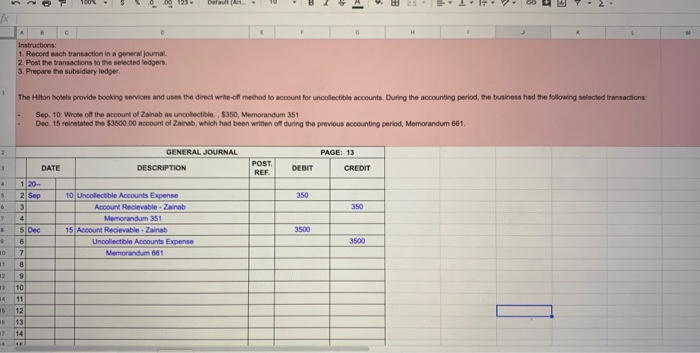

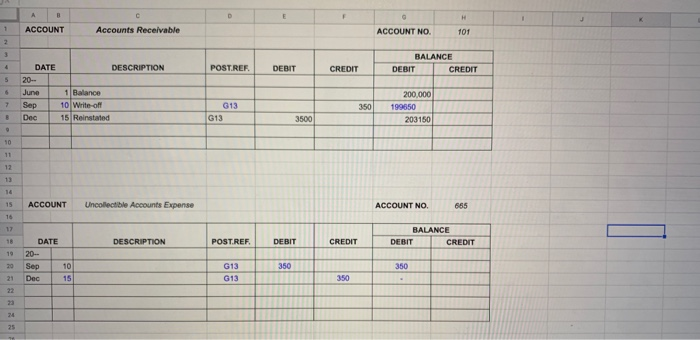

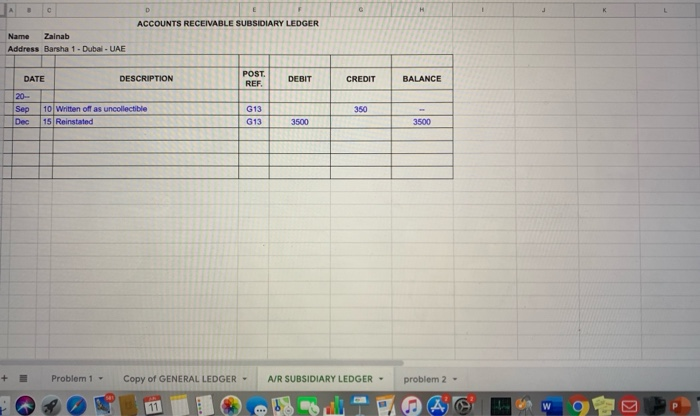

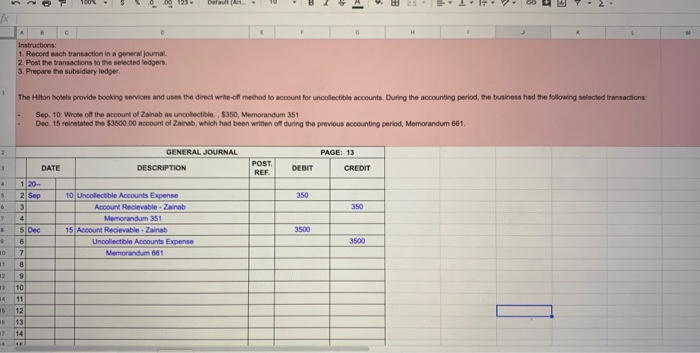

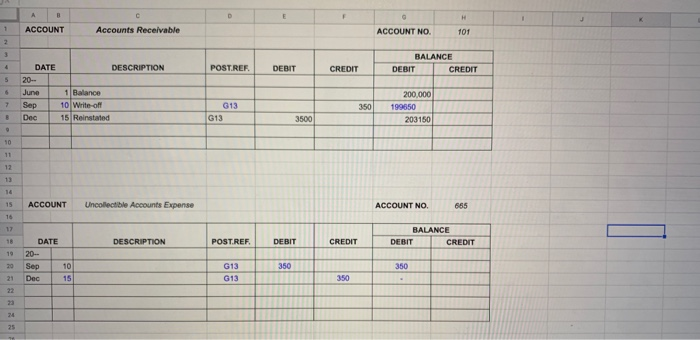

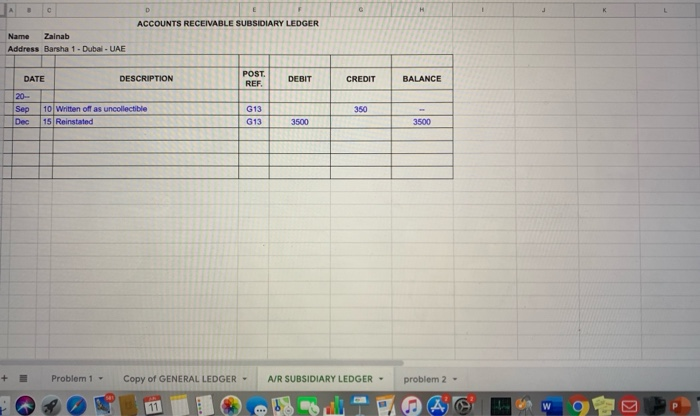

Can you just check the working out and answers, wether its correct? Default 2- x c A Instructions: 1. Record each transaction in a general

Can you just check the working out and answers, wether its correct? Default 2- x c A Instructions: 1. Record each transaction in a general joumal 2. Post the transactions to the selected ledgers. 3. Prepare the subsidiary ledge The Hilton hotels provide booking services and uses the direct write-off method to account for uncollectible accounts. During the accounting period, the business had the following selected transactions: Sep 10: Wrote of the account of Zainab as uncollectible.. $350, Memorandum 351 Dec. 15 reinstated the $3500.00 account of Zainab, which had been written off during the previous accounting period, Memorandum 661. 2 GENERAL JOURNAL DESCRIPTION PAGE: 13 CREDIT POST REF DATE DEBIT 350 $ 6 1 20- 2 Sep 3 4 350 7 10 Uncolectible Accounts Expense Account Recievable - Zainab Memorandum 351 15 Account Recievable. Zainab Uncollectible Accounts Expense Memorandum 661 3500 - 5 Dec 6 7 3500 10 8 9 12 10 16 11 15 12 13 14 17 B D E H J 1 ACCOUNT Accounts Receivable ACCOUNT NO. 101 2 3 4 DESCRIPTION POST.RER BALANCE DEBIT CREDIT DEBIT CREDIT 5 6 DATE 20- June Sep Dec 7 1 Balance 10 Write-off 15 Reinstated 350 G13 G13 200,000 199650 203150 3500 9 10 12 13 15 ACCOUNT Uncollectible Accounts Expense ACCOUNT NO 665 16 17 BALANCE DEBIT CREDIT 18 DESCRIPTION POST.REF DEBIT CREDIT 19 DATE 20- Sep Dec 360 350 20 21 10 15 G13 G13 350 24 25 c D ACCOUNTS RECEIVABLE SUBSIDIARY LEDGER Name Zainab Address Barsha 1 - Dubai - UAE POST REF DEBIT CREDIT BALANCE DATE DESCRIPTION 20- Sep 10 Written off as uncollectible Dec 15 Reinstated 350 G13 G13 3500 3500 + Problem 1 - Copy of GENERAL LEDGER - A/R SUBSIDIARY LEDGER - problem 2 - 11 A

Can you just check the working out and answers, wether its correct? Default 2- x c A Instructions: 1. Record each transaction in a general joumal 2. Post the transactions to the selected ledgers. 3. Prepare the subsidiary ledge The Hilton hotels provide booking services and uses the direct write-off method to account for uncollectible accounts. During the accounting period, the business had the following selected transactions: Sep 10: Wrote of the account of Zainab as uncollectible.. $350, Memorandum 351 Dec. 15 reinstated the $3500.00 account of Zainab, which had been written off during the previous accounting period, Memorandum 661. 2 GENERAL JOURNAL DESCRIPTION PAGE: 13 CREDIT POST REF DATE DEBIT 350 $ 6 1 20- 2 Sep 3 4 350 7 10 Uncolectible Accounts Expense Account Recievable - Zainab Memorandum 351 15 Account Recievable. Zainab Uncollectible Accounts Expense Memorandum 661 3500 - 5 Dec 6 7 3500 10 8 9 12 10 16 11 15 12 13 14 17 B D E H J 1 ACCOUNT Accounts Receivable ACCOUNT NO. 101 2 3 4 DESCRIPTION POST.RER BALANCE DEBIT CREDIT DEBIT CREDIT 5 6 DATE 20- June Sep Dec 7 1 Balance 10 Write-off 15 Reinstated 350 G13 G13 200,000 199650 203150 3500 9 10 12 13 15 ACCOUNT Uncollectible Accounts Expense ACCOUNT NO 665 16 17 BALANCE DEBIT CREDIT 18 DESCRIPTION POST.REF DEBIT CREDIT 19 DATE 20- Sep Dec 360 350 20 21 10 15 G13 G13 350 24 25 c D ACCOUNTS RECEIVABLE SUBSIDIARY LEDGER Name Zainab Address Barsha 1 - Dubai - UAE POST REF DEBIT CREDIT BALANCE DATE DESCRIPTION 20- Sep 10 Written off as uncollectible Dec 15 Reinstated 350 G13 G13 3500 3500 + Problem 1 - Copy of GENERAL LEDGER - A/R SUBSIDIARY LEDGER - problem 2 - 11 A

Can you just check the working out and answers, wether its correct?

Can you just check the working out and answers, wether its correct? Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started