Answered step by step

Verified Expert Solution

Question

1 Approved Answer

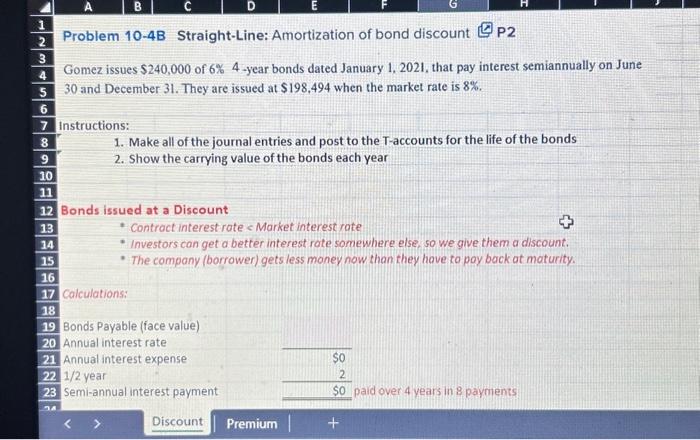

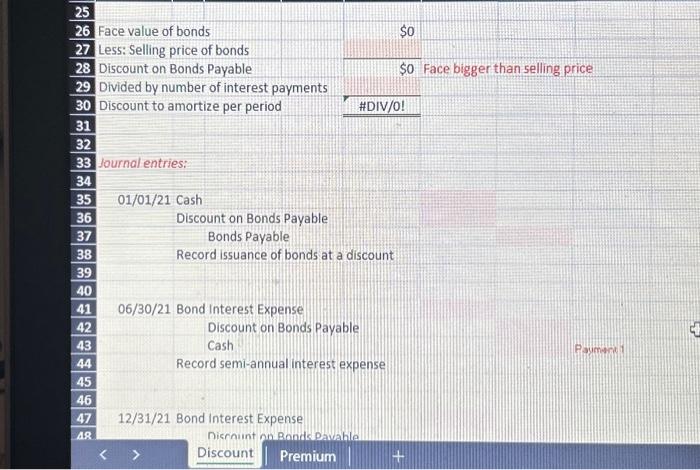

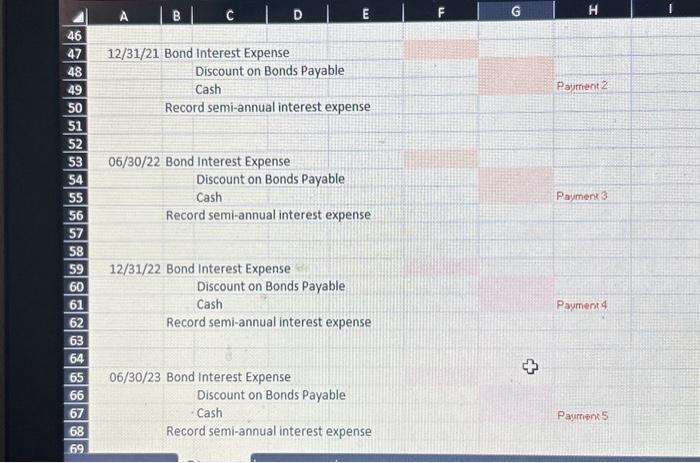

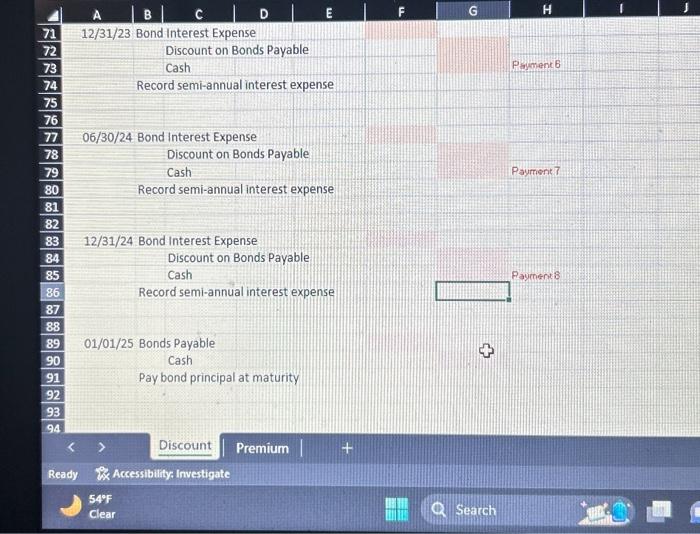

can you just do the blue one i am uploading it right now Gomez issues $240,000 of 6% 4-year bonds dated January 1, 2021, that

can you just do the blue one i am uploading it right now

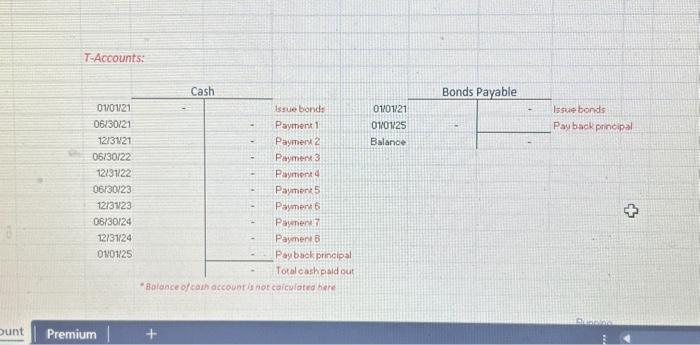

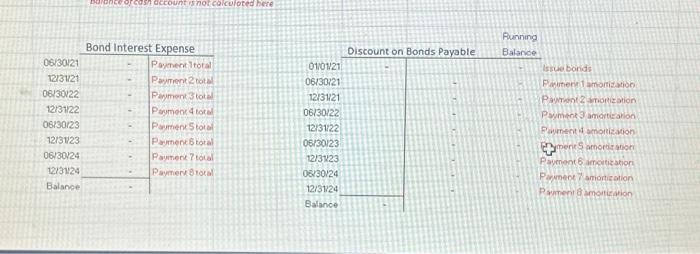

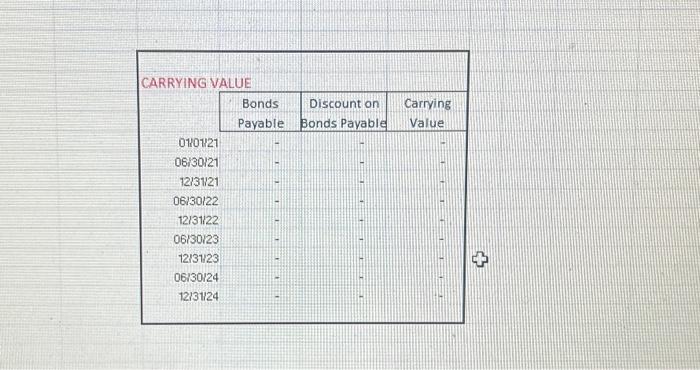

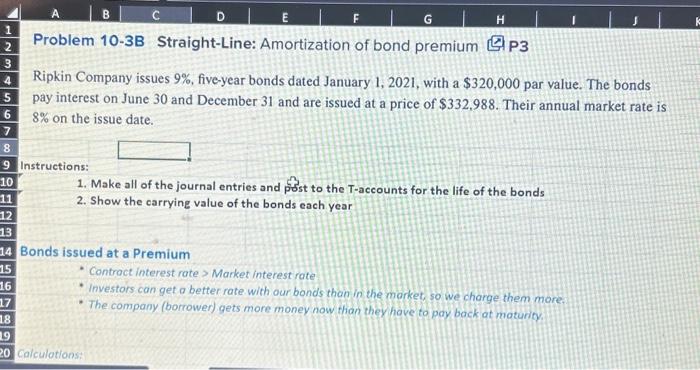

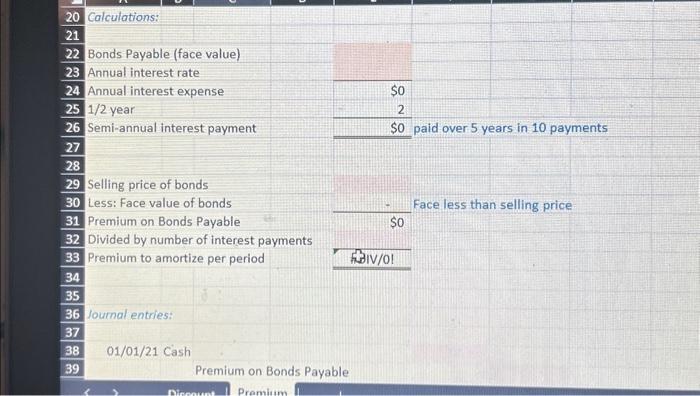

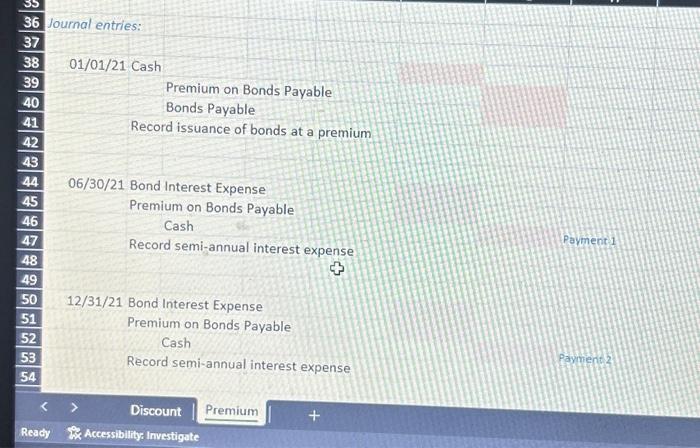

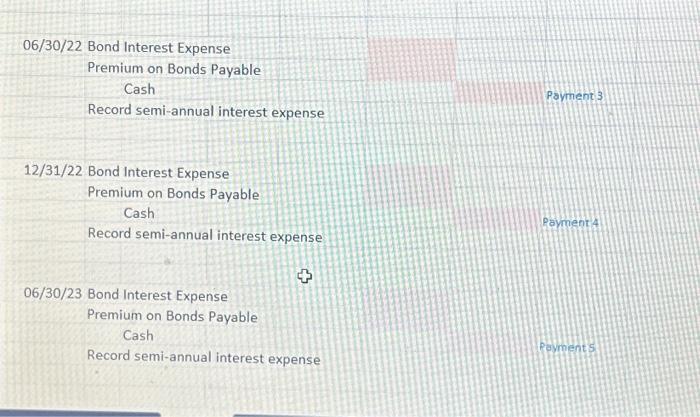

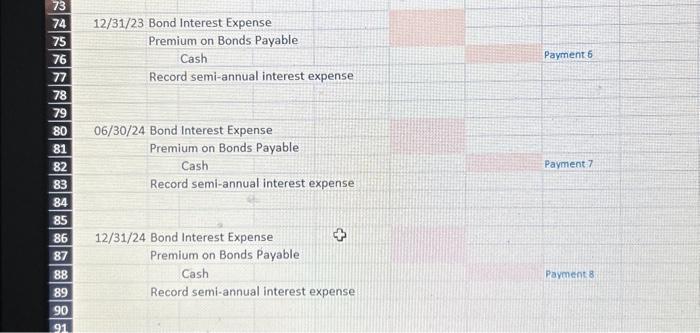

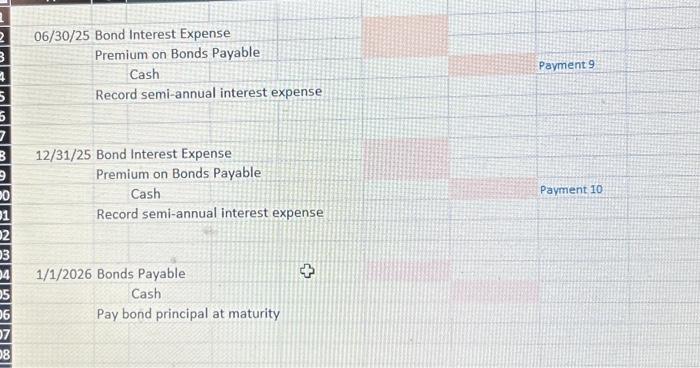

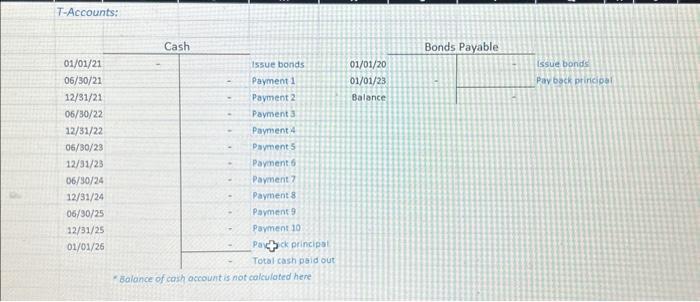

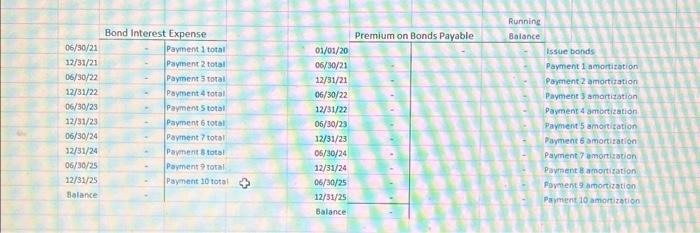

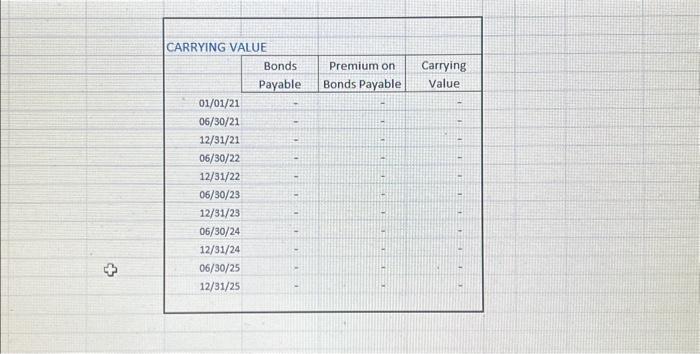

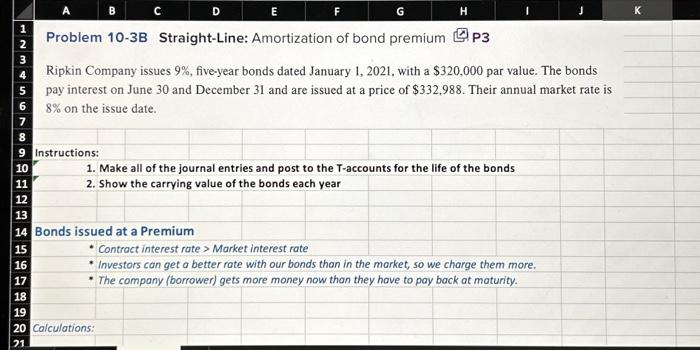

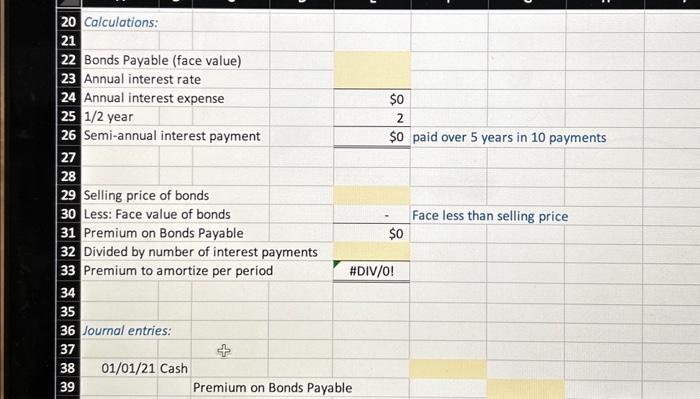

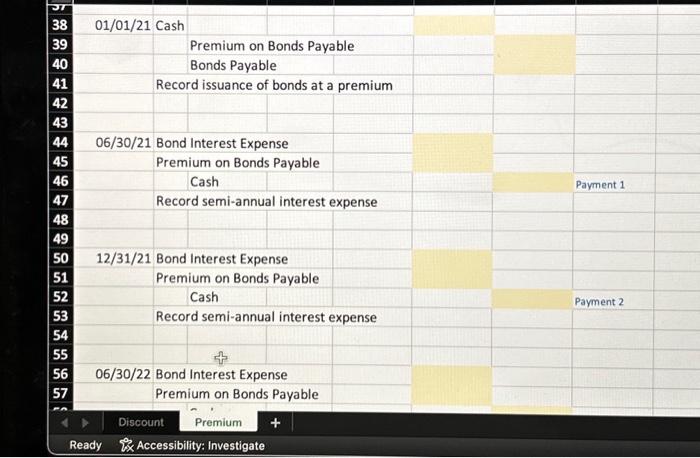

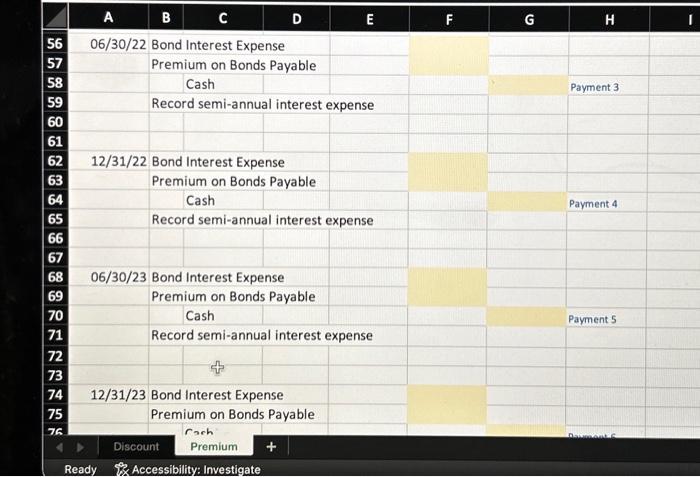

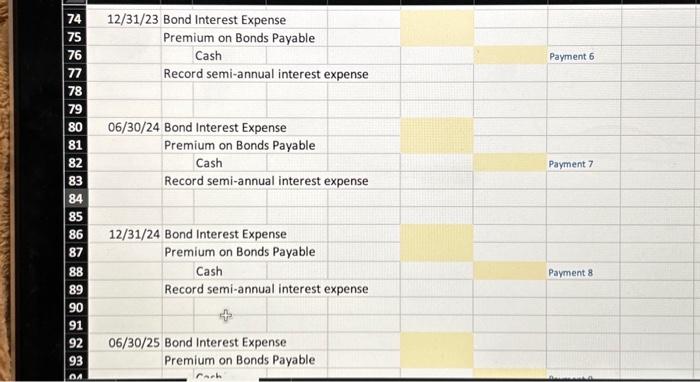

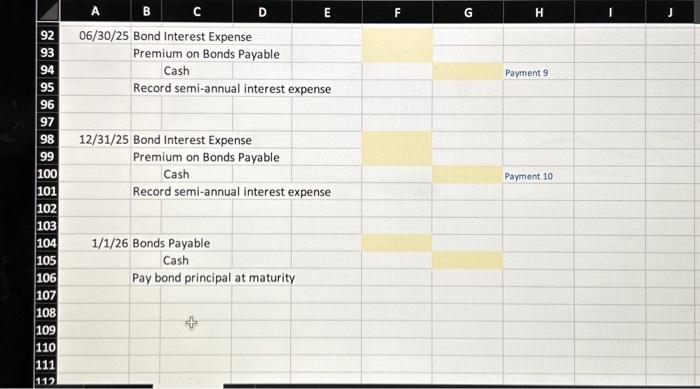

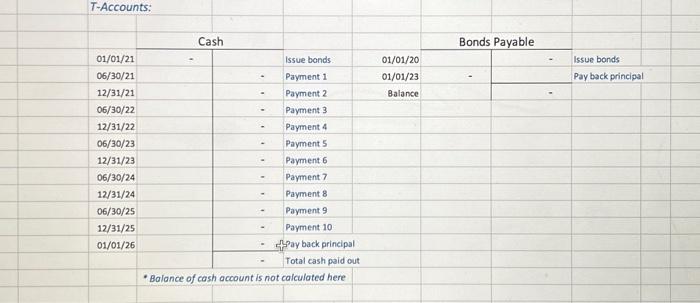

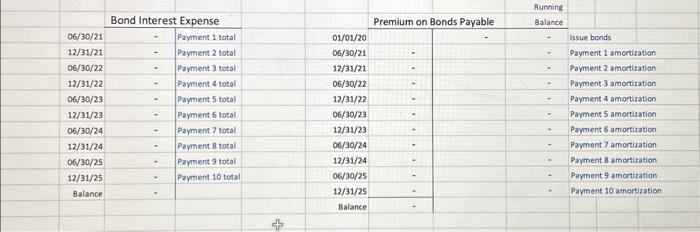

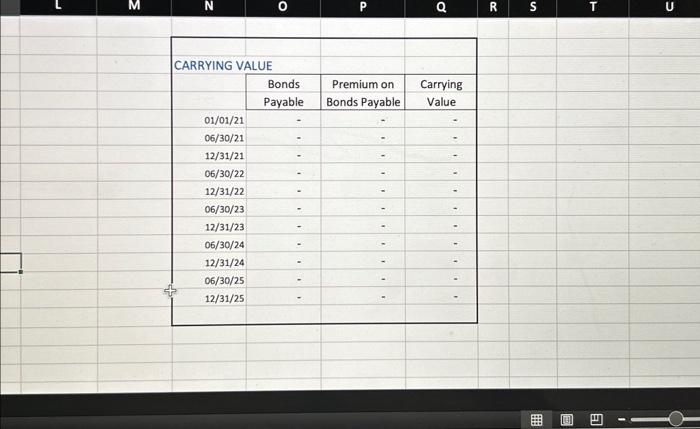

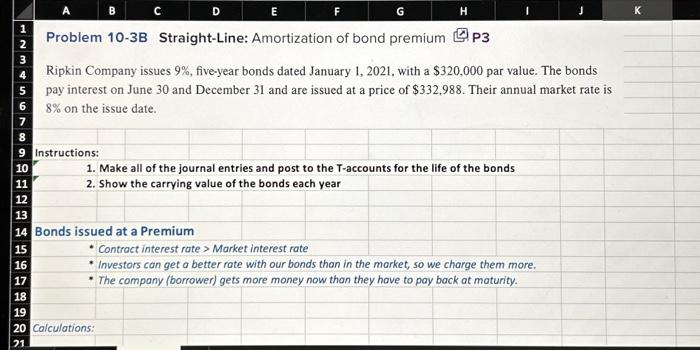

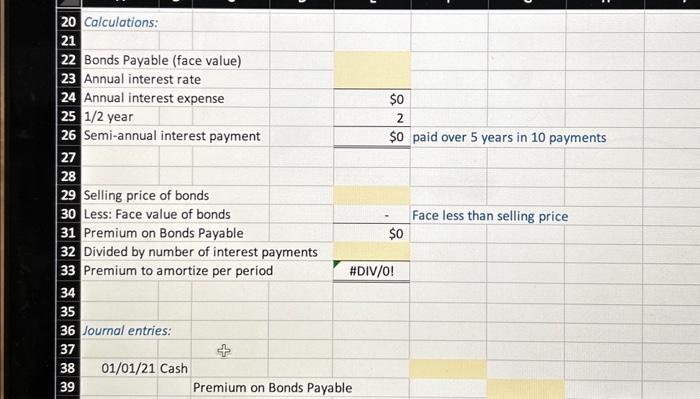

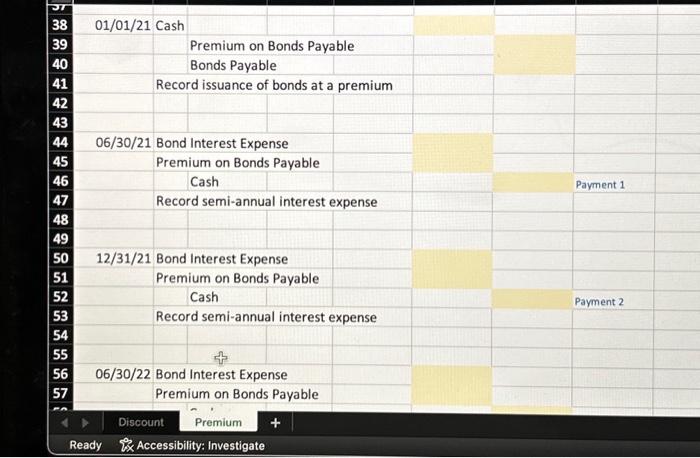

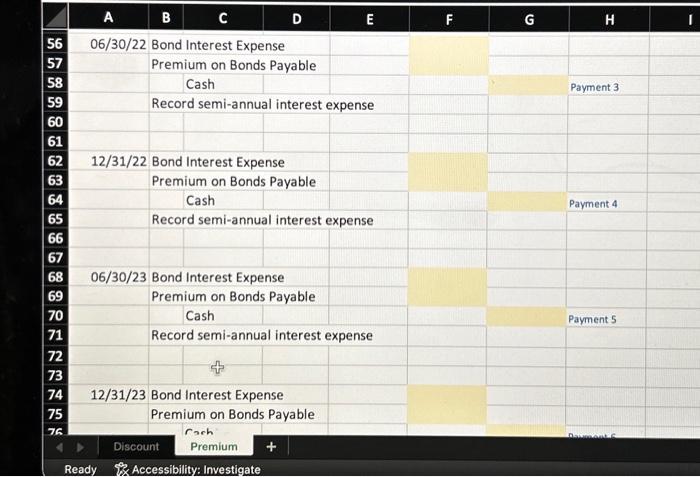

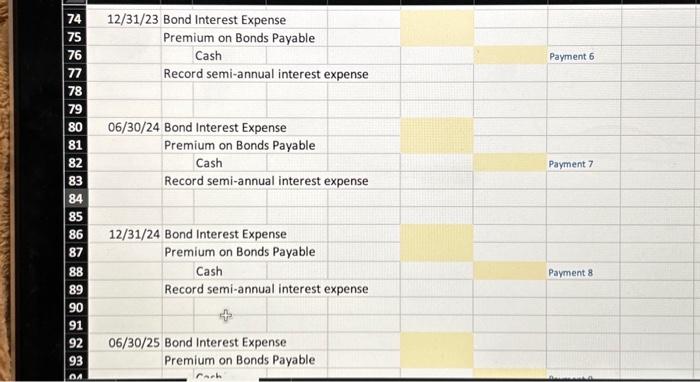

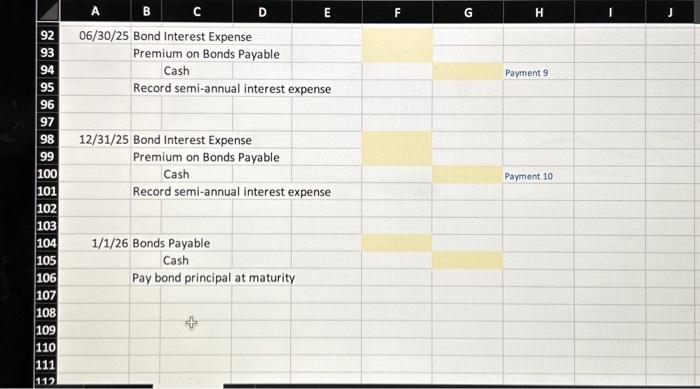

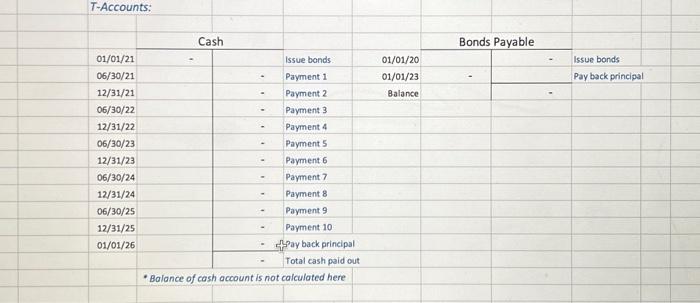

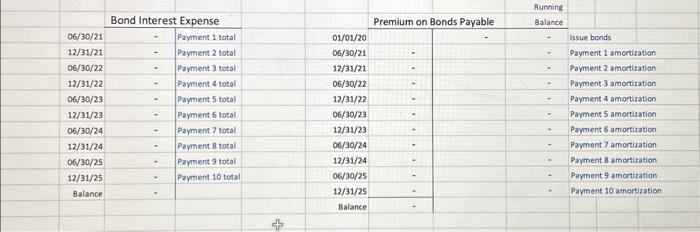

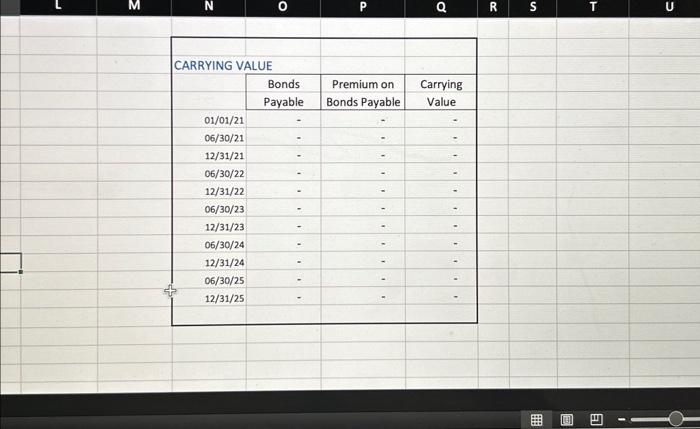

Gomez issues $240,000 of 6% 4-year bonds dated January 1, 2021, that pay interest semiannually on June 30 and December 31 . They are issued at $198,494 when the market rate is 8%. Instructions: 1. Make all of the journal entries and post to the T-accounts for the life of the bonds 2. Show the carrying value of the bonds each year Bonds issued at a Discount Contract interest rate Market interest rate - Investors can get a better rate with our bonds than in the morket so we charge them more. - The company (borrower) gets more money now than they have to pay back at maturity. Premium on Bonds Payable /31/21 Bond Interest Expense Premium on Bonds Payable Cash Record semi-annual interest expense 06/30/23 Bond Interest Expense Premium on Bonds Payable Cash Record semi-annual interest expense 747312/31/23 Bond Interest Expense Premium on Bonds Payable Cash Payment 5 Record semi-annual interest expense 06/30/24 Bond Interest Expense Premium on Bonds Payable Cash Payment 7 Record semi-annual interest expense 12/31/24 Bond Interest Expense Premium on Bonds Payable Cash Payment 8 Record semi-annual interest expense 06/30/25 Bond Interest Expense Premium on Bonds Payable Cash Payment 9 Record semi-annual interest expense 12/31/25 Bond Interest Expense Premium on Bonds Payable Cash Payment 10 Record semi-annual interest expense 1/1/2026 Bonds Payable Cash Pay bond principal at maturity T-Accounts: Problem 10-3B Straight-Line: Amortization of bond premium [G P3 Ripkin Company issues 9%, five-year bonds dated January 1,2021 , with a $320,000 par value. The bonds pay interest on June 30 and December 31 and are issued at a price of $332,988. Their annual market rate is 8% on the issue date. 20 Calculations: 22 Bonds Payable (face value) 23 Annual interest rate 24 Annual interest expense 251/2 year 26 Semi-annual interest payment $0 paid over 5 years in 10 payments 30 Less: Face value of bonds 31 Premium on Bonds Payable 32 Divided by number of interest payments 33 Premium to amortize per period HDIV/O! Journal entries: 01/01/21 Cash Premium on Bonds Payable Premium on Bonds Payable Bonds Payable Record issuance of bonds at a premium 06/30/21 Bond Interest Expense Premium on Bonds Payable Cash Payment 1 Record semi-annual interest expense 12/31/21 Bond Interest Expense Premium on Bonds Payable Cash Payment 2 Record semi-annual interest expense 06/30/22 Bond Interest Expense Premium on Bonds Payable Ready \&x Accessibility: Investigate 7412/31/23 Bond Interest Expense Premium on Bonds Payable Cash Payment 6 Record semi-annual interest expense 06/30/24 Bond Interest Expense Premium on Bonds Payable Cash Payment 7 Record semi-annual interest expense 12/31/24 Bond Interest Expense Premium on Bonds Payable Cash Payment 8 Record semi-annual interest expense 06/30/25 Bond Interest Expense Premium on Bonds Payable T-Accounts: - Balance of cash account is not calculated here CARRYING VALUE \begin{tabular}{|c|c|c|c|} \hline & Bonds & Premium on & Carrying \\ & Payable & Bonds Payable & Value \\ \hline 01/01/21 & - & - & - \\ \hline 06/30/21 & - & - & - \\ \hline 12/31/21 & - & - & - \\ \hline 06/30/22 & - & - & - \\ \hline 12/31/22 & - & - & - \\ 06/30/23 & - & - & - \\ 12/31/23 & - & - & - \\ 06/30/24 & - & - & - \\ 12/31/24 & - & - & - \\ \hline 06/30/25 & - & - & - \\ \hline 12/31/25 & - & - & - \\ \hline \end{tabular} Gomez issues $240,000 of 6% 4-year bonds dated January 1, 2021, that pay interest semiannually on June 30 and December 31 . They are issued at $198,494 when the market rate is 8%. Instructions: 1. Make all of the journal entries and post to the T-accounts for the life of the bonds 2. Show the carrying value of the bonds each year Bonds issued at a Discount Contract interest rate Market interest rate - Investors can get a better rate with our bonds than in the morket so we charge them more. - The company (borrower) gets more money now than they have to pay back at maturity. Premium on Bonds Payable /31/21 Bond Interest Expense Premium on Bonds Payable Cash Record semi-annual interest expense 06/30/23 Bond Interest Expense Premium on Bonds Payable Cash Record semi-annual interest expense 747312/31/23 Bond Interest Expense Premium on Bonds Payable Cash Payment 5 Record semi-annual interest expense 06/30/24 Bond Interest Expense Premium on Bonds Payable Cash Payment 7 Record semi-annual interest expense 12/31/24 Bond Interest Expense Premium on Bonds Payable Cash Payment 8 Record semi-annual interest expense 06/30/25 Bond Interest Expense Premium on Bonds Payable Cash Payment 9 Record semi-annual interest expense 12/31/25 Bond Interest Expense Premium on Bonds Payable Cash Payment 10 Record semi-annual interest expense 1/1/2026 Bonds Payable Cash Pay bond principal at maturity T-Accounts: Problem 10-3B Straight-Line: Amortization of bond premium [G P3 Ripkin Company issues 9%, five-year bonds dated January 1,2021 , with a $320,000 par value. The bonds pay interest on June 30 and December 31 and are issued at a price of $332,988. Their annual market rate is 8% on the issue date. 20 Calculations: 22 Bonds Payable (face value) 23 Annual interest rate 24 Annual interest expense 251/2 year 26 Semi-annual interest payment $0 paid over 5 years in 10 payments 30 Less: Face value of bonds 31 Premium on Bonds Payable 32 Divided by number of interest payments 33 Premium to amortize per period HDIV/O! Journal entries: 01/01/21 Cash Premium on Bonds Payable Premium on Bonds Payable Bonds Payable Record issuance of bonds at a premium 06/30/21 Bond Interest Expense Premium on Bonds Payable Cash Payment 1 Record semi-annual interest expense 12/31/21 Bond Interest Expense Premium on Bonds Payable Cash Payment 2 Record semi-annual interest expense 06/30/22 Bond Interest Expense Premium on Bonds Payable Ready \&x Accessibility: Investigate 7412/31/23 Bond Interest Expense Premium on Bonds Payable Cash Payment 6 Record semi-annual interest expense 06/30/24 Bond Interest Expense Premium on Bonds Payable Cash Payment 7 Record semi-annual interest expense 12/31/24 Bond Interest Expense Premium on Bonds Payable Cash Payment 8 Record semi-annual interest expense 06/30/25 Bond Interest Expense Premium on Bonds Payable T-Accounts: - Balance of cash account is not calculated here CARRYING VALUE \begin{tabular}{|c|c|c|c|} \hline & Bonds & Premium on & Carrying \\ & Payable & Bonds Payable & Value \\ \hline 01/01/21 & - & - & - \\ \hline 06/30/21 & - & - & - \\ \hline 12/31/21 & - & - & - \\ \hline 06/30/22 & - & - & - \\ \hline 12/31/22 & - & - & - \\ 06/30/23 & - & - & - \\ 12/31/23 & - & - & - \\ 06/30/24 & - & - & - \\ 12/31/24 & - & - & - \\ \hline 06/30/25 & - & - & - \\ \hline 12/31/25 & - & - & - \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started