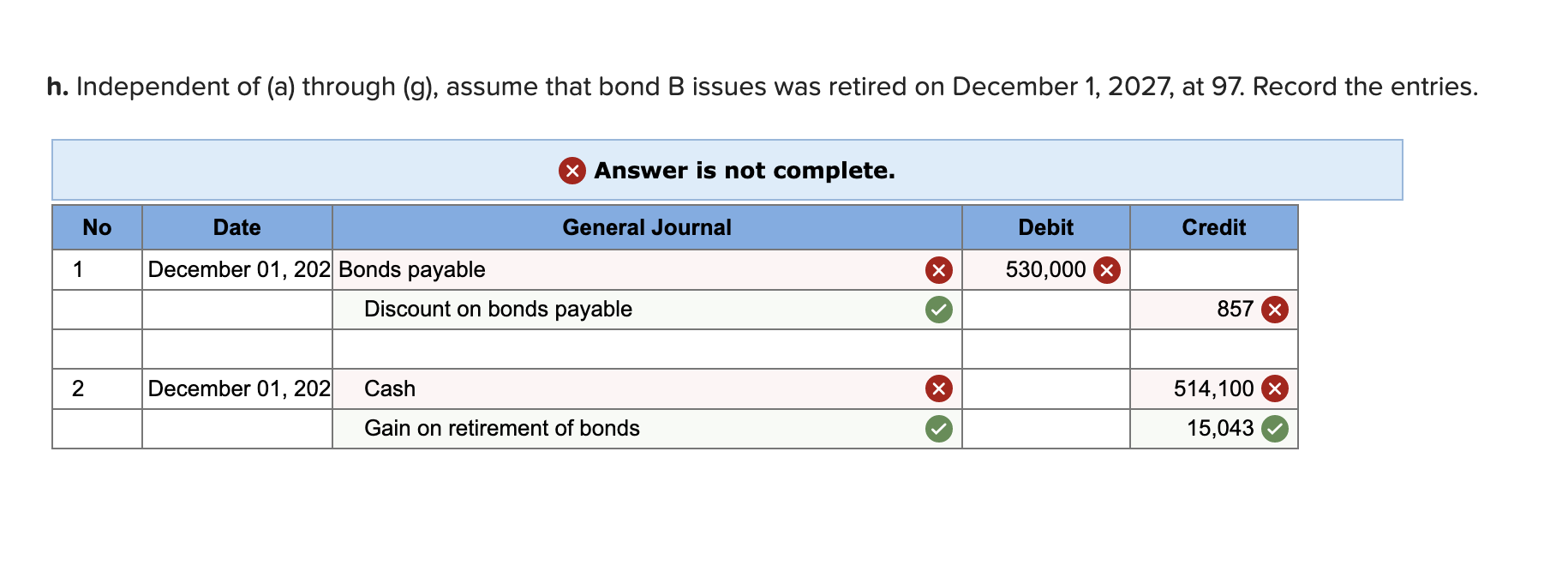

Can you just fix the question h) for both questions #1,2. Other than that, everything is correct. Red x parts are the wrong parts.

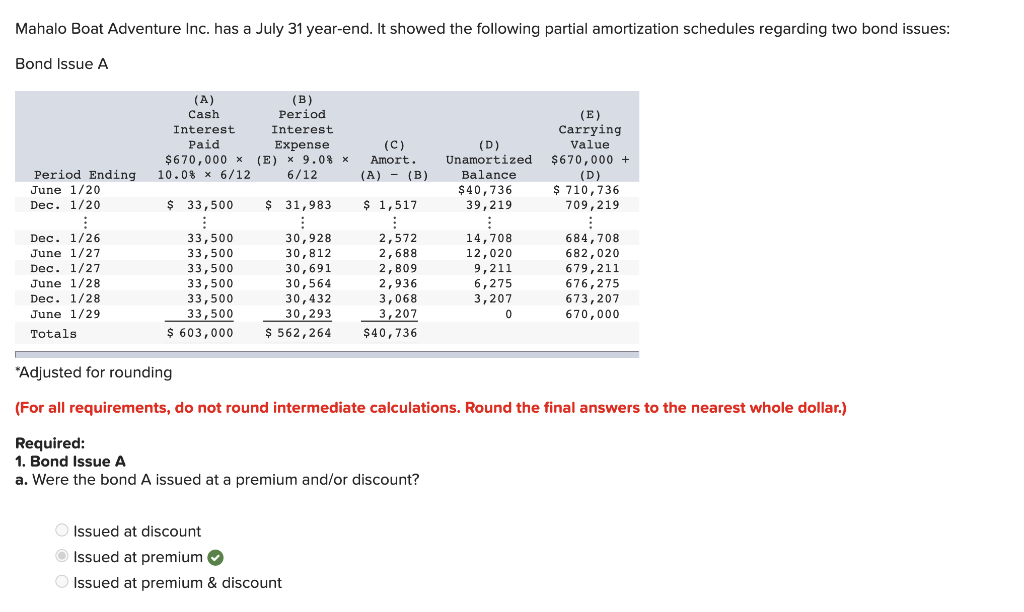

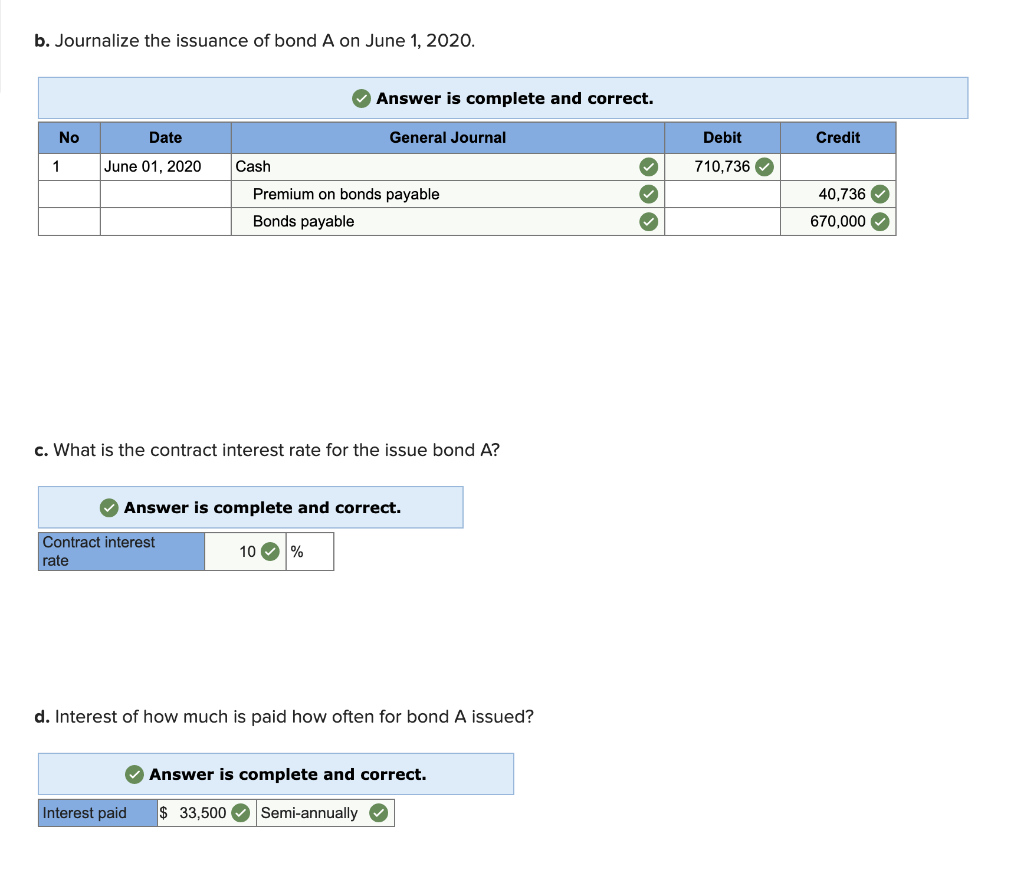

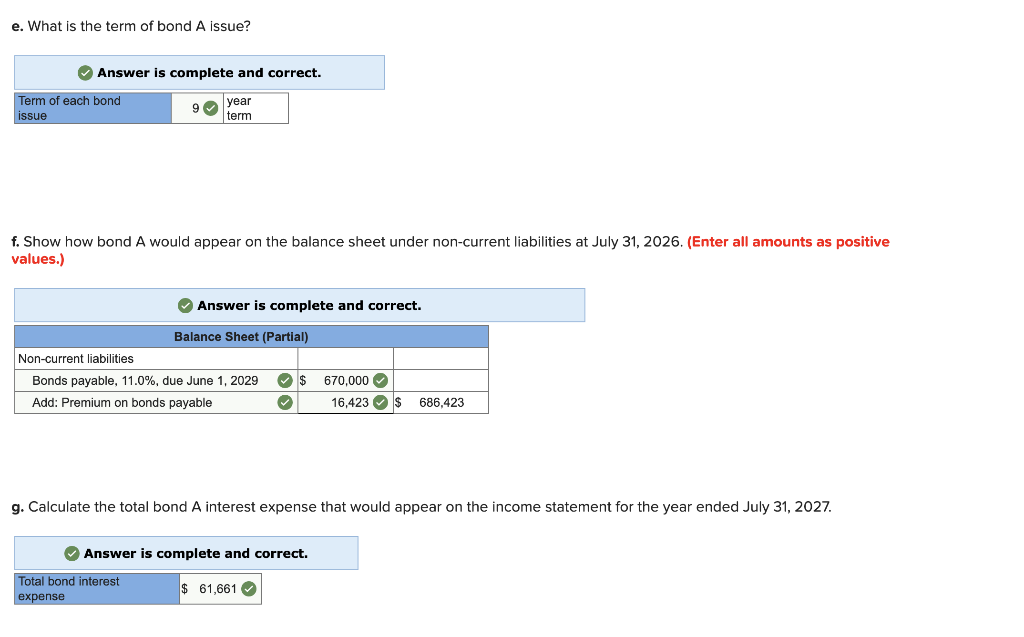

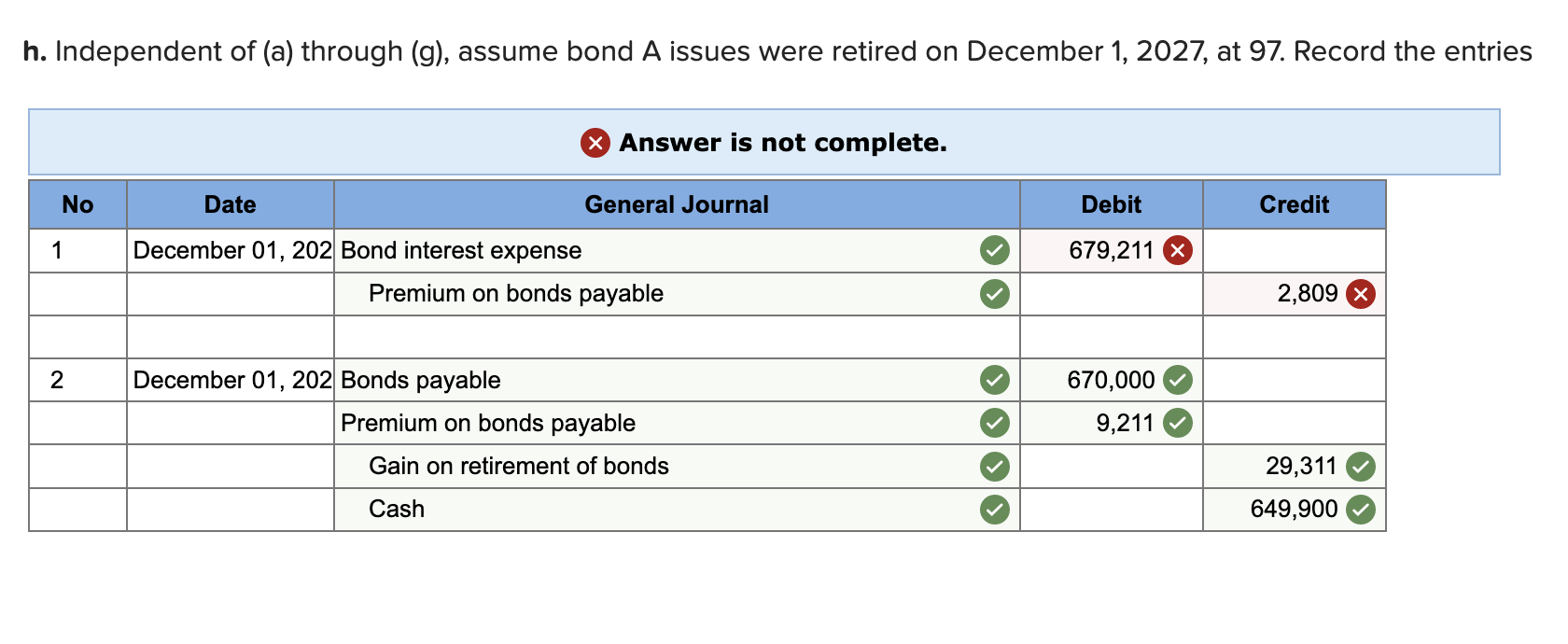

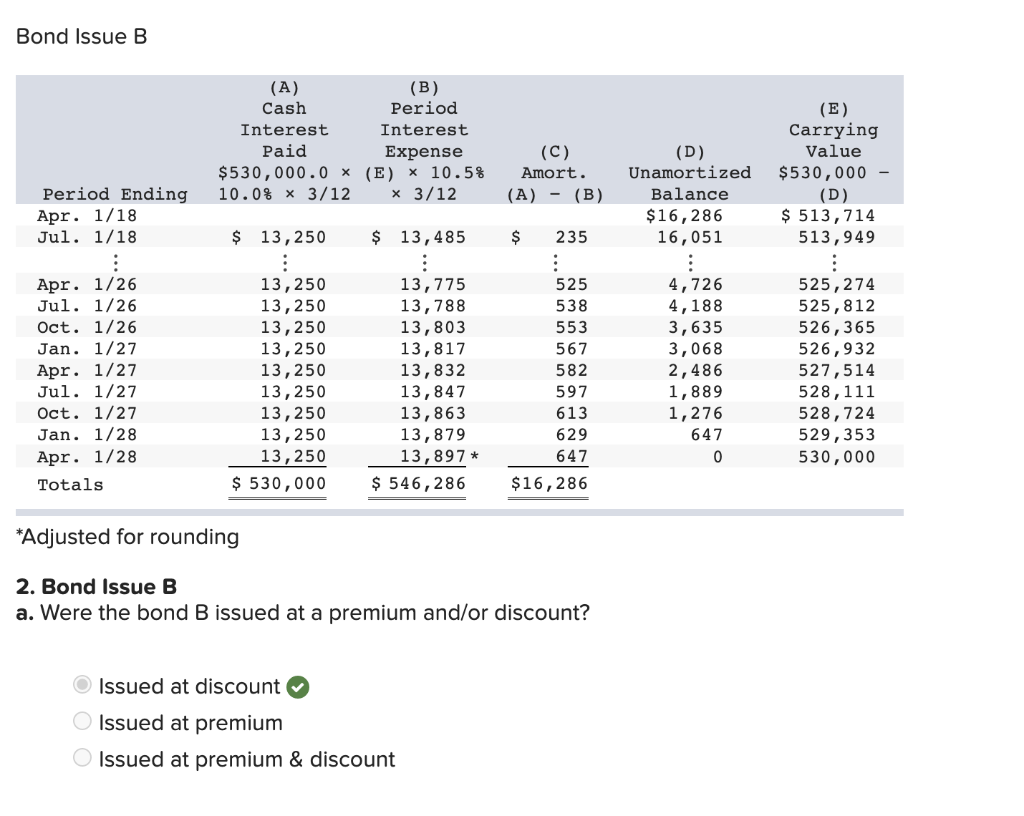

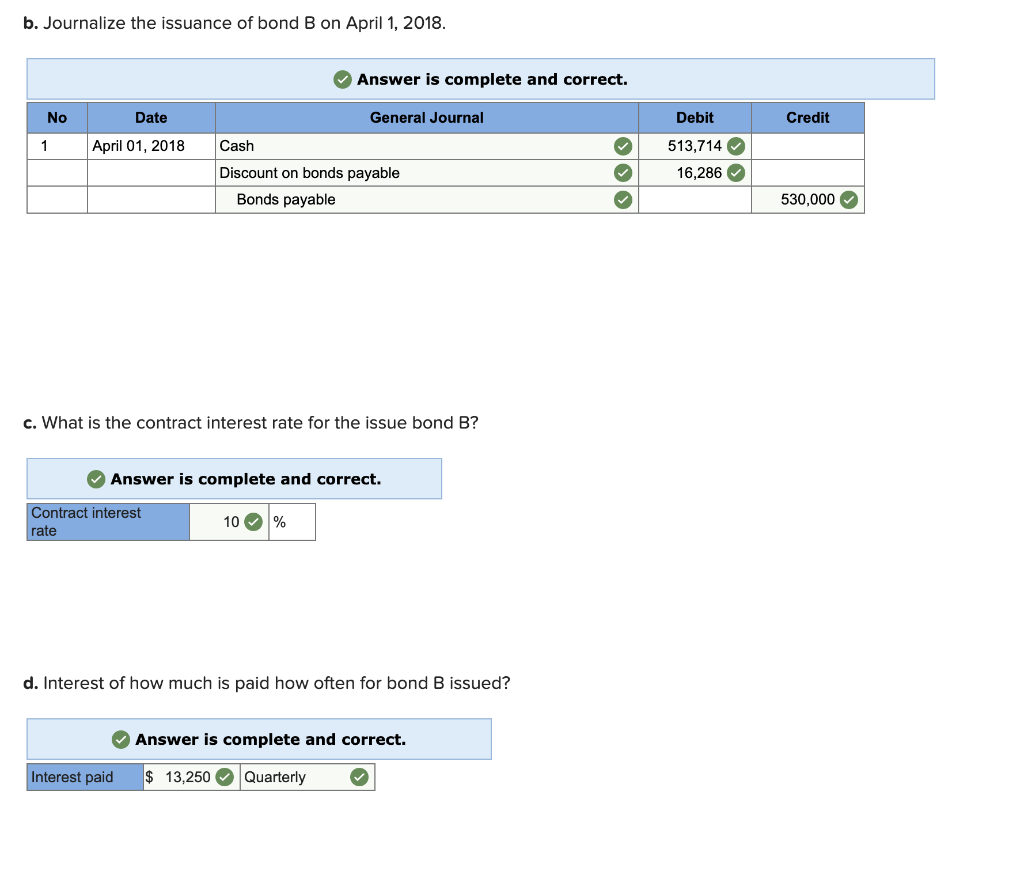

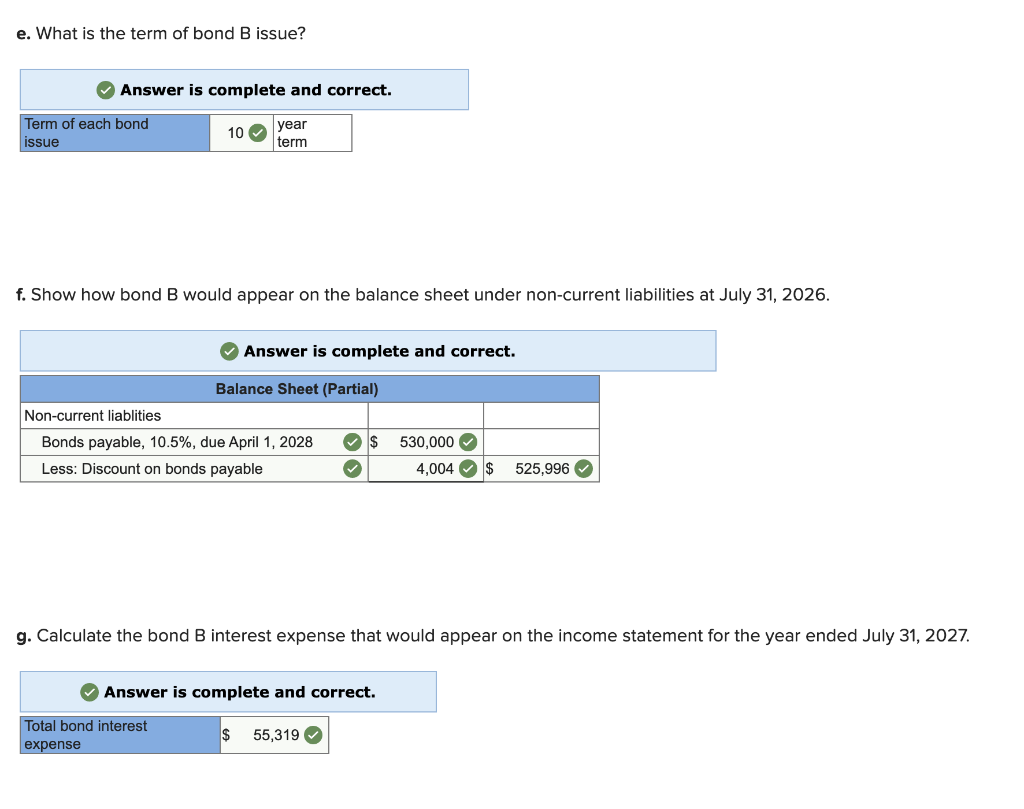

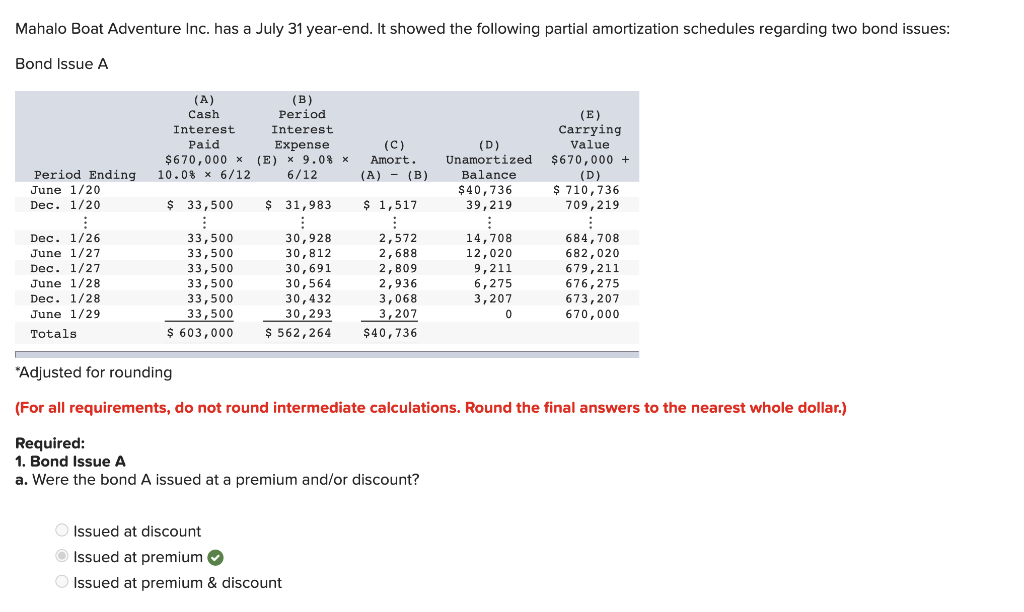

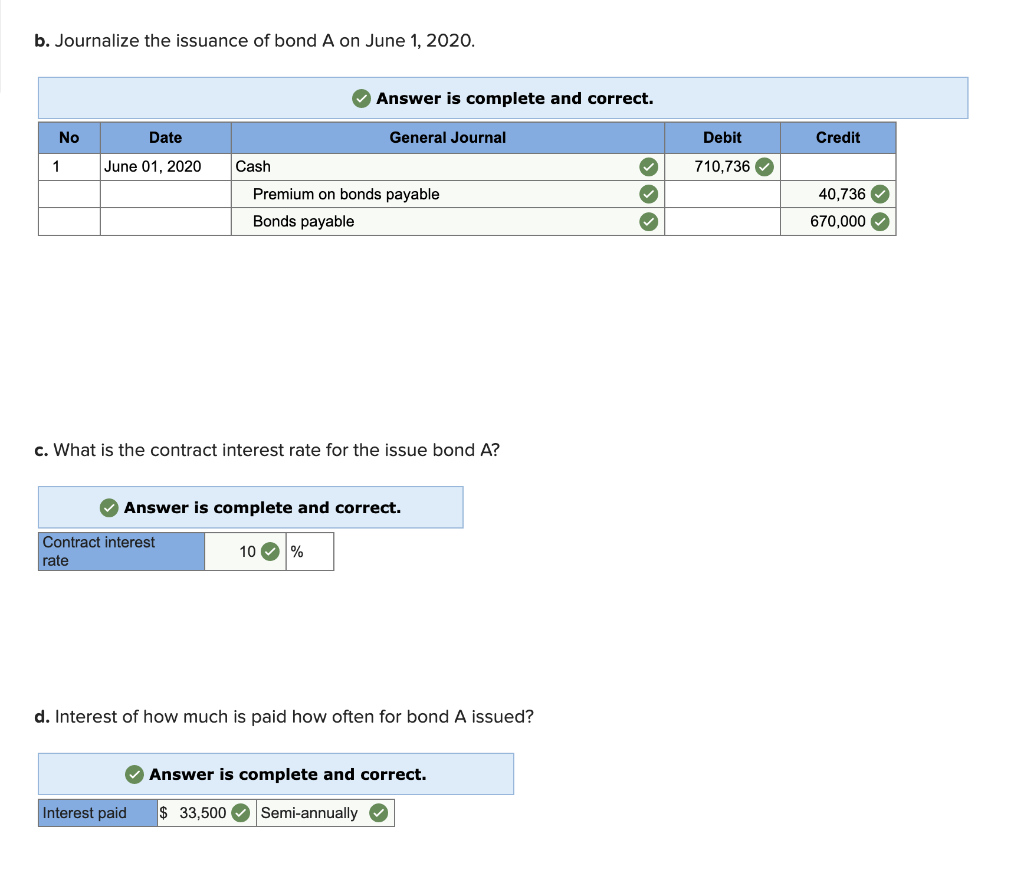

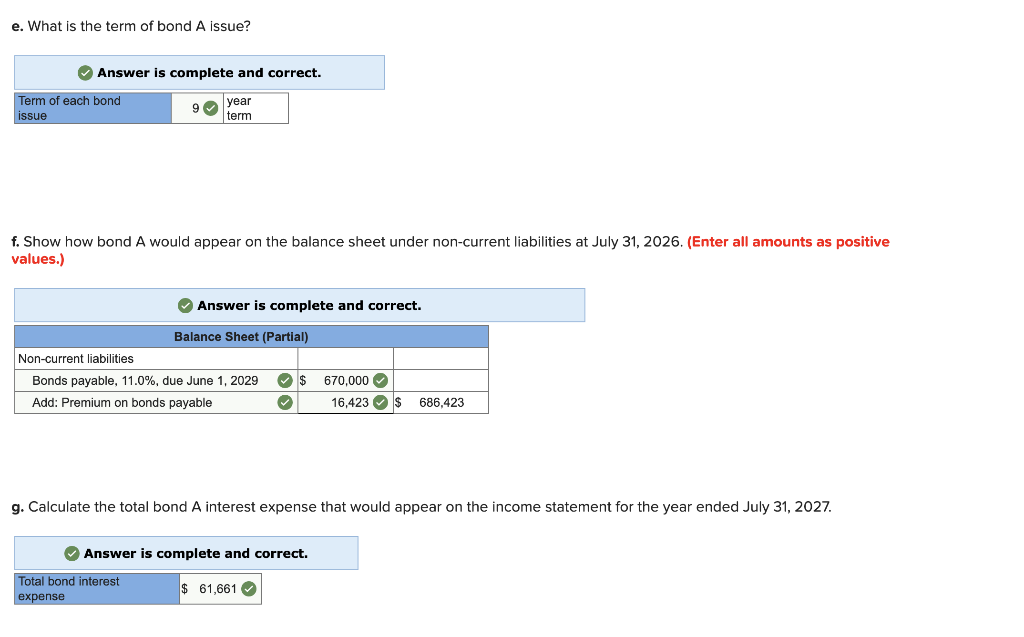

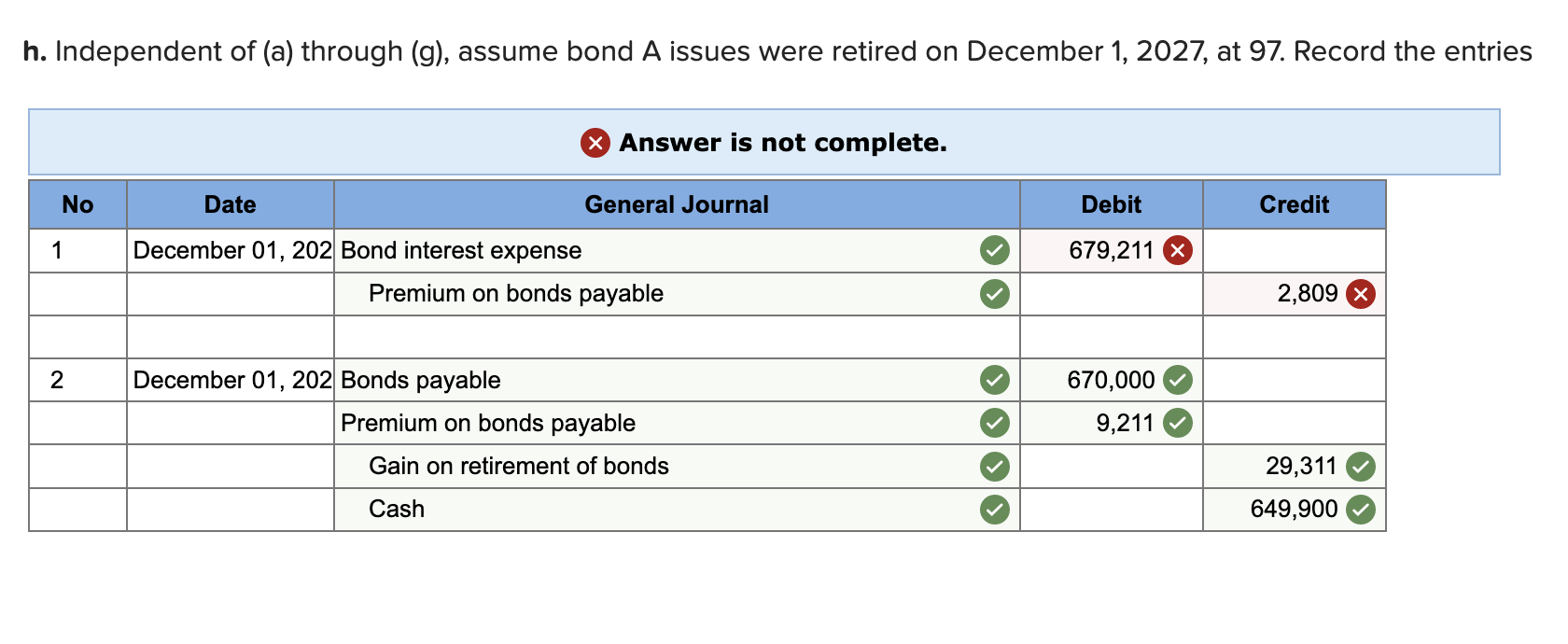

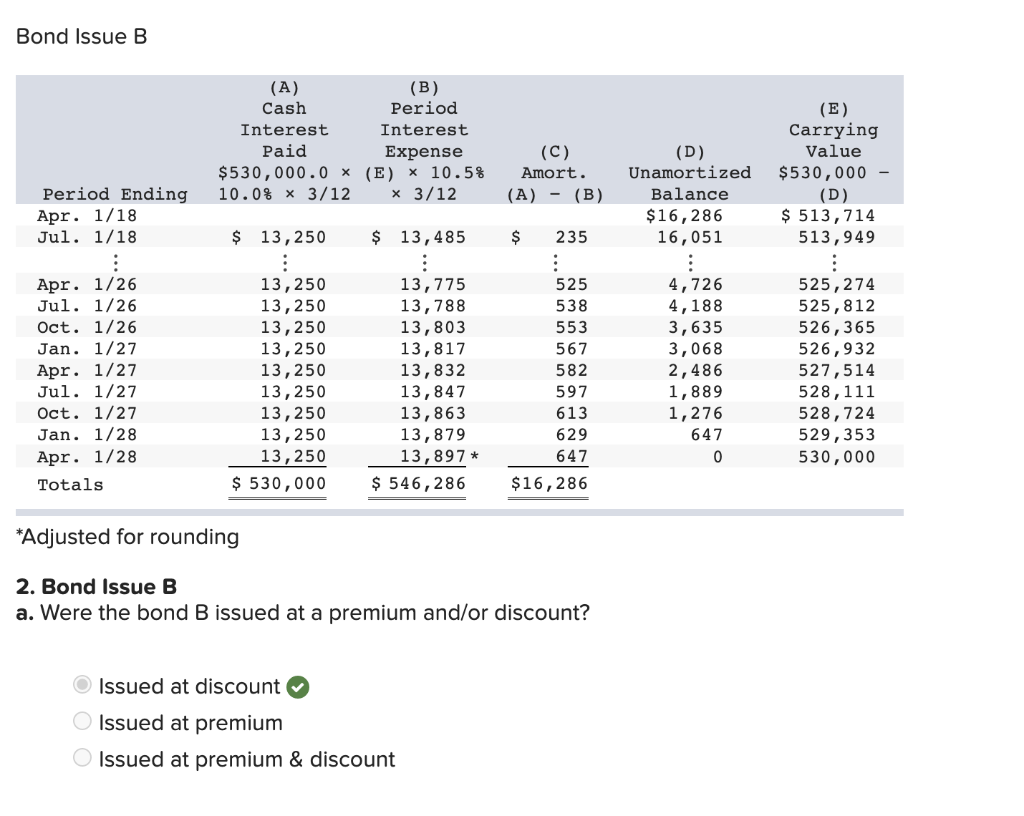

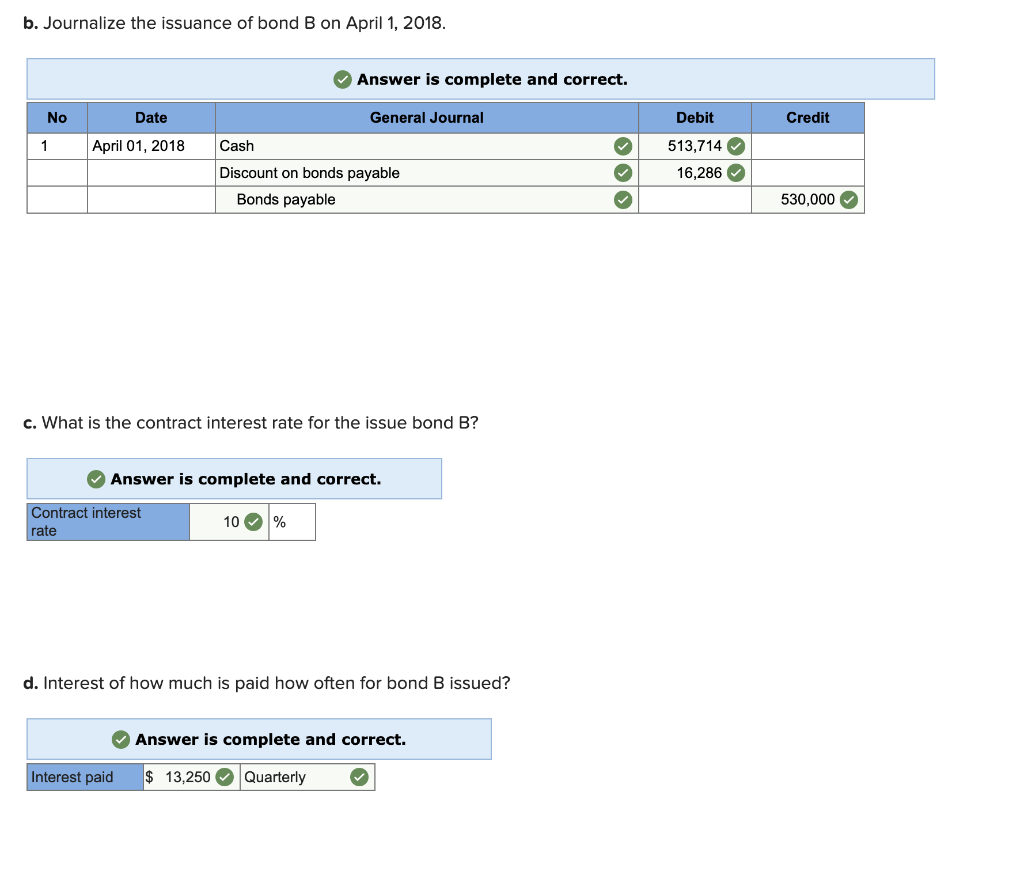

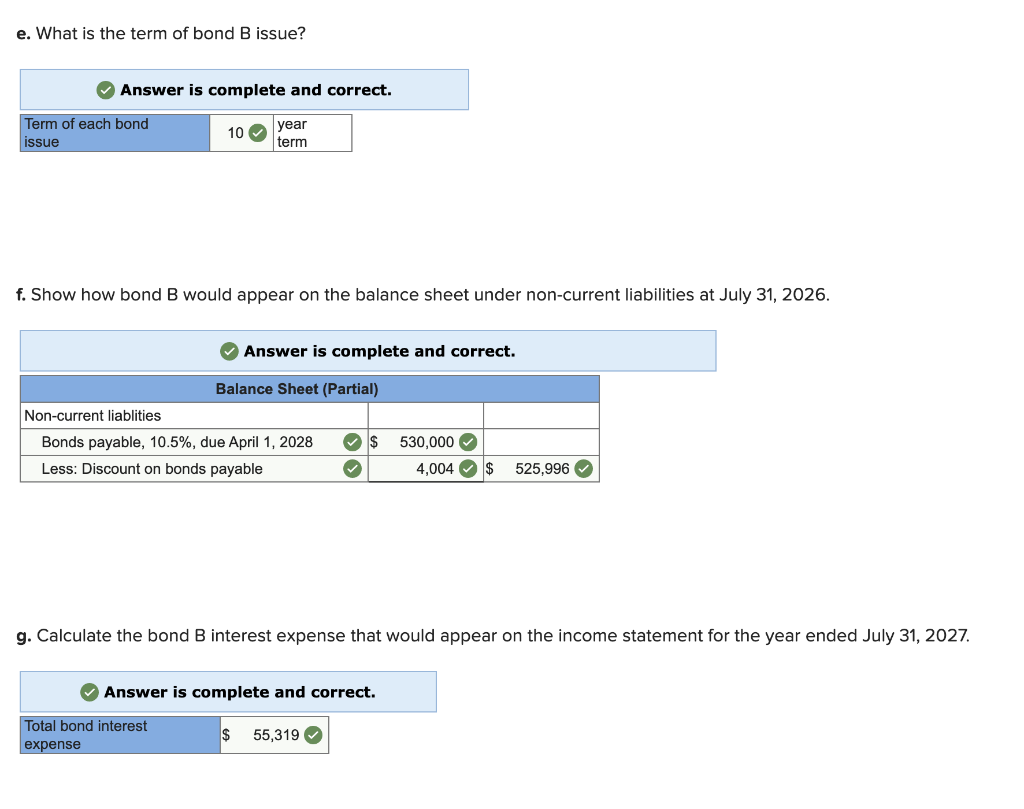

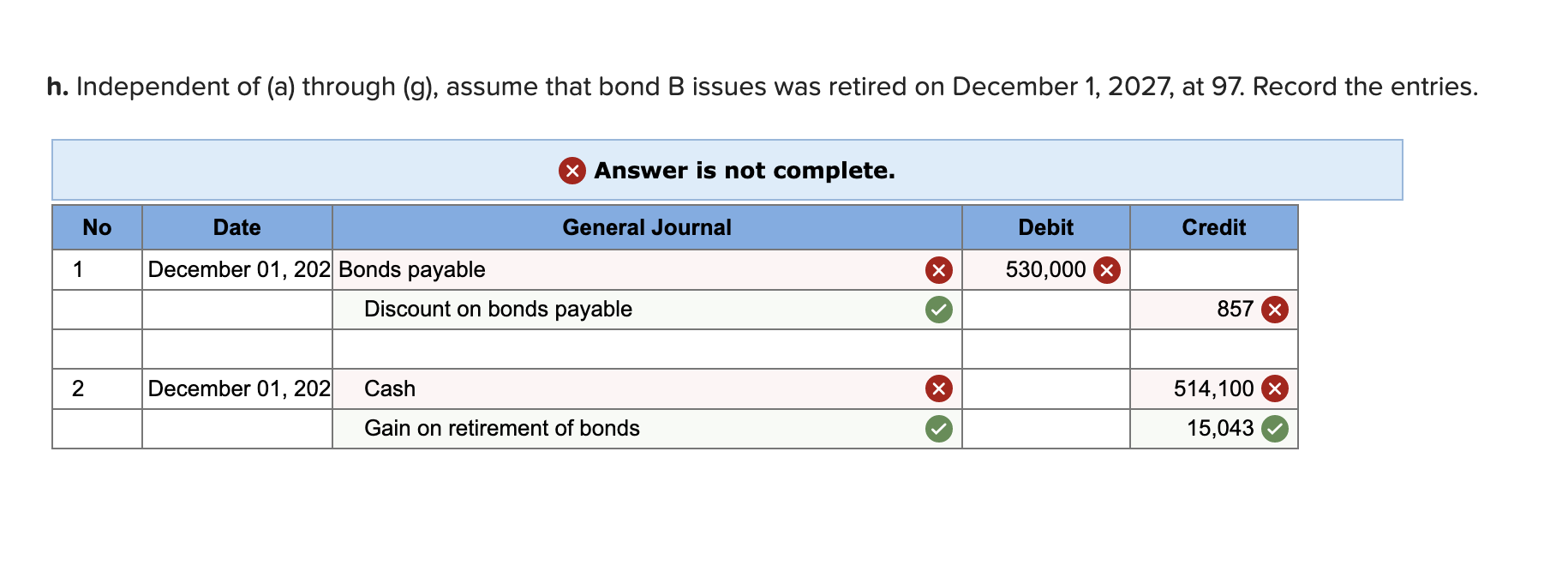

Mahalo Boat Adventure Inc. has a July 31 year-end. It showed the following partial amortization schedules regarding two bond issues: Bond Issue A (A) (B) Cash Period Interest Interest Paid Expense $ 670,000 * (E) * 9.0% * 10.0% x 6/12 6/12 (C) Amort. (A) - (B) (E) Carrying Value $670,000 + (D) $ 710,736 709,219 (D) Unamortized Balance $ 40,736 39,219 Period Ending June 1/20 Dec. 1/20 $ 33,500 $ 31,983 Dec. 1/26 June 1/27 Dec. 1/27 June 1/28 Dec. 1/28 June 1/29 Totals 33,500 33,500 33,500 33,500 33,500 33,500 $ 603,000 30,928 30,812 30,691 30,564 30, 432 30,293 $ 562, 264 $ 1,517 : 2,572 2,688 2,809 2,936 3,068 3,207 $40,736 14,708 12,020 9,211 6,275 684, 708 682,020 679,211 676, 275 673, 207 670,000 3,207 *Adjusted for rounding (For all requirements, do not round intermediate calculations. Round the final answers to the nearest whole dollar.) Required: 1. Bond Issue A a. Were the bond A issued at a premium and/or discount? Issued at discount Issued at premium Issued at premium & discount b. Journalize the issuance of bond A on June 1, 2020. Answer is complete and correct. No Date General Journal Debit Credit 1 June 01, 2020 Cash 710,736 Premium on bonds payable Bonds payable 40,736 670,000 c. What is the contract interest rate for the issue bond A? Answer is complete and correct. Contract interest rate 10% d. Interest of how much is paid how often for bond A issued? Answer is complete and correct. Interest paid $ 33,500 Semi-annually e. What is the term of bond A issue? Answer is complete and correct. Term of each bond issue 9 year term f. Show how bond A would appear on the balance sheet under non-current liabilities at July 31, 2026. (Enter all amounts as positive values.) Answer is complete and correct. Balance Sheet (Partial) Non-current liabilities Bonds payable, 11.0%, due June 1, 2029 $ Add: Premium on bonds payable 670,000 16,423$ 686,423 g. Calculate the total bond A interest expense that would appear on the income statement for the year ended July 31, 2027. Answer is complete and correct. Total bond interest expense $ 61,661 h. Independent of (a) through (g), assume bond A issues were retired on December 1, 2027, at 97. Record the entries X Answer is not complete. No Date General Journal Debit Credit 1 679,211 X December 01, 202 Bond interest expense Premium on bonds payable 2,809 X 2 December 01, 202 Bonds payable Premium on bonds payable 670,000 9,211 Gain on retirement of bonds 29,311 649,900 Cash Bond Issue B (A) (B) Cash Period Interest Interest Paid Expense $530,000.0 % (E) X 10.5% 10.0% x 3/12 x 3/12 (C) Amort. (A) - (B) Period Ending Apr. 1/18 Jul. 1/18 $ 13, 250 $ 13,485 $ Apr. 1/26 Jul. 1/26 Oct. 1/26 Jan. 1/27 Apr. 1/27 Jul. 1/27 Oct. 1/27 Jan. 1/28 Apr. 1/28 Totals 13,250 13,250 13,250 13,250 13,250 13,250 13,250 13,250 13,250 $ 530,000 13,775 13,788 13,803 13,817 13,832 13,847 13,863 13,879 13,897 * $ 546,286 235 : 525 538 553 567 582 597 613 629 647 (D) Unamortized Balance $16,286 16,051 : 4,726 4,188 3,635 3,068 2,486 1,889 1,276 647 0 (E) Carrying Value $530,000 (D) $ 513,714 513,949 : 525, 274 525, 812 526,365 526,932 527,514 528, 111 528,724 529, 353 530,000 $16,286 *Adjusted for rounding 2. Bond Issue B a. Were the bond B issued at a premium and/or discount? Issued at discount Issued at premium Issued at premium & discount b. Journalize the issuance of bond B on April 1, 2018. Answer is complete and correct. No Date General Journal Debit Credit 1 April 01, 2018 Cash 513,714 16,286 Discount on bonds payable Bonds payable 530,000 c. What is the contract interest rate for the issue bond B? Answer is complete and correct. Contract interest rate 10% d. Interest of how much is paid how often for bond B issued? Answer is complete and correct. Interest paid $ 13,250 Quarterly e. What is the term of bond B issue? Answer is complete and correct. Term of each bond issue 10 year term f. Show how bond B would appear on the balance sheet under non-current liabilities at July 31, 2026. Answer is complete and correct. Balance Sheet (Partial) Non-current liablities Bonds payable, 10.5%, due April 1, 2028 $ Less: Discount on bonds payable 530,000 4,004 $ 525,996 g. Calculate the bond B interest expense that would appear on the income statement for the year ended July 31, 2027. Answer is complete and correct. Total bond interest expense $ 55,319 h. Independent of (a) through (g), assume that bond B issues was retired on December 1, 2027, at 97. Record the entries. X Answer is not complete. No Date General Journal Debit Credit 1 530,000 X December 01, 202 Bonds payable Discount on bonds payable 857 X 2 December 01, 202 Cash 514,100 X 15,043 Gain on retirement of bonds