Answered step by step

Verified Expert Solution

Question

1 Approved Answer

can you pleaese help me answer these! 1 2 3 The following data are given for Harry Company: Budgeted production Actual production Materials: Standard price

can you pleaese help me answer these!  1

1

2

2  3

3

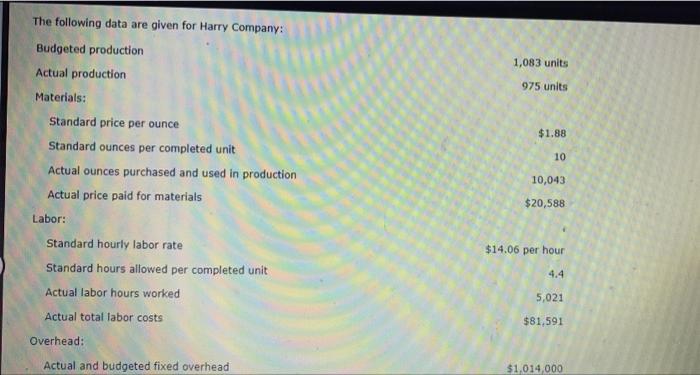

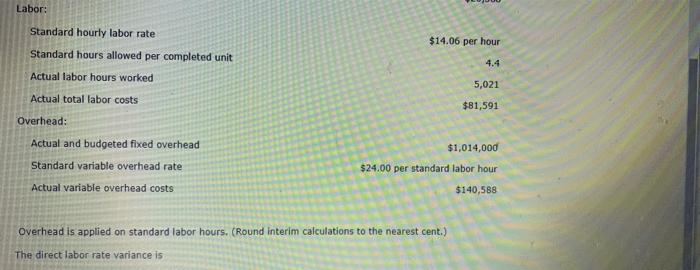

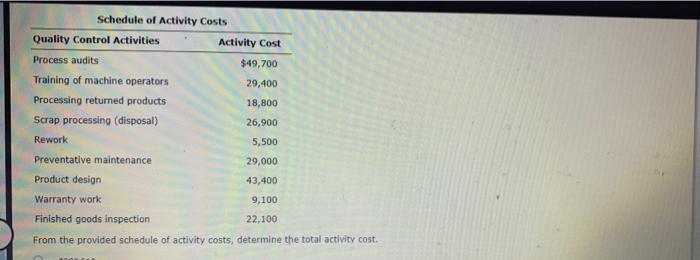

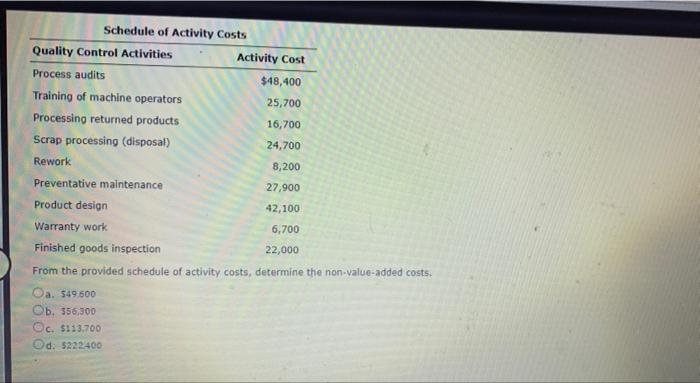

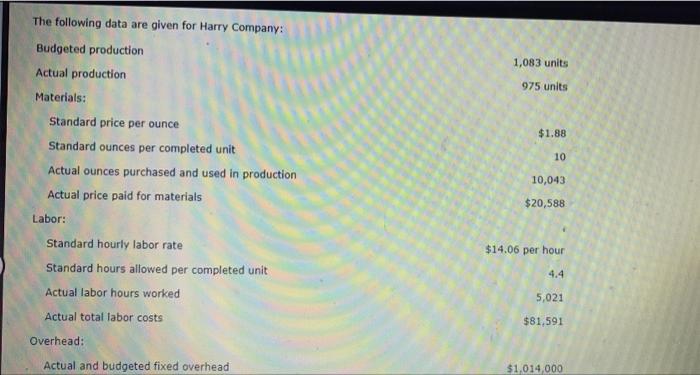

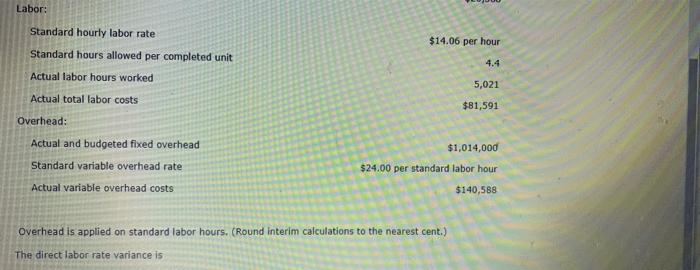

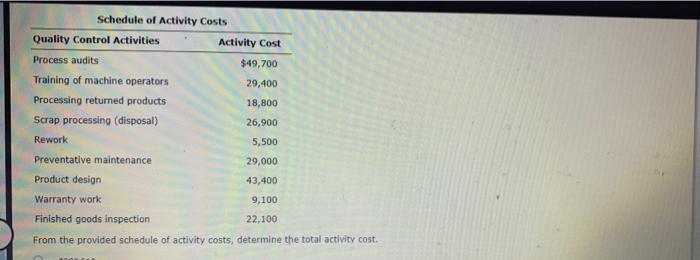

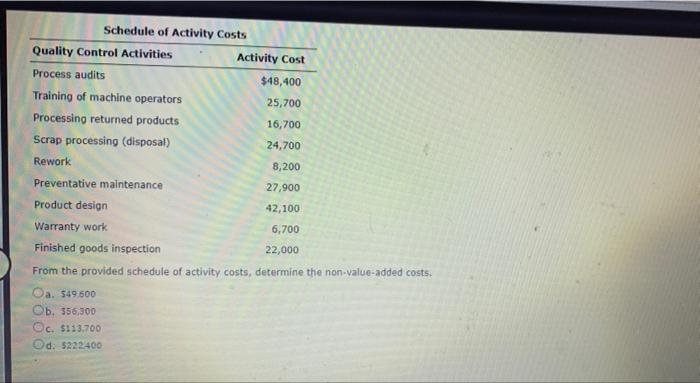

The following data are given for Harry Company: Budgeted production Actual production Materials: Standard price per ounce Standard ounces per completed unit Actual ounces purchased and used in production Actual price paid for materials Labor: Standard hourly labor rate Standard hours allowed per completed unit Actual labor hours worked Actual total labor costs. Overhead: Actual and budgeted fixed overhead 1,083 units 975 units $1.88 10 10,043 $20,588 $14.06 per hour 4.4 5,021 $81,591 $1,014,000 Labor: Standard hourly labor rate : Standard hours allowed per completed unit Actual labor hours worked. Actual total labor costs Overhead: Actual and budgeted fixed overhead Standard variable overhead rate Actual variable overhead costs overhead is applied on standard labor hours. (Ro interim calculations to the nearest cent.) The direct labor rate variance is $14.06 per hour 4.4 5,021 $81,591 $1,014,000 $24.00 per standard labor hour $140,588 Schedule of Activity Costs Quality Control Activities Activity Cost Process audits $49,700 Training of machine operators 29,400 Processing returned products 18,800 Scrap processing (disposal) 26,900 Rework 5,500 Preventative maintenance 29,000 Product design 43,400 Warranty work 9,100 Finished goods inspection 22,100 From the provided schedule of activity costs, determine the total activity cost. Schedule of Activity Costs Quality Control Activities Activity Cost Process audits $48,400 Training of machine operators 25,700 Processing returned products 16,700 Scrap processing (disposal) 24,700 Rework 8,200 Preventative maintenance 27,900 Product design 42,100 Warranty work 6,700 Finished goods inspection 22,000 From the provided schedule of activity costs, determine the non-value-added costs. Oa. $49.600 Ob. 356,300 Oc. $113,700 Od: $222400  1

1

2

2 3

3Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started