Please resolve this homework

Please be aware that this is wrong

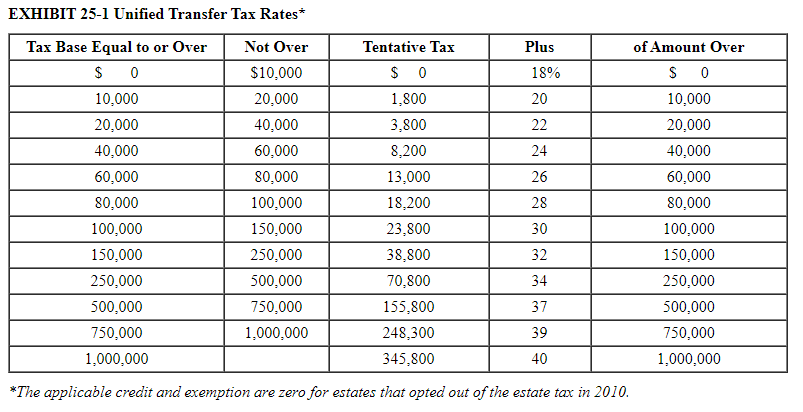

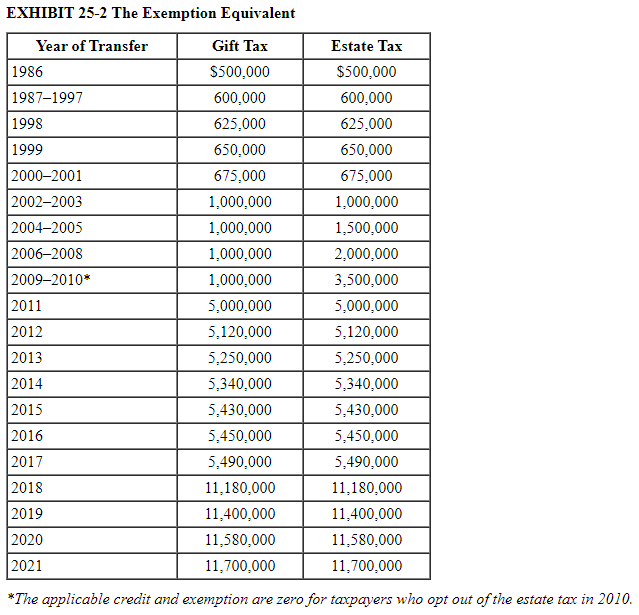

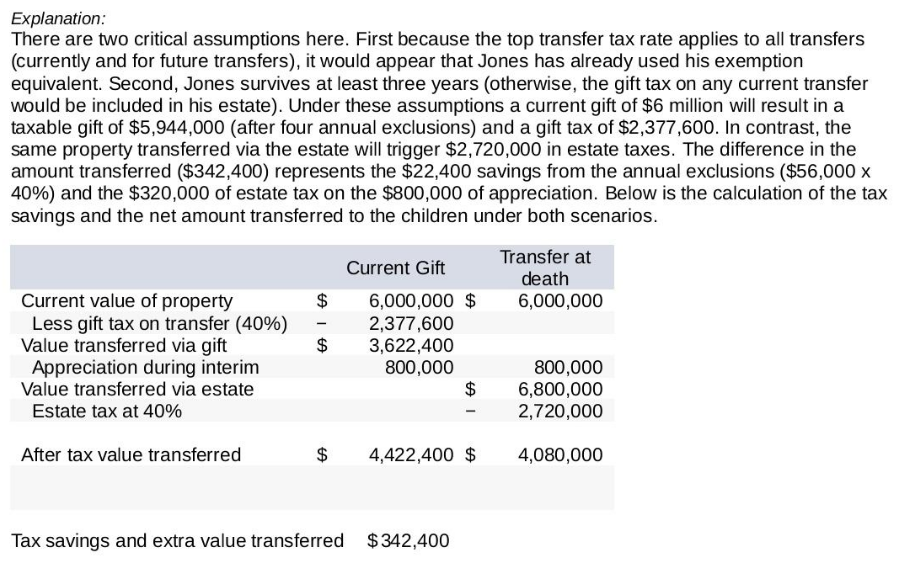

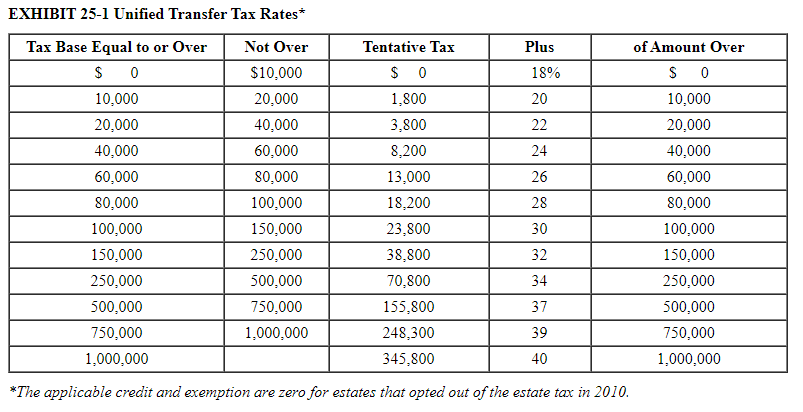

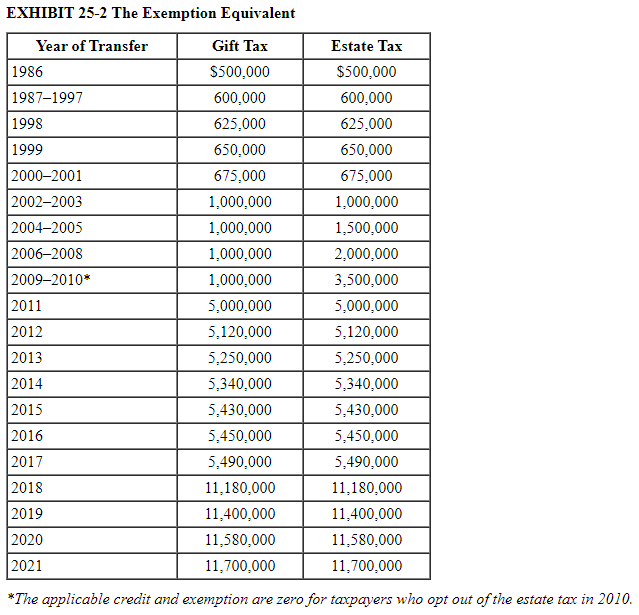

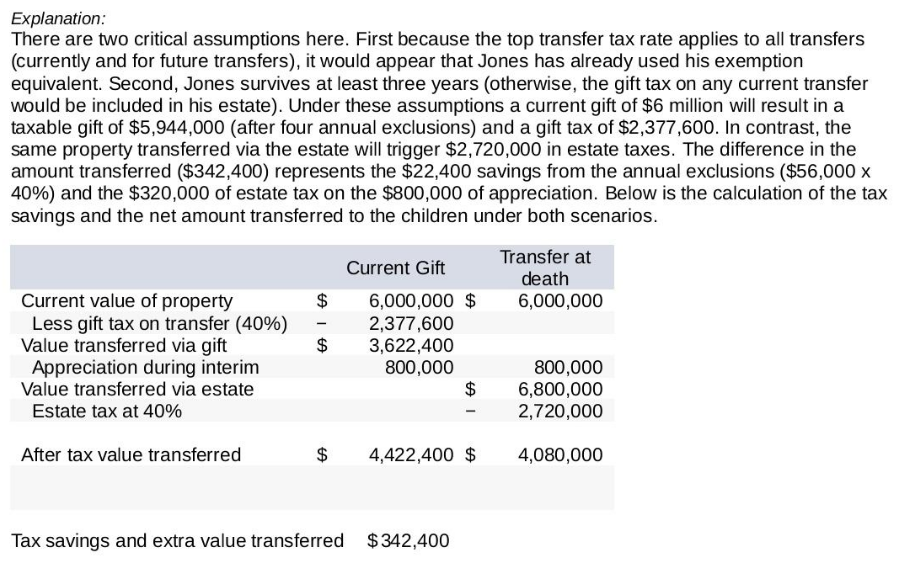

(For all requirements, enter your answers in dollars and not in millions of dollars.) a-1. Amount of gift tax a-2. Amount of estate tax savings EXHIBIT 25-1 Unified Transfer Tax Rates* Tax Base Equal to or Over $ 0 Not Over $10,000 20,000 40,000 60,000 80,000 100,000 150,000 250,000 500,000 750,000 1,000,000 10,000 20,000 40,000 60,000 80,000 100,000 150,000 250,000 500,000 750,000 1,000,000 Plus Tentative Tax $0 1,800 3,800 8,200 24 13,000 26 18,200 28 23,800 30 38,800 32 70,800 34 155,800 37 248,300 39 345,800 40 *The applicable credit and exemption are zero for estates that opted out of the estate tax in 2010. 18% 20 22 of Amount Over SO 10,000 20,000 40,000 60,000 80,000 100,000 150,000 250,000 500,000 750,000 1,000,000 EXHIBIT 25-2 The Exemption Equivalent Year of Transfer Gift Tax $500,000 600,000 625,000 650,000 675,000 1,000,000 1,000,000 1,000,000 1,000,000 5,000,000 5,120,000 5,250,000 5,340,000 5,430,000 5,450,000 5,490,000 11,180,000 11,400,000 11,580,000 11,700,000 Estate Tax $500,000 600,000 625,000 650,000 675,000 1,000,000 1,500,000 2,000,000 3,500,000 2011 5,000,000 2012 5,120,000 2013 5,250,000 2014 5,340,000 2015 5,430,000 2016 5,450,000 2017 5,490,000 2018 11,180,000 2019 11,400,000 2020 11,580,000 2021 11,700,000 *The applicable credit and exemption are zero for taxpayers who opt out of the estate tax in 2010. 1986 1987-1997 1998 1999 2000-2001 2002-2003 2004-2005 2006-2008 2009-2010** Explanation: There are two critical assumptions here. First because the top transfer tax rate applies to all transfers (currently and for future transfers), it would appear that Jones has already used his exemption equivalent. Second, Jones survives at least three years (otherwise, the gift tax on any current transfer would be included in his estate). Under these assumptions a current gift of $6 million will result in a taxable gift of $5,944,000 (after four annual exclusions) and a gift tax of $2,377,600. In contrast, the same property transferred via the estate will trigger $2,720,000 in estate taxes. The difference in the amount transferred ($342,400) represents the $22,400 savings from the annual exclusions ($56,000 x 40%) and the $320,000 of estate tax on the $800,000 of appreciation. Below is the calculation of the tax savings and the net amount transferred to the children under both scenarios. Current value of property Less gift tax on transfer (40%) Value transferred via gift Appreciation during interim Value transferred via estate Estate tax at 40% After tax value transferred $ $ Current Gift 6,000,000 $ 2,377,600 3,622,400 800,000 $ $ 4,422,400 $ Tax savings and extra value transferred $342,400 Transfer at death 6,000,000 800,000 6,800,000 2,720,000 4,080,000