Answered step by step

Verified Expert Solution

Question

1 Approved Answer

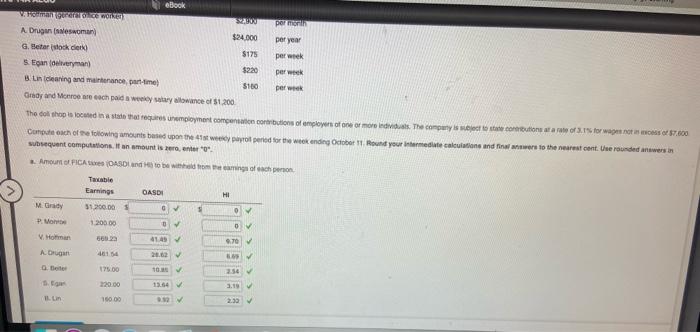

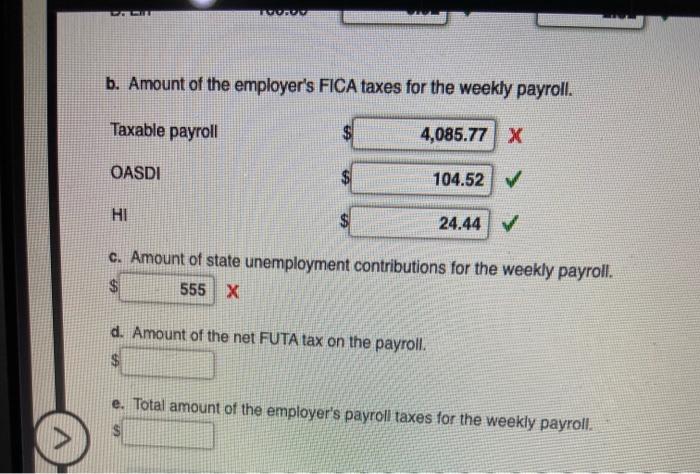

can you please amswer the blank spaces and the one with a red x. eBook Wange WORST sy por A Drugan (som $24.000 per year

can you please amswer the blank spaces and the one with a red x.

eBook Wange WORST sy por A Drugan (som $24.000 per year G. Beter och der $175 per week Egan forman $220 per week B.Un caring and maintenance anime $100 per week Grady and More reach paid a way towance of 1.200 The do this located in a state that requires remployment compensation corbutions of employers of one or more individuals. The company is section state of 3.1 for wat 7.000 Contach of the following amounts based upon the 41st weeky part period for the weekend in October Round your intermediate calculations and where to the nearest cent. Une rounded anwen subsequent computations. It an amount is, entero Amount PICADAS to be home of each person Taxable Earnings CASDI HI MG 31.200.00 0 O P. Monte 120000 0V Homan 4149 70 A Druga 401 4 20. 175.00 13.54 IL 100.00 12 2.32 DOU TOROV b. Amount of the employer's FICA taxes for the weekly payroll. Taxable payroll $ 4,085.77 X OASDI 104.52 HI 24.44 c. Amount of state unemployment contributions for the weekly payroll . $ 555 X d. Amount of the net FUTA tax on the payroll. $ e. Total amount of the employer's payroll taxes for the weekly payroll eBook Wange WORST sy por A Drugan (som $24.000 per year G. Beter och der $175 per week Egan forman $220 per week B.Un caring and maintenance anime $100 per week Grady and More reach paid a way towance of 1.200 The do this located in a state that requires remployment compensation corbutions of employers of one or more individuals. The company is section state of 3.1 for wat 7.000 Contach of the following amounts based upon the 41st weeky part period for the weekend in October Round your intermediate calculations and where to the nearest cent. Une rounded anwen subsequent computations. It an amount is, entero Amount PICADAS to be home of each person Taxable Earnings CASDI HI MG 31.200.00 0 O P. Monte 120000 0V Homan 4149 70 A Druga 401 4 20. 175.00 13.54 IL 100.00 12 2.32 DOU TOROV b. Amount of the employer's FICA taxes for the weekly payroll. Taxable payroll $ 4,085.77 X OASDI 104.52 HI 24.44 c. Amount of state unemployment contributions for the weekly payroll . $ 555 X d. Amount of the net FUTA tax on the payroll. $ e. Total amount of the employer's payroll taxes for the weekly payroll Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started