Answered step by step

Verified Expert Solution

Question

1 Approved Answer

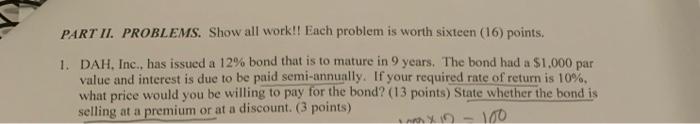

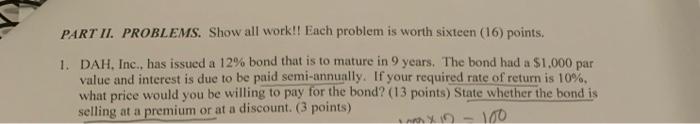

can you please ans the following question my ans was 1108.48 where as my professor had 1117.44 thank you PART II. PROBLEMS. Show all work!!

can you please ans the following question

PART II. PROBLEMS. Show all work!! Each problem is worth sixteen (16) points. 1. DAH, Inc., has issued a 12% bond that is to mature in 9 years. The bond had a $1.000 par value and interest is due to be paid semi-annually. If your required rate of return is 10% what price would you be willing to pay for the bond? (13 points) State whether the bond is selling at a premium or at a discount. (3 points) O 100 my ans was 1108.48 where as my professor had 1117.44

thank you

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started