can you please answer all quation in 30 munties

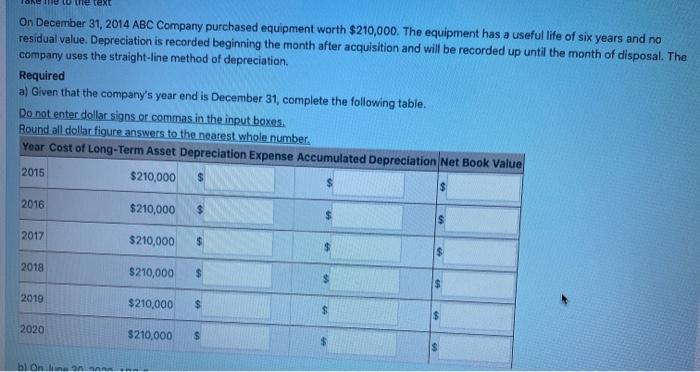

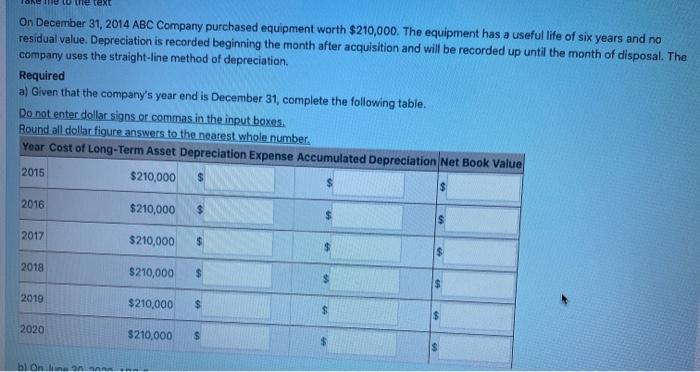

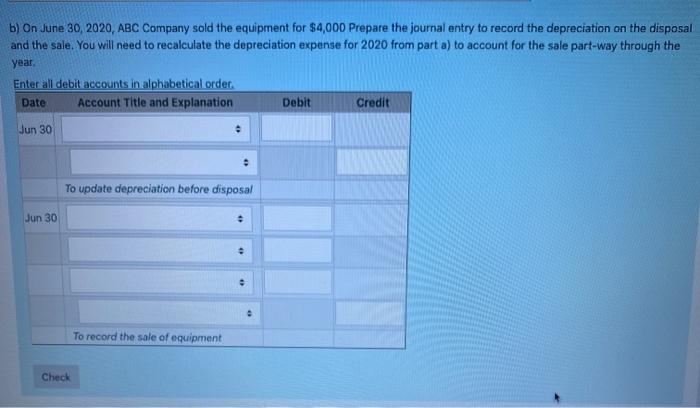

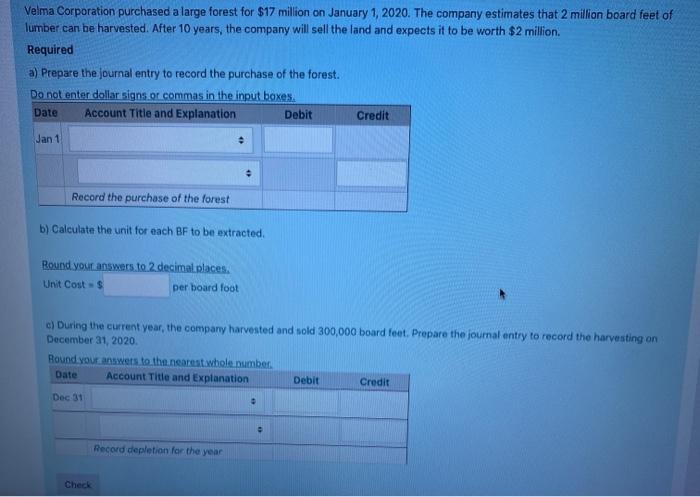

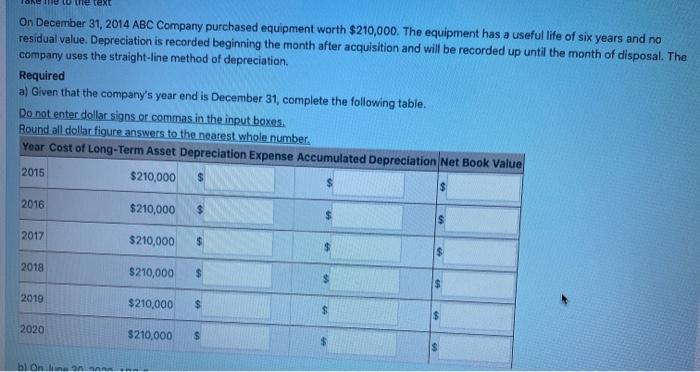

The text On December 31, 2014 ABC Company purchased equipment worth $210,000. The equipment has a useful life of six years and no residual value. Depreciation is recorded beginning the month after acquisition and will be recorded up until the month of disposal. The company uses the straight-line method of depreciation Required a) Given that the company's year end is December 31, complete the following table. Do not enter dollar signs or commas in the input boxes. Round all dollar figure answers to the nearest whole number Year Cost of Long-Term Asset Depreciation Expense Accumulated Depreciation Net Book Value 2015 $210,000 2016 $210,000 $ 2017 $210,000 $ $ 2018 $210,000 $ $ 2019 $210,000 $ $ 2020 $210.000 $ bl Online b) On June 30, 2020, ABC Company sold the equipment for $4,000 Prepare the journal entry to record the depreciation on the disposal and the sale. You will need to recalculate the depreciation expense for 2020 from part a) to account for the sale part-way through the year. Enter all debit accounts in alphabetical order. Account Title and Explanation Debit Credit Date Jun 30 To update depreciation before disposal Jun 30 . To record the sale of equipment Check Building, equipment, and land were purchased for a total amount of $1,500,000 on August 19, 2020. The assessed values of these purchases were, Building for $595,000; Equipment for $187,000; Land for $918,000. Calculate the cost of each asset by filling in the following table, and write the journal entry that records the purchase. Required a) Complete the table for the bulk asset purchase. Do not enter dollar signs or commas in the input boxes. Round all dollar figure answers to the nearest whole number Round all percentage figures to 2 decimal places Item Assessment Percent Applied to Cost Building $595,000 % $ Equipment $187,000 %$ Land $918,000 % S Total $1,700,000 $ b) Write the journal entry to record the purchase. Assume the company had enough cash to pay for the assets. Enter the debit entries in alphabetical order Date Account Title and Explanation Debit Credit Aug 19 To record the purchase of building equiment and land Velma Corporation purchased a large forest for $17 million on January 1, 2020. The company estimates that 2 million board feet of lumber can be harvested. After 10 years, the company will sell the land and expects it to be worth $2 million. Required a) Prepare the journal entry to record the purchase of the forest. Do not enter dollar signs or commas in the input boxes. Date Account Title and Explanation Debit Credit Jan 1 Record the purchase of the forest b) Calculate the unit for each BF to be extracted Round your answers to 2 decimal places. Unit Costs per board foot c) During the current year, the company harvested and sold 300,000 board feet. Prepare the journal entry to record the harvesting on December 31, 2020 Round your answers to the nearest.whole number Date Account Title and Explanation Debit Credit Dec 31 Record depletion for the year Check