Answered step by step

Verified Expert Solution

Question

1 Approved Answer

can you please answer from A to I Essan Construction Inc, which has a calendar year end, has entered into a non-cancellable fixed-price contract for

can you please answer from A to I

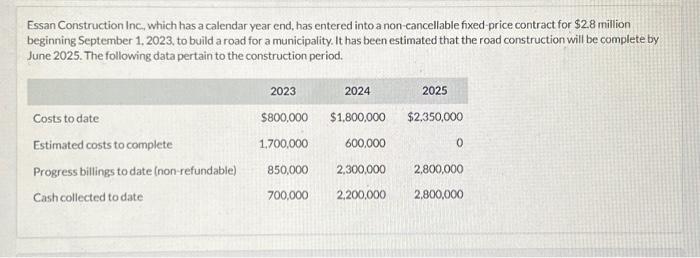

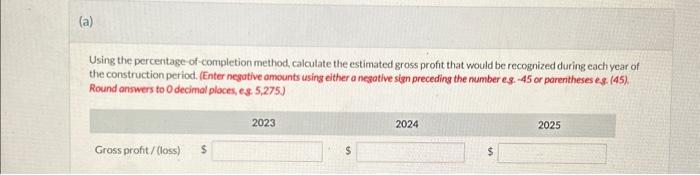

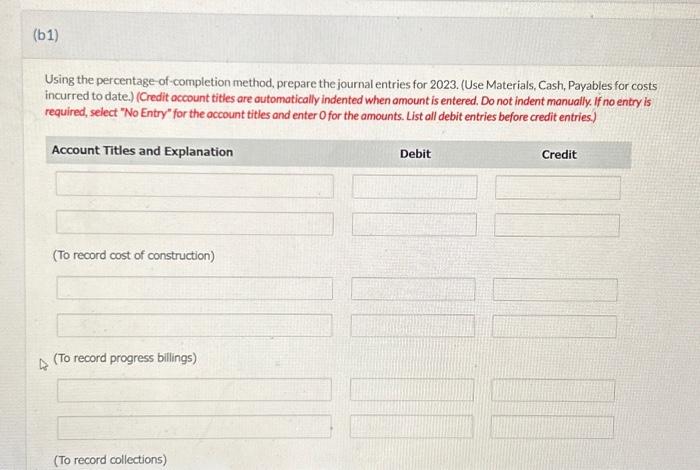

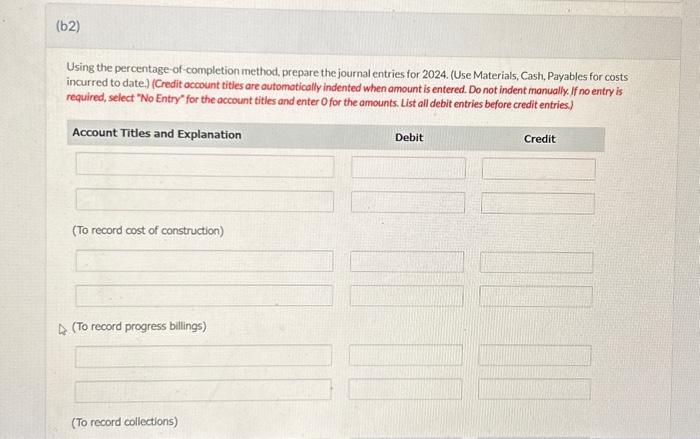

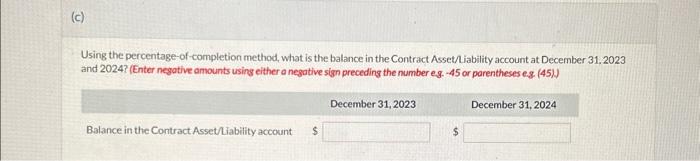

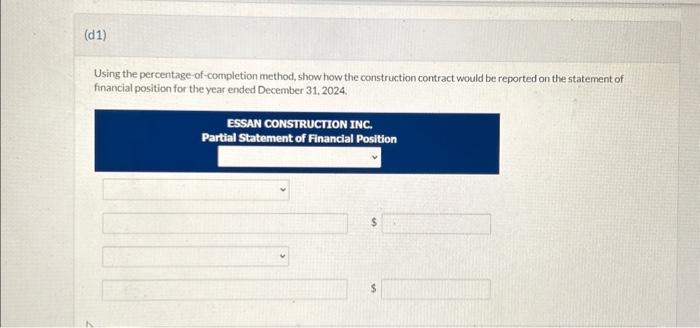

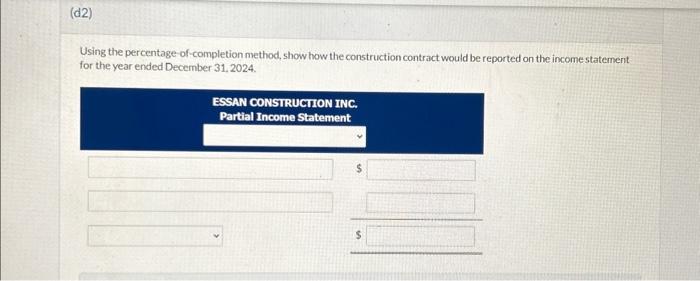

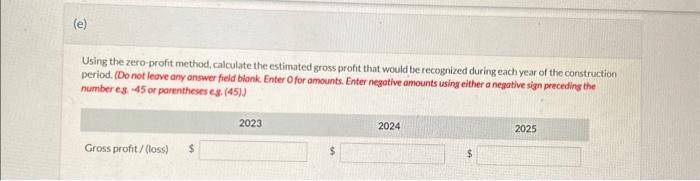

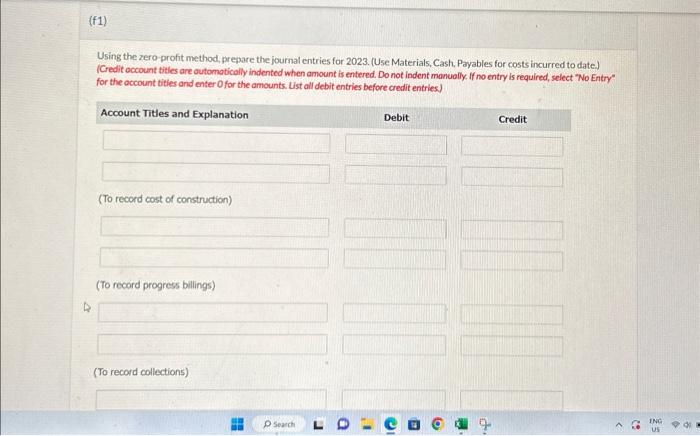

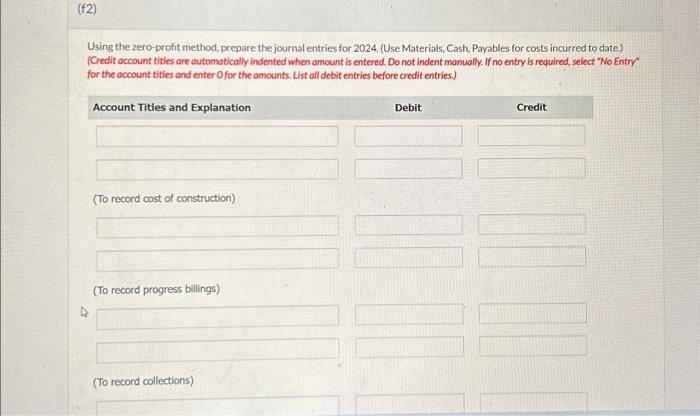

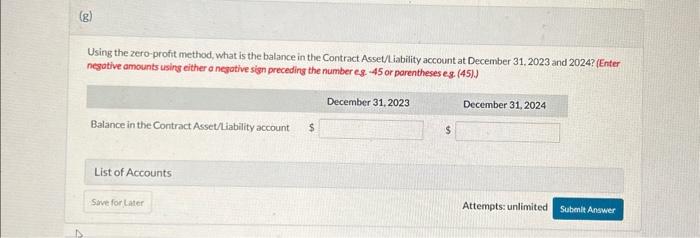

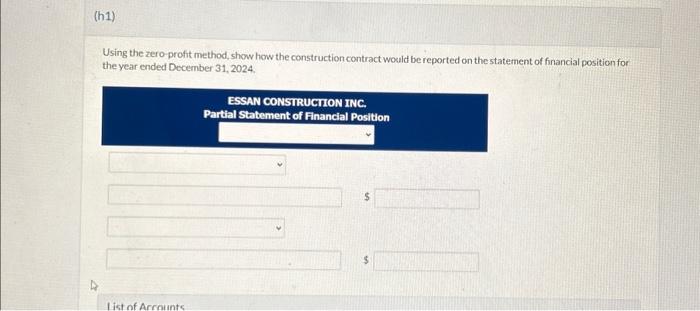

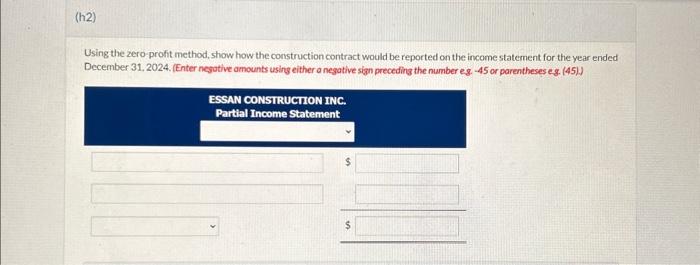

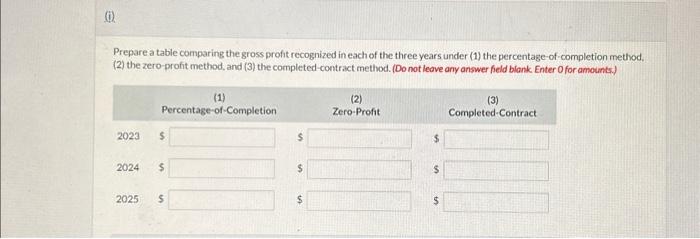

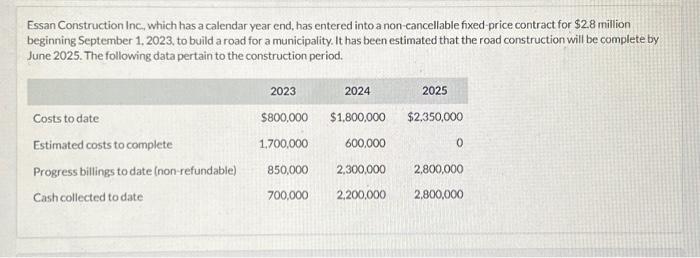

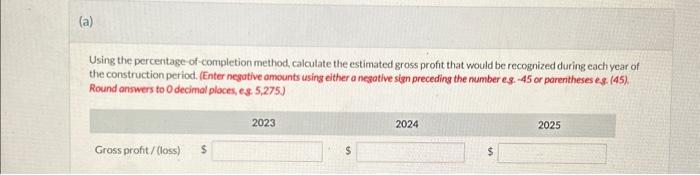

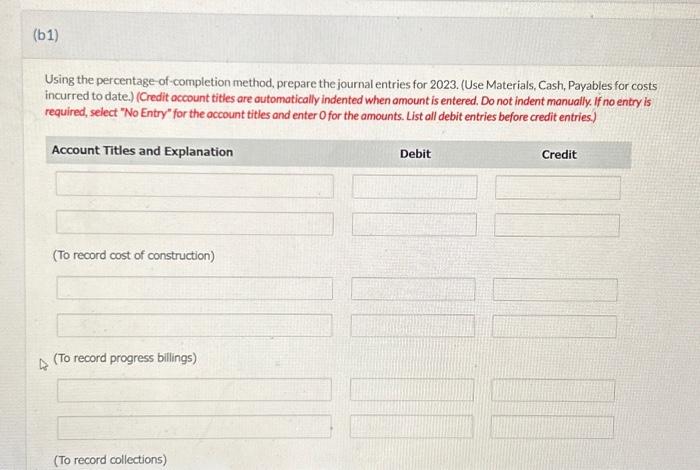

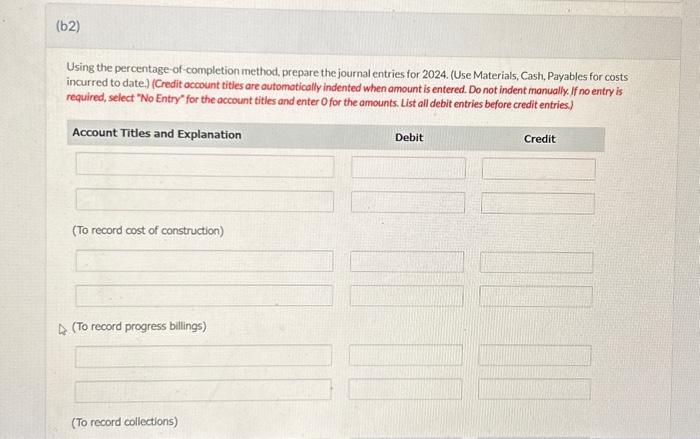

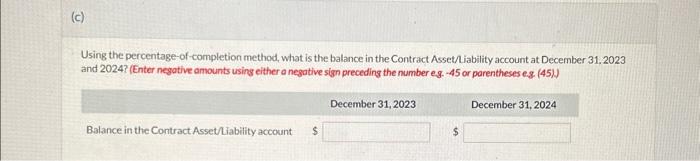

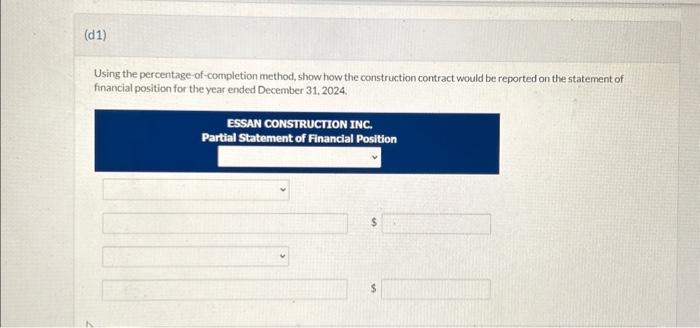

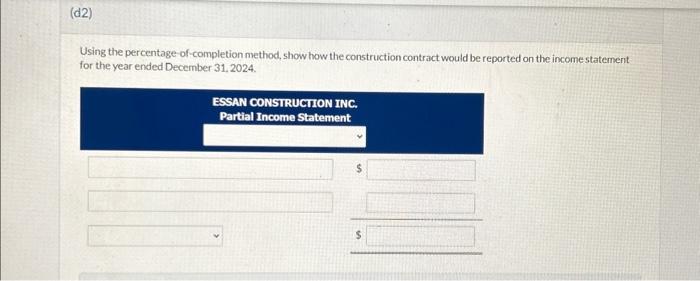

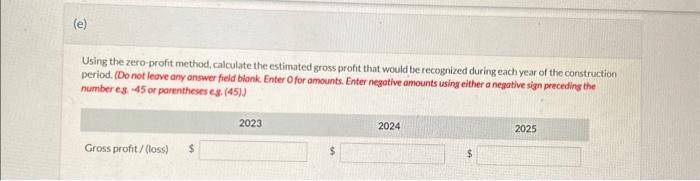

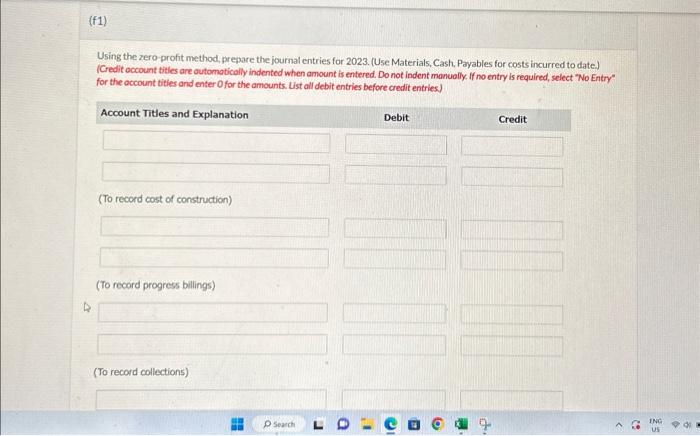

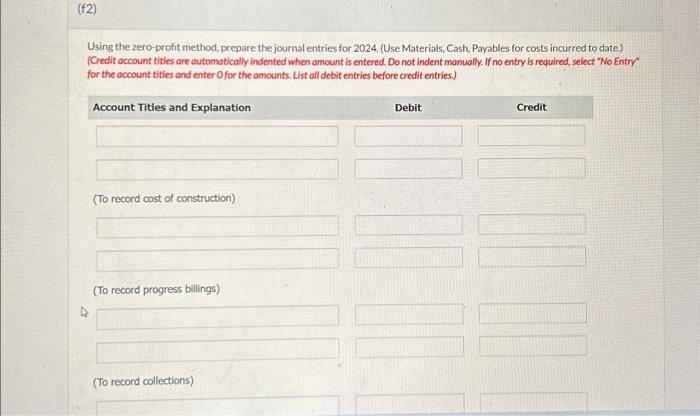

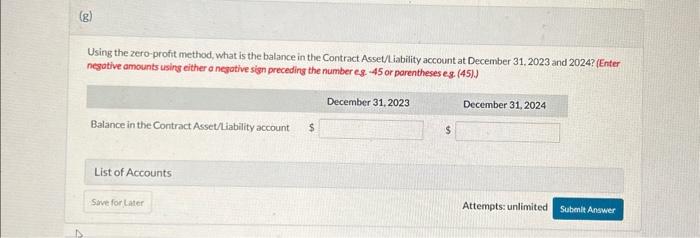

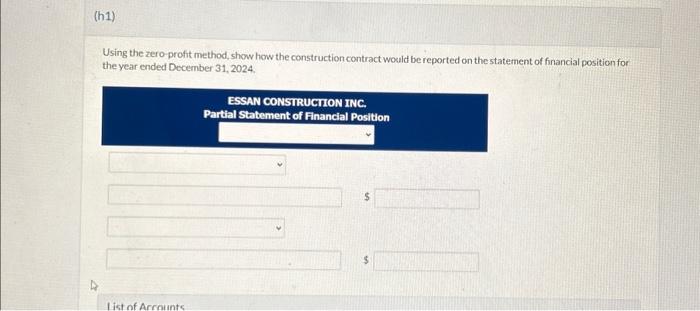

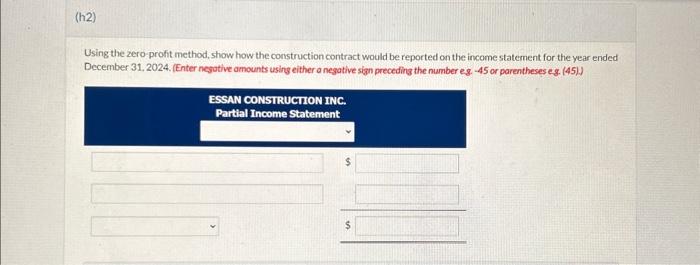

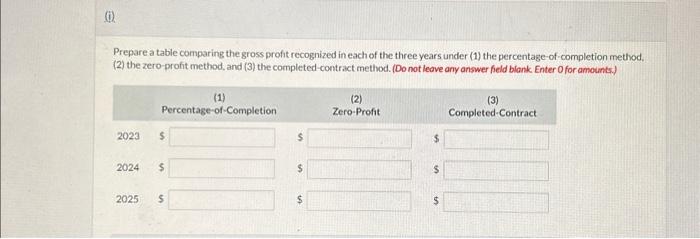

Essan Construction Inc, which has a calendar year end, has entered into a non-cancellable fixed-price contract for $2.8 million beginning September 1, 2023, to build a road for a municipality. It has been estimated that the road construction will be complete by June 2025. The following data pertain to the construction period. Using the percentage-of-completion method, calculate the estimated gross profit that would be recognized during each year of the construction period. (Enter negative amounts using either a nesative sign preceding the mumber e.9. -45 or porentheses es. (45). Round answers to O decimal places, es. 5,275) Using the percentage of-completion method, prepare the journal entries for 2023. (Use Materials, Cash, Payables for costs incurred to date.) (Credit account titles are outomatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the occount tities and enter O for the amounts. List all debit entries before credit entries.) Using the percentage-of-completion method, prepare the journal entries for 2024. (Use Materials, Cash, Payables for costs incurred to date.) (Credit account tities are outomotically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List all debit entries before credit entries.) Using the percentage-of-completion method, what is the balance in the Contract Asset/ Liability account at December 31.2023 and 2024 ? (Enter negotive amounts using either a negative sign preceding the number eg. -45 or parentheses eg. (45)) Using the percentage of-completion method, show how the construction contract would be reported on the statement of financial position for the year ended December 31,2024. Using the percentage- of-completion method, show how the construction contract would be reported on the income staternent for the year encied December 31, 2024. Using the zero-profit method, calculate the estimated gross profit that would be recognized during each year of the construction period. (Do not leove any answer field blonk. Enter Ofor amounts. Enter negotive amounts using either a negative sign preceding the number es -45 or parentheses es. (45).) Using the zero-profit method, prepare the journal entries for 2023. (Use Materials, Cash, Payables for costs incurred to date) (Credit occount titles are outomatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account tities and enter O for the amounts. List all debit entries before credit entries) Using the zero-profit method, prepare the journal entries for 2024. (Use Materials, Cash, Payables for costs incurred to date) (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account tities and enter 0 for the amounts. List all debit entries before credit entries.) Using the zero-profit method, what is the balance in the Contract Asset/Liability account at December 31, 2023 and 2024 ? (Enter negotive amounts using either a negotive sign preceding the number eg -45 or parentheses eg. (45).) Using the zero-profit method, show how the construction contract would be reported on the statement of financial position for the year ended December 31, 2024. Using the zero-profit method, show how the construction contract would be reported on the income statement for the year ended December 31, 2024. (Enter negutive amounts using either a negative sign preceding the number eg. -45 or parentheses eg. (45)) Prepare a table comparing the gross profit recognized in each of the three years under (1) the percentage-of-completion method. (2) the zero-profit method, and (3) the completed-contract method. (Do not leave any answer field blank Enter 0 for amounts.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started