Answered step by step

Verified Expert Solution

Question

1 Approved Answer

can you please answer part a and b showing the work by using the formula and not excel so that i was know how to

can you please answer part a and b showing the work by using the formula and not excel so that i was know how to actually solve the problem?  plzzzzz go by the actual formula so i can understanding

plzzzzz go by the actual formula so i can understanding

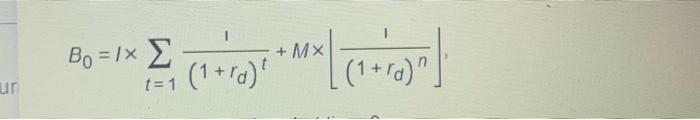

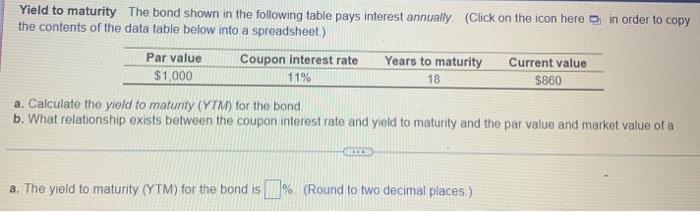

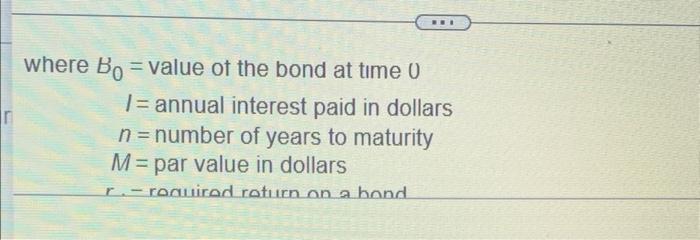

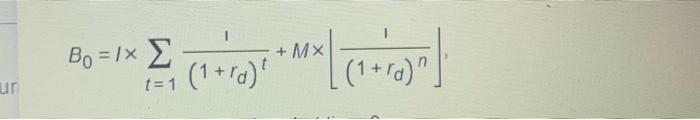

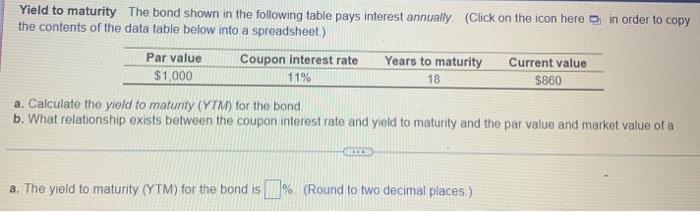

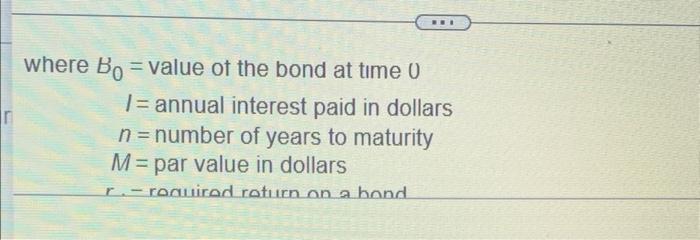

Bo = 1 t=1 (1+ro Yield to maturity The bond shown in the following table pays interest annually (Click on the icon here in order to copy the contents of the data table below into a spreadsheet.) Par value $1,000 Coupon interest rate 11% Years to maturity 18 Current value $860 a. Calculate the yield to maturity (YTM) for the bond. b. What relationship exists between the coupon interest rate and yield to maturity and the par value and market value of a SIOP a. The yield to maturity (YTM) for the bond is% (Round to two decimal places) where Bo = value of the bond at time 0 /= annual interest paid in dollars n = number of years to maturity M = par value in dollars r.-roquired return on a bond  plzzzzz go by the actual formula so i can understanding

plzzzzz go by the actual formula so i can understanding (i ned this in 10 mins)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started