Can you please answer question 7.4,7.5 and 7.6

Also please drow cash follow diagram

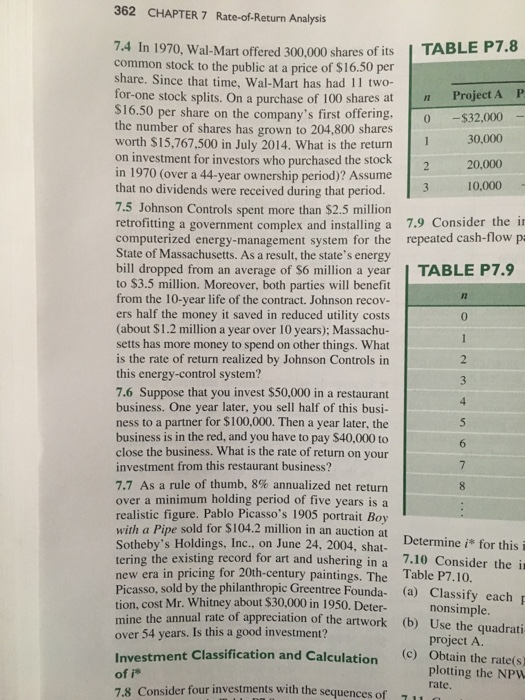

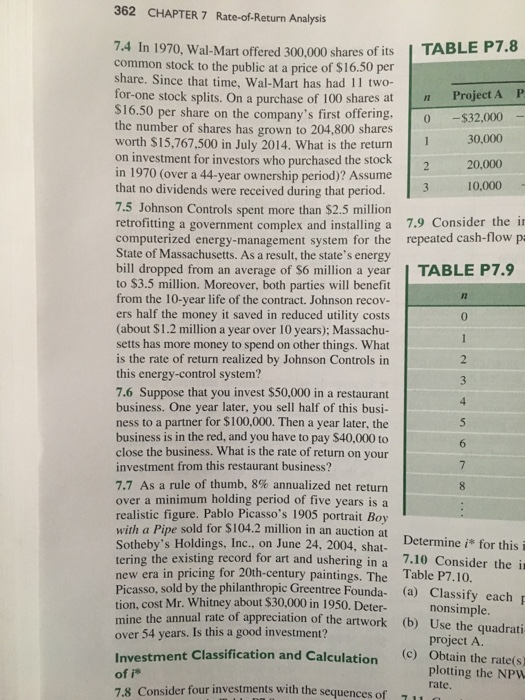

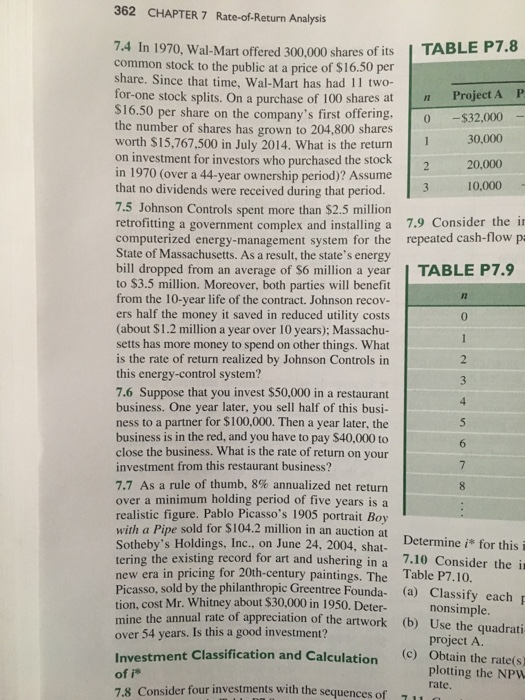

362 CHAPTER 7 Rate-of-Return Analysis 7.4 In 1970, Wal-Mart offered 300,000 shares of its TABLE P7.8 common stock to the public at a price of $16.50 per share. Since that time. Wal-Mart has had two for one stock splits. On a purchase of 100 shares at Project A P 16.50 per share on the company's first offering. $32,000 the number of shares has grown to 204,8 shares 30.000 worth $15,767,500 in July 2014. What is the return on investment for investors who purchased the stock 0,000 in 1970 (over a 44-year ownership period Assume 10.000 that no dividends were received during that period 7.5 Johnson Controls spent more than $2.5 million retrofitting a government complex and installing a 7.9 Consider the i computerized energy-management system for the repeated cash-flow pa State of Massachusetts. As a result, the state's energy bill dropped from an average of $6 mi TABLE P7.9 on a year to $3.5 million. Moreover, both parties will benefit from the 10-year life of the contract. Johnson recov- ers half the money it saved in reduced utility costs (about $1.2 million a year over 10 years); Massachu- setts has more money to spend on other things. What is the rate of return realized by Johnson Controls in this energy-control system? 7.6 Suppose that you invest $50,000 in a restaurant business. One year later, you sell half of this busi ness to a partner for $100,000. Then a year later, the business is in the red, and you have to pay $40,000 to close the business. What is the rate of return on your investment from this restaurant business? a rule of thumb, 8% annualized net return over a minimum holding period of five years is a realistic figure. Pablo Picasso's 1905 portrait Boy sold for $104.2 million in an auction at with a Pipe Determine i for this i Sotheby's Holdings, Inc on June 24, 2004. shat tering the existing record for art and ushering in a 7.10 Consider the i new era in pricing for 20th-century paintings. The Table P7.10 Picasso, sold by the philanthropic Greentree Founda- (a) Classify each tion, cost Whitney about S30,000 in 1950. Deter. nonsimple mine the annual rate of appreciation of the artwork (b) Use the quadra r 54 years. Is this good investment? project A (c) obtain the rate(s Investment Classification and Calculation plotting the NPW of rate. 7.8 Consider four investments with the sequences of