Answered step by step

Verified Expert Solution

Question

1 Approved Answer

can you please answer questions showing full working out, thank you QUESTION 3 Consider a CAPM world with three risky securities but no risk-free asset.

can you please answer questions showing full working out, thank you

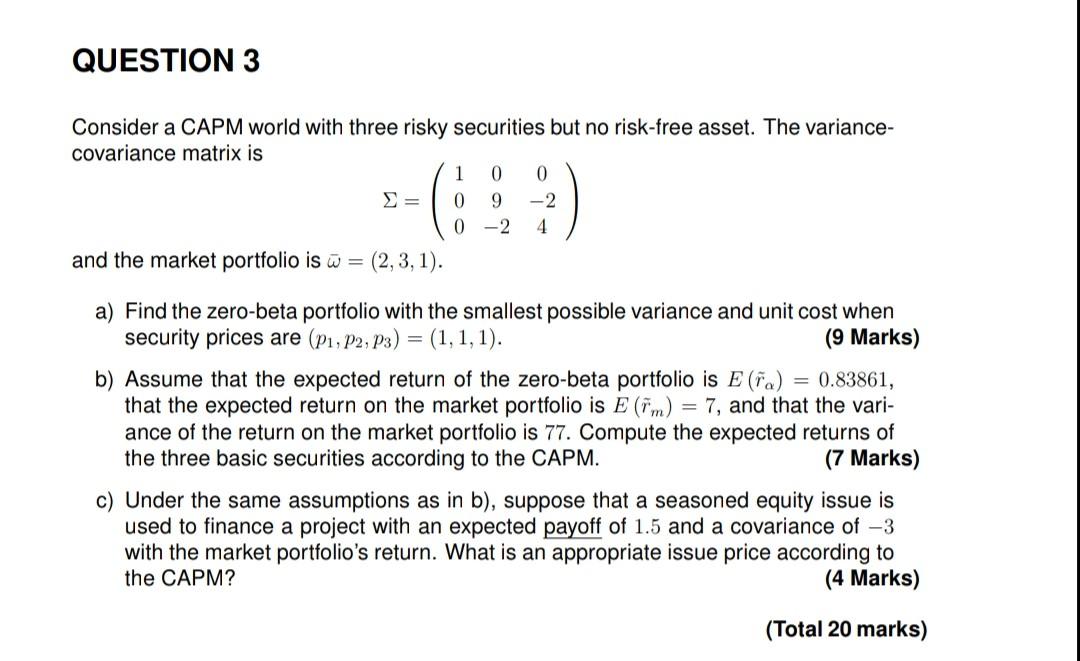

QUESTION 3 Consider a CAPM world with three risky securities but no risk-free asset. The variance- covariance matrix is 1 0 0 0 9 -2 0 -2 4 and the market portfolio is w = (2,3,1). a) Find the zero-beta portfolio with the smallest possible variance and unit cost when security prices are (P1, P2, P3) = (1,1,1). (9 Marks) b) Assume that the expected return of the zero-beta portfolio is E (fa) = 0.83861, that the expected return on the market portfolio is E (im) = 7, and that the vari- ance of the return on the market portfolio is 77. Compute the expected returns of the three basic securities according to the CAPM. (7 Marks) c) Under the same assumptions as in b), suppose that a seasoned equity issue is used to finance a project with an expected payoff of 1.5 and a covariance of -3 with the market portfolio's return. What is an appropriate issue price according to the CAPM? (4 Marks) (Total 20 marks) QUESTION 3 Consider a CAPM world with three risky securities but no risk-free asset. The variance- covariance matrix is 1 0 0 0 9 -2 0 -2 4 and the market portfolio is w = (2,3,1). a) Find the zero-beta portfolio with the smallest possible variance and unit cost when security prices are (P1, P2, P3) = (1,1,1). (9 Marks) b) Assume that the expected return of the zero-beta portfolio is E (fa) = 0.83861, that the expected return on the market portfolio is E (im) = 7, and that the vari- ance of the return on the market portfolio is 77. Compute the expected returns of the three basic securities according to the CAPM. (7 Marks) c) Under the same assumptions as in b), suppose that a seasoned equity issue is used to finance a project with an expected payoff of 1.5 and a covariance of -3 with the market portfolio's return. What is an appropriate issue price according to the CAPM? (4 Marks) (Total 20 marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started