can you please answer this one.

and check answer for other questions.

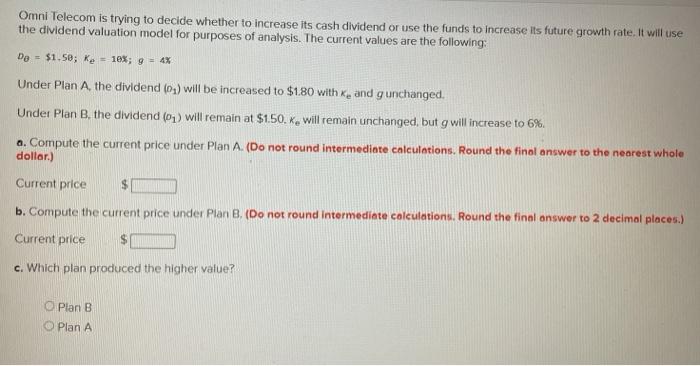

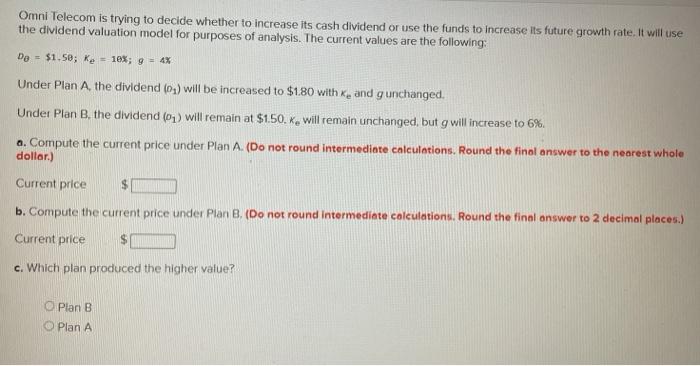

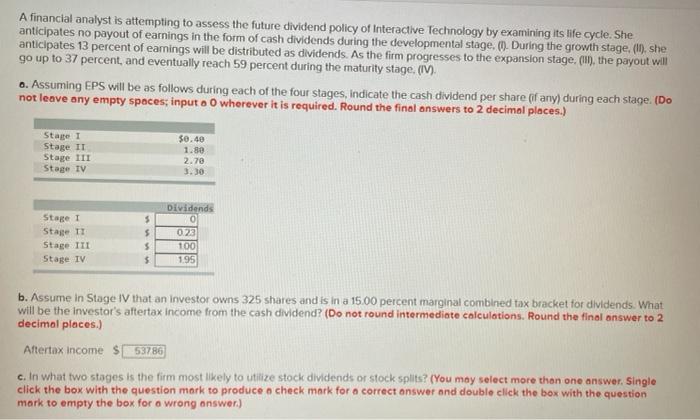

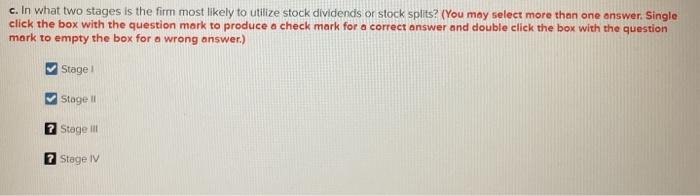

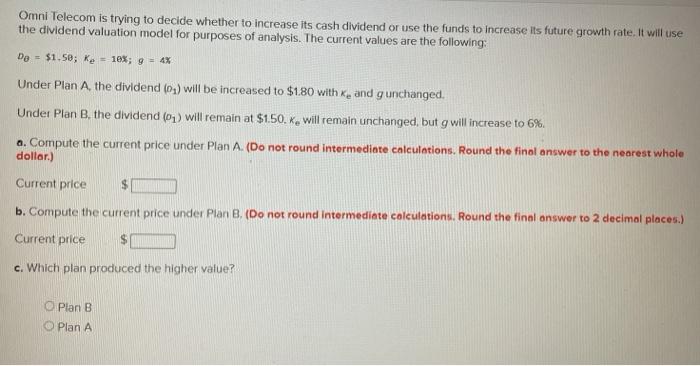

Omni Telecom is trying to decide whether to increase its cash dividend or use the funds to increase its future growth rate. It will use the dividend valuation model for purposes of analysis. The current values are the following: De = $1.50; Ke -10%; 9 - 4% Under Plan A the dividend (01) will be increased to $1.80 with Ke and gunchanged. Under Plan B, the dividend (1) will remain at $1.50. K, will remain unchanged, but g will increase to 6%. a. Compute the current price under Plan A. (Do not round Intermediate calculations. Round the final answer to the nearest whole dollar.) Current price b. Compute the current price under Plan B. (Do not round intermediate calculations. Round the final answer to 2 decimal places.) Current price c. Which plan produced the higher value? Plan B Plan A A financial analyst is attempting to assess the future dividend policy of Interactive Technology by examining its life cycle. She anticipates no payout of earnings in the form of cash dividends during the developmental stage. (). During the growth stage. (It). She anticipates 13 percent of eamings will be distributed as dividends. As the firm progresses to the expansion stage, (11), the payout will go up to 37 percent, and eventually reach 59 percent during the maturity stage. (IV). o. Assuming EPS will be as follows during each of the four stages, indicate the cash dividend per share (if any) during each stage. (Do not leave any empty spaces; input o O wherever it is required. Round the final answers to 2 decimal places.) Stage 1 Stage 11 Stage III Stage IV $0.40 1.80 2.70 Stage 1 Stage 1 Stage III Stage IV $ $ $ $ Dividends O 0.23 100 1.95 b. Assume in Stage IV that an investor owns 325 shares and is in a 15.00 percent marginal combined tax bracket for dividends. What will be the investor's aftertax income from the cash dividend? (Do not round intermediate calculations. Round the final answer to 2 decimal places.) Aftertax income 53780 c. In what two stages is the firm most likely to utilize stock dividends or stock splits? (You may select more than one answer. Single click the box with the question mark to produce a check mark for a correct answer and double click the box with the question mork to empty the box for a wrong answer.) c. In what two stages is the firm most likely to utilize stock dividends or stock splits? (You may select more than one answer. Single click the box with the question mark to produce a check mark for a correct answer and double click the box with the question mark to empty the box for a wrong answer.) Stage 1 Stage 1 2 Stage il ? Stage IV