Question

CAN YOU PLEASE CHECK ALL MY WORK THAT ITS IN THE EXTRA INFORMATION, TELL ME IF ITS CORRECT AND ONLY ANSWER PART 1 I INDICATE

CAN YOU PLEASE CHECK ALL MY WORK THAT ITS IN THE EXTRA INFORMATION, TELL ME IF ITS CORRECT AND ONLY ANSWER PART 1 I INDICATE BELOW PLEASE!!

Im going to put some information of the other problems, its all the same exercise just different parts, so it can help you answer Part 1.

Main information

EXTRA INFORMATION SO IT CAN HELP YOU ANSWER PART 1 and please tell me if all this part below is correct after you answer "PART 1", thank you a lot!

Part 1 (this is the part you need to answer)

And these are the options that they give me to put in the general journal

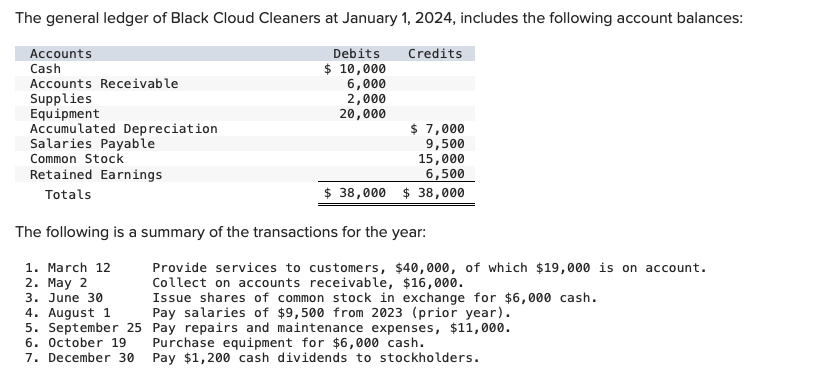

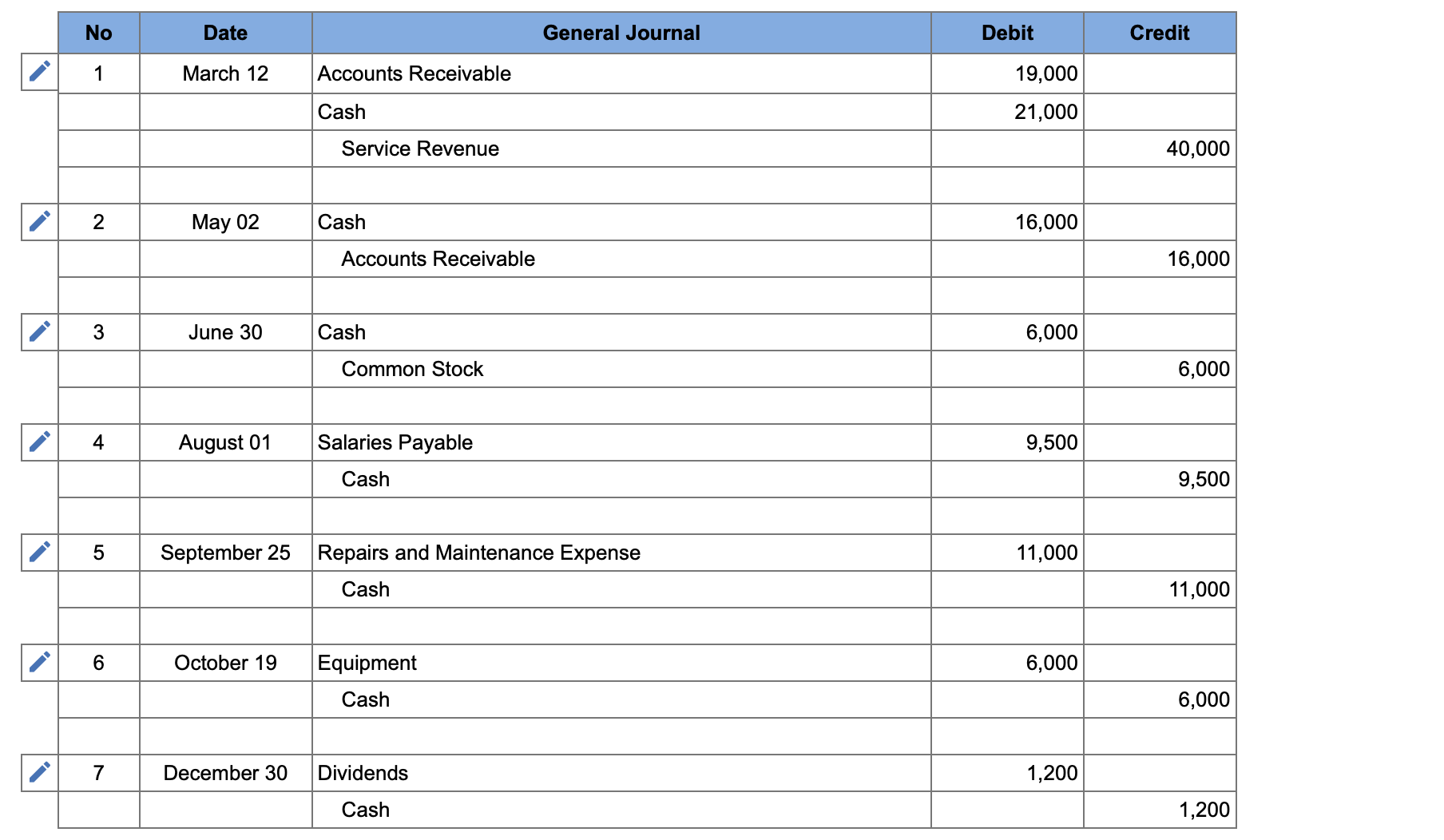

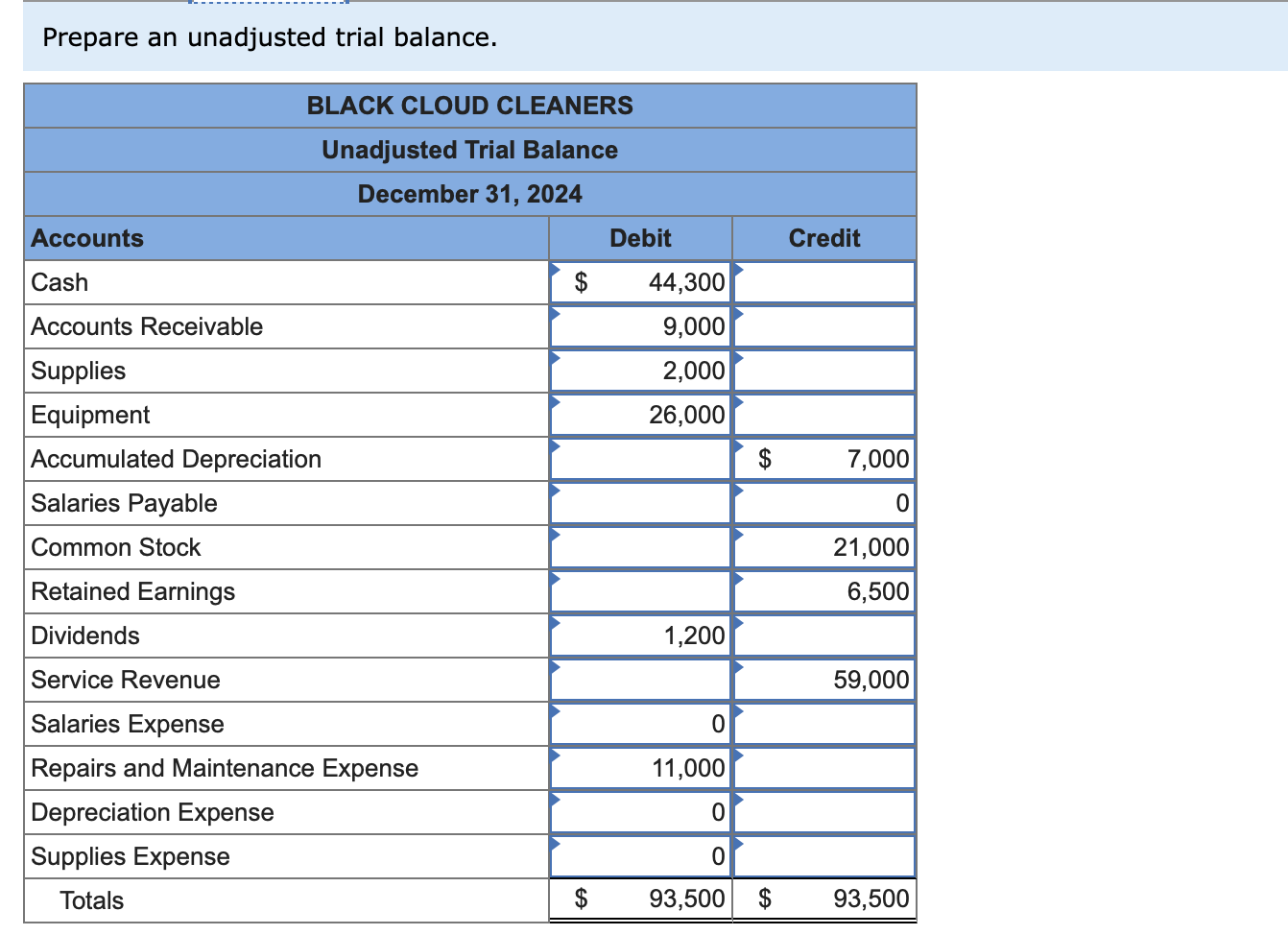

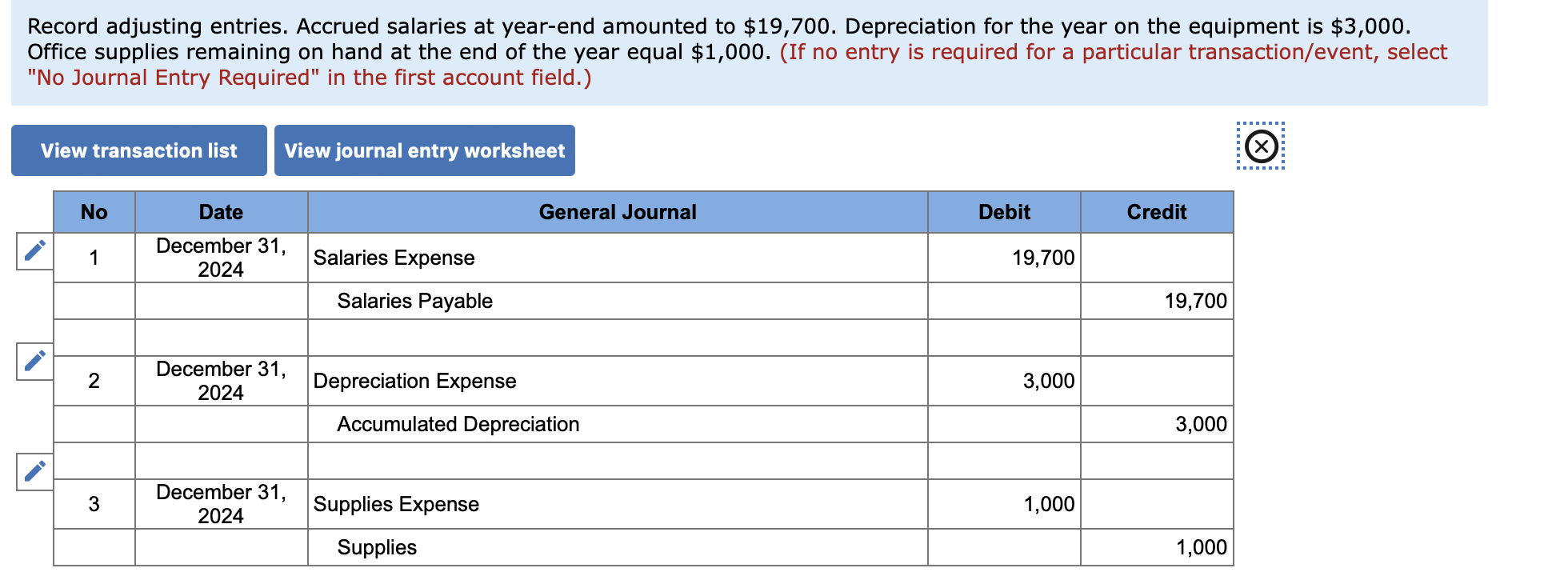

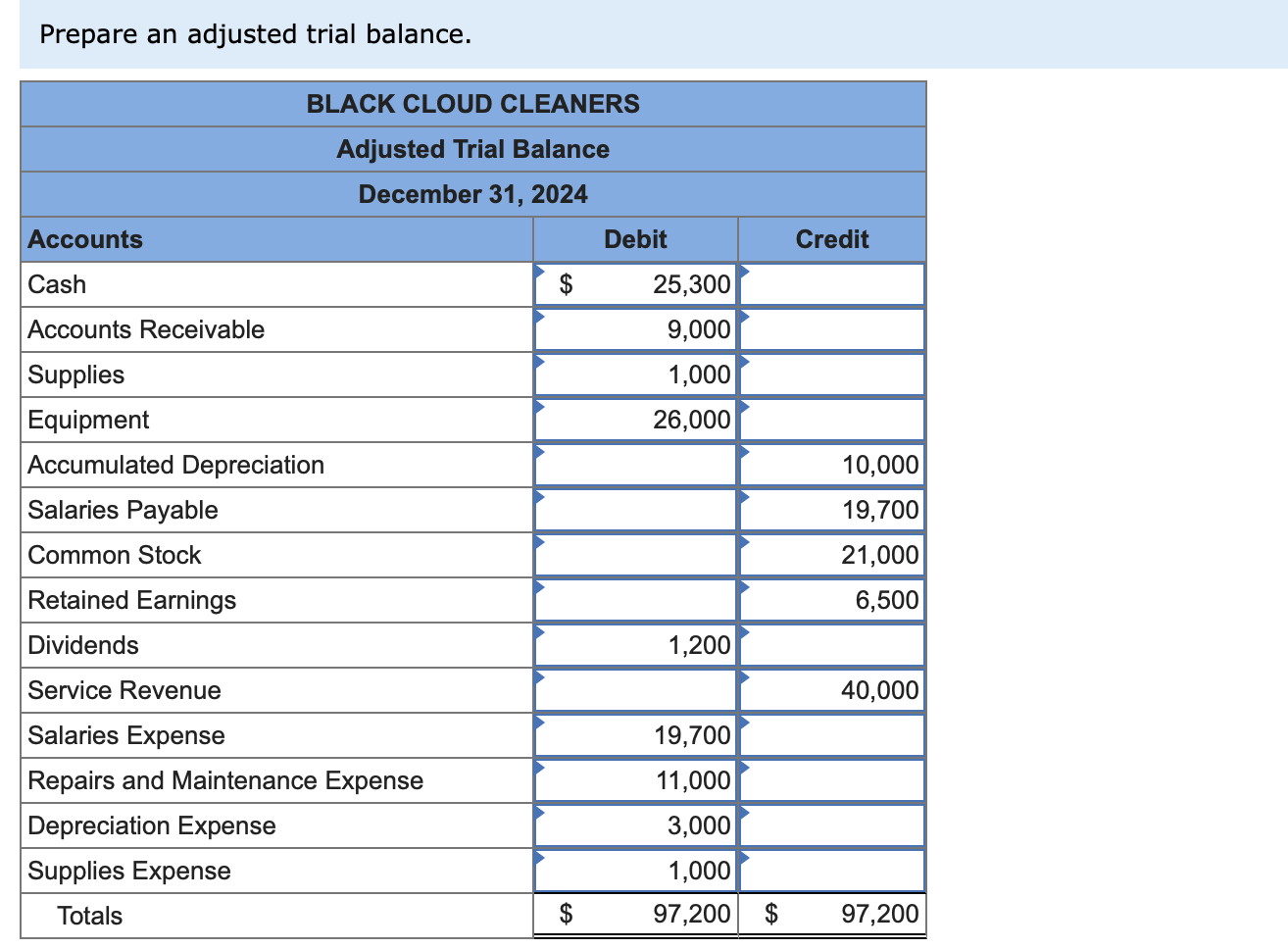

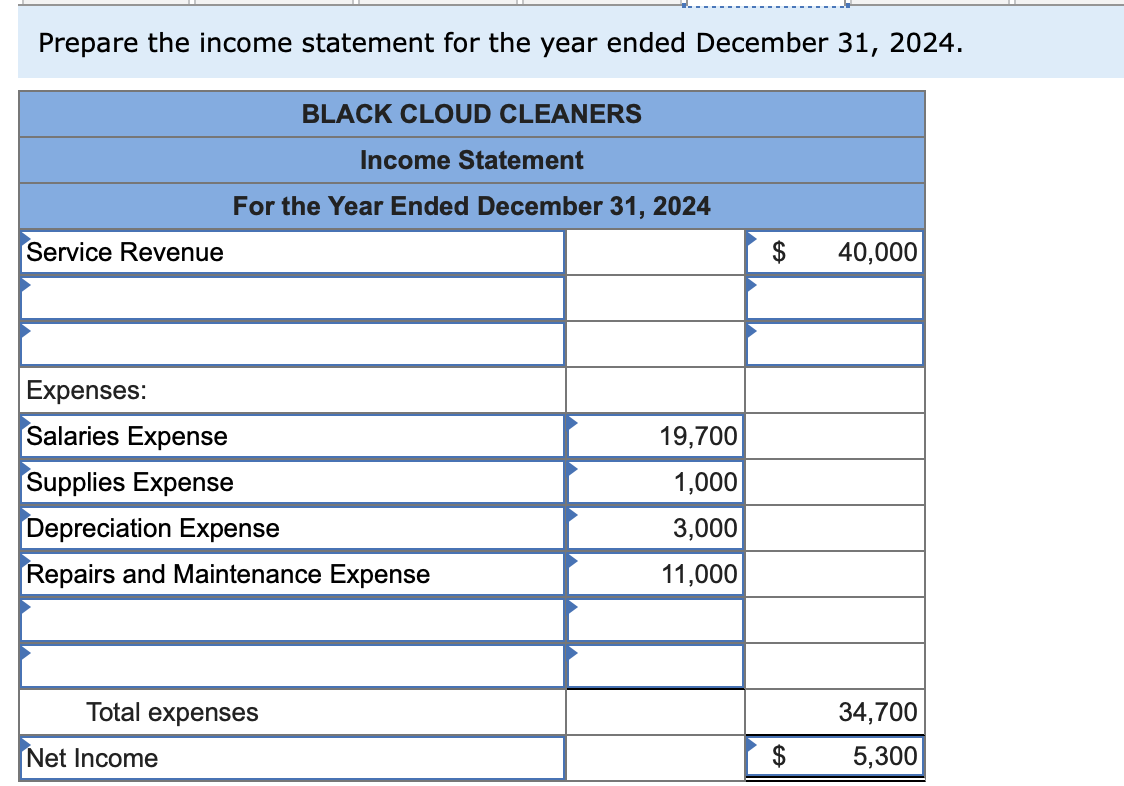

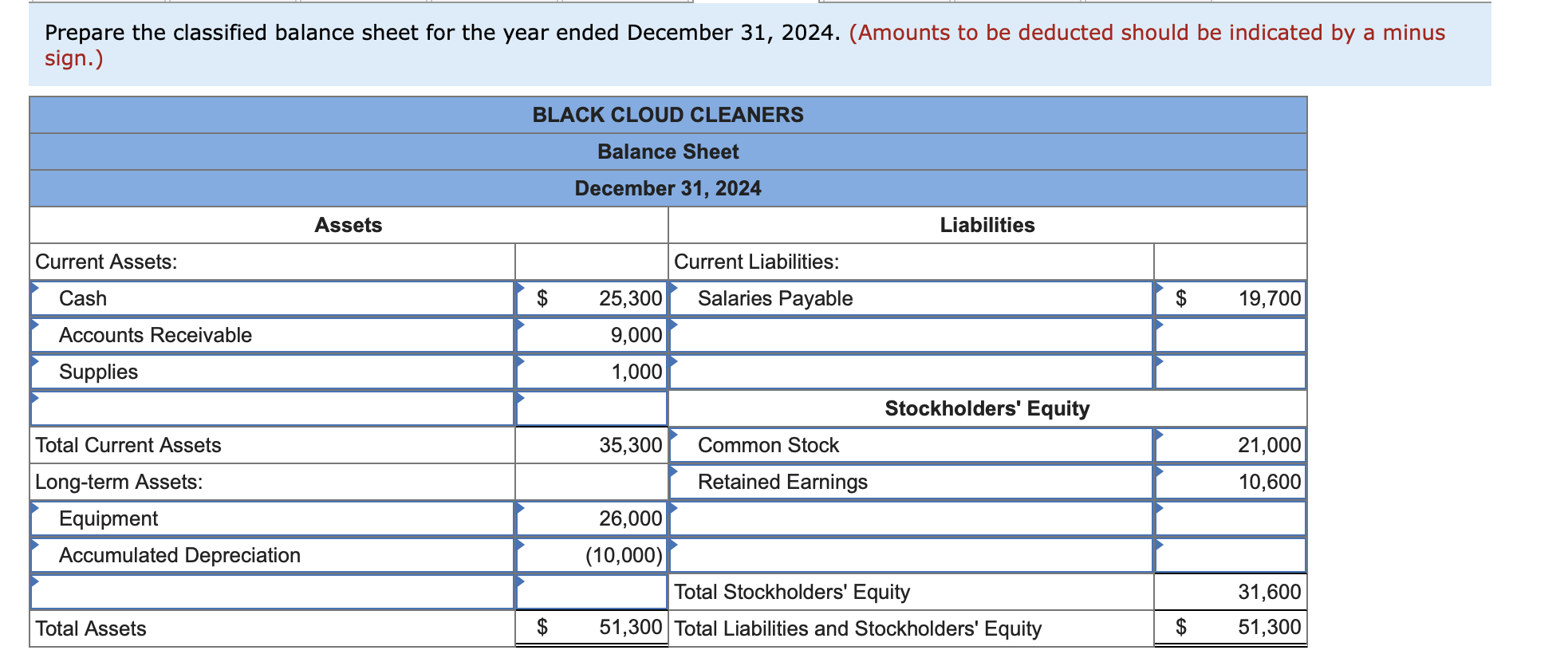

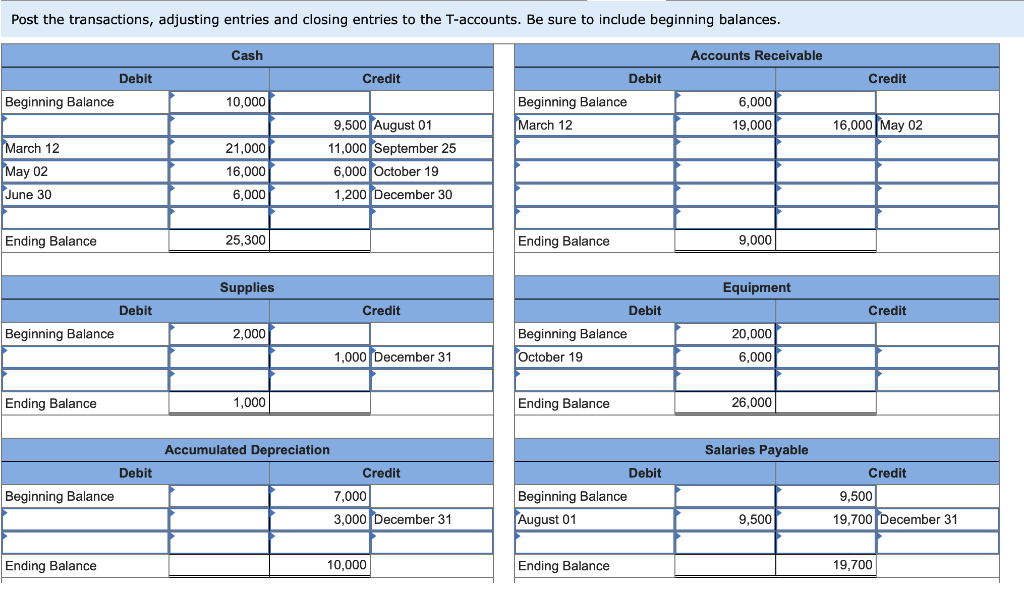

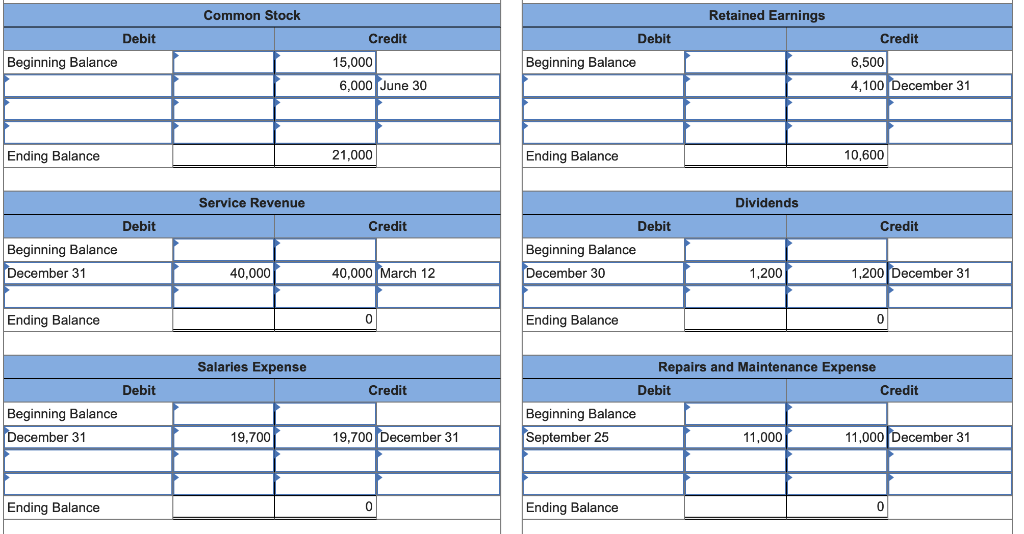

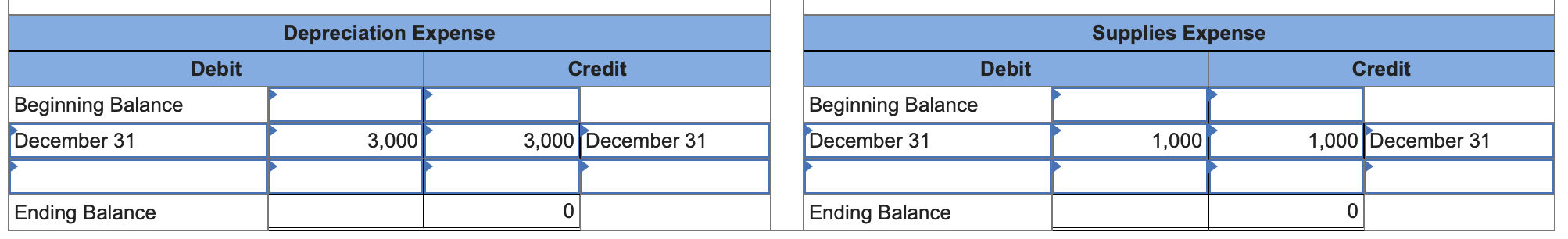

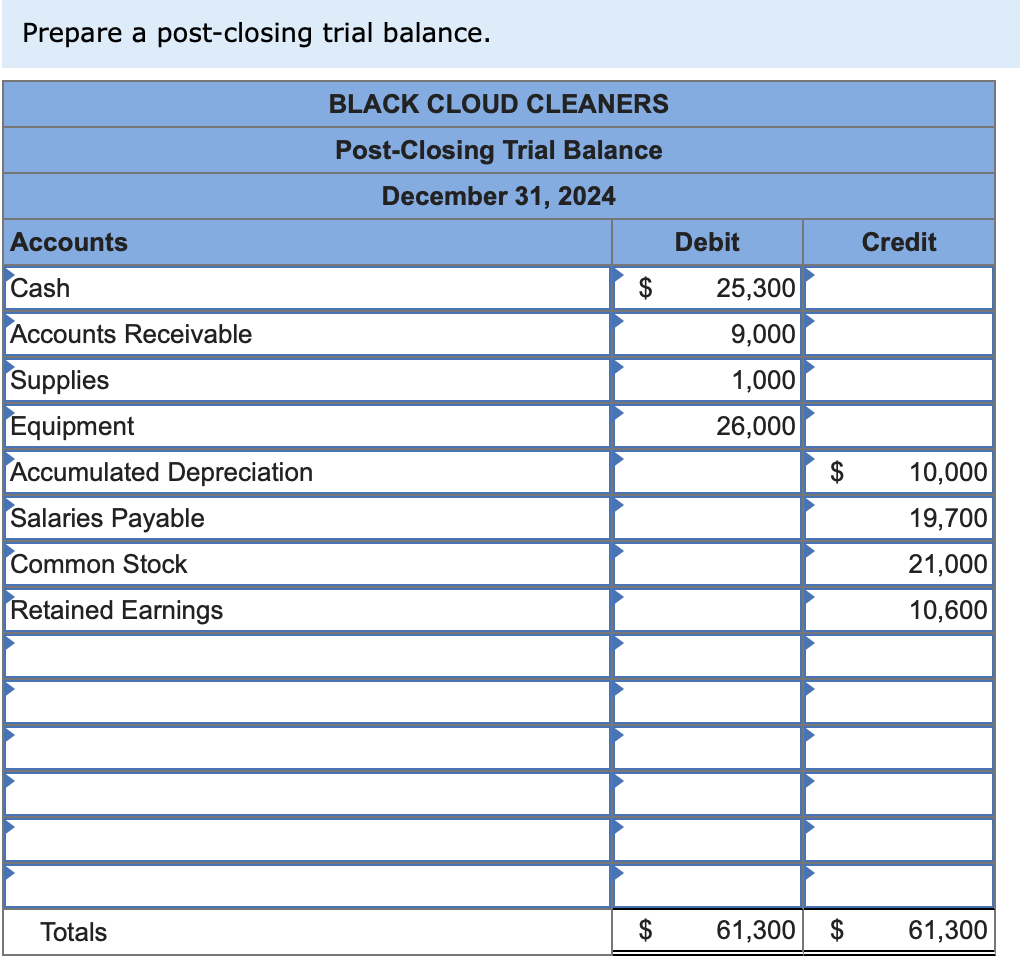

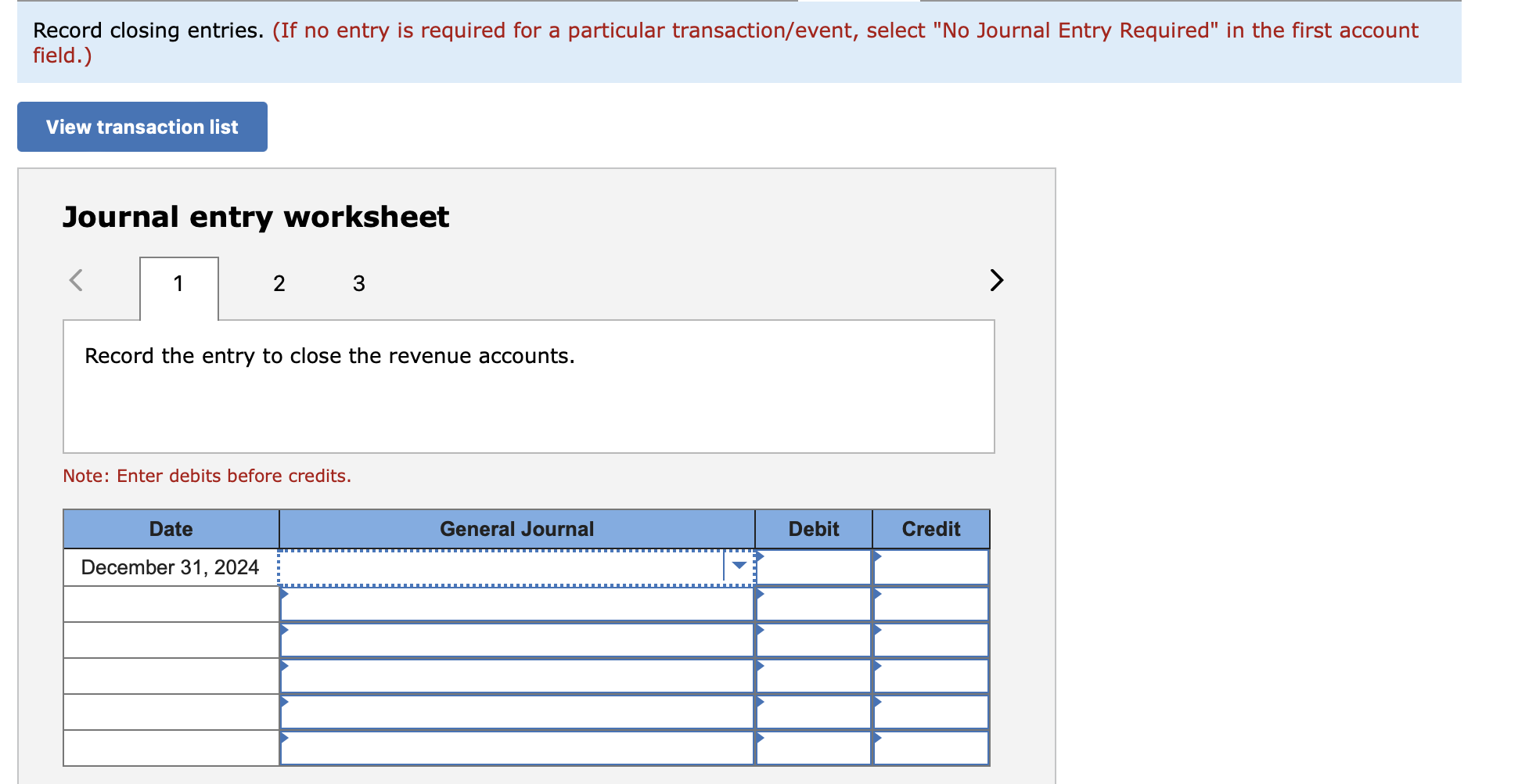

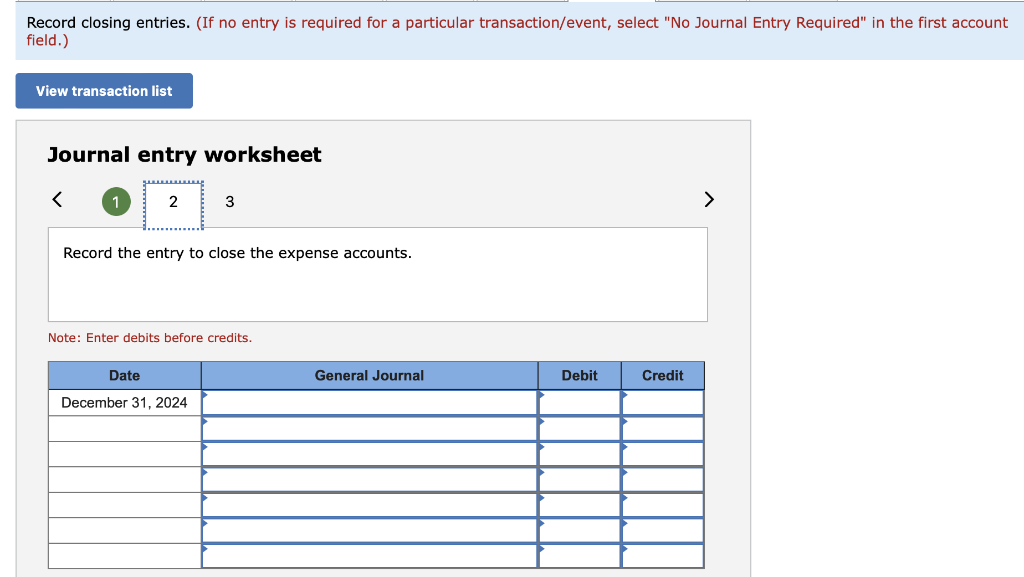

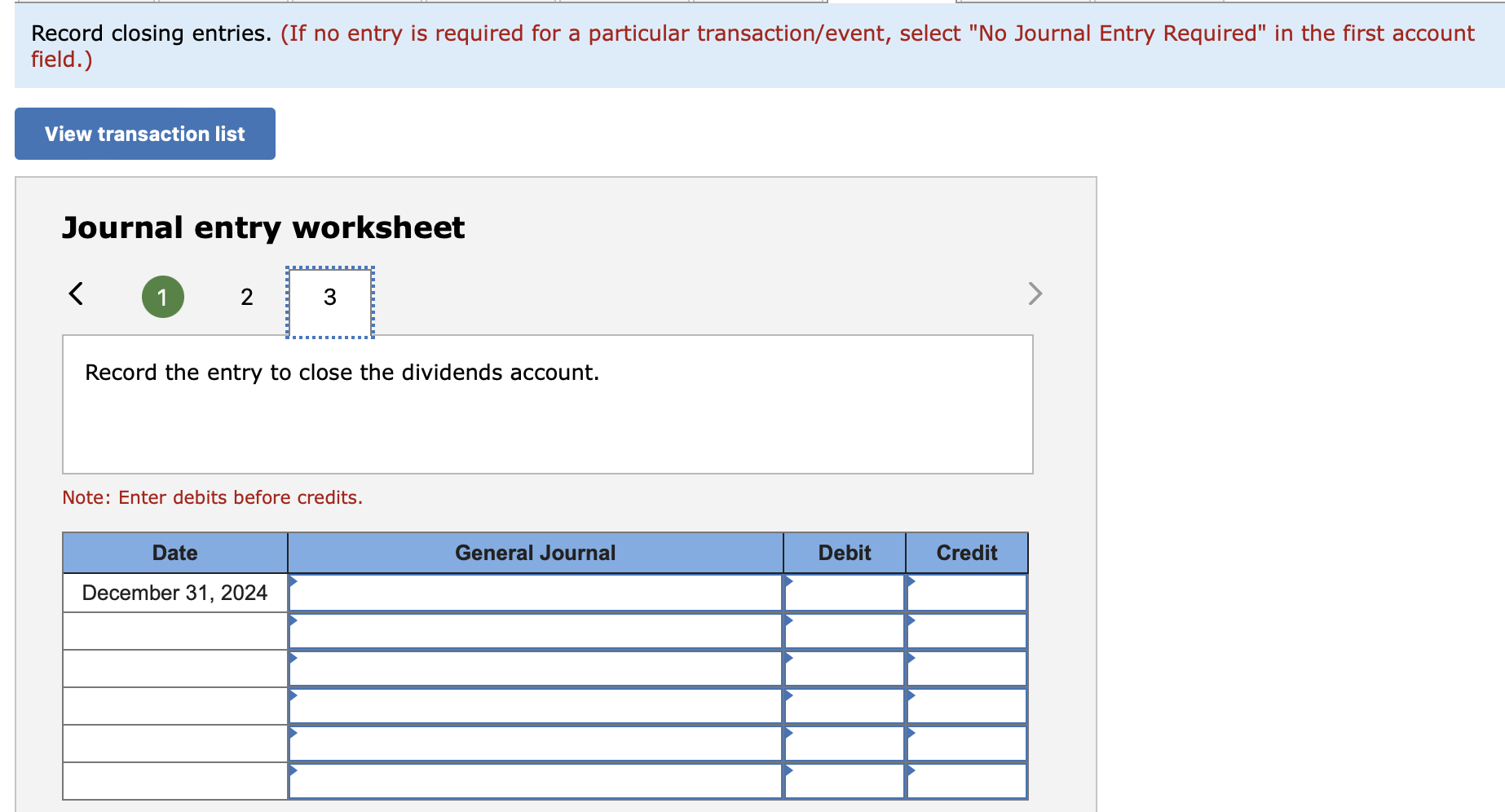

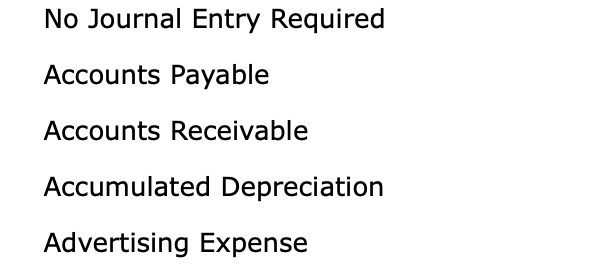

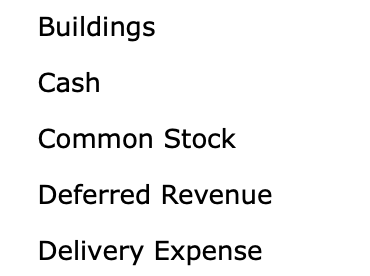

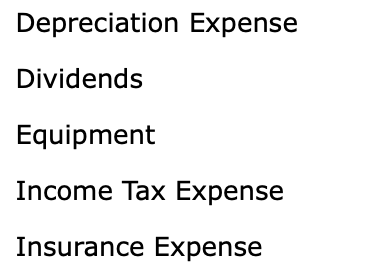

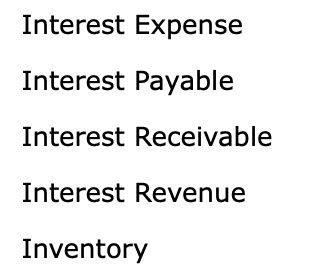

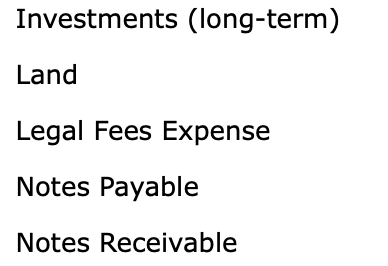

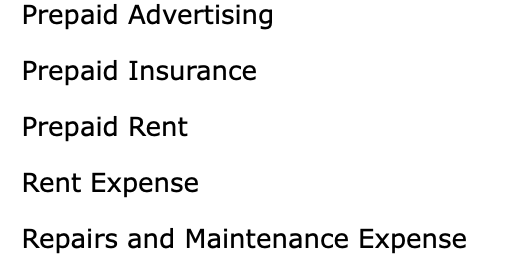

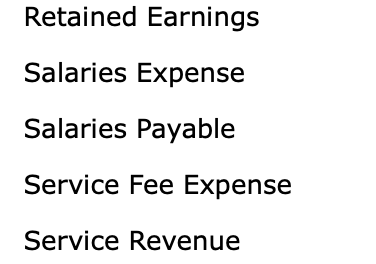

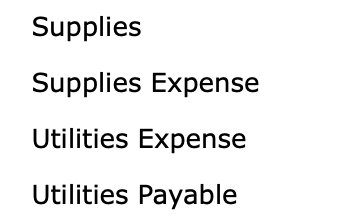

The general ledger of Black Cloud Cleaners at January 1, 2024, includes the following account balances: The following is a summary of the transactions for the year: 1. March 12 Provide services to customers, $40,000, of which $19,000 is on account. 2. May 2 Collect on accounts receivable, $16,000. 3. June 30 Issue shares of common stock in exchange for $6,000 cash. 4. August 1 Pay salaries of $9,500 from 2023 (prior year). 5. September 25 Pay repairs and maintenance expenses, $11,000. 6. October 19 Purchase equipment for $6,000 cash. 7. December 30 Pay $1,200 cash dividends to stockholders. Prepare an unadjusted trial balance. Record adjusting entries. Accrued salaries at year-end amounted to $19,700. Depreciation for the year on the equipment is $3,000. Office supplies remaining on hand at the end of the year equal $1,000. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) Prepare an adjusted trial balance. Prepare the income statement for the year ended December 31, 2024. Prepare the classified balance sheet for the year ended December 31, 2024. (Amounts to be deducted should be indicated by a minus sign.) Post the transactions, adjusting entries and closing entries to the T-accounts. Be sure to include beginning balances. \begin{tabular}{|l|r|r|r|} \hline \multicolumn{2}{|c|}{ Depreciation Expense } \\ \hline \multicolumn{2}{|c|}{ Debit } & & \\ \hline Beginning Balance & & & \multicolumn{2}{|c|}{ Credit } \\ \hline December 31 & 3,000 & 3,000 & December 31 \\ \hline & & 0 \\ \hline Ending Balance & & \\ \hline \end{tabular} Prepare a post-closing trial balance. Record closing entries. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) Journal entry worksheet Note: Enter debits before credits. Record closing entries. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) Journal entry worksheet Record the entry to close the expense accounts. Note: Enter debits before credits. Record closing entries. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) Journal entry worksheet Note: Enter debits before credits. No Journal Entry Required Accounts Payable Accounts Receivable Accumulated Depreciation Advertising Expense Buildings Cash Common Stock Deferred Revenue Delivery Expense Depreciation Expense Dividends Equipment Income Tax Expense Insurance Expense Interest Expense Interest Payable Interest Receivable Interest Revenue Inventory Investments (long-term) Land Legal Fees Expense Notes Payable Notes Receivable Prepaid Advertising Prepaid Insurance Prepaid Rent Rent Expense Repairs and Maintenance Expense Retained Earnings Salaries Expense Salaries Payable Service Fee Expense Service Revenue Supplies Supplies Expense Utilities Expense Utilities Payable

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started