Answered step by step

Verified Expert Solution

Question

1 Approved Answer

can you please do all work in steps on a paper if possible Exercises: The Foreign Exchange Market and Exchange Rate Determination EXERCISE 7 (Exchange

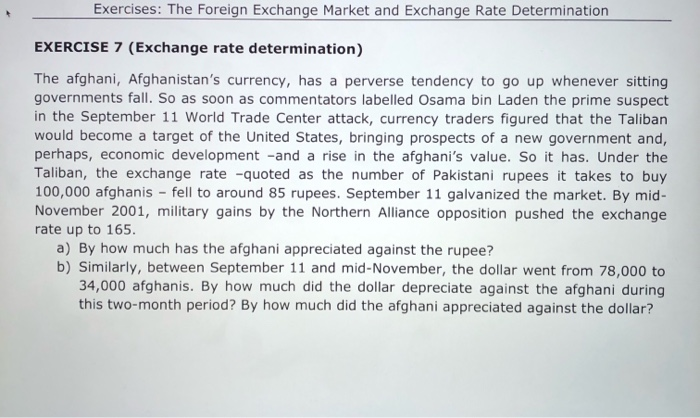

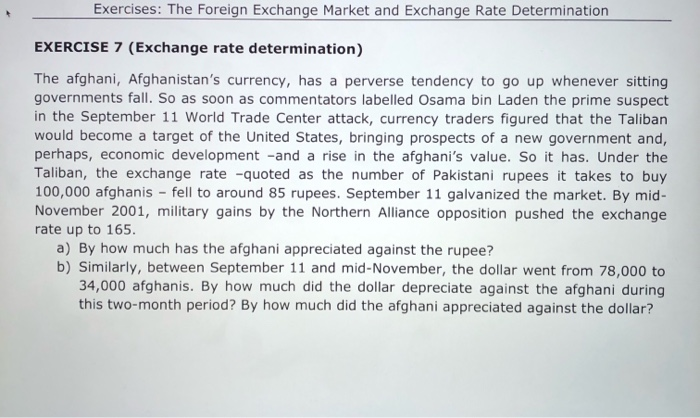

can you please do all work in steps on a paper if possible  Exercises: The Foreign Exchange Market and Exchange Rate Determination EXERCISE 7 (Exchange rate determination) The afghani, Afghanistan's currency, has a perverse tendency to go up whenever sitting governments fall. So as soon as commentators labelled Osama bin Laden the prime suspect in the September 11 World Trade Center attack, currency traders figured that the Taliban would become a target of the United States, bringing prospects of a new government and, perhaps, economic development -and a rise in the afghani's value. So it has. Under the Taliban, the exchange rate -quoted as the number of Pakistani rupees it takes to buy 100,000 afghanis - fell to around 85 rupees. September 11 galvanized the market. By mid- November 2001, military gains by the Northern Alliance opposition pushed the exchange rate up to 165. a) By how much has the afghani appreciated against the rupee? b) Similarly, between September 11 and mid-November, the dollar went from 78,000 to 34,000 afghanis. By how much did the dollar depreciate against the afghani during this two-month period? By how much did the afghani appreciated against the dollar

Exercises: The Foreign Exchange Market and Exchange Rate Determination EXERCISE 7 (Exchange rate determination) The afghani, Afghanistan's currency, has a perverse tendency to go up whenever sitting governments fall. So as soon as commentators labelled Osama bin Laden the prime suspect in the September 11 World Trade Center attack, currency traders figured that the Taliban would become a target of the United States, bringing prospects of a new government and, perhaps, economic development -and a rise in the afghani's value. So it has. Under the Taliban, the exchange rate -quoted as the number of Pakistani rupees it takes to buy 100,000 afghanis - fell to around 85 rupees. September 11 galvanized the market. By mid- November 2001, military gains by the Northern Alliance opposition pushed the exchange rate up to 165. a) By how much has the afghani appreciated against the rupee? b) Similarly, between September 11 and mid-November, the dollar went from 78,000 to 34,000 afghanis. By how much did the dollar depreciate against the afghani during this two-month period? By how much did the afghani appreciated against the dollar

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started