can you please do it on excel

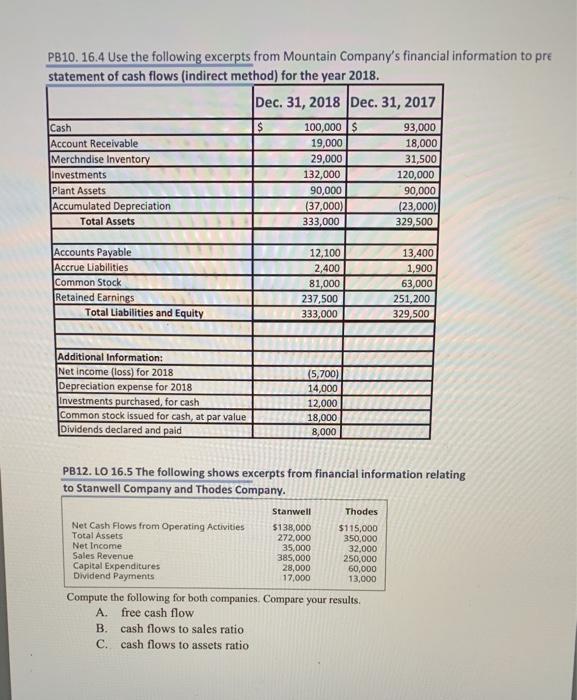

PB10. 16.4 Use the following excerpts from Mountain Company's financial information to pre statement of cash flows (indirect method) for the year 2018. Dec. 31, 2018 Dec 31, 2017 $ Cash Account Receivable Merchndise Inventory Investments Plant Assets Accumulated Depreciation Total Assets 100,000 $ 19,000 29,000 132,000 90,000 (37,000) 333,000 93,000 18,000 31,500 120,000 90,000 (23,000) 329,500 Accounts Payable Accrue Liabilities Common Stock Retained Earnings Total Liabilities and Equity 12,100 2,400 81,000 237,500 333,000 13,400 1,900 63,000 251,200 329,500 Additional Information: Net Income (loss) for 2018 Depreciation expense for 2018 Investments purchased, for cash Common stock issued for cash, at par value Dividends declared and paid (5,700) 14,000 12,000 18,000 8,000 PB12. LO 16.5 The following shows excerpts from financial information relating to Stanwell Company and Thodes Company, Stanwell Thodes Net Cash Flows from Operating Activities $138,000 $115,000 Total Assets 272,000 350,000 Net Income 35,000 32.000 Sales Revenue 385,000 250,000 Capital Expenditures 28,000 60,000 Dividend Payments 17,000 13,000 Compute the following for both companies. Compare your results. A. free cash flow B. cash flows to sales ratio C. cash flows to assets ratio PB10. 16.4 Use the following excerpts from Mountain Company's financial information to pre statement of cash flows (indirect method) for the year 2018. Dec. 31, 2018 Dec 31, 2017 $ Cash Account Receivable Merchndise Inventory Investments Plant Assets Accumulated Depreciation Total Assets 100,000 $ 19,000 29,000 132,000 90,000 (37,000) 333,000 93,000 18,000 31,500 120,000 90,000 (23,000) 329,500 Accounts Payable Accrue Liabilities Common Stock Retained Earnings Total Liabilities and Equity 12,100 2,400 81,000 237,500 333,000 13,400 1,900 63,000 251,200 329,500 Additional Information: Net Income (loss) for 2018 Depreciation expense for 2018 Investments purchased, for cash Common stock issued for cash, at par value Dividends declared and paid (5,700) 14,000 12,000 18,000 8,000 PB12. LO 16.5 The following shows excerpts from financial information relating to Stanwell Company and Thodes Company, Stanwell Thodes Net Cash Flows from Operating Activities $138,000 $115,000 Total Assets 272,000 350,000 Net Income 35,000 32.000 Sales Revenue 385,000 250,000 Capital Expenditures 28,000 60,000 Dividend Payments 17,000 13,000 Compute the following for both companies. Compare your results. A. free cash flow B. cash flows to sales ratio C. cash flows to assets ratio