Answered step by step

Verified Expert Solution

Question

1 Approved Answer

CAN YOU PLEASE EXPLAIN EACH STEP HOW YOU DO THIS QUESTION IN DEATALED WAY PLEASE DO NOT COPY PAST FROM SOMEWHERE THANKS Case Study -2

CAN YOU PLEASE EXPLAIN EACH STEP HOW YOU DO THIS QUESTION IN DEATALED WAY PLEASE DO NOT COPY PAST FROM SOMEWHERE THANKS

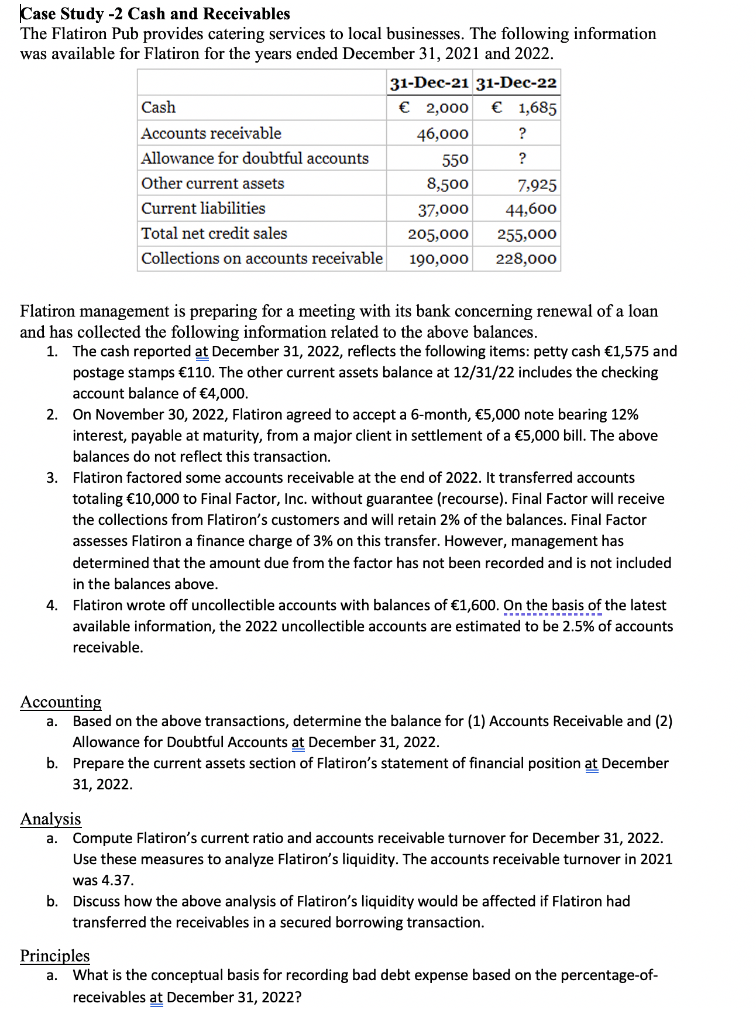

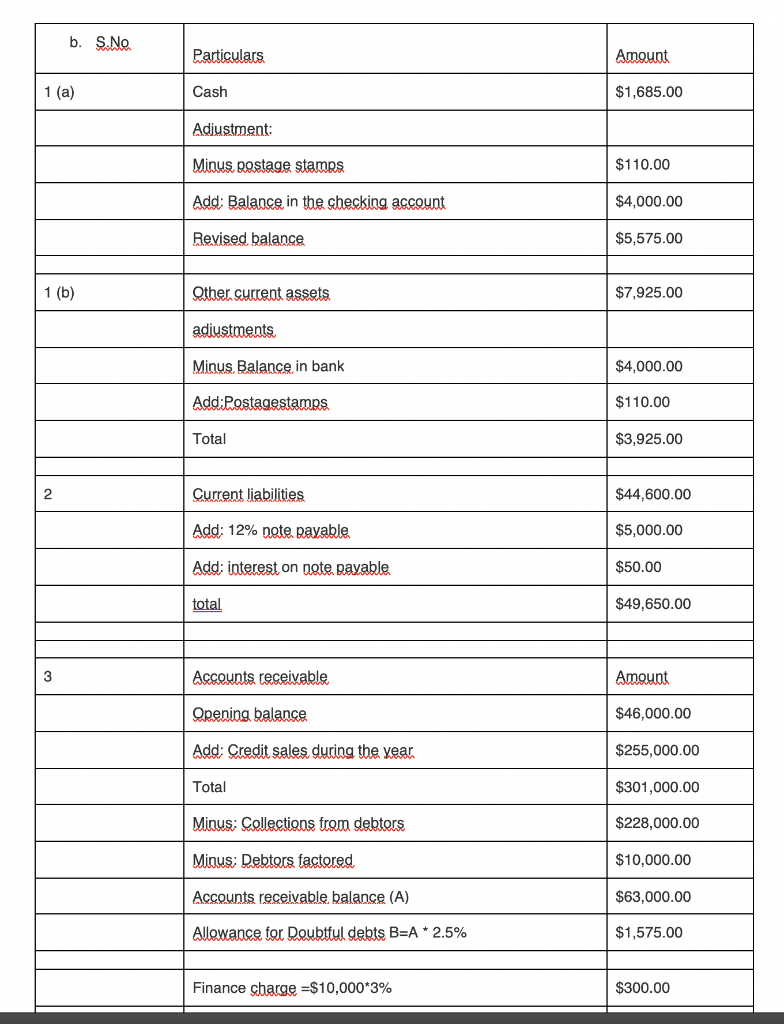

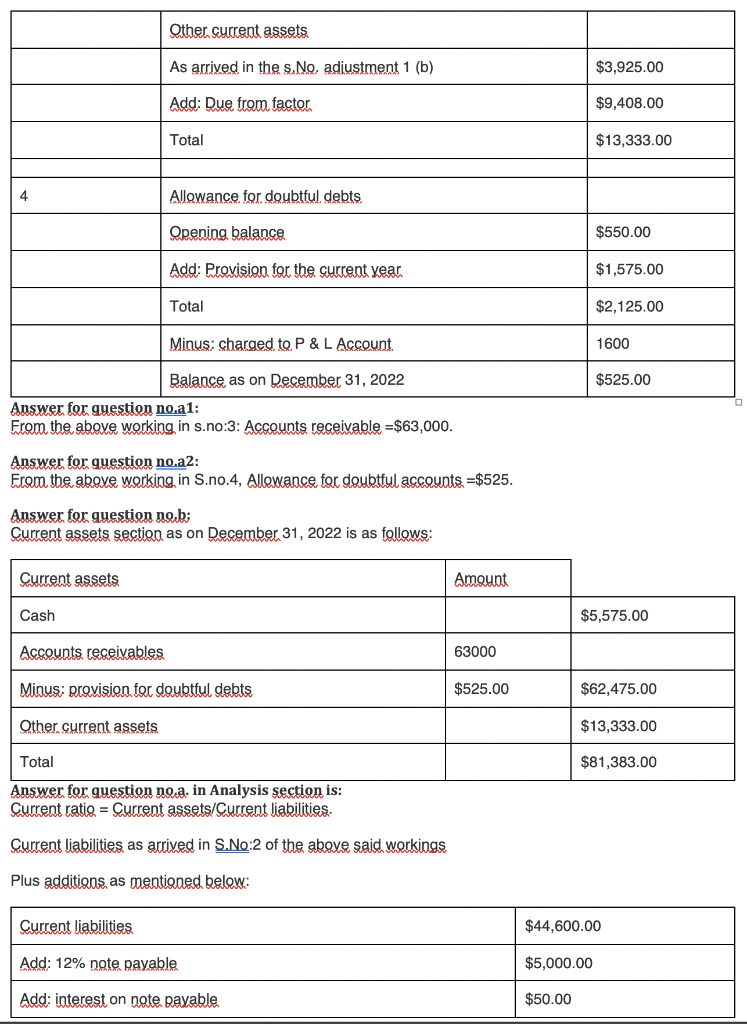

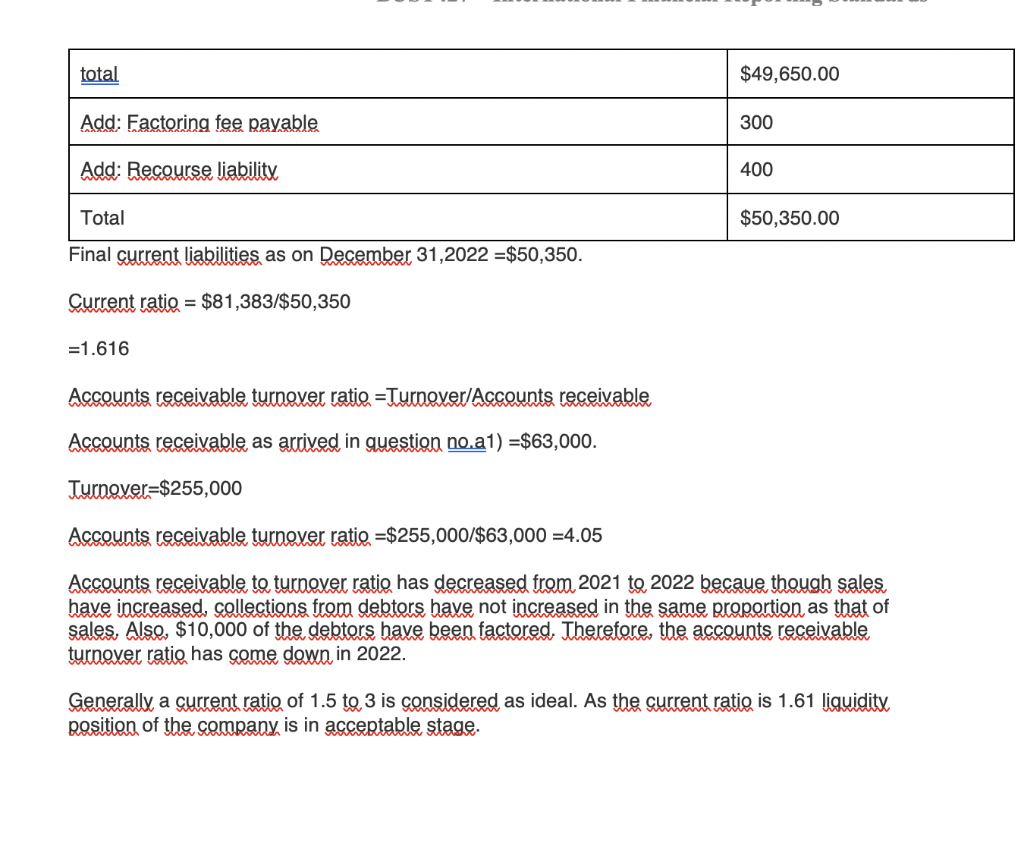

Case Study -2 Cash and Receivables The Flatiron Pub provides catering services to local businesses. The following information was available for Flatiron for the years ended December 31, 2021 and 2022. 31-Dec-21 31-Dec-22 Cash 2,000 1,685 Accounts receivable 46,000 ? Allowance for doubtful accounts 550 ? Other current assets 8,500 7,925 Current liabilities 37,000 44,600 Total net credit sales 205,000 255,000 Collections on accounts receivable 190,000 228,000 Flatiron management is preparing for a meeting with its bank concerning renewal of a loan and has collected the following information related to the above balances. 1. The cash reported at December 31, 2022, reflects the following items: petty cash 1,575 and postage stamps 110. The other current assets balance at 12/31/22 includes the checking account balance of 4,000. 2. On November 30, 2022, Flatiron agreed to accept a 6-month, 5,000 note bearing 12% interest, payable at maturity, from a major client in settlement of a 5,000 bill. The above balances do not reflect this transaction. 3. Flatiron factored some accounts receivable at the end of 2022. It transferred accounts totaling 10,000 to Final Factor, Inc. without guarantee (recourse). Final Factor will receive the collections from Flatiron's customers and will retain 2% of the balances. Final Factor assesses Flatiron a finance charge of 3% on this transfer. However, management has determined that the amount due from the factor has not been recorded and is not included in the balances above. 4. Flatiron wrote off uncollectible accounts with balances of 1,600. On the basis of the latest available information, the 2022 uncollectible accounts are estimated to be 2.5% of accounts receivable. Accounting a. Based on the above transactions, determine the balance for (1) Accounts Receivable and (2) Allowance for Doubtful Accounts at December 31, 2022. b. Prepare the current assets section of Flatiron's statement of financial position at December 31, 2022. Analysis a. Compute Flatiron's current ratio and accounts receivable turnover for December 31, 2022. Use these measures to analyze Flatiron's liquidity. The accounts receivable turnover in 2021 was 4.37. b. Discuss how the above analysis of Flatiron's liquidity would be affected if Flatiron had transferred the receivables in a secured borrowing transaction. Principles a. What is the conceptual basis for recording bad debt expense based on the percentage-of- receivables at December 31, 2022? b. S.No Particulars Amount 1 (a) Cash $1,685.00 Adjustment: Minus postage stamps $110.00 Add: Balance in the checking account $4,000.00 Revised balance $5,575.00 1 (b) Other current assets $7,925.00 adiustments Minus Balance in bank $4,000.00 Add:Postagestamps $110.00 Total $3,925.00 2 Current liabilities $44,600.00 Add: 12% note payable $5,000.00 Add: interest on note payable $50.00 total $49,650.00 3 Accounts receivable Amount Opening balance $46,000.00 Add: Credit sales during the year $255,000.00 Total $301,000.00 Minus; Collections from debtors $228,000.00 Minus; Debtors factored $10,000.00 Accounts receivable balance (A) $63,000.00 Allowance for Doubtful debts B=A* 2.5% $1,575.00 Finance charge=$10,000*3% $300.00 Other current assets As arrived in the s.No, adiustment 1 (b) $3,925.00 Add: Due from factor $9,408.00 Total $13,333.00 4 Allowance for doubtful debts, Opening balance $550.00 Add: Provision for the current year $1,575.00 Total $2,125.00 Minus: charged to P & L Account 1600 Balance as on December 31, 2022 $525.00 Answer for guestion no.a1: From the above working in s.no:3: Accounts receivable =$63,000. Answer for question no.a2: From the above working in S.no.4, Allowance for doubtful accounts =$525. Answer for question na.b; Current assets section as on December 31, 2022 is as follows: Current assets Amount Cash $5,575.00 Accounts receivables 63000 Minus: provision for doubtful debts $525.00 $62,475.00 Other current assets $13,333.00 Total $81,383.00 Answer for question no.a. in Analysis section is: Current ratio = Current assets/Current liabilities: Current liabilities as arrived in S. No:2 of the above said workings Plus additions, as mentioned below: Current liabilities $44,600.00 Add: 12% note payable $5,000.00 Add: interest on note payable $50.00 total $49,650.00 Add: Factoring fee payable 300 Add: Recourse liability 400 Total $50,350.00 Final current liabilities as on December 31,2022 =$50,350. Current ratio = $81,383/$50,350 =1.616 Accounts receivable turnover ratio =Turnover/Accounts receivable Accounts receivable as arrived in question no.al) =$63,000. Turnover=$255,000 Accounts receivable turnover ratio =$255,000/$63,000 =4.05 Accounts receivable to turnover ratio has decreased from 2021 to 2022 becaue though sales, have increased, collections from debtors have not increased in the same proportion as that of sales. Also, $10,000 of the debtors have been factored. Therefore, the accounts receivable turnover ratio has come down in 2022. Generally a current ratio of 1.5 to 3 is considered as ideal. As the current ratio is 1.61 liquidity position of the company is in acceptable stageStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started