can you please explain how you get the answer for part 3

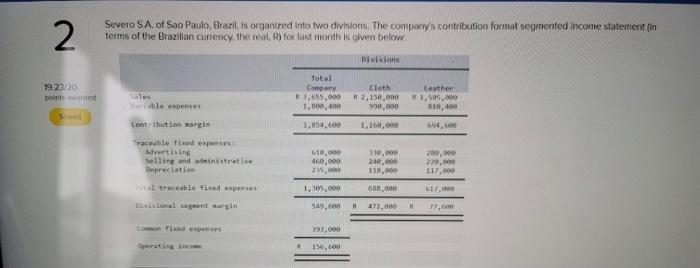

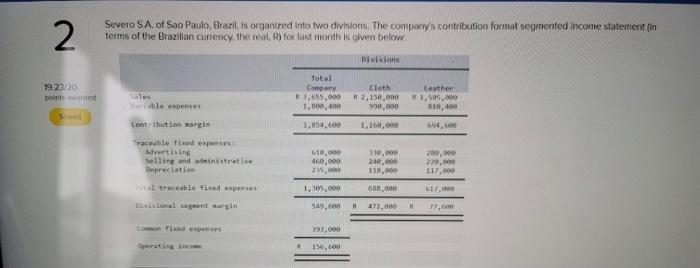

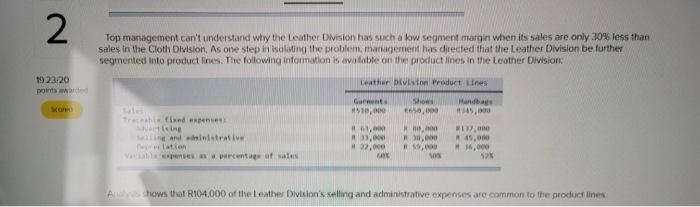

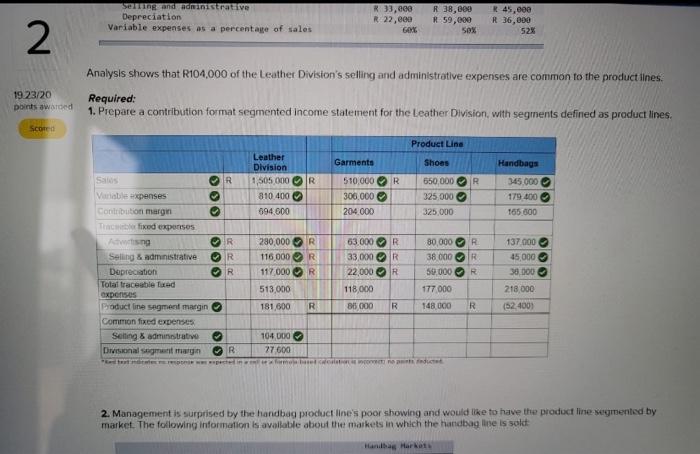

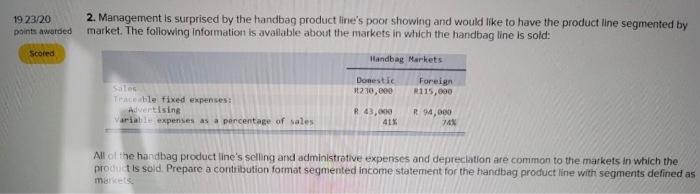

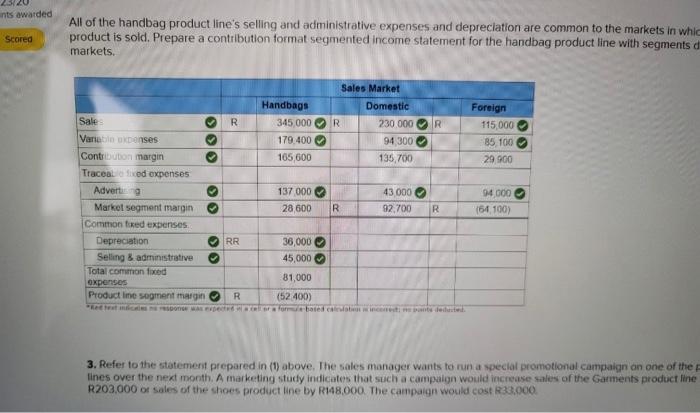

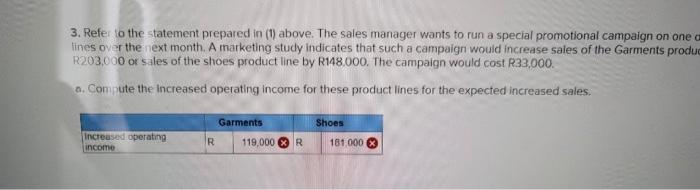

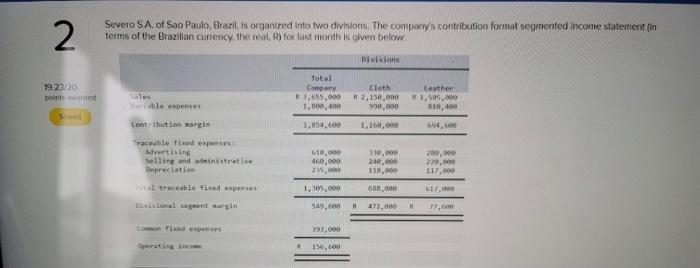

2 Severo SA of Sao Paulo, Brazil, is organized into two divisions. The company's contribution format segmented income statement in terms of the Brazilian currency, the real, R for last month is given below Divonis 19 23:20 powded Total Copy 3,655.000 1.500,00 Cloth 12,150,000 990.000 Leather R 1.505.000 110,00 Vable expenses 1,854,600 1,160,00 694. Contribution margin raceable the expect Advertising Selling and ministrative Depreciati 610.000 460,000 21,00 330,000 240.000 115,00 650,000 289,00 220,00 117.000 1,305,000 beslotal punt margin 50.000 11.600 191,00 156,00 2 Top management can't understand why the Leather Division has such a low segment margin when its sales are only 30% less than Sales in the Cloth Division As one step in isolating the problem, management has directed that the Leather Division be further segmented into product lines. The following information available on the product lines in the Leather Division 19 23:20 po Leather Division Product Lines Gart $10,000 Show 650,000 R$45,000 Fixed R. and ministrative lotion # 33. #2,000 Hone 49,00 16,000 000 sos Ahows that R104,000 of the leather Division's selling and administrative expenses are common to the product lines ses and administrave Depreciation Variable expenses as a percentage of sales R 33, co R 22, eco GM R 38,800 R 59,000 50% R 45,000 R 36,000 52% 2 1923/20 points award Analysis shows that R104,000 of the Leather Division's selling and administrative expenses are common to the product lines. Required: 1. Prepare a contribution format segmented income statement for the Leather Division, with segments defined as product lines. Scored Product Line Garments Shoes Handbags R Leather Division 1,505.000 810 400 694 600 510,000R 306.000 204 000 650,000 R 325.000 325 000 345.000 179 400 165.000 280,000 R Sals R Vanexpenses Contribution margin The fixed expenses R Selling & administrative R Depreciation OR Total traceable Tocad Oxenses Product line segment margin Common fixed expenses Selling & administrative Donalagang R 116 000R 117.000 R 63.000 R 33,000 R 22000 R 80,000 R 38 000 R 50.000 R 137.000 45,000 30.000 218 000 (52.400) OOO 177 000 513,000 181 800 118,000 85000 R R 148 000 R . 104 000 27600 Konce 2. Management is surprised by the handbag product line's poor showing and would like to have the product line segmented by market. The following information is available about the markets in which the handbag line is sold 1923/20 points awarded 2. Management is surprised by the handbag product line's poor showing and would like to have the product line segmented by market. The following information is available about the markets in which the handbag line is sold: Handbag Markets Scored Domestic 230,000 Foreign R115,000 Sales Techle fixed expenses: Advertising Variable expenses as a percentage of Sales R 43, 41% RM,000 24 All of the handbag product line's selling and administrative expenses and depreciation are common to the markets in which the prodhtis sold. Prepare a contribution format segmented income statement for the handbag product line with segments defined as mark nts awarded All of the handbag product line's seling and administrative expenses and depreciation are common to the markets in whic product is sold. Prepare a contribution format segmented income statement for the handbag product line with segments d Scored markets, R R Sales Market Domestic 230 000 94300 135,700 Handbags 345 000 179.400 165,600 R Foreign 115,000 85 100 29.900 O Sale Varian konses Contribution margin Traceala fixed expenses Advert Market segment margin Common fixed expenses Depreciation Seling & administrative Total common food oxpenses Product ime segment margin OS 137000 28 600 43 000 92.700 94,000 161 100) R R RR 38,000 45,000 81,000 (52 400) R 3. Refer to the statement prepared in (1) above. The sales manager wants to run a special promotional campaign on one of the lines over the next month. A marketing study indicates that such a campaign would increase sales of the Garments product line R203,000 or sales of the shoes product line by R148,000. The campaign would cost R33.000 3. Refer to the statement prepared in (1) above. The sales manager wants to run a special promotional campaign on one lines over the next month. A marketing study indicates that such a campaign would increase sales of the Garments produc R203,000 or sales of the shoes product line by R148,000. The campaign would cost R33,000. a. Compute the increased operating income for these product lines for the expected increased sales. Shoes Increased operating income Garments R 119,000 R 181 000