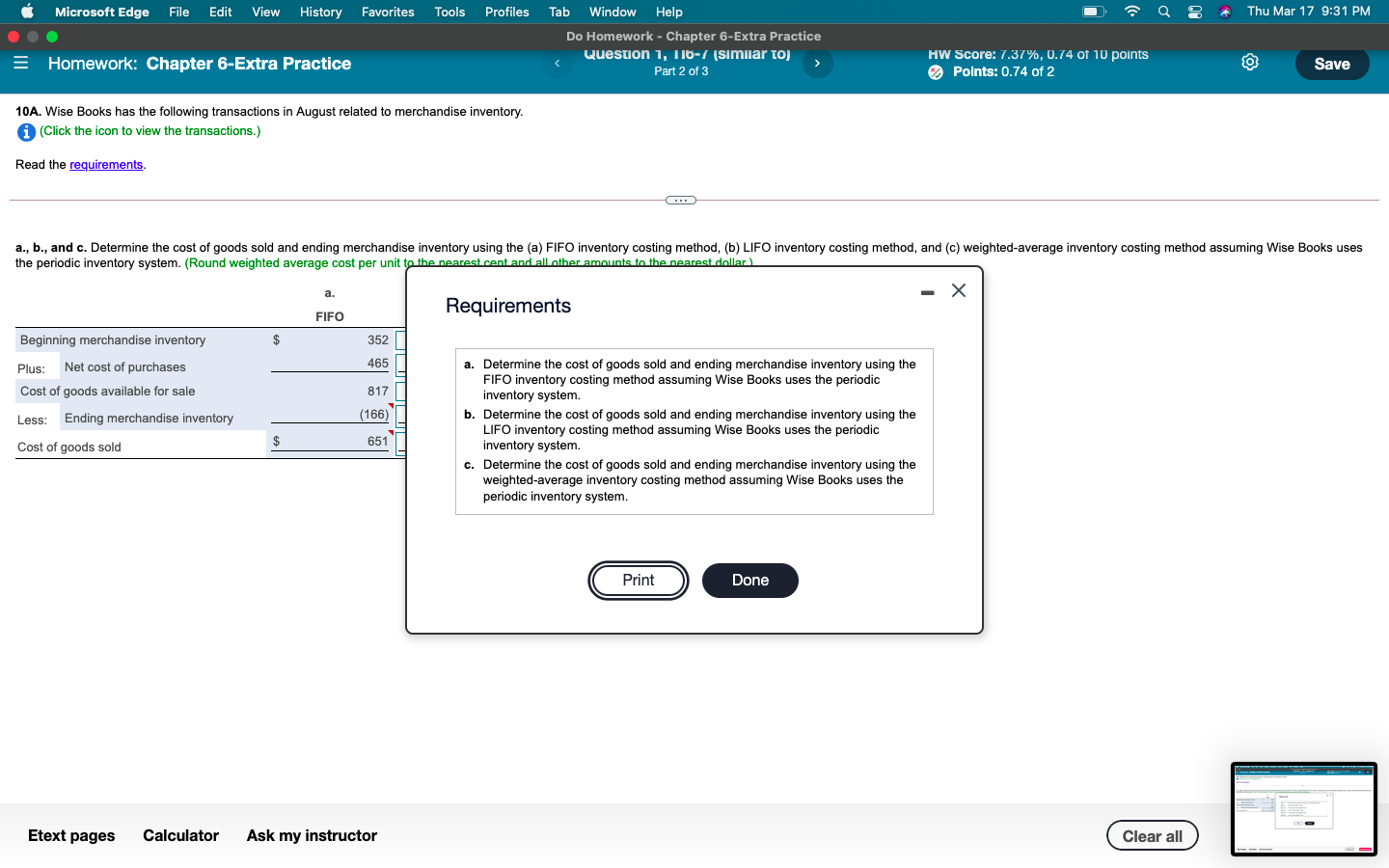

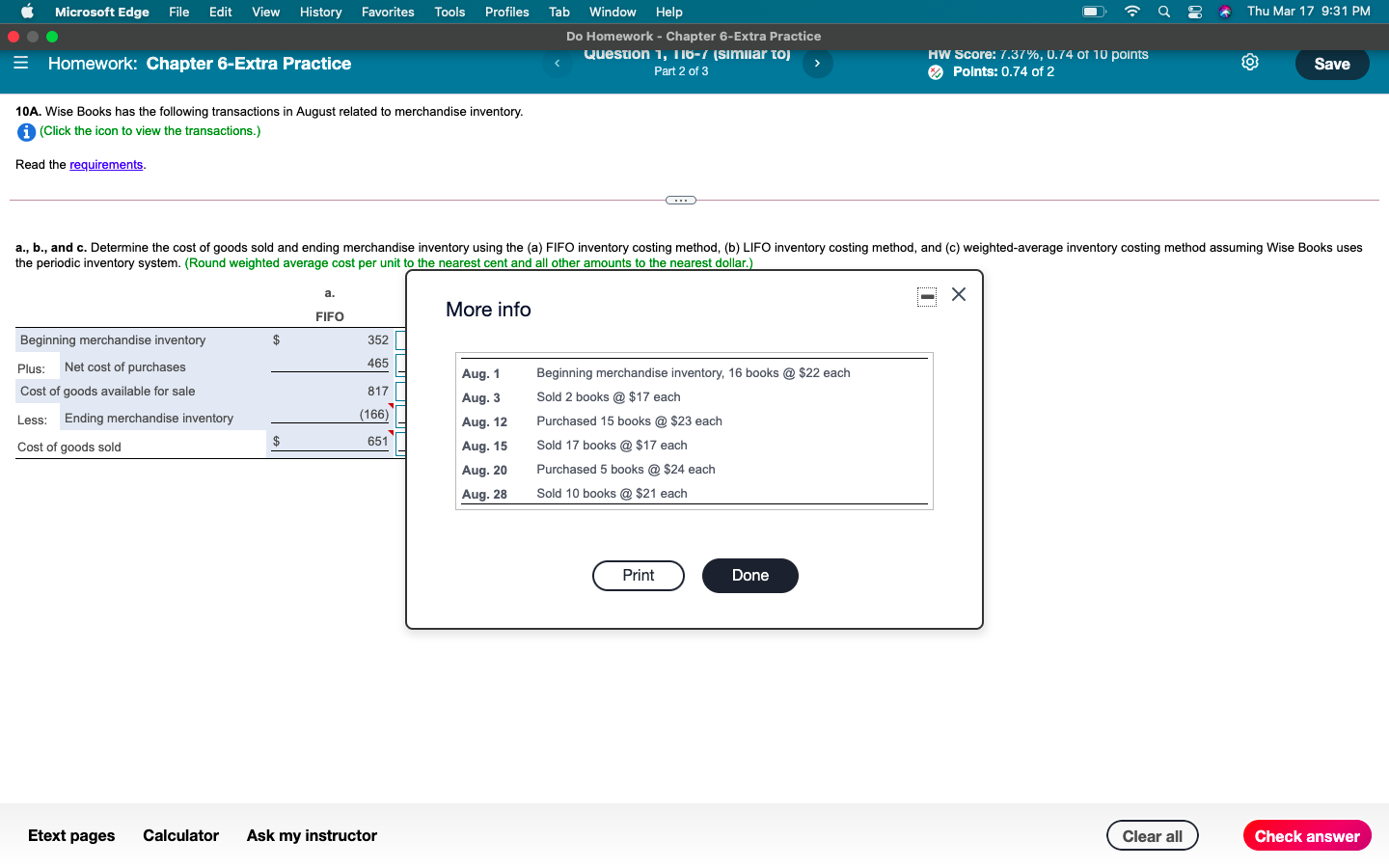

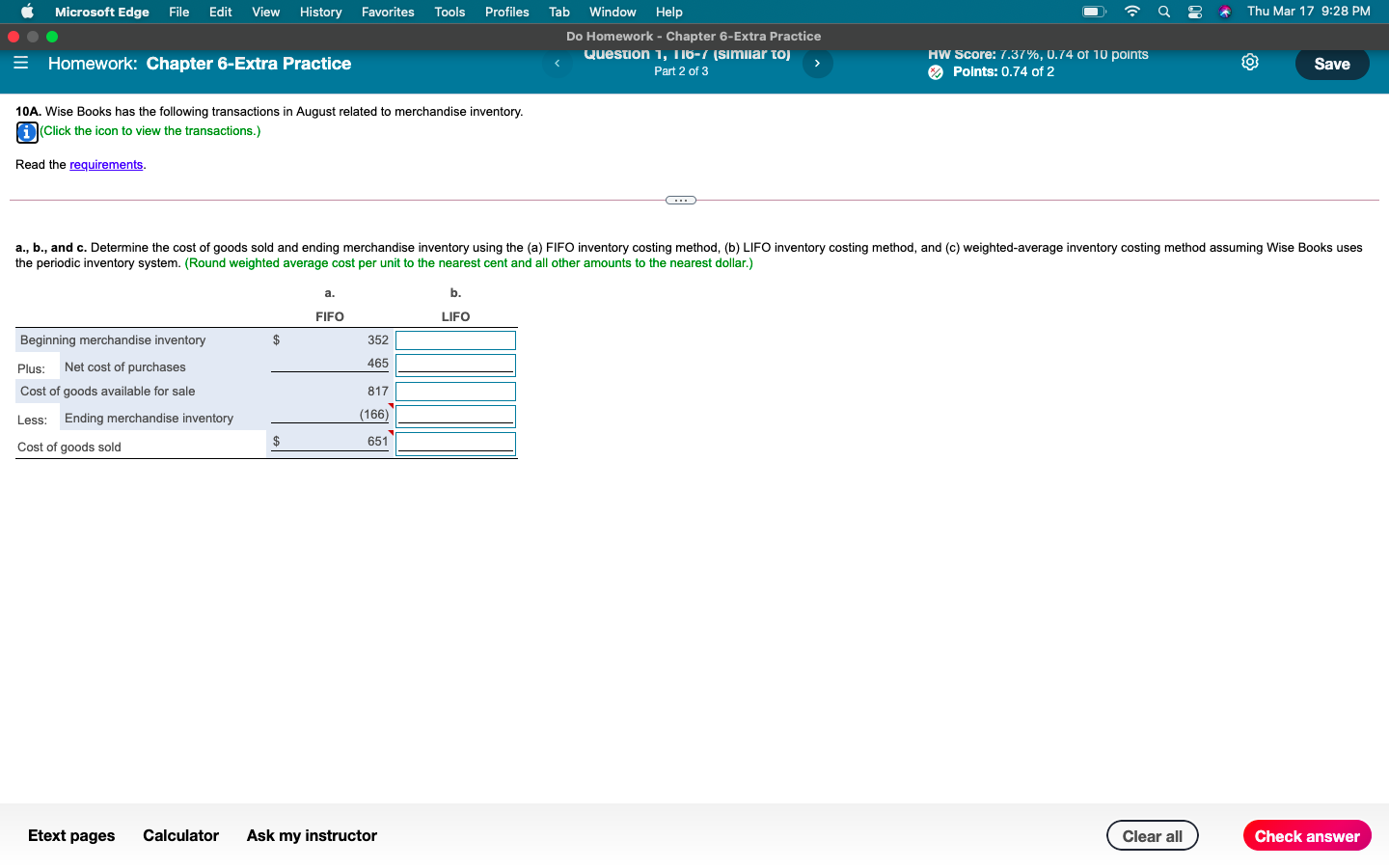

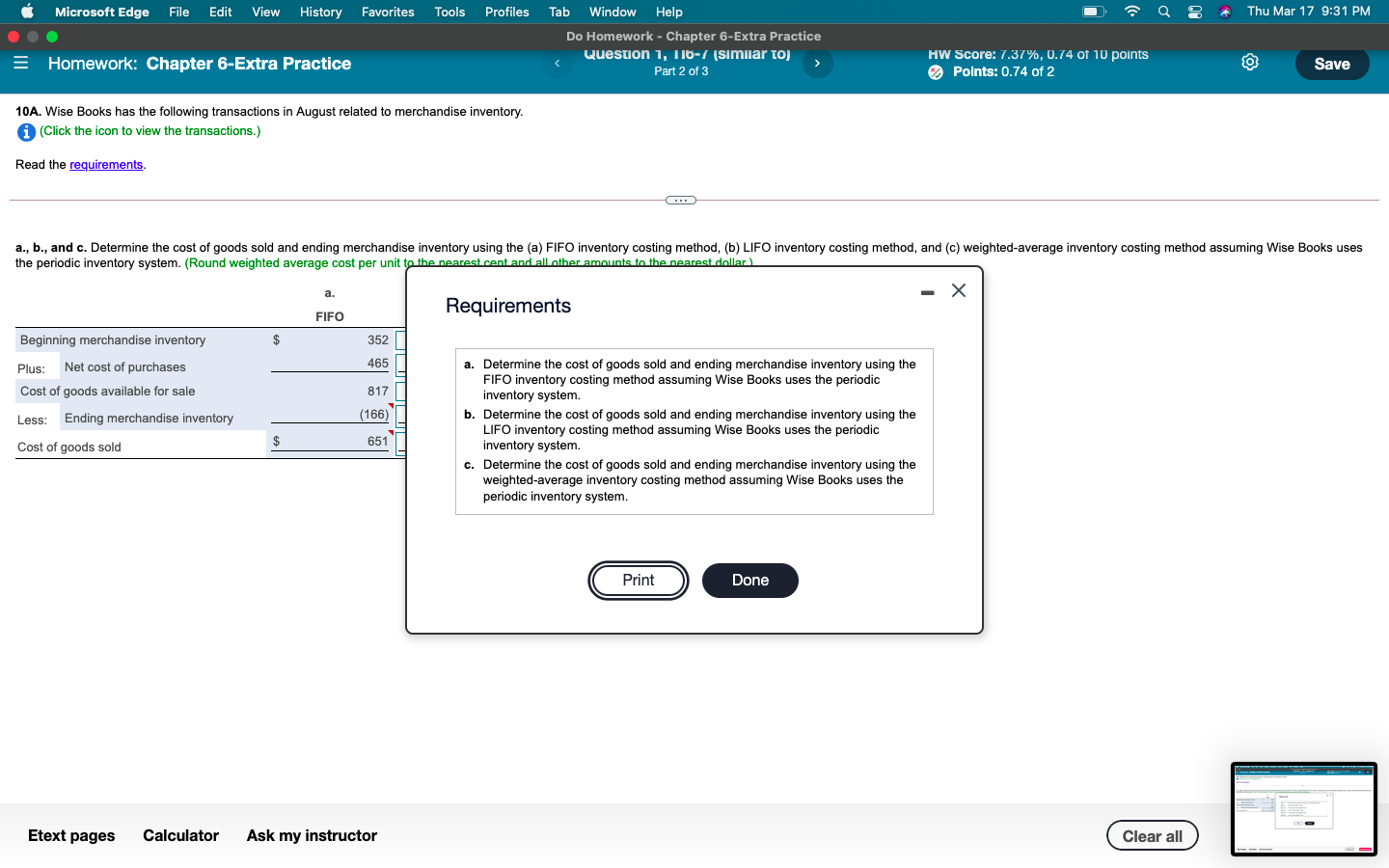

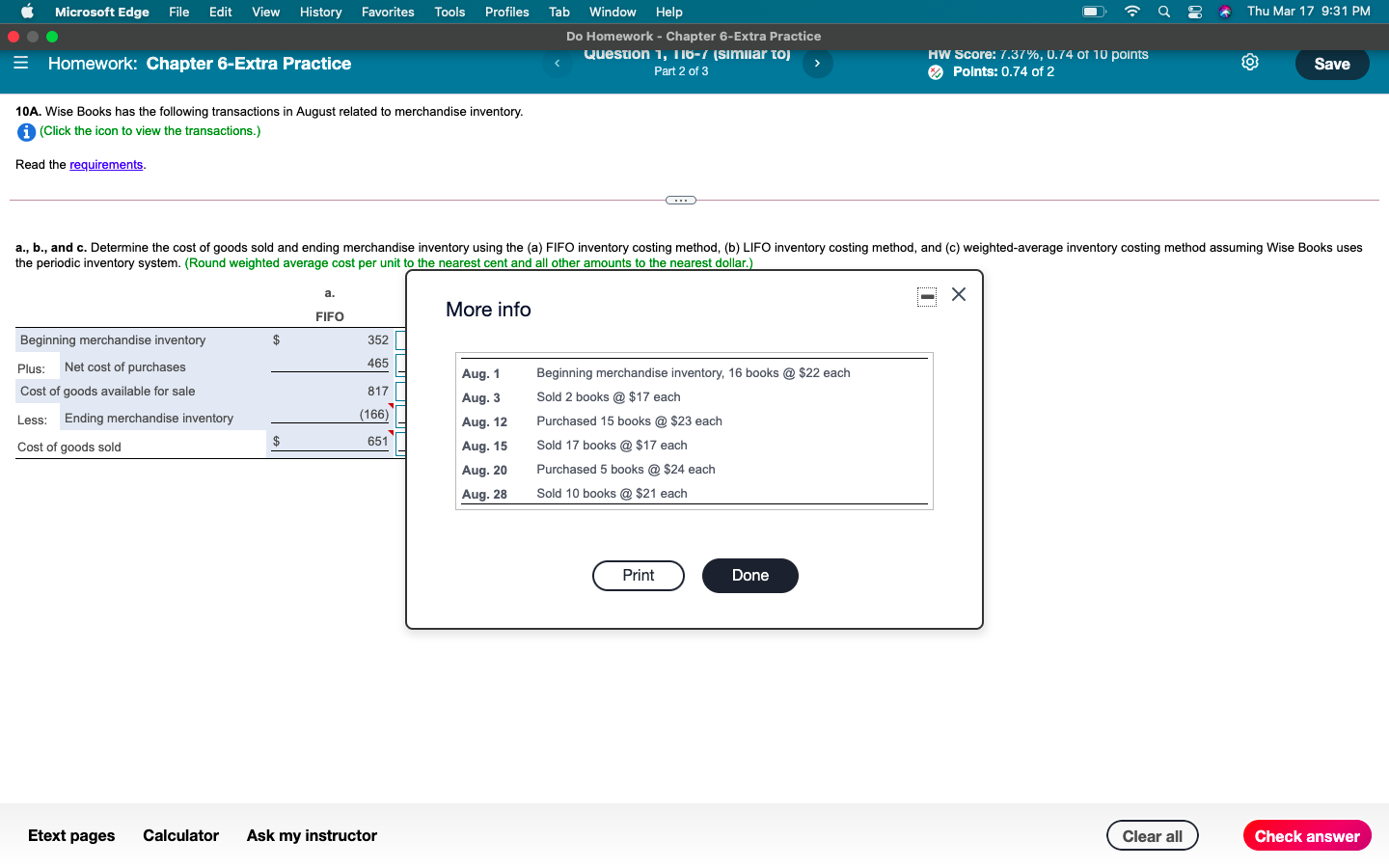

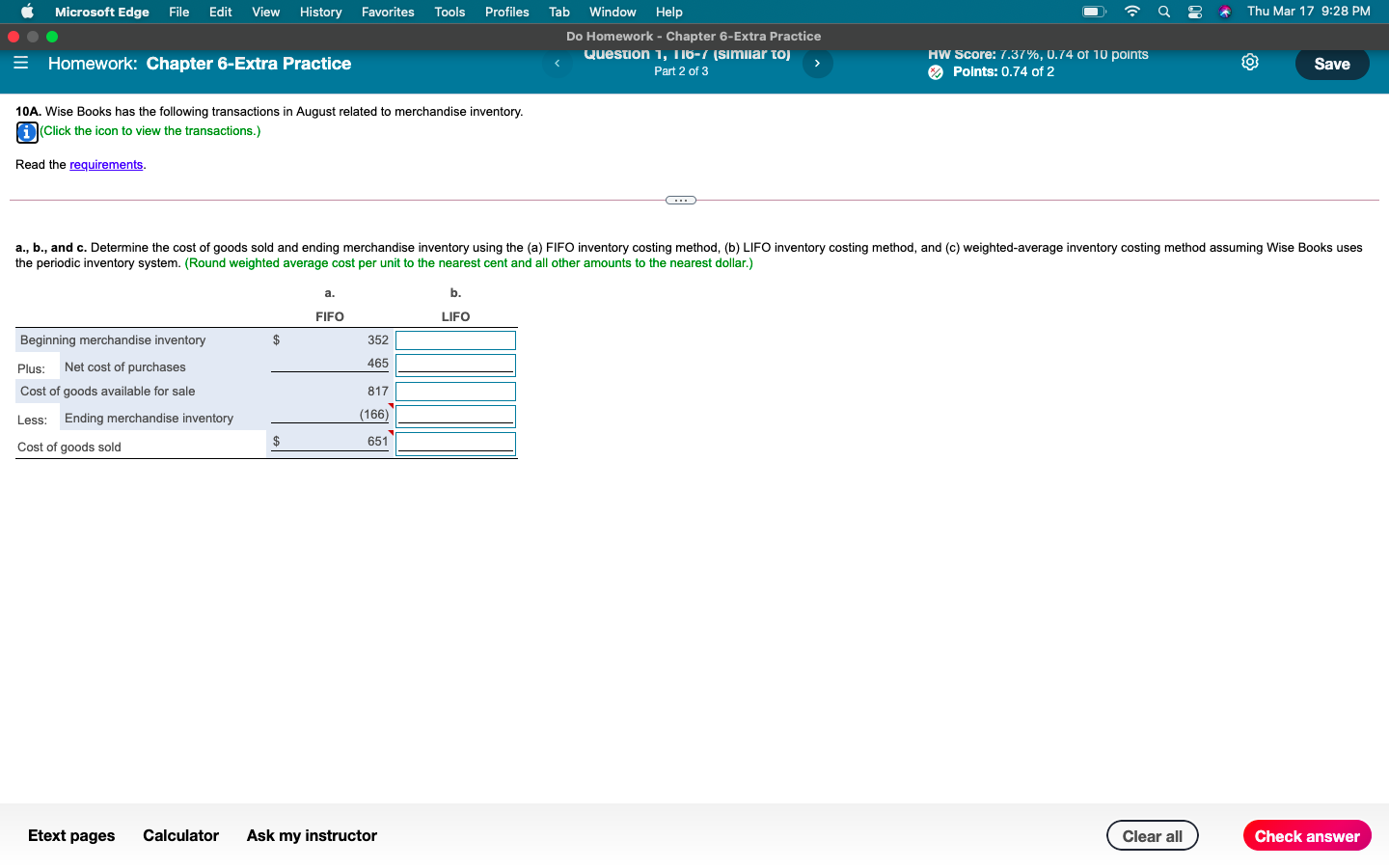

Can you please explain step by step how to calculate these answers especially the less: ending merchandise inventory and weighted average? TIA

Microsoft Edge File Edit View History Favorites Tools Profiles A Thu Mar 17 9:31 PM Tab Window Help Do Homework - Chapter 6-Extra Practice Question 1, 116-1 (similar toj Part 2 of 3 = Homework: Chapter 6-Extra Practice HW Score: 7.37%, 0.74 of 10 points Points: 0.74 of 2 Save 10A. Wise Books has the following transactions in August related to merchandise inventory. (Click the icon to view the transactions.) Read the requirements. .. a., b., and c. Determine the cost of goods sold and ending merchandise inventory using the (a) FIFO inventory costing method, (b) LIFO inventory costing method, and (c) weighted average inventory costing method assuming Wise Books uses the periodic inventory system. (Round weighted average cost per unit to the nearest cent and all other amounts to the nearest dollar) a. - X Requirements FIFO Beginning merchandise inventory $ 352 Plus: Net cost of purchases 465 a. Determine the cost of goods sold and ending merchandise inventory using the FIFO inventory costing method assuming Wise Books uses the periodic Cost of goods available for sale 817 inventory system Less: Ending merchandise inventory (166) b. Determine the cost of goods sold and ending merchandise inventory using the LIFO inventory costing method assuming Wise Books uses the periodic 651 $ Cost of goods sold inventory system. c. Determine the cost of goods sold and ending merchandise inventory using the weighted-average inventory costing method assuming Wise Books uses the periodic inventory system. Print Done Etext pages Calculator Ask my instructor Clear all Microsoft Edge File Edit View History Favorites Tools Profiles A Thu Mar 17 9:31 PM Tab Window Help Do Homework - Chapter 6-Extra Practice Question 1, 116-1 (similar toj Part 2 of 3 = Homework: Chapter 6-Extra Practice HW Score: 7.37%, 0.74 of 10 points Points: 0.74 of 2 Save 10A. Wise Books has the following transactions in August related to merchandise inventory. (Click the icon to view the transactions.) Read the requirements. .. a., b., and c. Determine the cost of goods sold and ending merchandise inventory using the (a) FIFO inventory costing method, (b) LIFO inventory costing method, and (c) weighted average inventory costing method assuming Wise Books uses the periodic inventory system. (Round weighted average cost per unit to the nearest cent and all other amounts to the nearest dollar.) a. More info FIFO $ 352 465 Beginning merchandise inventory Plus: Net cost of purchases Cost of goods available for sale Less: Ending merchandise inventory 817 Beginning merchandise inventory, 16 books @ $22 each Sold 2 books @ $17 each Purchased 15 books @ $23 each (166) Aug. 1 1 Aug. 3 Aug. 12 Aug. 15 Aug. 20 Aug. 28 651 $ Cost of goods sold Sold 17 books @ $17 each Purchased 5 books @ $24 each Sold 10 books @ $21 each Print Done Etext pages Calculator Ask my instructor Clear all Check answer Microsoft Edge File Edit View History Favorites Tools Profiles A Thu Mar 17 9:28 PM Tab Window Help Do Homework - Chapter 6-Extra Practice Question 1, 116-1 (similar toj Part 2 of 3 = Homework: Chapter 6-Extra Practice HW Score: 7.37%, 0.74 of 10 points Points: 0.74 of 2 Save 10A. Wise Books has the following transactions in August related to merchandise inventory. Click the icon to view the transactions.) Read the requirements. .. a., b., and c. Determine the cost of goods sold and ending merchandise inventory using the (a) FIFO inventory costing method, (b) LIFO inventory costing method, and (c) weighted average inventory costing method assuming Wise Books uses the periodic inventory system. (Round weighted average cost per unit to the nearest cent and all other amounts to the nearest dollar.) a. b. FIFO LIFO $ 352 465 Beginning merchandise inventory Plus: Net cost of purchases Cost of goods available for sale Less: Ending merchandise inventory 817 (166) $ 651 Cost of goods sold Etext pages Calculator Ask my instructor Clear all Check