Question: Can you please explain this process? I'm stuck on calculating the carrying costs of recievables and need help with calculating the incremental after tax cost

Can you please explain this process? I'm stuck on calculating the carrying costs of recievables and need help with calculating the incremental after tax cost associated the change in credit terms. I don't really need help with all of the conceptual questions.

Can you please explain this process? I'm stuck on calculating the carrying costs of recievables and need help with calculating the incremental after tax cost associated the change in credit terms. I don't really need help with all of the conceptual questions.

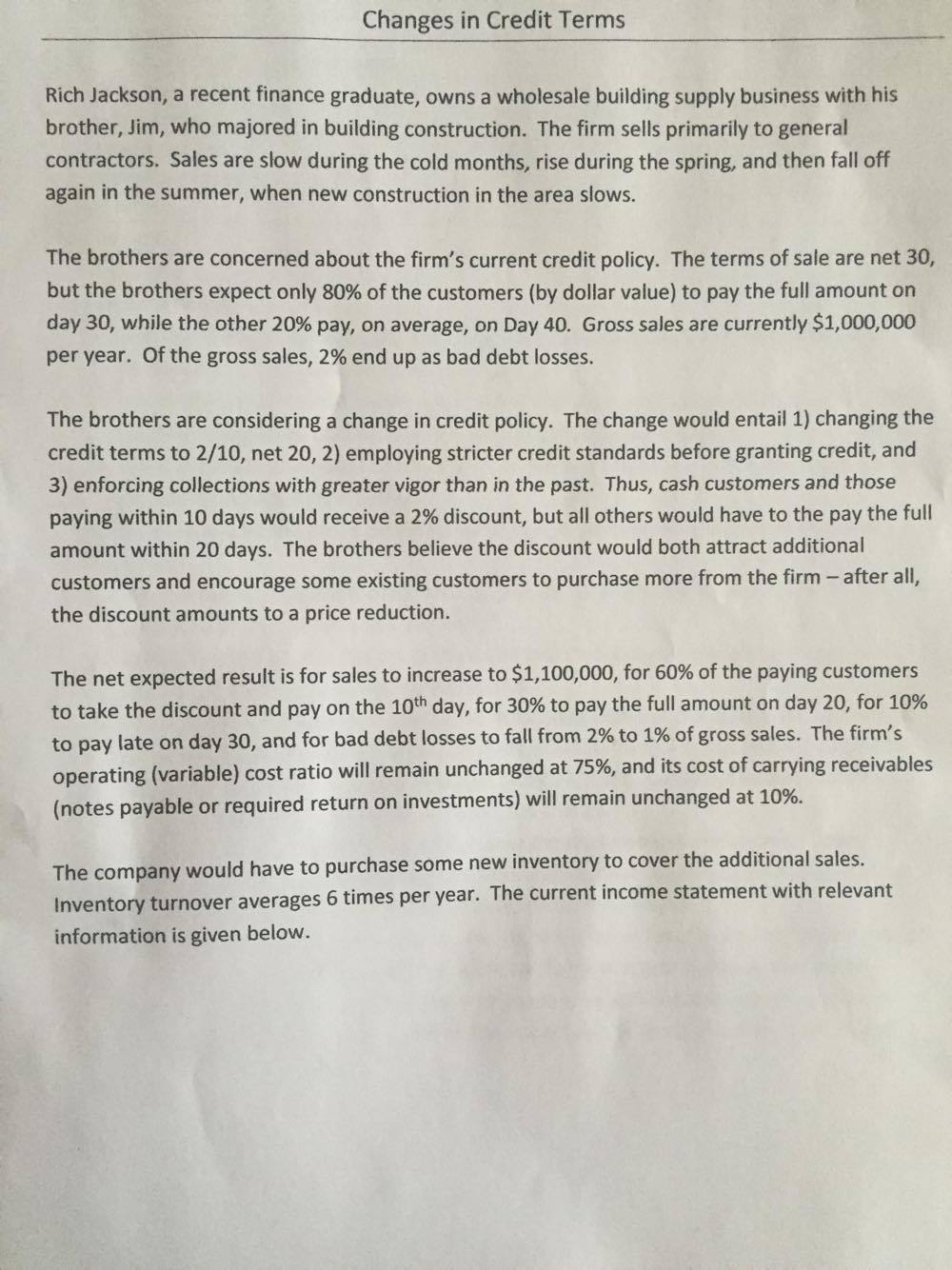

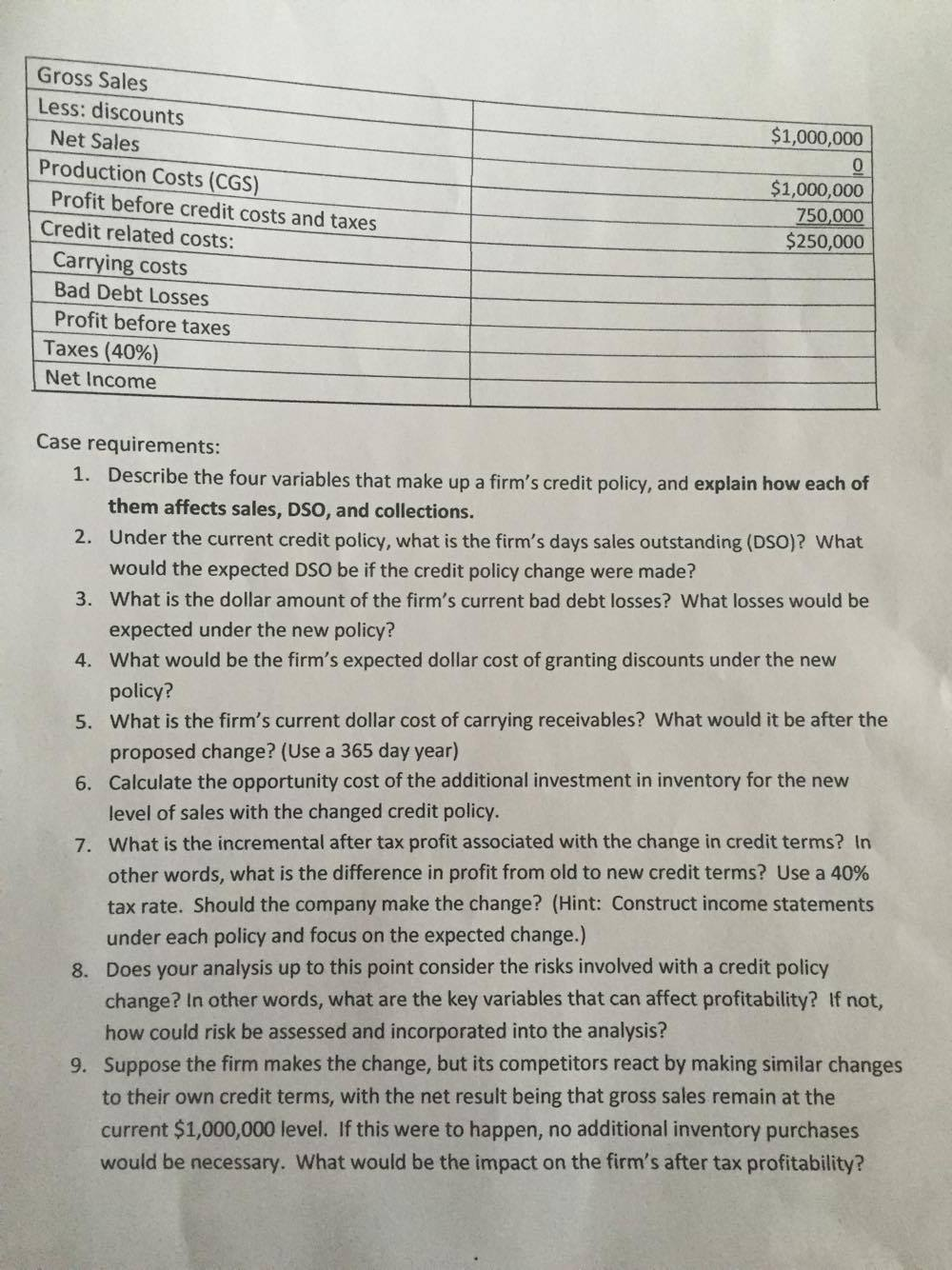

Changes in Credit Terms Rich Jackson, a recent finance graduate, owns a wholesale building supply business with his brother, Jim, who majored in building construction. The firm sells primarily to general contractors. Sales are slow during the cold months, rise during the spring, and then fall off again in the summer, when new construction in the area slows. The brothers are concerned about the firm's current credit policy. The terms of sale are net 30, but the brothers expect only 80% of the customers (by dollar value) to pay the full amount on day 30, while the other 20% pay, on average, on Day 40 Gross sales are currently $1,000,000 per year. Of the gross sales, 2% end up as bad debt losses. The brothers are considering a change in credit policy. The change would entail 1) changing the credit terms to 2/10, net 20, 2) employing stricter credit standards before granting credit, and 3) enforcing collections with greater vigor than in the past. Thus, cash customers and those paying within 10 days would receive a 2% discount, but all others would have to the pay the full amount within 20 days. The brothers believe the discount would both attract additional customers and encourage some exsting customers to purchase more from the firm- after all, the discount amounts to a price reduction. The net expected result is for sales to increase to $1,100,000, for 60% of the paying customers to take the discount and pay on the 10th day, for 30% to pay the full amount on day 20, for 10% to pay late on day 30, and for bad debt losses to fa from 2% to 1% of gross sales. The firm's operating (variable) cost ratio will remain unchanged at 75%, and its cost of carrying receivables (notes payable or required return on investments) will remain unchanged at 10%. The company would have to purchase some new inventory to cover t Inventory turnover information is given below. he additional sales. averages 6 times per year. The current income statement with relevant

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts