Answered step by step

Verified Expert Solution

Question

1 Approved Answer

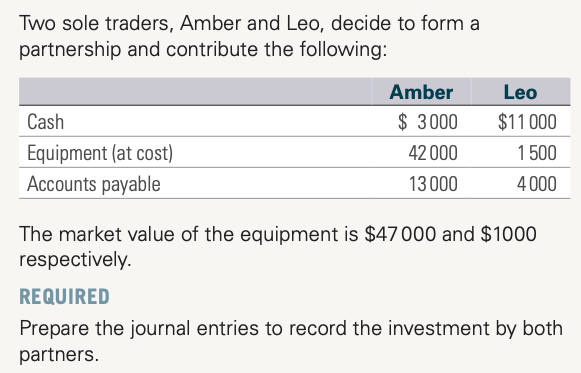

Can you please explain to me how Amber gets $37,000 and Leo gets $8,000? Two sole traders, Amber and Leo, decide to form a partnership

Can you please explain to me how Amber gets $37,000 and Leo gets $8,000?

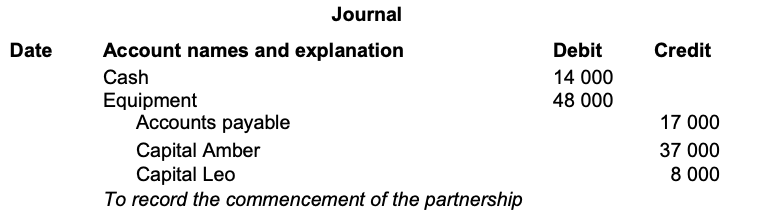

Two sole traders, Amber and Leo, decide to form a partnership and contribute the following: Amber Cash $ 3000 Equipment (at cost) 42000 Accounts payable 13000 Leo $11000 1500 4000 The market value of the equipment is $47000 and $1000 respectively. REQUIRED Prepare the journal entries to record the investment by both partners. Date Credit Journal Account names and explanation Cash Equipment Accounts payable Capital Amber Capital Leo To record the commencement of the partnership Debit 14 000 48 000 17 000 37 000 8 000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started