Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Can you please explain to me step by step? Case Your company is a distributor of surfboards located in La Jolla, California. The company does

Can you please explain to me step by step?

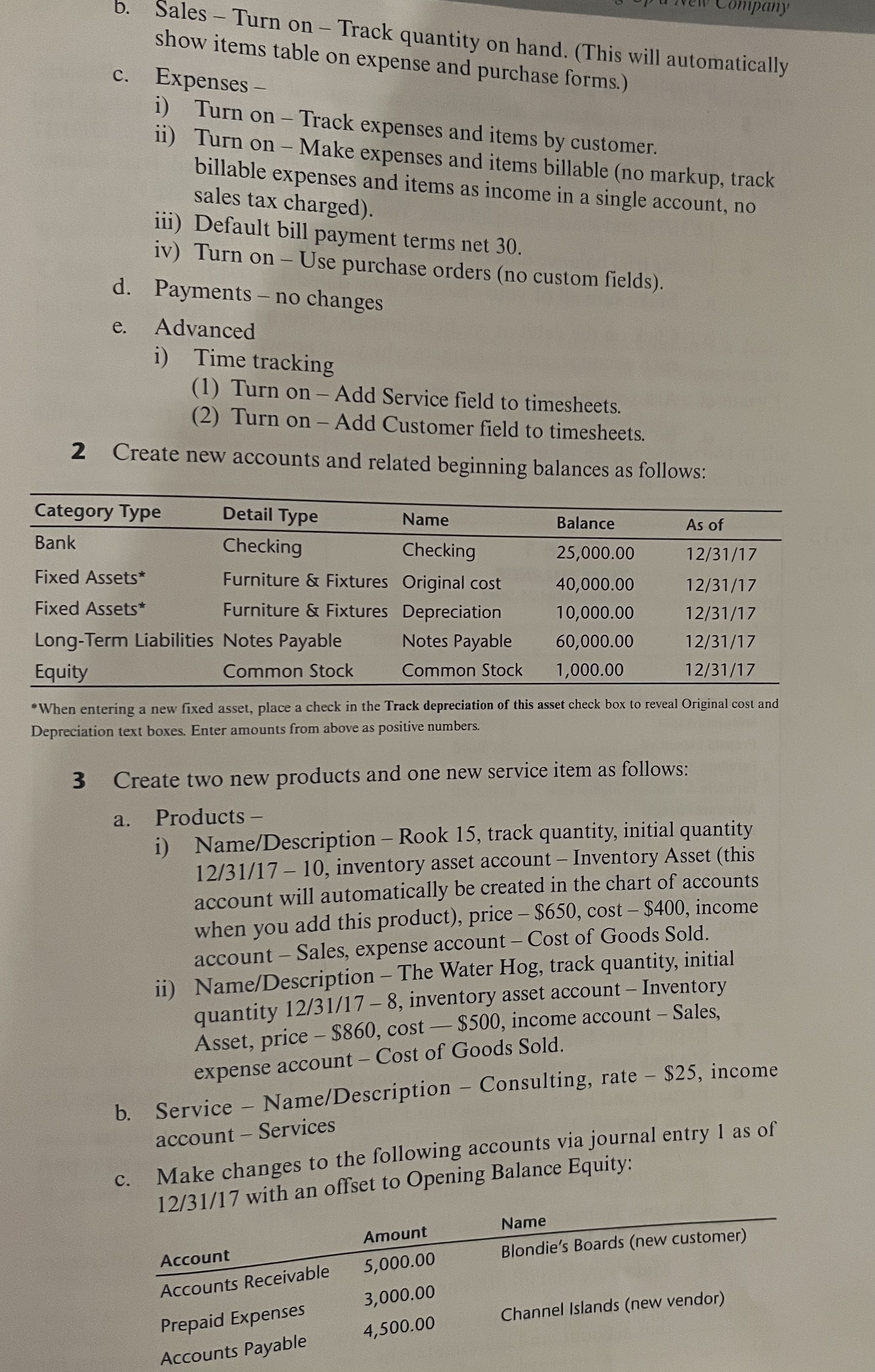

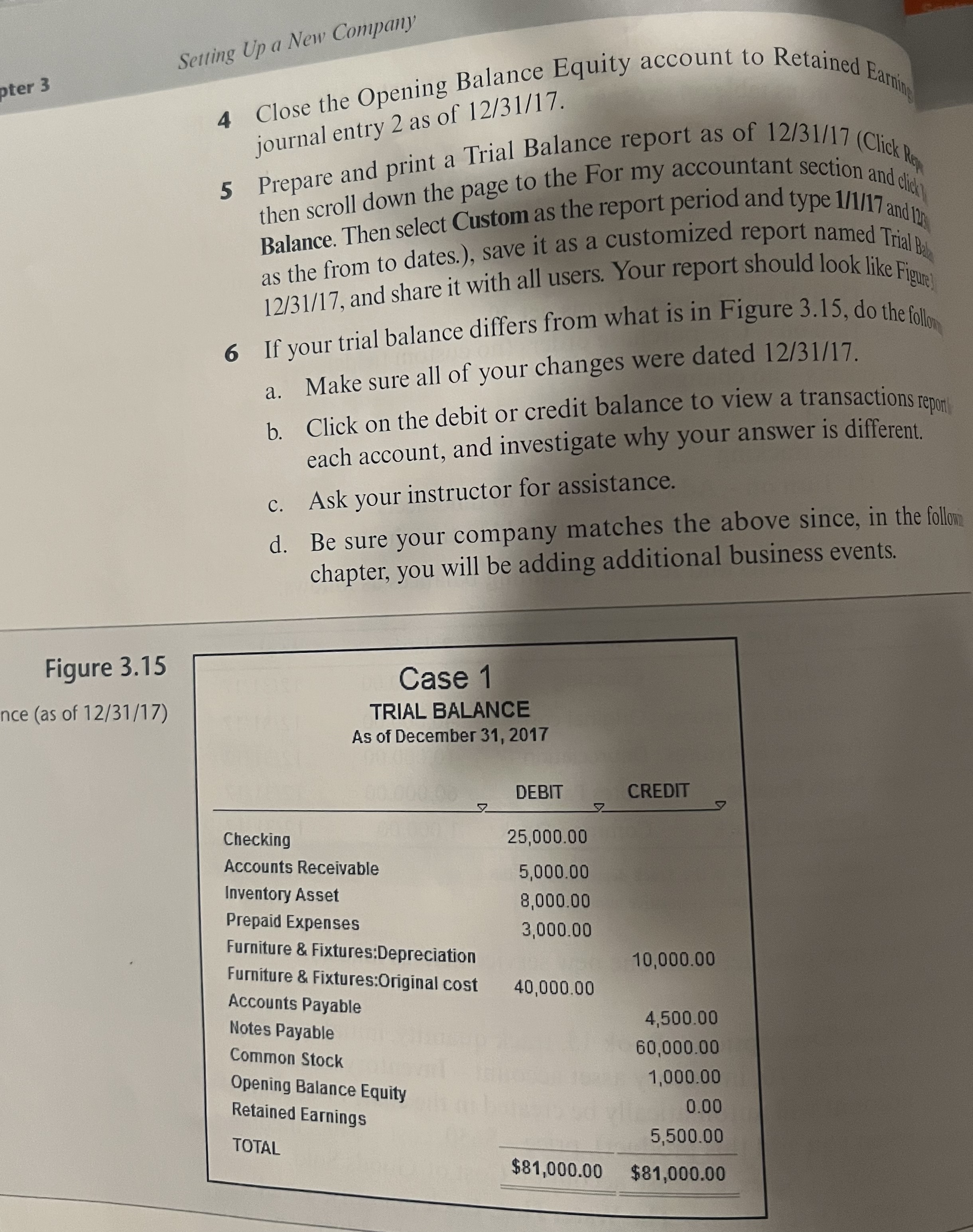

Case Your company is a distributor of surfboards located in La Jolla, California. The company does not collect sales tax since all of its customers are resellers. They began business in 2017 and want to use QBO starting January 1, 2018. Beginning balances as of 12/31/2017 have been provided below. You must make changes to your company. Based on what you learned in the text using the Sample Company, you are to make the following changes to the company you created in Chapter 1: 1 Modify settings as follows: a. Company - i) Company name - Modify the company name to Case 01 Student Name (ID Number) replacing Student Name with your name and ID Number with the number your instructor indicated. ii) Company type - Modify the Tax form by selecting Form 1120 from the drop-down list of forms. Then type Retail Shop or Online Commerce in the Industry text box, then click Save. Setting Up a New Company 4 Close the Opening Balance Equity account to Retained Earning journal entry 2 as of 12/31/17. 5 Prepare and print a Trial Balance report as of 12/31/17 (Click ph then scroll down the page to the For my accountant section and clindy Balance. Then select Custom as the report period and type 1/1/17 and 1/2, as the from to dates.), save it as a customized report named Trial By 12/31/17, and share it with all users. Your report should look like Figure? 6 If your trial balance differs from what is in Figure 3.15, do the follon a. Make sure all of your changes were dated 12/31/17. b. Click on the debit or credit balance to view a transactions repont each account, and investigate why your answer is different. c. Ask your instructor for assistance. d. Be sure your company matches the above since, in the follonin chapter, you will be adding additional business events. b. Sales - Turn on - Track quantity on hand. (This will automatically show items table on expense and purchase forms.) c. Expenses - i) Turn on - Track expenses and items by customer. ii) Turn on - Make expenses and items billable (no markup, track billable expenses and items as income in a single account, no sales tax charged). iii) Default bill payment terms net 30 . iv) Turn on - Use purchase orders (no custom fields). d. Payments - no changes e. Advanced i) Time tracking (1) Turn on - Add Service field to timesheets. (2) Turn on - Add Customer field to timesheets. 2 Create new accounts and related beginning balances as follows: *When entering a new fixed asset, place a check in the Track depreciation of this asset check box to reveal Original cost and Depreciation text boxes. Enter amounts from above as positive numbers. 3 Create two new products and one new service item as follows: a. Products - i) Name/Description - Rook 15 , track quantity, initial quantity 12/31/17 - 10, inventory asset account - Inventory Asset (this account will automatically be created in the chart of accounts when you add this product), price - $650, cost $400, income account - Sales, expense account - Cost of Goods Sold. ii) Name/Description - The Water Hog, track quantity, initial quantity 12/31/17 - 8, inventory asset account - Inventory Asset, price - $860, cost - $500, income account - Sales, expense account - Cost of Goods Sold. b. Service - Name/Description - Consulting, rate - $25, income account - Services c. Make changes to the following accounts via journal entry 1 as of 1n/21/17 with an offset to Opening Balance Equity

Case Your company is a distributor of surfboards located in La Jolla, California. The company does not collect sales tax since all of its customers are resellers. They began business in 2017 and want to use QBO starting January 1, 2018. Beginning balances as of 12/31/2017 have been provided below. You must make changes to your company. Based on what you learned in the text using the Sample Company, you are to make the following changes to the company you created in Chapter 1: 1 Modify settings as follows: a. Company - i) Company name - Modify the company name to Case 01 Student Name (ID Number) replacing Student Name with your name and ID Number with the number your instructor indicated. ii) Company type - Modify the Tax form by selecting Form 1120 from the drop-down list of forms. Then type Retail Shop or Online Commerce in the Industry text box, then click Save. Setting Up a New Company 4 Close the Opening Balance Equity account to Retained Earning journal entry 2 as of 12/31/17. 5 Prepare and print a Trial Balance report as of 12/31/17 (Click ph then scroll down the page to the For my accountant section and clindy Balance. Then select Custom as the report period and type 1/1/17 and 1/2, as the from to dates.), save it as a customized report named Trial By 12/31/17, and share it with all users. Your report should look like Figure? 6 If your trial balance differs from what is in Figure 3.15, do the follon a. Make sure all of your changes were dated 12/31/17. b. Click on the debit or credit balance to view a transactions repont each account, and investigate why your answer is different. c. Ask your instructor for assistance. d. Be sure your company matches the above since, in the follonin chapter, you will be adding additional business events. b. Sales - Turn on - Track quantity on hand. (This will automatically show items table on expense and purchase forms.) c. Expenses - i) Turn on - Track expenses and items by customer. ii) Turn on - Make expenses and items billable (no markup, track billable expenses and items as income in a single account, no sales tax charged). iii) Default bill payment terms net 30 . iv) Turn on - Use purchase orders (no custom fields). d. Payments - no changes e. Advanced i) Time tracking (1) Turn on - Add Service field to timesheets. (2) Turn on - Add Customer field to timesheets. 2 Create new accounts and related beginning balances as follows: *When entering a new fixed asset, place a check in the Track depreciation of this asset check box to reveal Original cost and Depreciation text boxes. Enter amounts from above as positive numbers. 3 Create two new products and one new service item as follows: a. Products - i) Name/Description - Rook 15 , track quantity, initial quantity 12/31/17 - 10, inventory asset account - Inventory Asset (this account will automatically be created in the chart of accounts when you add this product), price - $650, cost $400, income account - Sales, expense account - Cost of Goods Sold. ii) Name/Description - The Water Hog, track quantity, initial quantity 12/31/17 - 8, inventory asset account - Inventory Asset, price - $860, cost - $500, income account - Sales, expense account - Cost of Goods Sold. b. Service - Name/Description - Consulting, rate - $25, income account - Services c. Make changes to the following accounts via journal entry 1 as of 1n/21/17 with an offset to Opening Balance Equity Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started