Answered step by step

Verified Expert Solution

Question

1 Approved Answer

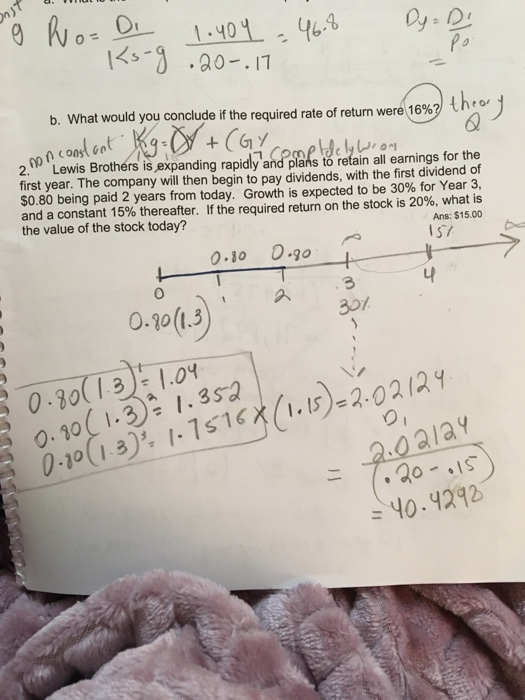

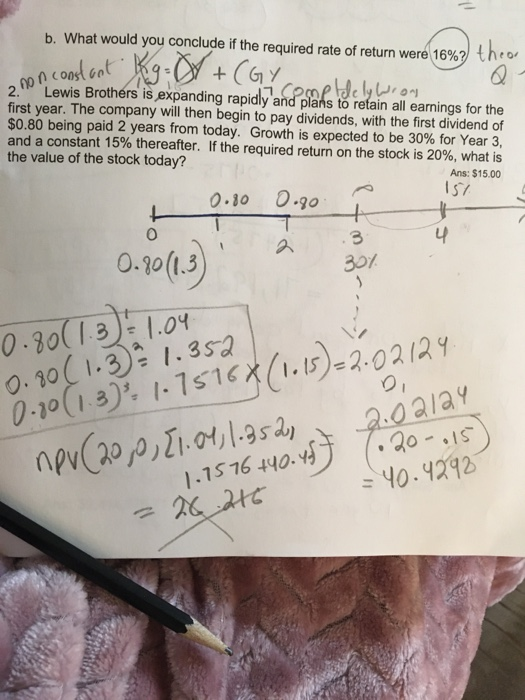

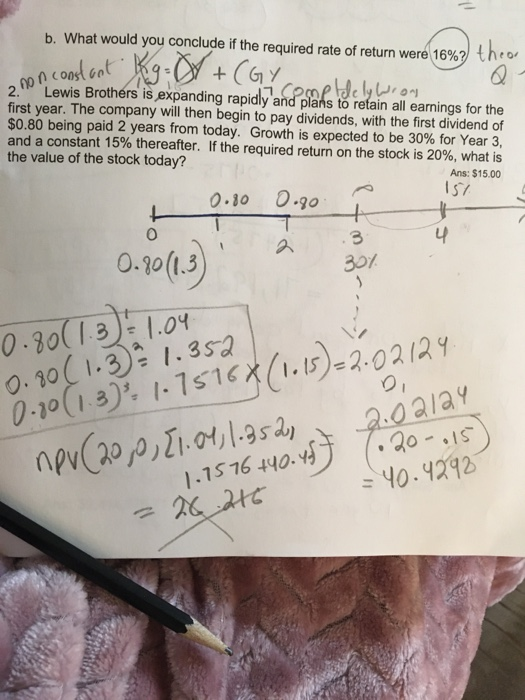

can you please explain what i am doing wrong Inst No-Di Dy Di 1.404 . 46.8 20-.17 non constant 17 pollicly Wio b. What would

can you please explain what i am doing wrong

Inst No-Di Dy Di 1.404 . 46.8 20-.17 non constant 17 pollicly Wio b. What would you conclude if the required rate of return were 16% ti Y+(GY 2." Lewis Brothers is expanding rapidly and plans to retain all earnings for the first year. The company will then begin to pay dividends, with the first dividend of $0.80 being paid 2 years from today. Growth is expected to be 30% for Year 3, and a constant 15% thereafter. If the required return on the stock is 20%, what is the value of the stock today? Ans: $15.00 151 0.80 0.80 TT 0.80(1.3) 30.80(1.3): 1.04 30.80 (1.3 1.352 0.00 (1.3): 1.75164 (1015)=2.02124. 2.02124 = T. 20-015) = 40.4293 b. What would you conclude if the required rate of return were 16%?) theo I constant RgV +(GY 2.''Lewis Brothers is expanding rapidly and plans to retain all earnings for the complely wion first year. The company will then begin to pay dividends, with the first dividend of $0.80 being paid 2 years from today. Growth is expected to be 30% for Year 3, and a constant 15% thereafter. If the required return on the stock is 20%, what is the value of the stock today? Ans: $15.00 157 0.80 0.80 - 0.80(1.3) 0.801.3) = 1.04 0.80 (1.3 1.352 0.00 (1.3)1.7516X (1.15)=2.02124. nov (2000, [1.04, 1.3520 2.02124 1.7516 +40.497 (520-15) - 26. 216 -40.4293

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started